In the world of finance, investment strategies can vary widely, and some individuals are more inclined towards high-risk options. This paragraph introduces the topic by highlighting the diverse approaches people take when crafting their investment plans. It emphasizes that while some investors prefer a more conservative approach, others are willing to take on higher risks in pursuit of potentially greater returns. The focus is on understanding the factors that drive individuals to choose high-risk investment options, which can be a crucial aspect of financial decision-making.

What You'll Learn

- High-Risk Tolerance: Understanding an individual's risk appetite and willingness to invest in volatile assets

- Market Knowledge: Assessing their understanding of high-risk investments and potential risks

- Diversification: Exploring if they have a strategy to balance high-risk with other asset classes

- Risk Management: Evaluating their ability to handle potential losses and make informed decisions

- Emotional Control: Determining their capacity to make rational choices despite market volatility

High-Risk Tolerance: Understanding an individual's risk appetite and willingness to invest in volatile assets

High-risk tolerance is a critical aspect of investment planning, as it determines an individual's willingness to engage with volatile and potentially lucrative assets. This tolerance is deeply personal and varies widely among investors, influenced by factors such as age, financial goals, and risk-taking history. For some, high-risk investments are a strategic choice, while for others, they represent a significant challenge. Understanding this tolerance is essential for financial advisors and investors alike, as it helps in crafting tailored investment strategies that align with an individual's unique needs and preferences.

At its core, high-risk tolerance refers to an investor's capacity to withstand market volatility and potential losses. It is a measure of an individual's comfort with uncertainty and their ability to make rational decisions during turbulent times. Investors with high-risk tolerance are often more inclined to invest in assets like stocks, derivatives, and other speculative instruments, which can offer substantial returns but also carry the risk of significant losses. These investors are typically more focused on long-term growth and are willing to accept short-term fluctuations in their portfolio value.

Assessing an individual's risk tolerance involves a comprehensive evaluation of their financial situation, goals, and personality. It is not merely about age or income level but also about an investor's attitude towards risk. Younger investors, for instance, often have a higher risk tolerance due to their longer investment horizons and a greater capacity to recover from potential setbacks. They are more likely to view market volatility as an opportunity rather than a threat. In contrast, older investors might have a lower risk tolerance, preferring more stable investments to preserve their capital and ensure a steady income stream during retirement.

Financial advisors play a crucial role in guiding investors towards the right investment choices based on their risk tolerance. They employ various tools and techniques to assess risk, including risk assessment questionnaires, portfolio reviews, and discussions about an investor's financial goals and time horizon. By understanding an individual's risk tolerance, advisors can recommend investment strategies that are both aligned with the investor's goals and comfortable for them. This personalized approach ensures that investors are more likely to stick to their investment plans, even during challenging market conditions.

In summary, high-risk tolerance is a key determinant of an investor's strategy, influencing the types of assets they choose and their overall approach to the market. It is a complex interplay of personal factors, financial goals, and market conditions. By recognizing and understanding an individual's risk tolerance, financial advisors can provide more effective guidance, helping investors make informed decisions that are both profitable and manageable. This understanding is vital for building long-term wealth and achieving financial success in an ever-changing economic landscape.

Life Cycle Theory: Savings and Investment Strategies Explored

You may want to see also

Market Knowledge: Assessing their understanding of high-risk investments and potential risks

When evaluating an individual's investment strategy, it is crucial to assess their understanding of high-risk investments and the potential risks associated with them. This evaluation is essential as it directly impacts the long-term success and sustainability of their financial plan. Here's a detailed approach to gauging their market knowledge in this area:

Understanding High-Risk Investments: Begin by examining whether the person has a clear grasp of what constitutes a high-risk investment. These typically include volatile assets like options, futures, and certain derivatives. It is important to assess if they recognize the inherent volatility and potential for significant losses that these investments carry. A comprehensive understanding of these concepts is vital, as it forms the foundation for making informed decisions.

Risk Assessment: The next step is to evaluate their ability to identify and assess risks. High-risk investments often come with unique challenges, such as liquidity issues, market manipulation, and the potential for rapid price fluctuations. Instruct them to consider factors like the underlying asset's volatility, the investor's risk tolerance, and the potential impact of external market events. For instance, they should be able to explain how a sudden economic downturn could affect their high-risk portfolio and devise strategies to mitigate these risks.

Research and Analysis: A well-informed investor conducts thorough research and analysis before making any investment decision. Encourage the individual to demonstrate their knowledge by presenting a detailed plan outlining the research methods they would employ for high-risk investments. This could include studying historical price movements, analyzing market trends, and understanding the fundamentals of the underlying assets. The ability to provide a comprehensive research strategy showcases a strong understanding of the market dynamics.

Risk Management Strategies: Effective risk management is a critical aspect of high-risk investing. Ask the person to describe the strategies they would implement to manage potential risks. This might include setting stop-loss orders, diversifying the portfolio, or employing hedging techniques. By demonstrating an understanding of these strategies, they showcase their ability to navigate the inherent risks and protect their capital.

Long-Term Perspective: Finally, assess their long-term perspective on high-risk investments. These options are often used for short-term gains but can be detrimental if not managed properly. Encourage them to consider the potential impact of market volatility over an extended period and how it aligns with their investment goals. A comprehensive understanding of the market knowledge and risks involved will enable them to make more informed and balanced investment choices.

Equilibrium Economics: Savings-Investment Identity

You may want to see also

Diversification: Exploring if they have a strategy to balance high-risk with other asset classes

When considering an investment strategy centered around high-risk options, it is crucial to explore the concept of diversification as a means to balance potential risks. Diversification involves spreading investments across various asset classes, sectors, and geographic regions to mitigate the impact of any single investment's performance on the overall portfolio. This approach is particularly important for those who have opted for high-risk options, as it can help manage volatility and potential losses.

One key aspect of diversification is asset allocation, which determines the distribution of investments among different asset classes such as stocks, bonds, real estate, and commodities. For individuals with a high-risk appetite, a well-diversified portfolio might include a mix of growth-oriented stocks, income-generating bonds, and alternative investments like real estate investment trusts (REITs) or derivatives. By allocating capital across these asset classes, investors can reduce the concentration risk associated with holding only high-risk assets.

Additionally, sector diversification is another critical component. This strategy involves investing in various sectors of the economy to avoid the potential negative impact of a single industry's downturn. For instance, an investor with a high-risk mindset might allocate funds to technology, healthcare, consumer staples, and financial sectors. This approach ensures that the portfolio is not overly exposed to the risks associated with a specific industry, providing a more stable investment environment.

Geographic diversification is also essential to consider. This strategy involves investing in companies or assets from different countries to reduce the impact of country-specific risks. For high-risk investors, this could mean allocating a portion of their portfolio to international markets, including developed and emerging economies. By diversifying globally, investors can benefit from the growth potential of various regions while also managing the risks associated with any single country's economic or political instability.

In summary, for individuals who have chosen to base their investment plan on high-risk options, diversification is a powerful strategy to balance potential risks. By employing asset allocation, sector diversification, and geographic diversification techniques, investors can create a well-rounded portfolio that aims to provide both growth potential and risk mitigation. This approach allows for a more comprehensive and thoughtful investment strategy, ensuring that high-risk investments are managed within a broader context.

Exploring the Riskiest Investment: Navigating High-Reward, High-Risk Vehicles

You may want to see also

Risk Management: Evaluating their ability to handle potential losses and make informed decisions

When assessing an individual's approach to risk management, it's crucial to evaluate their ability to handle potential losses and make informed decisions, especially when their investment plan involves high-risk options. Here's a detailed breakdown of how to approach this evaluation:

Understanding Risk Tolerance: Begin by understanding the person's risk tolerance level. Do they have a high-risk appetite, indicating they are comfortable with potential losses in exchange for higher gains? Or are they risk-averse, preferring safer investments with lower potential returns? This understanding is fundamental as it reflects their willingness to embrace volatility.

Risk Assessment and Management Strategies: Examine the strategies they employ to assess and manage risk. A well-informed investor should have a structured approach to identifying potential risks associated with high-risk options. This includes analyzing historical data, market trends, and industry-specific risks. Effective risk management involves implementing strategies like diversification, where investments are spread across various assets to minimize potential losses.

Decision-Making Process: Evaluate the decision-making process behind their high-risk choices. Do they conduct thorough research and analysis before making investments? Informed decisions are often backed by comprehensive research, considering factors like market conditions, company performance, and industry analysis. A disciplined approach to decision-making ensures that potential losses are minimized while maximizing the chances of success.

Loss Mitigation and Recovery: Assess their strategies for loss mitigation and recovery. In high-risk investments, losses are inevitable, and a robust plan should include mechanisms to minimize the impact. This might involve setting stop-loss orders, which automatically sell investments if they reach a certain price, or having a well-defined exit strategy. Additionally, understanding how they plan to recover from potential losses is essential.

Continuous Monitoring and Adaptation: Effective risk management is an ongoing process. Encourage the individual to continuously monitor their investments and adapt their strategies based on market changes. Regular reviews ensure that potential risks are identified early, and decisions can be made to mitigate losses or capitalize on emerging opportunities.

By thoroughly evaluating these aspects, you can gain insights into the individual's risk management capabilities and their overall approach to high-risk investments. This evaluation is vital for making informed financial decisions and ensuring a well-rounded investment strategy.

Addressing Investment Risk: Strategies for a Secure Financial Plan

You may want to see also

Emotional Control: Determining their capacity to make rational choices despite market volatility

Emotional control is a critical aspect of successful investing, especially when dealing with high-risk options. It involves the ability to make rational decisions, even in the face of market volatility and emotional turmoil. This skill is essential for investors who have chosen to base their investment strategies on high-risk assets, as it can significantly impact their long-term financial well-being.

When an investor decides to venture into high-risk options, they are essentially embracing the potential for substantial gains, but also accepting the possibility of significant losses. This decision often requires a strong emotional control mechanism to navigate the inherent market volatility. Market volatility can be unpredictable, and it's easy for emotions to take over, leading to impulsive and potentially detrimental investment choices. For instance, fear and greed can drive investors to make hasty decisions, such as selling off investments at the wrong time or chasing short-term gains without proper research.

To maintain emotional control, investors must develop a disciplined approach to decision-making. This includes setting clear investment goals, understanding risk tolerance, and creating a well-defined investment strategy. By having a structured plan, investors can make rational choices, even when the market takes an unexpected turn. Regularly reviewing and adjusting the strategy based on market performance and personal circumstances is also crucial. This ensures that the investment plan remains aligned with the investor's goals and risk appetite.

Additionally, investors should educate themselves about the market and the specific high-risk options they are considering. A thorough understanding of the underlying assets, historical performance, and potential risks can help in making informed decisions. Knowledge empowers investors to make rational choices, as they can better assess the potential outcomes and make adjustments as needed. It also helps in recognizing and managing emotional biases that may arise during market fluctuations.

In summary, emotional control is a vital skill for investors who have chosen high-risk options. It enables them to make rational decisions, even in volatile markets, by maintaining discipline, staying informed, and regularly reviewing their investment strategy. This approach ensures that the investment plan remains on track, contributing to the long-term success of the investor's financial goals.

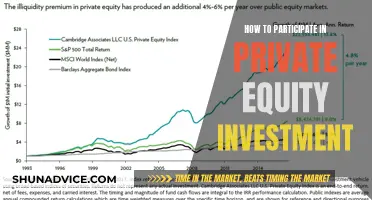

Private Equity Investing: A Guide to Getting Started

You may want to see also

Frequently asked questions

One notable figure is Elon Musk, who has been associated with various high-risk investments, including his involvement in PayPal, Tesla, and SpaceX. He has a reputation for taking bold risks and making unconventional investment decisions.

While some financial advisors may offer high-risk investment options, it is generally not a common practice. Ethical financial advisors typically advise clients to invest in a diversified portfolio of low to moderate-risk assets to ensure long-term financial stability. High-risk investments are usually recommended for a small portion of a client's portfolio, if at all.

Relying exclusively on high-risk investments can lead to significant financial losses. These assets are often volatile and can experience rapid price fluctuations, resulting in substantial gains or losses. Without proper risk management and diversification, investors may face substantial financial risks and potential ruin.

A well-known example is the investment approach of Warren Buffett, who is famous for his value investing principles. While he is not solely focused on high-risk investments, he has made bold bets on undervalued companies, such as his early investments in Coca-Cola and American Express. However, it's important to note that his strategy emphasizes thorough research, long-term holding, and a disciplined approach, which is not typical of high-risk, short-term trading.