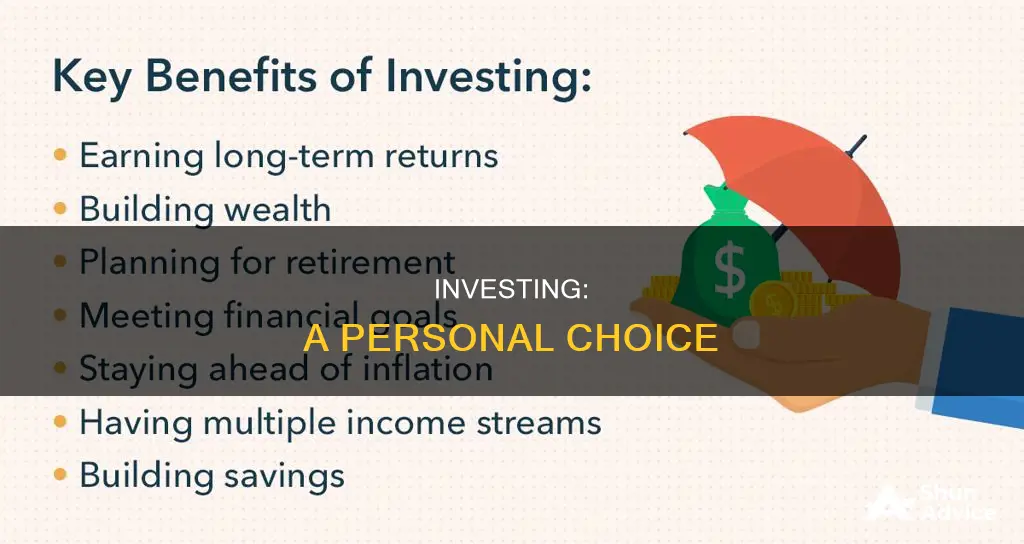

People choose to invest for a variety of reasons, which can be categorised into three main groups: investing for peace of mind, investing for wellbeing, and investing for a personal goal. Investing is a way to build wealth, save for retirement, and reach financial goals. It is also a way to take advantage of compound interest and beat inflation, ensuring that money is worth more in the future. For some, investing is a way to support new ventures and entrepreneurs, while for others, it is a way to reduce taxable income. Ultimately, investing is a personal decision that depends on an individual's financial situation, risk tolerance, and goals.

| Characteristics | Values |

|---|---|

| Peace of mind | Retirement, children's education, growing wealth |

| Wellbeing | Less stress, early retirement, holiday |

| Personal goal | Dream home, sports car |

| Wealth | Beat inflation, save for retirement, financial goals |

| Returns | Higher returns than savings accounts |

| Tax | Reduce taxable income |

| Business | Support entrepreneurs, new jobs, new products |

| Risk | Risk-reward trade-off |

What You'll Learn

Peace of mind

Investing is often a means to an end, and that end is usually peace of mind. People invest to build wealth, to secure their future, and to ensure they have the funds to live the life they want.

The most common reason people choose to invest is to save for retirement. By putting money into a portfolio of investments, such as stocks, bonds, mutual funds, real estate, or businesses, people can aim to live off the funds earned from these investments during their retirement. This provides peace of mind that they will have financial security when they are no longer working.

Another reason people invest is to achieve financial goals, such as buying a home, a car, or putting children through college. By investing, people can grow their wealth and increase their financial worth, providing the means to achieve these goals.

Additionally, investing can help reduce taxable income. Certain investment vehicles, like employer-sponsored 401(k)s, allow people to invest pre-tax dollars, which can lower taxable income. This provides peace of mind that people are optimising their finances and keeping more of their hard-earned money.

Investing can also be a way to protect loved ones. By investing in insurance, such as health insurance, life insurance, and homeowner's or renter's insurance, people can ensure that their family is taken care of financially in the event of an illness, accident, or disaster. This provides peace of mind that their loved ones will be protected and provided for, no matter what happens.

Finally, investing can be a way to build a diverse portfolio that provides financial flexibility. By investing in a range of vehicles, such as stocks, bonds, ETFs, mutual funds, or precious metals, people can reduce the risk of losing all their money in one type of investment. This provides peace of mind that their investments are relatively safe and that they have financial options in different scenarios.

Overall, investing is a powerful tool for achieving financial security and peace of mind. It allows people to save for the future, achieve their goals, and protect their loved ones, ultimately reducing financial worries and providing a sense of security.

Scams: Why People Fall for Investment Schemes

You may want to see also

Wellbeing

Investing is about more than just financial gains. It's about changing lives, making dreams a reality, and improving overall wellbeing.

Investing for Wellbeing

Investing can be a powerful tool for enhancing one's wellbeing. It can provide the financial means to reduce stress, take a break from work, and enjoy enriching, fulfilling experiences. Here are some ways in which investing can positively impact an individual's wellbeing:

- Stress Reduction: Investing can provide the financial freedom to take a step back from a stressful job. This can be in the form of an early retirement, a well-deserved holiday, or a break to focus on one's health and wellbeing.

- Enriching Experiences: Investing can enable individuals to pursue experiences that enrich their lives, such as travelling, spending time in nature, or engaging in hobbies and activities that bring joy and fulfilment.

- Financial Security: Investing wisely can help individuals build their wealth, save for retirement, and achieve financial goals. This financial security can reduce money-related stress and improve overall wellbeing.

- Personal Growth: Investing in oneself is a form of investing for wellbeing. This can include investing in one's education, personal development, or health. By investing in personal growth, individuals can improve their skills, knowledge, and overall wellbeing, leading to a more fulfilling life.

- Achieving Dreams: Investing allows individuals to work towards their personal dreams and goals. This could be saving for a dream home, starting a business, or pursuing a passion project. Achieving these goals can bring a sense of accomplishment and improve overall life satisfaction.

Investing in Employee Wellbeing

Investing in employee wellbeing is not just a moral imperative but also makes good business sense. Here are some reasons why organisations should prioritise employee wellbeing:

- Reduced Costs: Poor employee wellbeing can result in high costs for businesses due to increased sickness absence, presenteeism, and staff turnover. Investing in employee wellbeing can reduce these costs and improve overall organisational performance.

- Improved Performance: Studies suggest a clear link between employee wellbeing and organisational performance. Organisations with high levels of employee wellbeing tend to outperform the stock market and demonstrate higher shareholder returns.

- Enhanced Creativity and Innovation: Organisations that prioritise employee health and wellbeing are seen as more creative and innovative. By investing in employee wellbeing, businesses can foster an environment that encourages creativity and drives innovation.

- Improved Interpersonal Relationships: Poor wellbeing can negatively impact how individuals view themselves and others. Investing in employee wellbeing can improve interpersonal relationships, enhance collaboration, and contribute to a positive work environment.

- Attracting and Retaining Talent: In today's transparent age, job seekers consider an organisation's reputation for wellbeing when applying for positions. Investing in employee wellbeing can enhance the employer brand, attract top talent, and reduce staff turnover.

Wealthy Secrets: Where the Rich Invest

You may want to see also

Personal goals

Investing is a highly personal endeavour, with each individual having their own unique financial goals and circumstances. For some, investing is a way to achieve personal goals that may have previously seemed out of reach.

Investing can also be a tool for building generational wealth, providing financial security for one's children and helping to bridge the wealth gap faced by many communities. It allows individuals to take control of their financial future and work towards specific milestones, such as buying a home or retiring early.

The power of investing lies in its ability to help individuals achieve their unique personal goals. It is not just about financial gain but also about the freedom and opportunities that come with it. For example, investing can provide the means to take a career break or extended holiday, improving one's overall wellbeing.

Ultimately, investing is about more than just money; it's about changing lives and making dreams a reality. It empowers individuals to take control of their financial future and work towards the life they desire.

Who Invests in Schools?

You may want to see also

Wealth creation

There are several reasons why wealth creation is important:

- It helps secure your financial future by enabling you to achieve milestones such as retirement, children's education, and home ownership within planned timelines.

- It prepares you for unforeseen circumstances like job loss, business setbacks, or health issues, eliminating the need to take on debt.

- It improves your quality of life, allowing you to enjoy travelling, socialising, and entertainment, as well as contributing to better healthcare and education.

- It enables you to pass on your wealth as an inheritance, ensuring the financial well-being of future generations.

To achieve successful wealth creation, it is important to set clear financial goals, create a budget, and increase your income. Additionally, prioritising saving systematically, paying off high-interest debt, and investing wisely are key steps. It is also crucial to set realistic milestones, track your progress, and maintain discipline.

Challenges to wealth creation include the temptation of instant gratification, market fluctuations, and a lack of financial literacy. However, with a well-crafted plan, a long-term focus, and informed decision-making, these challenges can be overcome.

Marijuana Investing: Overcoming Investor Fear

You may want to see also

Retirement

People choose to invest to prepare for their retirement. Here are some reasons why:

Compound Interest

Compound interest is a powerful tool for retirement savings. The earlier you start investing, the more time your money has to grow. For example, if you invest $250 a month with an average annual return of 8%, you could accumulate over $800,000 by the time you retire at 65 if you start investing at 25. Waiting until you're 35 or 45 results in significantly less savings.

Protect Against Market Risk

Investing for retirement early can help cushion against stock market volatility. Starting early gives your finances time to recover from short-term losses, allowing you to take more aggressive actions with your portfolio and potentially yield higher returns. As you get closer to retirement, the focus shifts from growing your wealth to protecting your savings.

Tax Benefits

Financial Discipline

Making retirement savings a habit can create financial discipline. Regular saving can become as routine as paying a monthly bill. This habit can help you build a substantial fund over time.

Diversification

Peace of Mind

Saving for retirement gives you more control over your lifestyle and financial freedom. It ensures you can meet your basic needs and have enough left over to comfortably do the things you want during retirement.

Savings Indirectly Matched with Investors

You may want to see also

Frequently asked questions

Investing allows you to grow your wealth and save for retirement. It helps you reach financial goals such as buying a home, starting a business, or saving for your children's education.

Investing is necessary for retirement as it bridges the gap between your savings and what you need to live off during retirement. It also helps beat inflation, ensuring your money retains its value over time.

Investing allows you to put your money in vehicles that offer returns over the long term. These returns create wealth and increase your financial worth.

People invest for peace of mind, wellbeing, or personal goals. This could include retirement planning, stress reduction, or achieving a dream purchase.