In today's fast-paced business environment, effective management of cash flow is crucial for any organization's success. Managers often face the challenge of allocating short-term excess cash strategically to maximize its value. This decision is critical as it can impact the company's financial health, growth prospects, and overall stability. The question of where to invest this surplus capital is a complex one, requiring careful consideration of various factors such as liquidity, risk tolerance, and potential returns. This paragraph aims to explore the various options available to managers, highlighting the importance of making informed choices to ensure the efficient utilization of short-term excess cash.

| Characteristics | Values |

|---|---|

| Bank Deposits | Safe, liquid, and easily accessible. Offers slightly higher interest rates than traditional savings accounts. |

| Money Market Funds | Low risk, highly liquid, and offer higher yields than savings accounts. |

| Treasury Bills | Backed by the U.S. government, very low risk, and offer short-term liquidity. |

| Commercial Paper | Short-term debt issued by corporations, generally considered low risk. |

| Short-Term Bonds | Low to moderate risk, offering slightly higher returns than money market funds. |

| Reverse Repurchase Agreements | Involves lending cash to a financial institution in exchange for a security, typically with low risk. |

| Tax-Free Municipal Bonds | Issued by local governments, offering tax-free income, but with slightly lower yields. |

| Corporate Bonds | Issued by companies, offering higher yields but with higher risk. |

| Stock Market | Investing in stocks can provide higher returns but carries more risk. |

| Real Estate Investment Trusts (REITs) | Allows investment in real estate without direct property ownership, offering diversification. |

| Short-Term Loans to Customers | Can be a viable option for businesses with strong customer relationships and creditworthiness. |

| Treasury Inflation-Protected Securities (TIPS) | Protects against inflation, offering principal and interest protection. |

| Short-Term Loans to Suppliers | Can be a strategic move for businesses with strong supplier relationships. |

| Short-Term Loans to Employees | Provides a way to manage payroll fluctuations and maintain cash flow. |

| Short-Term Loans to Other Businesses | Can be a way to generate interest income and support business relationships. |

What You'll Learn

- Liquidity Management: Ensure cash is accessible for immediate needs

- Debt Repayment: Prioritize reducing short-term debt to improve financial health

- Operational Efficiency: Invest in projects to boost productivity and reduce costs

- Market Opportunities: Explore potential investments in growth areas

- Emergency Fund: Maintain a reserve for unexpected expenses and crises

Liquidity Management: Ensure cash is accessible for immediate needs

Effective liquidity management is crucial for any business to ensure that it has the necessary cash flow to meet its short-term obligations and take advantage of immediate opportunities. When managers have a surplus of cash, it presents an opportunity to optimize its use and enhance the company's financial health. Here's a comprehensive guide on how to approach this:

Understanding Liquidity Needs: Begin by assessing the company's immediate financial requirements. This involves identifying short-term liabilities, such as accounts payable, upcoming expenses, and any short-term debts that need to be repaid. By understanding these obligations, managers can determine the minimum amount of cash required to cover these immediate needs. For instance, if a company has a large invoice payment due in the next week, it should allocate a portion of the excess cash to ensure the payment is made on time.

Implementing a Cash Reserve: Establishing a cash reserve is a fundamental strategy for liquidity management. This reserve acts as a safety net, providing quick access to cash for unforeseen circumstances or urgent requirements. The amount allocated to the reserve should be based on the company's specific needs and risk tolerance. A common approach is to set aside a percentage of the excess cash, such as 10-15%, as a liquid reserve. This ensures that the company has a readily available fund to cover unexpected expenses or take advantage of sudden business opportunities.

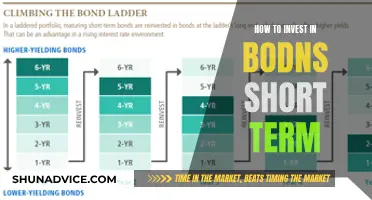

Short-Term Investment Options: Managers should explore various short-term investment opportunities to make the most of their excess cash while maintaining liquidity. These investments should be low-risk and easily convertible to cash without significant loss. Here are some strategies:

- Money Market Funds: Investing in money market funds provides a safe and liquid option, offering a higher return than traditional savings accounts.

- Treasury Bills: These are low-risk, short-term investments issued by governments, providing a stable return with quick accessibility.

- Short-Term Corporate Bonds: Carefully selecting short-term corporate bonds can offer higher yields while still being relatively safe.

Regular Review and Adjustment: Liquidity management is an ongoing process that requires regular monitoring and adjustment. Managers should schedule periodic reviews to assess the effectiveness of the cash reserve and investment strategies. Market conditions and business needs may change, so staying agile is essential. For instance, if the company's short-term liabilities decrease, the cash reserve can be adjusted accordingly, potentially freeing up funds for other strategic initiatives.

By implementing these practices, managers can ensure that excess cash is not only preserved but also actively contributing to the company's financial stability and growth. It allows the business to navigate short-term challenges and seize opportunities with a well-managed cash flow.

Long-Term Investing: Understanding the Credit-Debit Balance

You may want to see also

Debt Repayment: Prioritize reducing short-term debt to improve financial health

When managers find themselves with excess cash in the short term, one of the most prudent strategies is to prioritize debt repayment. This approach is a cornerstone of sound financial management and can significantly improve a company's financial health and stability. Short-term debt, often in the form of accounts payable, supplier invoices, or short-term loans, can be a burden if not managed effectively. By focusing on reducing this debt, managers can unlock several benefits that contribute to the overall financial well-being of the organization.

The primary advantage of prioritizing debt repayment is the immediate improvement in the company's liquidity position. Short-term debt is typically due within one year, and by allocating excess cash towards this repayment, the company reduces its financial obligations in the near term. This action ensures that the business has more cash available for day-to-day operations, investments, or potential emergencies, providing a buffer against unforeseen circumstances. Effective management of short-term debt can also enhance the company's creditworthiness, as it demonstrates a commitment to financial responsibility and can lead to better borrowing terms in the future.

Additionally, reducing short-term debt can have a positive impact on the company's cash flow. When a business pays off its short-term debts, it frees up cash that was previously allocated to interest payments and principal repayment. This improved cash flow can be reinvested in the business, allowing for expansion, research and development, or the enhancement of operational efficiency. Over time, this can lead to increased profitability and a stronger financial position.

To implement this strategy, managers should conduct a thorough analysis of the company's short-term liabilities and negotiate with creditors to establish a repayment plan. Prioritizing debt repayment may involve reallocating funds from less critical areas or seeking alternative financing options. It is crucial to maintain a balance between debt reduction and maintaining sufficient liquidity to meet ongoing obligations. Regular monitoring of the company's financial health and adjusting strategies accordingly will ensure that the business remains on a stable financial path.

In summary, prioritizing short-term debt repayment is a strategic decision that can have a profound impact on a company's financial stability and growth. By taking control of short-term liabilities, managers can improve cash flow, enhance creditworthiness, and provide a more secure foundation for the organization's future endeavors. This approach demonstrates a proactive and responsible management style, which is essential for long-term success in a competitive business environment.

Understanding the Nature of Investment Sales: Operating or Not?

You may want to see also

Operational Efficiency: Invest in projects to boost productivity and reduce costs

When managers find themselves with short-term excess cash, one strategic approach is to invest in operational efficiency projects. This strategy focuses on optimizing internal processes to enhance productivity and reduce costs, ensuring that the organization operates at its highest potential. By allocating funds to these initiatives, managers can make a significant impact on the company's overall performance and financial health.

The primary goal of investing in operational efficiency is to streamline processes and eliminate waste. This involves a thorough analysis of current operations to identify areas of improvement. For instance, a manufacturing company might examine its production lines to reduce downtime, optimize assembly processes, or implement just-in-time inventory management to minimize holding costs. Similarly, a service-based business could focus on automating repetitive tasks, improving customer support systems, or redesigning workflows to enhance overall efficiency.

One effective method to boost productivity is by implementing lean management principles. This approach emphasizes eliminating activities that do not add value to the customer, reducing waste, and optimizing processes. For example, a company could introduce Kanban boards to manage workflow, reduce bottlenecks, and improve lead times. Additionally, cross-training employees to perform multiple tasks can increase flexibility and ensure that critical functions are covered during peak periods or when specific roles are vacant.

Reducing costs is another critical aspect of operational efficiency. Managers can achieve this by negotiating better deals with suppliers, especially for raw materials or services that are essential to the production process. Implementing energy-efficient technologies and practices can also lead to significant cost savings over time. For instance, investing in LED lighting, energy-efficient appliances, or smart building management systems can reduce utility expenses.

Furthermore, investing in employee training and development can have a substantial impact on operational efficiency. Well-trained employees are more productive, make fewer errors, and often require less supervision. Providing regular training programs, workshops, or mentorship opportunities can enhance the skills of the workforce, leading to improved performance and reduced costs associated with errors or rework.

In summary, investing short-term excess cash in operational efficiency projects is a strategic decision that can yield long-term benefits. By focusing on process optimization, waste reduction, and cost-saving measures, managers can significantly improve the organization's productivity and financial stability. This approach ensures that the company operates efficiently, delivers value to customers, and maintains a competitive edge in the market.

Understanding Cash as a Short-Term Investment: Strategies and Benefits

You may want to see also

Market Opportunities: Explore potential investments in growth areas

When managers have short-term excess cash, exploring market opportunities can be a strategic approach to generate returns and potentially grow their company's financial assets. This strategy involves identifying and investing in sectors or industries that are currently experiencing rapid growth and have the potential to yield significant returns in the short term. Here's a detailed breakdown of this approach:

Industry Research and Analysis: Begin by conducting thorough research on various industries and markets. Identify sectors that are witnessing rapid expansion and have a high potential for short-term growth. This could include emerging technologies, innovative startups, or industries with disruptive business models. For example, sectors like renewable energy, artificial intelligence, or digital health might offer exciting prospects. Utilize market research reports, industry publications, and financial data sources to gather insights and identify trends.

Growth Potential Assessment: Evaluate the growth prospects of the identified industries. Look for factors such as market size, growth rate, competitive landscape, and future projections. Analyze the factors that contribute to the industry's success, such as technological advancements, changing consumer preferences, or regulatory support. Assess the potential risks and challenges associated with each industry to make informed investment decisions.

Investment Strategies: Explore different investment avenues within these growth areas. Consider the following options:

- Equity Investments: Invest in companies operating in these growth industries by purchasing their stocks or shares. Look for companies with strong fundamentals, innovative products or services, and a solid management team. Diversify your investments across multiple companies to manage risk.

- Venture Capital Funds: Consider investing in venture capital (VC) funds that focus on early-stage startups within the identified growth sectors. VC funds pool money from multiple investors to support high-growth companies, and they can provide access to a portfolio of promising businesses.

- Direct Investment in Startups: For more hands-on involvement, managers can directly invest in startups or small businesses within these growth industries. This approach may require more due diligence and risk assessment but can offer significant returns if the investment proves successful.

Risk Management: While exploring market opportunities, it is crucial to manage risks effectively. Diversify your investments to minimize the impact of any single investment's performance. Regularly review and reassess your portfolio to ensure it aligns with your risk tolerance and financial goals. Stay updated on industry news and market trends to make timely adjustments to your investment strategy.

By focusing on market opportunities and investing in growth areas, managers can make strategic use of their short-term excess cash, potentially increasing the company's financial assets and contributing to its long-term success. This approach requires thorough research, analysis, and a willingness to embrace emerging trends in the business world.

Navigating Cash Flow: Short-Term Investments: A Balanced Approach

You may want to see also

Emergency Fund: Maintain a reserve for unexpected expenses and crises

An emergency fund is a crucial component of a manager's financial strategy, providing a safety net for unexpected expenses and crises. This reserve is essential to ensure that you can handle financial emergencies without resorting to high-interest debt or compromising long-term financial goals. The primary purpose of this fund is to provide liquidity during unforeseen circumstances, such as medical emergencies, sudden job loss, or unexpected home repairs.

To determine the appropriate amount for your emergency fund, consider your personal financial situation and risk tolerance. A common rule of thumb is to save enough to cover three to six months' worth of living expenses. This calculation takes into account your monthly income, fixed expenses, and variable costs. For instance, if your monthly expenses total $2,000, aiming for a six-month reserve would mean saving $12,000. This amount should ideally be kept in a readily accessible, low-risk investment vehicle to ensure liquidity when needed.

When building your emergency fund, it's essential to prioritize liquidity. This means choosing investment options that can be quickly converted into cash with minimal loss. High-yield savings accounts, money market funds, or short-term government bonds are excellent choices for this purpose. These options offer a balance between safety and accessibility, allowing you to access your funds without incurring significant penalties or losses.

Additionally, consider the potential impact of inflation on your emergency fund. Over time, the purchasing power of your savings may diminish due to inflation. To combat this, aim to invest in assets that outpace inflation. This could include a combination of high-yield savings, inflation-indexed bonds, or carefully selected stocks with a history of outperforming the market during inflationary periods.

In summary, an emergency fund is a vital tool for financial security, providing a buffer against life's unpredictable events. By setting aside a portion of your short-term excess cash, you can ensure that you have the financial resources to navigate unexpected expenses and crises with confidence. Regularly reviewing and adjusting your emergency fund based on your changing financial circumstances will help you maintain a robust safety net.

Maximize Your $5000: Short-Term Investment Strategies for Quick Returns

You may want to see also

Frequently asked questions

Managers often maintain a portion of their cash reserves in short-term investments to ensure liquidity, meet immediate financial obligations, and take advantage of potential short-term opportunities.

For the very short term, managers typically opt for highly liquid assets like money market funds, short-term government bonds (T-bills), or high-quality corporate paper. These investments offer minimal risk and can be quickly converted into cash without significant loss.

While short-term investments are generally considered low-risk, there are still considerations. Managers should be aware of potential credit risk, especially with corporate paper, and market risk, which can impact the value of investments if market conditions change.

Diversification is key. Managers can allocate funds across different short-term investment options, such as various money market funds, to minimize risk. Regularly reviewing and rebalancing the portfolio can also ensure optimal performance.

One common mistake is over-investing in a single asset, which can lead to concentrated risk. Another pitfall is holding cash in a traditional savings account, which may result in lost opportunities for higher returns. Managers should also avoid investing in illiquid assets that cannot be quickly converted to cash when needed.