The Central Provident Fund (CPF) is a government savings scheme that requires Singaporeans and permanent residents to save 20% of their salary to fund their retirement, healthcare, and housing needs. The CPF pays interest on savings in the Ordinary Account (OA) and Special Account (SA). The CPF Investment Scheme (CPFIS) lets you invest your OA and SA savings in a wide range of investments, including shares, to enhance your retirement savings. However, not all CPF savings can be used for investments, as the money is primarily for retirement needs. When investing with CPF savings, it's important to understand that the interest earned will be affected, so investment options with high returns may be needed to compensate for the difference. It's also crucial to consider the risks involved and only invest what you can afford to lose, as there is a possibility of losing some or all of your investment.

| Characteristics | Values |

|---|---|

| Who can invest | Anyone over 18 who is not an undischarged bankrupt and meets the financial criteria |

| Financial criteria | You must have over $20,000 in your Ordinary Account (OA) and/or over $40,000 in your Special Account (SA) |

| Investment limits | You can invest up to 35% of your investible savings in stocks and up to 10% in gold |

| Investment account | You need to open a CPF Investment Account with an approved CPFIS agent (DBS, OCBC, or UOB) |

| Shares | Only CPF-approved shares can be invested in |

| Company criteria | The company must be incorporated in Singapore, listed on the SGX Main Board, traded in Singapore dollars, not on the SGX watch-list, and must allow agent banks to appoint CPF shareholders as proxies |

| Returns | Over the last 10 years, less than 20% of those who used their CPF to invest in shares made returns larger than the OA's guaranteed returns of 2.5% |

| Interest | The CPF pays an interest of 2.5% for savings in the Ordinary Account (OA) and 4% for savings in the Special Account (SA), Medisave Account, and Retirement Account |

| Extra interest | An extra 1% interest is paid on the first $60,000 of your combined balance (including up to $20,000 from your OA) |

What You'll Learn

Eligibility criteria for investing CPF in shares

To be eligible to invest your CPF savings in shares, you must meet the following criteria:

- You must be at least 18 years old.

- You must not be an undischarged bankrupt.

- You must have more than $20,000 in your Ordinary Account (OA).

- You must have more than $40,000 in your Special Account (SA).

- You must complete the CPFIS Self-Awareness Questionnaire (SAQ) to ensure you understand the risks involved in investing.

The CPFIS-OA and CPFIS-SA schemes allow you to invest the savings from your Ordinary Account and Special Account, respectively. It is important to note that you can only invest a portion of your CPF savings, and there are specific limits on how much you can allocate to stocks and gold.

For the Ordinary Account, you must retain at least $20,000 in your OA. You can invest up to 35% of your investible savings in stocks and up to 10% in gold. "Investible savings" refers to your account balance plus any amounts withdrawn for housing and education.

For the Special Account, you must keep a minimum of $40,000 in your SA before investing the remaining funds.

You can find out how much of your OA and SA savings is available for investment through the CPF website, mobile app, or by visiting a CPF Service Centre.

Investing vs. Saving: Where Should Your Cash Go?

You may want to see also

Calculating how much you can invest

The amount you can invest with your CPF depends on whether you are investing your Ordinary Account (OA) or Special Account (SA) savings, and how much you have in each account.

Investing your OA savings

To start investing your OA savings, you must have at least $20,000 in your OA. Once you have met this requirement, you can invest your OA savings through the CPF Investment Scheme-Ordinary Account (CPFIS-OA). However, there are limits to how much you can invest in stocks and gold, known as the stock and gold limits. You can only invest up to 35% of your investible savings in stocks and 10% in gold. Investible savings refer to the sum of your OA balance and the amount of CPF you have withdrawn for investment and education.

Investing your SA savings

For your SA savings, you must have at least $40,000 in your SA before you can begin investing. This is done through the CPF Investment Scheme-Special Account (CPFIS-SA). Unlike the CPFIS-OA, there are no stock and gold limits for the CPFIS-SA.

Finding out how much you can invest

You can find out how much of your OA and SA savings you can invest by logging into the my CPF digital services or the CPF Mobile app with your Singpass, or by visiting any CPF Service Centre with your identity card.

Moomoo Investment's Apex Clearinghouse: What You Need to Know

You may want to see also

Opening a CPF investment account

To open a CPF Investment Account, you must meet the following eligibility criteria:

- Be a Singapore Citizen or Permanent Resident

- Be 18 years old or above

- Have more than $20,000 in your CPF Ordinary Account (OA)

- Have no existing CPF Investment Account with any bank

- Not be an undischarged bankrupt

- Have completed the CPFIS Self-Awareness Questionnaire (SAQ)

You can open a CPF Investment Account with one of the following CPFIS agent banks:

- DBS/POSB

- Overseas-Chinese Banking Corporation Ltd (OCBC)

- United Overseas Bank Ltd (UOB)

The application process varies depending on the bank you choose, but you will typically need to provide your CPF statement and proof that you meet the eligibility criteria.

Once your CPF Investment Account is open, you can start investing your OA savings in a wide range of investments, such as shares, unit trusts, government bonds, and treasury bills. It's important to note that you can only invest the monies in excess of $20,000 in your Ordinary Account.

Additionally, there are limits to how much you can invest in stocks and gold. You can only invest up to 35% of your investible savings in stocks and 10% in gold. Your investible savings refer to the sum of your OA balance and the amount of CPF you have withdrawn for investment and education.

Cash App Investing: How to Stop and Withdraw

You may want to see also

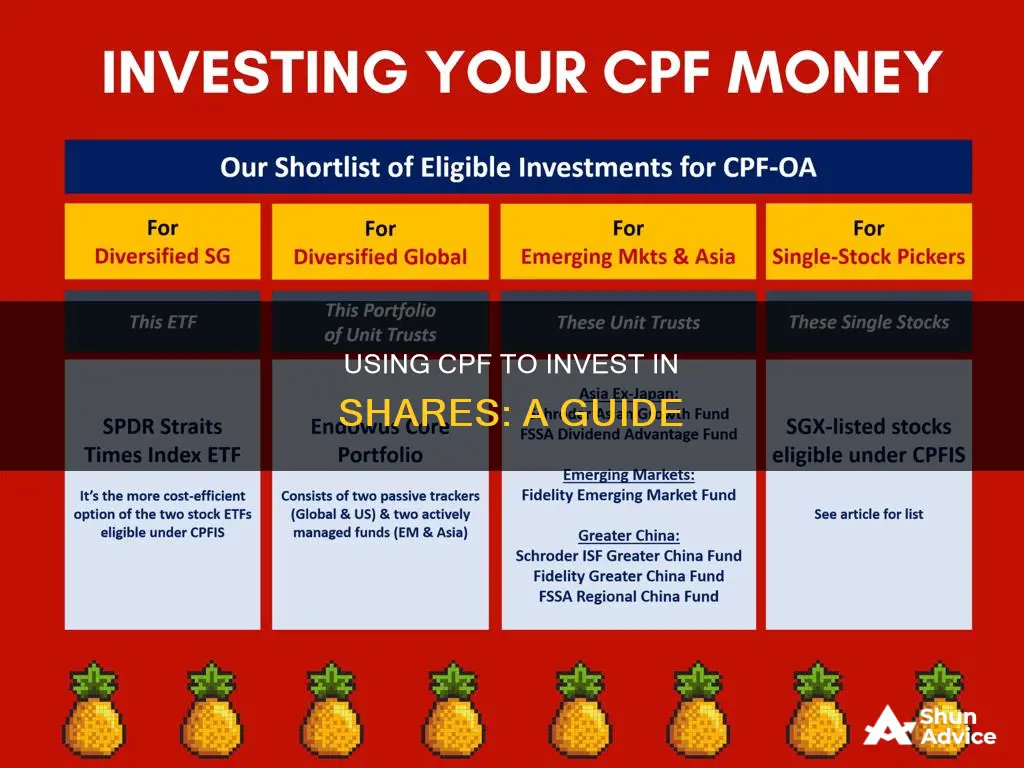

Understanding CPF-approved shares

The CPF Investment Scheme (CPFIS) allows you to invest your Ordinary Account (OA) and Special Account (SA) savings in a wide range of investments to enhance your retirement savings. CPFIS consists of two different schemes: CPF Investment Scheme-Ordinary Account (CPFIS-OA) and CPF Investment Scheme-Special Account (CPFIS-SA).

Through CPFIS, you can invest in a diverse range of financial products, including shares, unit trusts, government bonds, treasury bills, fixed deposits, and insurance products. This diversity allows you to tailor your investment strategy based on your risk tolerance and financial goals.

When investing in shares using your CPF, it's important to note that only Singapore stocks are eligible for CPF investments. Additionally, there are limits on the amount you can invest in stocks. For CPFIS-OA, you can invest up to 35% of your investible savings in stocks, while for CPFIS-SA, there is no stock investment option currently available.

Before investing in CPF-approved shares, it is crucial to understand the risks involved. All investments carry the risk of losing part or all of your invested funds due to financial market changes. It is recommended to assess your risk tolerance and determine if you are comfortable with the potential losses. Additionally, consider your investment goals, time horizon, risk-return trade-off, diversification, and investment charges.

To invest in CPF-approved shares, you need to open a CPF Investment Account with a CPFIS agent bank, such as DBS, OCBC, or UOB. These banks will administer your CPF funds and facilitate the purchase or sale of investments. Keep in mind that you must complete the CPFIS Self-Awareness Questionnaire (SAQ) before investing under CPFIS.

By investing in CPF-approved shares, you can potentially earn higher returns than the CPF interest rate. However, it is important to carefully consider your investment decisions and seek financial advice if needed to ensure that your investments align with your long-term financial goals.

A Secure Investment: T-Bills with CPF Funds

You may want to see also

Choosing the right company and time to invest

The Central Provident Fund (CPF) is a government savings scheme that requires Singaporeans and permanent residents to save 20% of their salary to fund their retirement, healthcare, and housing needs. The CPF pays an interest of 2.5% for savings in the Ordinary Account (OA) and 4% for savings in the Special Account (SA), Medisave Account, and Retirement Account.

When investing your CPF money, it is important to be extremely careful about how and when to deploy it. Leaving your CPF alone can give you a guaranteed return of 2.5% per annum in your OA and 4% in your SA. Thus, if you want to invest in shares using your CPF, you need to invest in stocks that can generate more than 4% in returns every year.

There are two things to consider before investing your CPF money in shares:

The Right Company

The company you choose to invest in must be a mature, stable, dividend-paying company that earns consistent recurring income. It is recommended to avoid investing your CPF money in a cyclical or project-based business whose income is less predictable. It is also advised to avoid investing your CPF in REITs as they call for rights issues to raise funds to acquire new properties from time to time. If your CPF doesn’t have sufficient funds to subscribe to the rights issue, you will have to fork out cash to do so or face having your stake diluted.

The Right Time

Your CPF is hard-earned money, so it is important to invest it when you are sure that your downside is protected and there is a good opportunity to earn higher returns. The best time to invest your CPF is during a market crisis because stocks are priced at their lowest. You can find stable companies that earn a recurring income and pay consistent dividends trading at a good discount during a crisis. A good dividend stock that usually pays a 4% dividend yield can see its yield go as high as 10% during a crisis. Remember, all things being equal, the lower the price you pay, the lower your risk and the higher your potential returns.

If you don’t have a suitable investment option, don’t invest. Leave your money in your CPF to continue earning interest while you wait for a good investment opportunity.

Emergency Cash: Best Places to Invest for Quick Access

You may want to see also

Frequently asked questions

The Central Provident Fund (CPF) is a government savings scheme that requires Singaporeans and permanent residents to save 20% of their salary to fund their retirement, healthcare, and housing needs.

You can use your CPF Ordinary Account (OA) and Special Account (SA) savings to invest in shares through the CPF Investment Scheme (CPFIS). You will need to open a CPF Investment Account with an approved CPFIS agent, such as DBS, OCBC, or UOB.

To invest with CPF, you must be at least 18 years old, not an undischarged bankrupt, and have more than S$20,000 in your OA and/or S$40,000 in your SA.

Yes, you can only invest in CPF-approved shares, which must meet certain criteria, including being incorporated in Singapore, listed on the SGX Main Board, and traded in Singapore dollars.

All investments carry risk, and there is a possibility of losing some or all of your investment. It is important to consider your investment goals, risk tolerance, and financial situation before investing. Leaving your CPF savings in your account can provide risk-free interest of up to 5-6% per annum.