Investment demand refers to the demand for physical capital goods and services by businesses to maintain or expand their operations. It does not refer to financial investments, which are typically undertaken by households to increase their wealth. Investment demand can be influenced by various factors, such as interest rates, expectations, economic activity, the stock of capital, capacity utilisation, and public policy. Understanding the relationship between investment and these factors is crucial, and this is where investment demand graphs come into play. These graphs illustrate the relationship between investment and factors like interest rates, providing valuable insights into businesses' investment decisions and their impact on the economy.

| Characteristics | Values |

|---|---|

| Purpose | To understand the relationship between the price of a good or service and the quantity demanded for a given period of time. |

| Data | Interest rates, GNP, income, inflation, GDP, price levels, expectations, transfer costs, preferences, etc. |

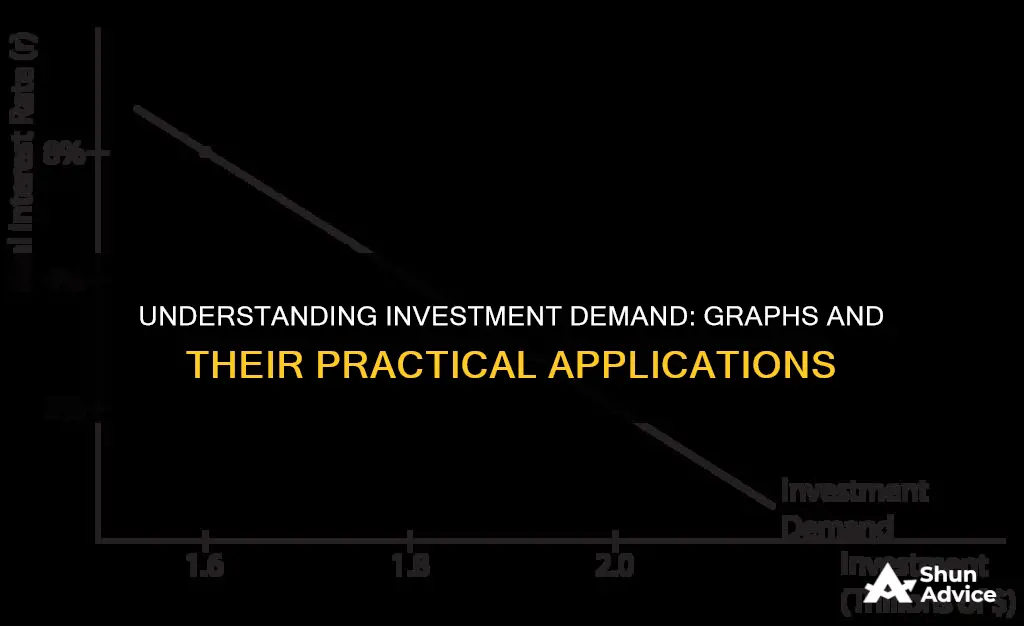

| Graph characteristics | The price appears on the y-axis, and the quantity demanded is on the x-axis. The curve generally slopes down from left to right. |

| Applications | Understanding price-quantity relationships for consumers in a particular market, e.g., corn or soybeans. |

What You'll Learn

Interest rates and investment demand

Investment demand refers to the demand for physical capital goods and services by businesses to maintain or expand their operations. It is important to note that this does not include financial investments, which are typically undertaken by households looking to increase their wealth.

Interest rates play a crucial role in investment demand. When interest rates are high, investment demand tends to decrease as the cost of borrowing money increases. On the other hand, lower interest rates stimulate investment demand by making it cheaper to borrow funds for expansion. This relationship between interest rates and investment demand is often illustrated using an investment demand curve, which demonstrates the inverse relationship between the two variables.

For example, consider a small factory owner contemplating the installation of a solar energy system costing $10,000, which is expected to reduce energy bills by $1,000 per year indefinitely. The owner has the option to either use their own funds for this investment or borrow money from a bank at a certain interest rate. If the owner has the money available, they must decide between investing in the solar energy system or purchasing a bond. At an interest rate of 12%, the bond is the better option, as it generates $1,200 in interest income, which is more than the $1,000 saved by investing in the solar energy system. However, if the interest rate on the bond is 8%, the solar energy system becomes the more attractive option. Therefore, the decision to invest in capital goods or opt for financial investments depends on the prevailing interest rates.

Changes in interest rates can also impact the overall level of investment in an economy. For instance, if interest rates rise from 5% to 7%, the quantity of investment falls from 100 to 80. This decrease in investment occurs because higher interest rates increase the opportunity cost of investment, making it more expensive to borrow funds from banks. As a result, firms require higher rates of return on their investments to justify the increased cost of borrowing.

In addition to interest rates, other factors influencing investment demand include investor confidence, economic growth, the willingness of banks to lend, accelerator theory, and the state of technology. These factors can shift the investment demand curve and play a significant role in driving investment choices.

Cash App Investing: Free or Fee-Based?

You may want to see also

GNP and investment demand

Investment demand refers to the demand for physical capital goods and services by businesses to maintain or expand their operations. This includes office and factory space, machinery, computers, and other equipment. It is important to note that this is distinct from financial investment, which is a form of saving typically undertaken by households.

Investment demand can be influenced by various factors, including GNP and interest rates. While the model assumes investment demand to be exogenous, or not dependent on any variables within the model, GNP and interest rates can have significant effects on investment demand in reality.

GNP, or Gross National Product, is the total value of all final products and services produced by a country's residents, both domestically and internationally, over a specific period. It includes personal consumption expenditures, private domestic investment, government expenditure, net exports, and income earned by residents from overseas investments, less income earned by foreign residents within the country. GNP can impact investment demand as a higher total size of the economy may lead to increased demand for business expansion. Additionally, a higher growth rate of GNP may indicate better future business prospects, encouraging more investment.

Interest rates also play a crucial role in investment demand. Many businesses need to borrow funds to finance expansions, and higher interest rates increase the cost of borrowing, potentially reducing investment demand. On the other hand, lower interest rates can stimulate investment by making borrowing more affordable.

In conclusion, while the investment demand model assumes exogeneity, GNP and interest rates are important factors that can influence investment demand in the real world. GNP reflects the overall economic activity of a country, while interest rates impact the cost of borrowing for businesses. Together, these factors can shape businesses' decisions regarding expansions and investments.

Schwab Total Cash & Cash Investments: What You Need to Know

You may want to see also

The cost of capital and investment demand

Investment demand refers to the demand by businesses for physical capital goods and services used to maintain or expand their operations. This includes things like office and factory space, machinery, computers, and other equipment. It is important to note that investment demand is different from financial investment, which typically refers to saving instruments used by households.

The cost of capital is a crucial concept in understanding investment demand. It refers to the minimum rate of return or profit a company must earn before generating value. In other words, it is the breakeven point for a project. This is calculated by a company's accounting department to assess financial risk and determine if an investment is justified. The cost of capital takes into account the cost of debt, cost of equity, and the weighted average cost of capital (WACC).

When considering investment decisions, companies compare the expected returns of a project with the cost of capital. If the expected returns exceed the cost of capital, the investment is likely to be profitable. On the other hand, if the cost of capital is higher than the expected returns, the investment may not be worthwhile.

Interest rates play a significant role in investment demand. Higher interest rates tend to reduce the quantity of investment, as they increase the cost of borrowing funds. On the other hand, lower interest rates encourage investment by making it cheaper to borrow money. This relationship is often illustrated using an investment demand curve, which shows the quantity of investment demanded at each interest rate.

Other factors that can influence investment demand include expectations, the level of economic activity, the stock of capital, capacity utilization, the cost of capital goods, technological changes, and public policy. For example, if a company expects higher sales in the future, it may be more inclined to invest in expanding its operations. Similarly, changes in tax policies, such as investment tax credits, can also impact investment decisions by effectively lowering the cost of capital.

In summary, the cost of capital is a critical factor in investment demand. Companies use it to evaluate the potential risk and return of investment opportunities. By comparing the cost of capital with expected returns, companies can make informed decisions about whether to undertake new projects or initiatives. Interest rates and other economic factors also play a significant role in shaping investment demand.

Temporary Investments: Are They Really Cash?

You may want to see also

The rate of return and investment demand

Investment demand refers to the demand for physical capital goods and services by businesses to maintain or expand their operations. This includes items such as office and factory space, machinery, computers, and other equipment. It is important to distinguish this from financial investment, which is typically done by households to maintain or increase their wealth.

The rate of return is a crucial metric in investment decisions. It represents the net gain or loss of an investment over a specified period, expressed as a percentage of the initial investment cost. The formula for calculating the rate of return is:

Rate of return = [(Current value - Initial value) / Initial value] x 100

The rate of return helps investors measure the profitability of an investment over time and compare different investment options. When the rate of return is positive, it indicates a gain, while a negative value reflects a loss on the investment.

When considering investments, businesses often compare the expected rate of return with the cost of borrowing funds (interest rate). If the expected rate of return exceeds the interest rate, the investment is likely to be profitable. However, if the interest rate is higher than the expected rate of return, the investment may not be worthwhile.

For example, consider a company that is deciding whether to invest in a new piece of equipment for $10,000. This equipment is expected to generate $2,000 in additional cash inflows per year for the next five years. The company's discount rate (minimum acceptable rate of return) is 5%. By applying the discount rate to the expected cash inflows, the company can determine if the investment is worthwhile. In this case, the investment would result in a positive net cash inflow, indicating that the rate of return is higher than the discount rate, and the investment is profitable.

Investment demand curves illustrate the relationship between investment and interest rates. These curves show that as interest rates decrease, the quantity of investment increases, and vice versa. This inverse relationship is based on the opportunity cost of investing funds in a project rather than earning interest by putting them in a savings account or investing in bonds.

However, it is important to note that while interest rates play a significant role in investment decisions, they are not the only factor. Other determinants of investment demand include expectations, the level of economic activity, the stock of capital, capacity utilization, the cost of capital goods, other factor costs, technological changes, and public policy. These factors can cause shifts in the investment demand curve, influencing businesses' investment choices.

Factor Investing with ETFs: Strategies and Benefits

You may want to see also

The law of demand and investment demand

The law of demand is a fundamental principle of economics that states that the quantity of a good purchased varies inversely with its price. In other words, as the price of a good increases, the quantity demanded decreases, and vice versa. This relationship is often represented by a downward-sloping demand curve on a graph.

The law of demand is derived from the law of diminishing marginal utility, which suggests that consumers use the first units of an economic good to satisfy their most urgent needs, and then use additional units for less important purposes. For example, a castaway on a desert island who obtains a six-pack of bottled water will likely use the first bottle to satisfy their thirst, the second for basic hygiene, and so on. As the castaway's need for each additional bottle decreases, so does their willingness to pay a higher price for it.

Investment demand, on the other hand, refers to the demand by businesses for physical capital goods and services used to maintain or expand their operations. This includes items such as office space, machinery, computers, and other equipment. Changes in investment demand can be influenced by various factors, including interest rates, GNP, and public policy.

According to the law of demand, an increase in the price of capital goods will lead to a decrease in investment demand. This is because businesses will be less willing to purchase these goods at higher prices, assuming their income remains constant. Additionally, higher interest rates increase the opportunity cost of investing, as businesses may choose to put their funds in financial investments with higher returns.

However, the relationship between investment demand and interest rates is not always straightforward. While higher interest rates generally discourage investment, they can also make it more expensive for businesses to borrow money to finance expansions. In this case, a decrease in interest rates may stimulate investment demand by making borrowing more affordable.

Public policy can also play a significant role in investment demand. Government agencies may invest in public capital projects, and their tax and regulatory policies can impact the investment choices of private firms. For example, policies that offer tax incentives or subsidies for certain types of investments can increase investment demand, while those that impose higher taxes or regulations may decrease it.

Warren Buffet's Strategy for Investing Berkshire's Cash Reserves

You may want to see also

Frequently asked questions

An investment demand graph, or curve, shows the relationship between the interest rate and the quantity of investment demanded over a given period.

Investment demand graphs are used to understand the price-quantity relationship for consumers in a particular market. They can also be used by businesses to determine whether their goods and services are priced correctly according to consumer demand.

The vertical axis of an investment demand graph typically shows the interest rate, while the horizontal axis shows the quantity of investment demanded. The curve on the graph will show how the quantity of investment demanded changes as the interest rate changes.