A cash flow statement is a financial report that details the inflow and outflow of cash and cash equivalents from a company's operations, investments, and financing activities. It is one of the three main financial statements, alongside the balance sheet and income statement. The cash flow statement provides insights into a company's financial health and operational efficiency, helping investors and creditors make informed decisions.

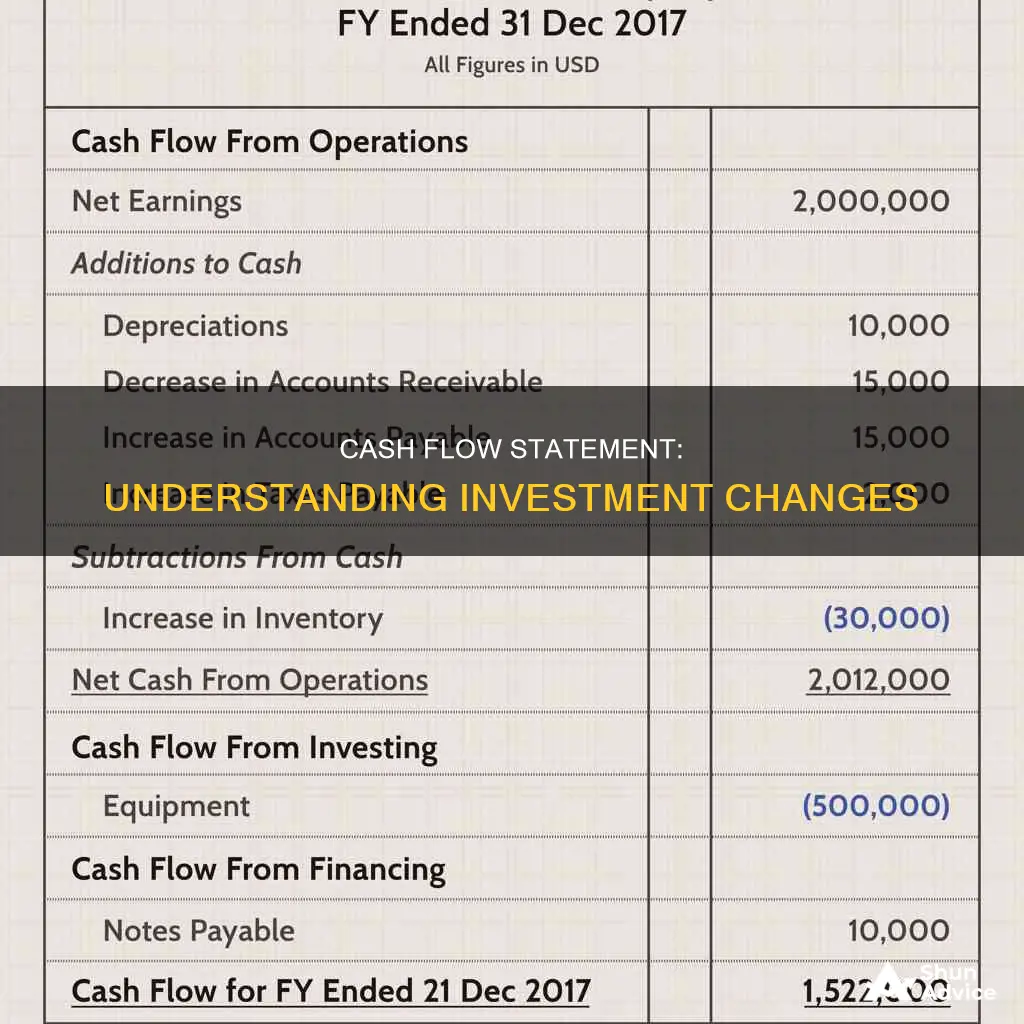

The cash flow statement is divided into three sections: operating activities, investing activities, and financing activities. Operating activities reflect the cash inflows and outflows related to a company's revenues and expenses. Investing activities involve the acquisition and disposition of long-term assets, as well as investments in other companies' securities. Financing activities encompass the inflows and outflows of cash related to creditors, owners, and debt or equity financing.

This information is crucial for understanding a company's liquidity, ability to meet financial obligations, and overall financial health.

| Characteristics | Values |

|---|---|

| Section of the cash flow statement | Cash flow from investing activities |

| Purpose | To display how much money has been used in or generated from making investments during a specific time period |

| Types of activities included | Purchases of long-term assets, acquisitions of other businesses, and investments in marketable securities |

| Examples of activities included | Purchase of property, plant, and equipment (PP&E), proceeds from the sale of PP&E, acquisitions of other businesses, proceeds from the sale of marketable securities |

| Calculation | The total cash flow from investing in an accounting period is found by adding together both positive and negative investing activities listed on the cash flow statement |

| Importance | It shows how a company is allocating cash for the long term and can indicate the company's financial health and ability to generate cash |

What You'll Learn

- Cash flow from investing activities includes the acquisition and disposal of non-current assets and other investments not included in cash equivalents

- Investing activities can include purchases of physical assets, investments in securities, or the sale of securities or assets

- Negative cash flow from investing activities is not a bad sign if it indicates that management is investing in the long-term health of the company

- Investing activities include changes in short-term investments, and property, plant, and equipment

- Capital expenditures are also found in this section

Cash flow from investing activities includes the acquisition and disposal of non-current assets and other investments not included in cash equivalents

A cash flow statement is a financial report that details the inflow and outflow of cash and cash equivalents, providing insights into a company's financial health and operational efficiency. It is one of the three main financial statements, alongside the balance sheet and the income statement.

The cash flow statement is divided into three sections: operating activities, investing activities, and financing activities. This answer will focus on the second section, "cash flow from investing activities".

Cash Flow from Investing Activities

Investing activities can include the purchase of physical assets, investments in securities, or the sale of securities or assets. These investments can be made to generate income or they may be long-term investments in the health or performance of the company.

Examples of investing activities include:

- Purchase of fixed assets

- Purchase of investments such as stocks or securities

- Sale of fixed assets

- Sale of investment securities

- Collection of loans and insurance proceeds

When analysing the cash flow statement, it is important to note that negative cash flow from investing activities is not always a negative indicator of the company's financial health. It often signifies that the company is investing in assets, research, or other long-term development activities that are crucial for the company's continued operations and future growth.

Example of Cash Flow from Investing Activities

As an example, let's consider Apple Inc.'s cash flow statement for the twelve months ending September 30, 2023. During this period, Apple's investing activities included:

- Purchases of marketable securities ($29.52 billion)

- Payments for acquisition of property, plant, and equipment ($10.96 billion)

- Other ($1.34 billion)

These investing activities resulted in a negative cash flow of $33.82 billion. However, Apple also had proceeds from maturities of marketable securities ($39.69 billion) and proceeds from the sale of marketable securities ($5.83 billion), which resulted in a positive cash flow of $45.52 billion. Overall, Apple had a net positive cash flow from investing activities of $3.71 billion.

Understanding Cash Flow: Investing Activities Analysis

You may want to see also

Investing activities can include purchases of physical assets, investments in securities, or the sale of securities or assets

A cash flow statement is a financial report that details the inflow and outflow of cash within a company during a reporting period. It is one of the three fundamental financial statements that financial leaders use, the other two being income statements and balance sheets.

The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. This information is used by business owners, managers, and stakeholders to understand the company's value, health, and financial decision-making.

Investing activities include purchases of physical assets, investments in securities, or the sale of securities or assets. This can include the purchase of physical assets such as property, plant, and equipment (PP&E), also known as capital expenditures. It also covers the proceeds from the sale of PP&E, acquisitions of other businesses or companies, and the sale of other businesses (divestitures).

Additionally, investing activities involve purchases of marketable securities, such as stocks or bonds, and the proceeds from the sale of these securities. These investments can be made to generate income or as long-term investments in the health and performance of the company.

Negative cash flow from investing activities does not necessarily indicate poor financial health. It often means that the company is investing in assets, research, or other long-term development activities that are crucial for the company's continued operations and future growth.

Invest to Conceal Cash: Strategies for Discreet Money Management

You may want to see also

Negative cash flow from investing activities is not a bad sign if it indicates that management is investing in the long-term health of the company

A negative cash flow from investing activities is not always a bad sign for a company. It could indicate that the company is investing in its long-term health and future growth. For example, a company may invest in long-term fixed assets, such as property, equipment, or technology, which could appear as a decrease in cash within its cash flow from investing activities. This type of investment is common for growing companies and even well-established companies looking to expand their operations or develop new product lines.

However, it is essential to review the entire cash flow statement to determine if the negative cash flow is a positive or negative development. Investors can calculate a company's free cash flow to evaluate a negative cash flow situation effectively. Free cash flow is the money remaining after paying for capital expenditures and operating expenses, and it indicates how effectively a company's management generates cash.

The cash flow statement is one of the three fundamental financial statements used by financial leaders, alongside the income statement and balance sheet. It provides insights into a company's financial health and operational efficiency, helping investors make informed decisions. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

Cash Outflow for Land Purchase: Investing Activity?

You may want to see also

Investing activities include changes in short-term investments, and property, plant, and equipment

A cash flow statement is a financial report that details how cash entered and left a business during a reporting period. It is one of the three fundamental financial statements used by financial leaders, alongside the income statement and balance sheet.

The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. This information is used by business owners, managers, and stakeholders to understand the value and health of their company and guide financial decision-making.

Investing Activities

Investing activities include any sources and uses of cash from a company's investments. This covers the purchase and sale of physical assets, investments in securities, or the sale of securities or assets. These investments can be made to generate income or they may be long-term investments in the health and performance of the company.

Negative cash flow from investing activities is not necessarily an indicator of poor financial health. It can mean that management is investing in the long-term health of the company, such as research and development.

Changes in Short-Term Investments

Changes in short-term investments are included in the investing activities section of the cash flow statement. Short-term investments are considered current assets and are usually converted to cash within a year. Examples of short-term investments include marketable securities such as stocks, bonds, and commercial paper.

Property, Plant, and Equipment

Property, plant, and equipment (PP&E) are also included in the investing activities section of the cash flow statement. PP&E refers to the physical assets that a company needs to operate, such as buildings, machinery, vehicles, and computers.

Purchases of PP&E are considered capital expenditures (CapEx) and result in negative cash flow. However, they are important for the growth and capital of a company, and can indicate that the company is investing in future operations.

Changes in Property, Plant, and Equipment

Changes in PP&E are reflected in the investing activities section of the cash flow statement. If a company has differences in the values of its PP&E from period to period on the balance sheet, this indicates investing activity.

For example, if a company purchases a new machine, its output will increase, improving cash flow and gross profits. Similarly, investing in a new building or additional equipment can increase efficiency and revenue.

In summary, investing activities, including changes in short-term investments and property, plant, and equipment, are a crucial part of the cash flow statement. They provide insight into how a company is allocating its cash and investing in its future operations and long-term health.

Maximizing Investment Returns: Timing Your Cash Withdrawals

You may want to see also

Capital expenditures are also found in this section

Capital expenditures (CapEx) refer to a company's long-term investments in physical fixed assets, such as property, buildings, and equipment. These are essential purchases for a company to operate and grow, and they are expected to provide benefits for more than 12 months. Capital expenditures are distinct from operating expenses (OpEx), which refer to the day-to-day costs of running a business and do not provide long-term benefits.

When a company makes a capital expenditure, it is recorded as a negative value on the cash flow statement for that accounting period. This is because capital expenditures represent an outflow of cash, even though they are expected to bring benefits in the future. The amount of capital expenditure can be calculated by subtracting the current period's PP&E (property, plant, and equipment) from the PP&E of the previous period and then adding depreciation.

For example, if a company purchases new computers and printers as capital expenditures, these assets will be necessary for the company's operations and may be expected to last for several years. However, the cost of these assets will be recorded as a negative value in the investing activities section of the cash flow statement for the period in which they were purchased.

Capital expenditures are crucial for businesses to maintain and grow their operations. They represent a significant outflow of cash and can have a major impact on a company's financial health and liquidity. Therefore, it is essential for businesses to carefully consider their capital expenditures and ensure they are aligned with their strategic goals and financial capabilities.

Is Your Cash App Investing Insured? Know the Facts

You may want to see also

Frequently asked questions

A cash flow statement is a financial report that details how cash entered and left a business during a reporting period. It is one of the three fundamental financial statements that provide crucial financial data to inform a company's decision-making.

There are three sections to a cash flow statement: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Cash flow from investing activities is a section of the cash flow statement that details the cash inflows and outflows related to the acquisition and disposition of long-term assets and investments in other companies' securities.

Investing activities include the purchase of physical assets, investments in securities, or the sale of securities or assets. Examples include purchasing property, plant, and equipment, as well as buying or selling stocks and bonds.