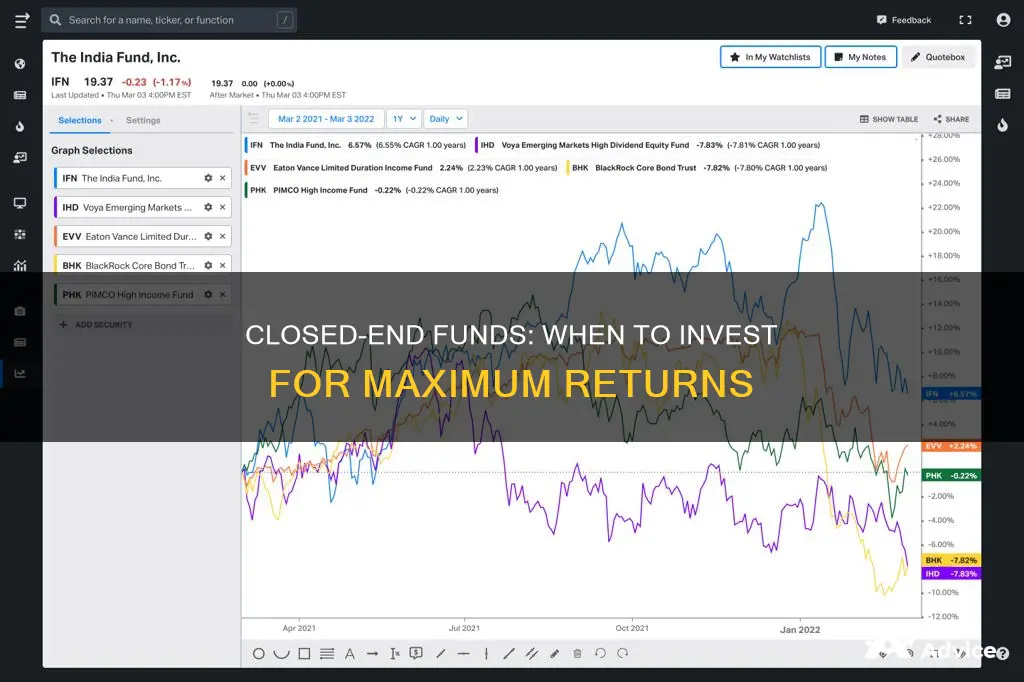

Closed-end funds are a type of mutual fund that issues a fixed number of shares through a one-time initial public offering (IPO). They are actively managed and tend to focus on a single industry, sector, or region. Unlike open-end funds, closed-end funds do not constantly accept new investor capital and do not redeem or buy back shares from shareholders. This means that to invest in a closed-end fund, you need to find someone willing to sell shares or wait for some to become available on the market. The best time to invest in a closed-end fund is when its discount is greater than normal, as this means you can buy the fund's shares for less than the value of its underlying assets.

What You'll Learn

- Closed-end funds are a type of mutual fund with a fixed number of shares

- They trade on a stock exchange throughout the day like stocks or ETFs

- They are actively managed and tend to focus on a single industry, sector or region

- They can be an attractive investment vehicle during market panics

- They are best bought at a discount to their net asset value

Closed-end funds are a type of mutual fund with a fixed number of shares

Closed-end funds are a type of mutual fund that issues a fixed number of shares through an initial public offering (IPO). This means that, unlike open-end funds, closed-end funds do not accept a constant flow of new investment capital and do not issue new shares. Instead, they raise a fixed amount of capital in a one-time offering of a set number of shares.

After the IPO, the shares of a closed-end fund can be bought and sold on a stock exchange, but no new shares will be created, and no new money will flow into the fund. The fund's parent company will not issue additional shares, and the fund itself won't buy back shares unless it is an interval fund. This structure gives closed-end funds more money to invest, as they don't have to maintain a large cash reserve.

Closed-end funds are usually actively managed and tend to concentrate on a single industry, sector, or region. They are often used to invest in less liquid securities, such as emerging-market stocks and municipal bonds, as their stable capital base makes them well-suited for this purpose.

The pricing of closed-end funds is another unique characteristic. The net asset value (NAV) of the fund is calculated regularly based on the value of its assets, but the trading price is market-driven and can be higher or lower than the NAV. This means that closed-end funds can trade at a premium or discount to their NAV.

Overall, closed-end funds offer the potential for higher returns than open-end funds due to their ability to use leverage and invest in less liquid securities. However, they are also less liquid and more volatile, making them a more complex investment vehicle that is less popular among investors.

Mutual Fund Investment: Current Smart Choices

You may want to see also

They trade on a stock exchange throughout the day like stocks or ETFs

Closed-end funds trade on a stock exchange throughout the day like stocks or ETFs. This means that investors can buy and sell shares at any time during the trading day. The price of these shares fluctuates in response to market demand.

Closed-end funds are launched through an initial public offering (IPO) that raises a fixed amount of money by issuing a fixed number of shares. After the IPO, shares are traded on an exchange, and the fund manager takes charge of the IPO proceeds to invest according to the fund's mandate.

Unlike open-end funds, closed-end funds do not continuously issue new shares or buy back shares from investors. Instead, investors must buy and sell shares from other market participants. This means that the fund itself does not control the supply of shares, which is determined by the market.

The price of a closed-end fund's shares is driven by supply and demand and may be higher or lower than its net asset value (NAV). The NAV is the value of the fund's assets minus its liabilities, divided by the number of shares. If the trading price is higher than the NAV, the fund is said to be trading at a premium; if it is lower, the fund is trading at a discount.

Because closed-end funds trade throughout the day, they can trade below their NAV for extended periods. This presents an opportunity for investors, who can buy shares at a discount and potentially profit if the discount decreases or the fund's holdings increase in value.

Overall, closed-end funds' ability to trade on a stock exchange like stocks or ETFs provides flexibility and the potential for higher returns, but it also introduces more volatility and risk compared to open-end funds.

Vanguard Funds: Minimum Investment Requirements and Options

You may want to see also

They are actively managed and tend to focus on a single industry, sector or region

Closed-end funds are a type of investment company or mutual fund that is actively managed by an investment firm. They are similar to open-end funds, or traditional mutual funds, in that they invest in a basket of securities, but there are some key differences. Unlike open-end funds, closed-end funds sell a fixed number of shares during their IPO and never reopen the fund to sell more. This means that closed-end funds are closed in the sense that capital does not regularly flow into them when investors buy shares, and it does not flow out when investors sell shares.

Closed-end funds tend to focus on a single industry, sector or region. They are often actively managed by an investment manager who is trying to beat the market, and they frequently use leverage to boost their returns. This means that they can be more volatile than open-end funds, and they tend to be used by more sophisticated investors.

Because closed-end funds are traded throughout the day, their share price can be higher or lower than their net asset value (NAV). If the share price is higher, the fund is said to be trading at a premium; if it is lower, the fund is trading at a discount. Many investors aim to buy closed-end funds at a discount, as this gives them a built-in edge on the market.

Overall, closed-end funds can be a good investment, but it is important to understand the risks involved, including the potential for higher fees and the impact of leverage on returns.

Mutual Fund Strategies: Deposits and Investments Timeline

You may want to see also

They can be an attractive investment vehicle during market panics

Closed-end funds can be an attractive investment vehicle during market panics. Here's why:

Closed-end funds are a type of mutual fund that issues a fixed number of shares through an initial public offering (IPO). They are actively managed by investment firms and invest in a basket of securities, similar to mutual funds and ETFs. However, unlike mutual funds, closed-end funds do not continuously issue new shares or buy back shares; instead, they trade on a stock exchange like stocks. This structure gives rise to discounts and premiums, with shares often trading at a discount to their net asset value (NAV).

During market panics, closed-end funds can be attractive because they often trade at significant discounts, providing an opportunity for investors to purchase them at a lower price than the value of their underlying assets. This strategy can potentially lead to gains if the fund's holdings rise in value or if the discount to NAV decreases, allowing investors to sell their shares at a profit.

Additionally, closed-end funds have the ability to use leverage by borrowing money or issuing debt to boost their returns. While this adds risk, it can also lead to greater rewards. In low-interest-rate environments, closed-end funds may increase their use of leverage to take advantage of higher returns from longer-term securities. This can result in higher overall returns for investors compared to open-fund mutual funds.

Furthermore, closed-end funds are less popular than open-ended funds due to their complexity, lower liquidity, and higher volatility. As a result, they are often used by more sophisticated investors. However, their unique characteristics, such as the ability to invest in illiquid securities and issue debt, make them a good option during market panics when investors are looking for alternative investment opportunities.

When considering investing in closed-end funds during market panics, it is essential to understand the fund's strategy, fees, distribution rate, and source. It is also crucial to assess the fund's discount to NAV and compare it to its historical average to identify attractive entry points.

In summary, closed-end funds can be an attractive investment vehicle during market panics due to their ability to trade at discounts, use leverage, and provide higher overall returns. However, investors should carefully consider the risks and fees associated with these funds before investing.

Vanguard Traditional IRA: Best Funds for Your Retirement Savings

You may want to see also

They are best bought at a discount to their net asset value

Closed-end funds are a type of mutual fund that issues a fixed number of shares through an initial public offering (IPO) to raise capital for its initial investments. Its shares can then be bought and sold on a stock exchange, but no new shares will be created, and no new money will flow into the fund. This is what makes them "closed-end".

The price of a closed-end fund's shares is determined by the market and can be higher or lower than its net asset value (NAV). When the price is higher, it is said to be trading at a "premium", and when it is lower, it is said to be trading at a "discount".

Many investors aim to buy closed-end funds at a discount to their net asset value. This is because it gives them a built-in edge on the market. Not only could they gain if the fund's holdings rise in value, but they may also benefit if the discount to the net asset value decreases and they decide to sell their shares. It is not uncommon for funds to trade at 10% or even 15% below their net asset value.

For example, when an investor buys a closed-end fund at a 10% discount to the net asset value, they pay 90 cents for every dollar worth of assets. This can give them a higher overall return than their open-fund mutual fund counterparts.

The ability to purchase closed-end funds at a discount is one of the attractive features of investing in them. However, it is important to note that closed-end funds are generally smaller in size than open-end funds, which leads to higher expense ratios. They are also more volatile due to the use of leverage and the fact that their share price can fluctuate around the net asset value.

Mutual Funds: Exploring Superior Investment Opportunities

You may want to see also