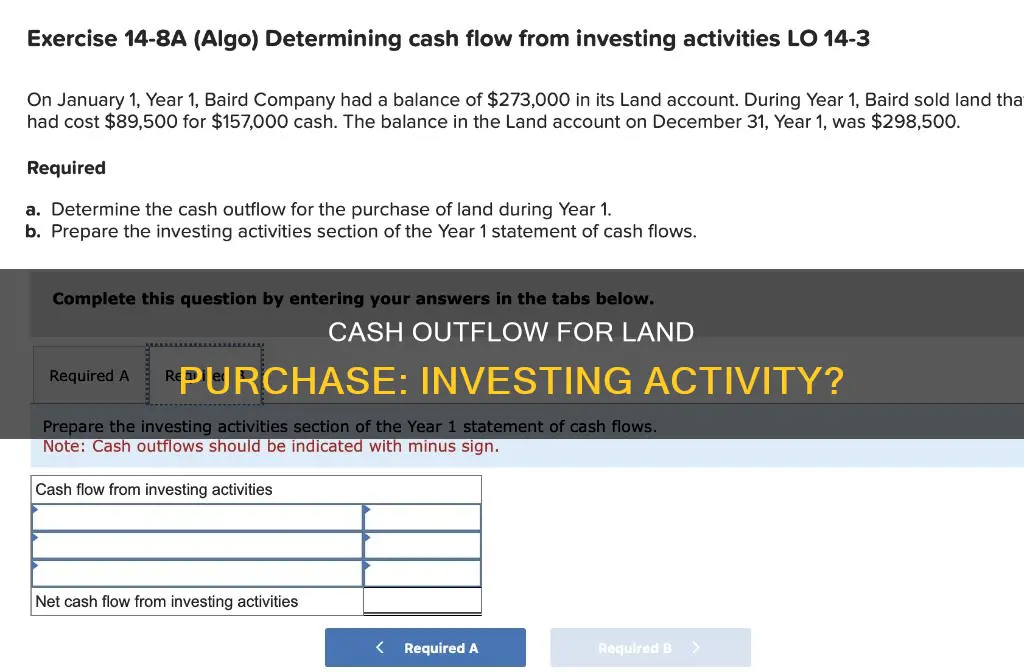

A company's cash flow statement is a crucial indicator of its financial health. It details the sources and usage of cash over a specific period, including cash flow from operations, investing, and financing. Investing activities involve the purchase and sale of long-term assets and business investments, such as property, plant, and equipment. This also includes the purchase of land, which would be classified as a cash outflow and an investing activity. While negative cash flow from investing activities can sometimes indicate poor financial performance, it is not always the case. Companies may be investing heavily in long-term assets, such as land, to support future growth and profitability. Therefore, it is essential to consider the nature of the investing activities when analyzing a company's financial health.

What You'll Learn

Purchase of fixed assets

Fixed assets are tangible assets that are purchased for the supply of services or goods, use in the production process, letting out on rent to third parties, or for administrative purposes. They are also known as non-current assets, property, plant, and equipment (PP&E), or capital assets. These assets are expected to be used for more than a year and are not consumed, sold, or converted to cash within an accounting calendar year.

The purchase of fixed assets is an investing activity that involves a cash outflow. It is recorded on the balance sheet and in the cash flow statement, which is one of the three main financial statements used by businesses. The cash flow statement details the sources and uses of funds, showing how much cash has been generated or spent on operating, investing, and financing activities over a specific period.

When a fixed asset is purchased, it is recorded on the balance sheet and the cash flow statement. The purchase price, as well as any additional costs such as shipping, installation, and taxes, are included in the total cost of the asset. This is then recorded as a debit to the fixed asset account and a credit to the cash account.

For example, if a company purchases a piece of equipment for $10,000 and incurs an additional $500 in shipping costs, the total cost of the asset would be $10,500. This would be recorded as a debit of $10,500 to the Equipment account and a credit of $10,500 to the Cash account.

It is important to note that fixed assets are depreciated over their useful lives, and this depreciation is recorded as a monthly expense. This means that the value of the asset is reduced over time, reflecting its decreasing value. The depreciation expense is recorded in the Accumulated Depreciation account, and it is important to monitor the net book value of the asset, which is calculated by subtracting the accumulated depreciation from the original cost.

In summary, the purchase of fixed assets is an investing activity that involves a cash outflow. It is recorded on the balance sheet and the cash flow statement, with the purchase price and any additional costs being debited to the fixed asset account and credited to the cash account. Depreciation of the asset is then recorded as a monthly expense, reducing its value over time.

Cash Investment Strategies: Your Guide to Profitable Opportunities

You may want to see also

Purchase of investments

Investing activities are one of the main categories of net cash activities that businesses report on their cash flow statements. This includes the purchase of investments such as stocks, bonds, or other types of investments.

The purchase of investments involves a business or individual acquiring assets or items with the goal of generating income or gaining appreciation. This can include various types of investments such as stocks, bonds, real estate, or alternative investments.

When a business purchases an investment in cash, it leads to a decrease in the company's cash flow from investing activities. This is because cash is flowing out of the business to cover the cost of the investment. However, it is important to note that this outflow of cash is done with the expectation of future gains or appreciation in the value of the investment.

The purchase of investments is typically done with the intention of holding them for the long term. This is different from speculation, which involves attempting to capitalize on short-term market inefficiencies. Investing generally carries a lower risk compared to speculation and is focused on long-term growth or income.

The purchase of investments can also be made by individuals for their personal financial goals. This may include creating a diversified portfolio, saving for retirement, or making major purchases. It is important for individuals to understand the vehicles they are investing in, establish a personal spending plan, and consider the tax implications of their investments.

Overall, the purchase of investments is a crucial aspect of investing activities, whether done by businesses or individuals, as it involves allocating cash for the expectation of future gains and long-term growth.

Mortgages: Cash or Investment? Understanding the Basics

You may want to see also

Proceeds from the sale of investments

The proceeds received before any deductions are known as gross proceeds, which include all expenses incurred in the transaction, such as legal fees, shipping costs, and broker commissions. Net proceeds, on the other hand, are the final amount received after all costs and expenses have been deducted from the gross proceeds. These costs can include fees, commissions, advertising or digital media costs, and taxes.

In the context of investing activities, proceeds from the sale of investments represent the cash inflows generated from selling securities or assets. This is considered an investing activity as it involves the disposal of non-current assets, which can include long-term investments, property, plant, and equipment.

For example, proceeds from the sale of marketable securities can contribute to a positive cash flow from investing activities, as seen in Apple's cash flow statement for the twelve months ending September 30, 2023. In this case, the proceeds from the sale of marketable securities amounted to $5.83 billion, contributing to a net cash flow of $3.71 billion from investing activities.

Cash Flow and Investing: What's the Real Relationship?

You may want to see also

Lending money

When a company lends money, it becomes an investment activity that can have several benefits. Firstly, lending money can provide a stable stream of income in the form of interest payments from the borrower. This interest income serves as a source of revenue for the lending entity. Secondly, lending money can help foster strategic partnerships and strengthen business relationships. By offering loans, a company may establish or solidify alliances with borrowers, potentially opening doors to future collaborations, business opportunities, or reciprocal benefits.

The decision to lend money should be approached with prudence and a thorough understanding of the associated risks. One of the primary risks is the possibility of default, where the borrower fails to repay the loan as agreed. This scenario can result in financial losses for the lender and negatively impact their cash flow. Assessing the creditworthiness of potential borrowers is essential to mitigate this risk. Another risk lies in the opportunity cost of lending money. By allocating funds to loans, a company forgoes other potential investment opportunities that could have generated higher returns. Therefore, lenders should carefully evaluate the potential gains and weigh them against the opportunity costs.

In conclusion, lending money is a significant aspect of investing activities, offering potential benefits such as interest income and strategic partnerships. However, it is important to carefully assess the risks involved, including the possibility of default and the opportunity costs associated with lending. By prudently managing these risks, companies can harness the power of lending money as a tool for generating positive cash flow and fostering business relationships.

Unlocking the Power of Idle Cash: Smart Investment Strategies

You may want to see also

Proceeds from the sale of fixed assets

When a company sells a fixed asset, several accounting steps must be taken:

- Record the fixed asset's depreciation expense up until the date of the sale.

- Remove the fixed asset's cost and updated accumulated depreciation from the books.

- Record the cash received from the sale.

- Calculate and record any gain or loss on the sale. The gain or loss is the difference between the net book value of the asset (original cost minus accumulated depreciation) and the cash received. If the cash received is greater than the net book value, the difference is recorded as a gain. If it is less, the difference is recorded as a loss.

The sale of fixed assets is classified as an investing activity on a company's cash flow statement. This statement shows the sources and uses of cash within a specific period, specifically related to investment activities. Investing activities can include the purchase or sale of physical assets, investments in securities, or the collection of loans and insurance proceeds.

Overall, the proceeds from the sale of fixed assets are an important aspect of a company's financial management and are reflected in its cash flow and accounting records.

Cash Allocation Strategies: Investing Your Money Wisely

You may want to see also

Frequently asked questions

A cash flow statement is a financial report that outlines a company's sources and usage of cash over a specific period. It is used to assess a company's liquidity, flexibility, and overall financial performance.

There are three types of cash flow activities: operating activities, investing activities, and financing activities. Operating activities refer to cash flows related to net income, such as sales revenue and payments for merchandise. Investing activities involve cash flows related to non-current assets, including long-term investments, property, and equipment. Financing activities include cash flows related to non-current liabilities, debt, equity, and dividend transactions.

Cash outflow is calculated by summing up all the payments or expenditures made during a specific period. For example, if a company purchases land, the cost of the land will be included in the cash outflow calculation.

Yes, the purchase of land is considered an investing activity. Investing activities include the acquisition of long-term assets, such as property, and equipment. The purchase of land would fall under this category as it is a non-current asset and a long-term investment.

Distinguishing between different types of cash flow activities is crucial for understanding a company's financial health and decision-making. For example, negative cash flow from investing activities, such as purchasing land, does not necessarily indicate poor performance. Instead, it could mean the company is investing in its long-term growth and development.