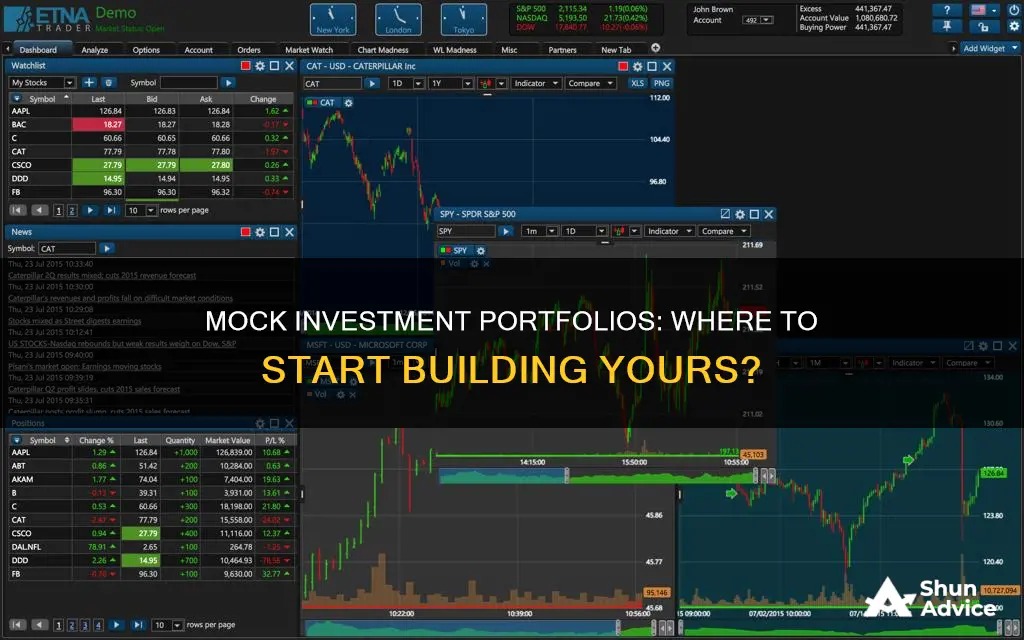

Mock investment portfolios are a great way to get a taste of the stock market without any of the risks. They are ideal for beginners, allowing them to go through the motions of investing without putting down any money. Many websites offer free mock portfolio services, such as MarketWatch Virtual Stock Exchange, Wall Street Survivor, and How the Market Works. These platforms often provide virtual cash to invest in stocks, simulating real market conditions. Additionally, some platforms offer competitions, allowing users to compete against others to see who can generate the highest profits.

| Characteristics | Values |

|---|---|

| Purpose | Educational tool for aspiring investors to learn about the market without financial risk |

| Function | Simulates the real market, allowing users to go through the motions of investing without using real money |

| Investment Types | Stocks, ETFs, mutual funds, bonds, cryptocurrencies |

| Additional Features | Trackers, portfolio optimisers, simulators, screeners, watchlists, alerts |

| Example Platforms | Yahoo Finance, Microsoft Excel, Google Sheets, Covey, Ziggma, Delta Investment Tracker, AssetDash, Stock Rover, Kubera |

What You'll Learn

Investment goals and objectives

Before creating a mock investment portfolio, it is important to determine your investment goals and objectives. This will help guide your investment decisions and ensure that you are making choices that align with your financial goals. Here are some key considerations to keep in mind:

- Investment Time Horizon: Consider the amount of time you are willing to commit to your investments. Are you looking to invest for the short-term or long-term? This will impact the types of investments you choose and the potential risks involved.

- Risk Tolerance: Determine your risk tolerance, which refers to the amount of risk you are comfortable taking with your investments. This will depend on your financial situation, goals, and personal comfort level with risk.

- Desired Outcomes: What are you hoping to achieve with your investments? Are you saving for a specific goal, such as a down payment on a car or a special purchase? Or are you looking to grow your wealth over time? Clearly defining your desired outcomes will help guide your investment strategies.

- Investment Types: Familiarize yourself with the different investment options available, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Each investment type comes with its own level of risk and potential for growth. Diversifying your portfolio by investing in a variety of assets can help balance risk and increase potential returns.

- Research and Education: Take the time to research and educate yourself about the stock market, financial websites, and investing strategies. Understanding key investment concepts such as diversification, risk, and market research will empower you to make more informed decisions.

- Regular Monitoring and Adjustments: A mock investment portfolio should be actively monitored and adjusted as needed. Stay up-to-date with financial news, market trends, and company updates that may impact your mock investments. Regularly review your portfolio's performance and consider making changes to optimize your returns and minimize losses.

- Learning from Mistakes: One of the benefits of a mock portfolio is the ability to learn from your mistakes without incurring real financial losses. Analyze the impact of your investment decisions and evaluate what strategies worked well and what could be improved. This will help refine your investment knowledge and decision-making skills.

By clearly defining your investment goals and objectives, you can create a mock investment portfolio that aligns with your financial aspirations and provides a valuable learning experience. Remember to consider your time horizon, risk tolerance, and desired outcomes, and stay committed to monitoring and adjusting your mock portfolio as you gain experience in the world of investing.

Assessing Chase You Invest: Portfolio Performance Indicators

You may want to see also

Investment types

There are several types of investments, each carrying different levels of risk and reward. Here are some of the most common investment types:

- Stocks / Equities: These are direct investments in a business, purchased through shares. Stocks can increase in value, and the company may pay dividends to shareholders. However, stock prices can also fluctuate and decrease.

- Bonds: These are fixed-income securities offered by governments and businesses. When you buy a bond, you are lending money to the issuer (the government or a company). Over the term of the bond, the issuer will typically pay you interest, and you will receive the original amount loaned (known as the face value) when the bond matures.

- Mutual Funds: These are pools of investments, allowing you to hold portions of many different investments. A professional fund manager decides where to invest the pooled money and when to buy and sell. The value of a mutual fund fluctuates based on the performance of its underlying investments.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, ETFs are also pools of investments that trade on stock exchanges. ETFs can invest in equities, bonds, or commodities and may specialise by industry, sector, or country. They are often attractive to retail investors due to their low cost, diversification, and share-like features.

- Real Estate: This includes investing in physical property, such as residential or commercial real estate, or in companies that manage and profit from real estate, such as Real Estate Investment Trusts (REITs). REITs trade on stock exchanges and pay regular distributions to investors from rental income.

- Cryptocurrencies: Crypto assets, such as Bitcoin and Ether, are digital assets that use cryptography and peer-to-peer networking to facilitate secure transactions. They are considered very risky due to their volatile nature and frequent price fluctuations.

- Commodities: These include metals, oil, grain, animal products, financial instruments, and currencies. Commodities can be traded through commodity futures or ETFs. They can be used for hedging risk or speculative purposes.

These are just a few examples of the many investment types available. Each type comes with its own set of risks and potential rewards, and it's important to understand these before making any investment decisions.

Investing in Art: Diversifying Your Portfolio with Masterpieces

You may want to see also

Online portfolio tracking

- Fool.com: This website offers a Quotes & Data area where you can set up a mock portfolio and track details such as when you "bought" the shares and at what price. You can then monitor your performance over time, aiming to beat the market.

- Covey: A free virtual mock portfolio tracker that allows you to submit a portfolio of equities, exchange-traded funds (ETFs), or crypto. You can compete with other users and discover how great an investor you are. Covey provides tools and resources to help you learn and improve your trading skills through its network of virtual investment communities.

- Ziggma: A comprehensive investment management platform that offers portfolio tracking, stock analysis, and innovative portfolio management tools. Ziggma helps investors understand their portfolios better and make more informed decisions. It offers a freemium version and a premium version at a monthly price.

- Delta Investment Tracker: A multi-asset portfolio tracker with a minimalist interface. Delta allows you to track live price movements of various asset classes, including cryptocurrencies, stocks, ETFs, bonds, options, and futures. It provides clear notifications when significant changes occur in your virtual portfolio.

- AssetDash: A privacy-focused platform that supports multiple assets, including stocks, crypto, NFTs, mutual funds, and bank balances. AssetDash is ideal for those with diverse portfolios who need a single platform to keep track of their investments.

- Stock Rover: This platform helps you analyse your portfolio's performance, holdings, dividend-adjusted returns, and the risk and reward of your investments. Stock Rover provides easy-to-read charts and various ways to analyse your investments.

- Kubera: A modern financial tracker that helps you monitor your net worth and investment returns for various asset classes, including cryptocurrencies, stocks, ETFs, mutual funds, global currencies, and precious metals. Kubera stands out for its connectivity to major crypto exchanges, wallets, and financial institutions. It offers a user-friendly spreadsheet-like interface and customizable charts and graphs.

When choosing an online portfolio tracker, consider factors such as the number of trackable assets, device compatibility and speed, user interface, and additional resources provided by the platform. These tools can help you develop and refine your investment strategies before entering the real market.

Age-Based Investment Strategies: Building a Strong Portfolio Mix

You may want to see also

Virtual market simulators

Covey

Covey is a free virtual portfolio tracker that allows users to create mock portfolios of equities, exchange-traded funds (ETFs), or cryptocurrencies. It offers a community aspect, allowing users to share ideas and learn from others. Covey also provides a competitive element, where users can compete to become an investment manager on its Copy Trading App.

Ziggma

Ziggma is a comprehensive investment management, stock analysis, and portfolio tracking platform. It offers portfolio monitoring, stock and ETF screening, and portfolio simulation tools. Ziggma helps investors understand their portfolios and make better-informed decisions with its algorithm-powered big data stock research.

Delta Investment Tracker

Delta is a multi-asset portfolio tracker that provides a clear overview of your total virtual portfolio balance and profit or loss for each timeframe. It supports various asset classes, including cryptocurrencies, stocks, ETFs, bonds, options, and futures. Delta features a minimalist design and default dark mode, making it ideal for beginners.

AssetDash

AssetDash is a privacy-focused platform that allows users to track a wide range of assets, including stocks, cryptocurrencies, NFTs, mutual funds, and bank balances. It supports over 100 apps and integrates with various financial markets, exchanges, and blockchain networks. AssetDash is an excellent choice for those with diverse portfolios.

Stock Rover

Stock Rover is a virtual portfolio tracker that provides in-depth analysis of your portfolio's performance, holdings, dividend-adjusted returns, and risk and reward of investments. It offers easy-to-read charts and various analysis tools to help users understand their portfolios better.

MockPortfolios.com

MockPortfolios.com is a free mock trading portal designed specifically for teen investors. It offers stock competitions with different rules and regulations, allowing users to practice investing in a controlled environment. The site also provides educational resources to help teens learn about the stock and crypto markets.

Understanding Portfolio Investment Entities in New Zealand

You may want to see also

Investment portfolio optimisation

Building a mock investment portfolio is a great way to get acquainted with investing without taking on any financial risk. It allows you to go through the motions of investing, from researching companies to deciding on a portfolio, without using real money. This risk-free method is an excellent way to learn about investing and can be especially beneficial for teenagers and children.

Getting Started

Before creating a mock portfolio, it is essential to determine your investment goals and objectives. This includes deciding on your investment time horizon, risk tolerance, and desired outcomes. For example, are you investing for retirement, to make a down payment on a house, or simply to grow your wealth? Having clear goals will guide your investment decisions.

Choosing Investments

The next step is to familiarise yourself with the basics of investing, including different investment types such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). It is also important to understand key investment concepts like diversification, risk, and return. Once you have a basic understanding, you can start selecting specific investments that align with your goals and risk tolerance.

Tools and Platforms

There are several online tools and platforms available to help you create and manage your mock investment portfolio. These include Yahoo Finance, where you can create an account and assemble a watchlist to track the performance of your chosen investments. Alternatively, you can use a spreadsheet program like Microsoft Excel or Google Sheets to input and monitor your mock investments.

Optimisation Strategies

Portfolio optimisation is the process of selecting the best portfolio out of a set of considered portfolios, typically aiming to maximise expected returns while minimising financial risk. This can involve using optimisation strategies such as Mean Variance Optimisation, which helps find the optimal risk-adjusted portfolio, or Conditional Value-at-Risk, which focuses on minimising expected tail loss. Other strategies include Risk Parity, which equalises the risk contribution of portfolio assets, and the Kelly Criterion, which aims to find the portfolio with the maximum expected geometric growth rate.

Monitoring and Adjusting

An important part of portfolio optimisation is regularly monitoring and evaluating the performance of your chosen investments. This includes analysing factors that may influence stock prices and making any necessary adjustments to your portfolio. Staying informed about financial news, market trends, and company updates can help guide your investment decisions and enhance your understanding of the market.

Benefits of Mock Portfolios

Mock investment portfolios provide a risk-free environment to learn about investing and make informed decisions. They allow you to gain experience in researching and selecting investments, tracking performance, and adjusting your portfolio. By optimising your mock portfolio, you can improve your decision-making skills and refine your investment strategy before investing with real money.

Savings and Planned Investments: What's the Difference?

You may want to see also

Frequently asked questions

A mock investment portfolio is a risk-free way to simulate investing in stocks, ETFs, mutual funds, and more, using pretend money.

Mock portfolios are great for beginners, teens, and kids who want to learn about investing and get familiar with market research and financial websites.

Mock portfolios allow you to learn the basics of investing, make mistakes without losing real money, and gain confidence before entering the real stock market.

You can create a mock portfolio on websites like Yahoo Finance, MockPortfolios.com, MarketWatch Virtual Stock Exchange, Wall Street Survivor, and How the Market Works.

Before creating your mock portfolio, take time to understand your investment goals, time horizon, risk tolerance, and desired outcomes. You should also familiarize yourself with different investment types and key concepts such as diversification, risk, and return.