Investing activities are a critical component of a company's cash flow statement, reflecting significant capital movements. The cash flow from investing activities is a section of a company's cash flow statement that shows the cash generated by or spent on investment activities. This includes the purchase or sale of non-current assets, investments in securities, or the sale of securities or assets. The cash flow from investing activities is an important indicator of a company's financial health and can provide insights into its capital expenditure and investment strategies. It is also crucial for stakeholders, including investors and financial professionals, to assess a company's future prospects and potential for growth.

| Characteristics | Values |

|---|---|

| Definition | Cash flow from investing activities |

| Type of financial statement | Cash flow statement |

| What it shows | How much cash has been generated or spent on investment activities in a specific period |

| Types of activities included | Acquisition and disposal of long-term assets, loans made to third parties, collection of loans, capital expenditures, proceeds from sales of fixed assets, purchase of investment securities, acquisition of another company, proceeds from sales of other business units |

| Types of activities excluded | Short-term investments or cash equivalents, cash flows from financing activities, interest payments or dividends, debt, equity or other forms of financing, depreciation of capital assets, all income and expenses related to normal business operations |

| Calculation | Total cash inflows from investing activities – Total cash outflows from investing activities |

| Importance | Shows a company's investment performance and capital allocation decisions, and provides insights into a company's financial health and future prospects |

What You'll Learn

Acquisition of long-term assets

Long-term assets are investments in a company that will benefit the company for years to come. They are also known as non-current assets and are reported on the balance sheet. Long-term assets are usually recorded at the price they were purchased for, and so may not reflect the current value of the asset. They are considered to be less liquid, meaning they cannot be easily converted into cash.

Long-term assets can be tangible or intangible. Tangible long-term assets include fixed assets such as property, plant, and equipment. Intangible long-term assets are those that cannot be physically touched, such as long-term investments, patents, trademarks, and goodwill.

When a company invests in long-term assets, it is reflected in the cash flow statement as a negative cash flow from investing activities. This is because the purchase of long-term assets requires spending money, which generates negative cash flow. However, this is not necessarily a bad sign, as it may indicate that the company is investing in its future operations and growth.

The acquisition of long-term assets is an important aspect of a company's growth and capital. It indicates that the company is investing in its future and allocating cash for the long term. This can include investing in fixed assets, such as property, plant, and equipment, as well as intangible assets such as trademarks and patents.

The purchase of long-term assets can be a significant source of cash outflow for a company, as it requires a large amount of capital. This can impact the company's cash flow and may require the company to seek external financing. However, it is important to note that the acquisition of long-term assets can also lead to future gains and growth if these investments are managed well.

Overall, the acquisition of long-term assets is a crucial aspect of a company's financial strategy and can have a significant impact on its cash flow and future prospects.

Examples of Cash Investments: Where to Put Your Money

You may want to see also

Investment in securities

The cash flow statement includes three sections: Cash Flow from Operations (CFO), Cash Flow from Investing (CFI), and Cash Flow from Financing Activities (CFF). The CFI section details the cash inflows and outflows from investment activities, including the acquisition and disposal of long-term assets such as property, plant, equipment, and investments in marketable securities.

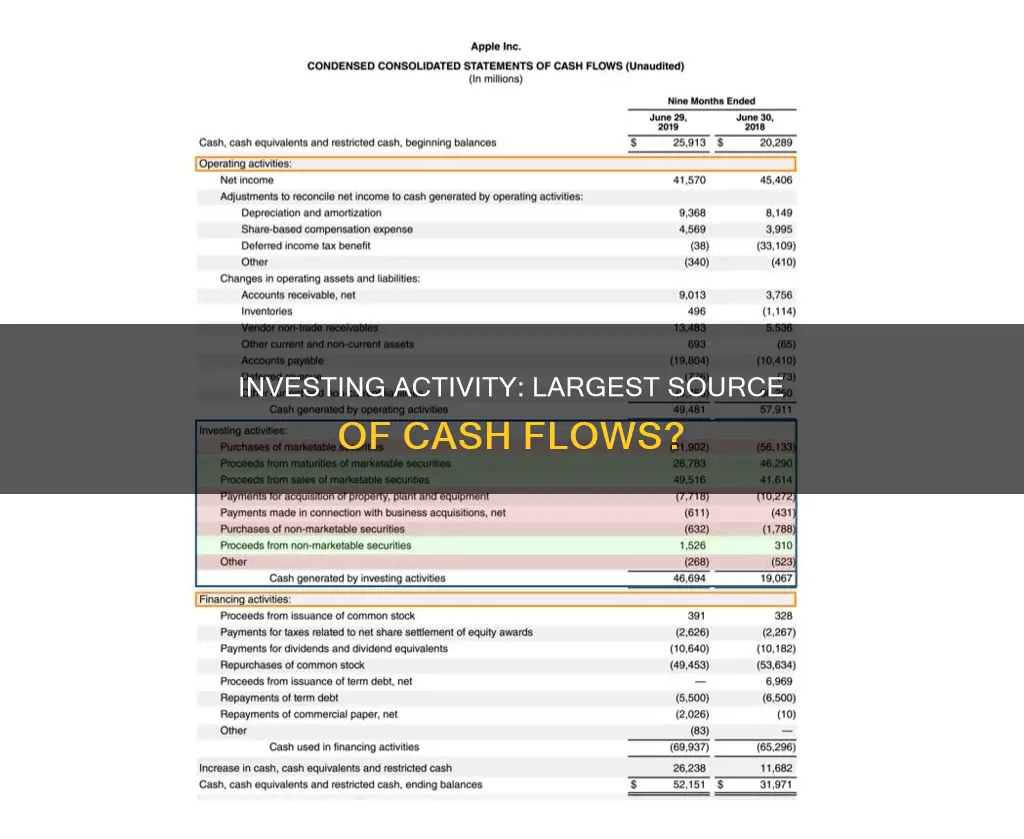

Investing in securities can generate positive cash flow when the sale of securities or assets occurs, and negative cash flow when purchases are made. For example, in Apple's 2023 financial report, the company had a large outflow of cash due to the purchase of marketable securities worth $29.52 billion. However, the sale of securities can result in positive cash flow, as seen in Apple's report, where proceeds from the sale of marketable securities reached $5.83 billion.

The purchase of securities is considered an important aspect of growth and capital for a company. It falls under investing activities in the cash flow statement, which also includes capital expenditures and lending money. A company's investment in securities can be a significant indicator of its financial strategy and health.

Cash Investments: Impacting Stockholders Equity Positively

You may want to see also

Sale of fixed assets

The sale of fixed assets is an important investing activity that can have a significant impact on a company's cash flow. Fixed assets are long-term assets such as property, plant, and equipment (PP&E) that are expected to be used for more than one accounting period. When a company sells a fixed asset, it can generate a positive cash flow, as the proceeds from the sale will increase the company's cash balance.

The sale of fixed assets can be a strategic decision made by companies for various reasons. One common reason is to generate capital for investment in other areas of the business. For example, a company may sell an old piece of machinery and use the proceeds to invest in new, more efficient technology. This can help improve the company's operational efficiency and productivity.

Another reason for the sale of fixed assets could be to dispose of obsolete or underutilised assets. Companies may choose to sell assets that are no longer essential to their operations or that are costing too much to maintain. By selling these assets, companies can free up capital and improve their cash position.

In some cases, the sale of fixed assets may also be done as part of a business's restructuring or divestment strategy. For instance, a company may decide to exit a particular business segment and sell off the associated fixed assets. This can provide a significant influx of cash, which can then be reinvested in core business areas or used to reduce debt obligations.

It is important to note that the sale of fixed assets can impact a company's financial statements, particularly the cash flow statement. The proceeds from the sale will be reflected as a positive cash flow in the investing activities section of the statement. Additionally, the removal of the fixed asset from the company's balance sheet will result in an adjustment to the non-current assets section.

Overall, the sale of fixed assets can be a strategic tool for companies to manage their cash flow, dispose of unnecessary assets, and generate capital for investment in other areas of the business. It plays a crucial role in ensuring the long-term health and growth of the company.

Cash Investment: Asset or Liability?

You may want to see also

Capital expenditure

CapEx is found in the cash flow from investing activities in a company's cash flow statement. Companies can highlight CapEx in various ways, including listing it as capital spending, purchases of property, plant, and equipment (PP&E), or acquisition expenses.

CapEx includes funds used to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment. This type of financial outlay is made by companies to increase the scope of their operations or to add future economic benefits to their operations.

CapEx is often used to undertake new projects or investments by a company. For example, making capital expenditures on fixed assets can include repairing a roof to extend its useful life, purchasing a piece of equipment, or building a new factory.

The amount of capital expenditure a company has depends on its industry. Some of the most capital-intensive industries with the highest levels of CapEx include oil exploration and production, telecommunications, manufacturing, and utilities.

Financial analysts and investors pay close attention to a company's capital expenditures, as they can have a significant impact on cash flow. CapEx is also used in calculating free cash flow to equity (FCFE), which is the amount of cash available to equity shareholders.

There are two main forms of capital expenditures: maintenance CapEx and growth CapEx. Maintenance CapEx refers to expenditures to maintain the current level of a company's operations, while growth CapEx involves expenditures that will enable future growth.

Free Cash Flow: Investment Costs and Their Inclusion

You may want to see also

Acquisition of other companies

Acquiring other companies is a common investing activity that can be a significant source of cash flow for a business. This activity is often driven by a company's desire to expand its operations, increase profits, and enhance its competitive position in the industry.

When one company acquires another, it becomes the owner of the acquired company's assets, including any cash held in its bank accounts. This acquisition of cash effectively reduces the net amount spent on the acquisition. The net amount spent is calculated by subtracting the cash acquired from the purchase price. For example, if Company A buys Company B for $100 million, and Company B has $20 million in its bank accounts, the net amount spent on the acquisition by Company A is $80 million.

This type of investing activity is typically recorded as a negative number in the "Cash Flow from Investing" section of a company's financial statements. It is important to note that this activity is distinct from "Purchases of Marketable Securities," which involves investing cash in securities like stocks and bonds. In contrast, acquiring another company often involves spending cash to purchase the majority or entirety of the target company.

The financial implications of acquiring other companies can be significant. The acquiring company must consolidate the target company's financial statements with its own, leading to noticeable jumps in values on the income statement, cash flow statement, and balance sheet. For example, if the acquiring company has revenues of $3 million and the target company has revenues of $1 million, the combined entity will report revenues of $4 million, representing a substantial increase.

Overall, the acquisition of other companies can be a substantial source of cash outflow for a business, and it is an important factor to consider when analysing a company's financial health and performance.

Unlocking Investment Opportunities with Cash-Out Refinancing

You may want to see also

Frequently asked questions

Cash flow from investing activities is a section of a company's cash flow statement that shows the cash generated by or spent on investment activities. This includes the purchase or sale of non-current assets, such as property, plant, and equipment (PPE), as well as investments in securities or other companies.

Investing activities can include the purchase of PPE, acquisitions of other businesses, proceeds from the sale of property and equipment, and purchases of marketable securities such as stocks or bonds.

Cash flow from investing activities is important because it provides insights into a company's capital expenditure and investment strategies. It helps stakeholders understand the company's financial health and assess its ability to invest in growth opportunities, acquire assets, and manage its long-term financial health.