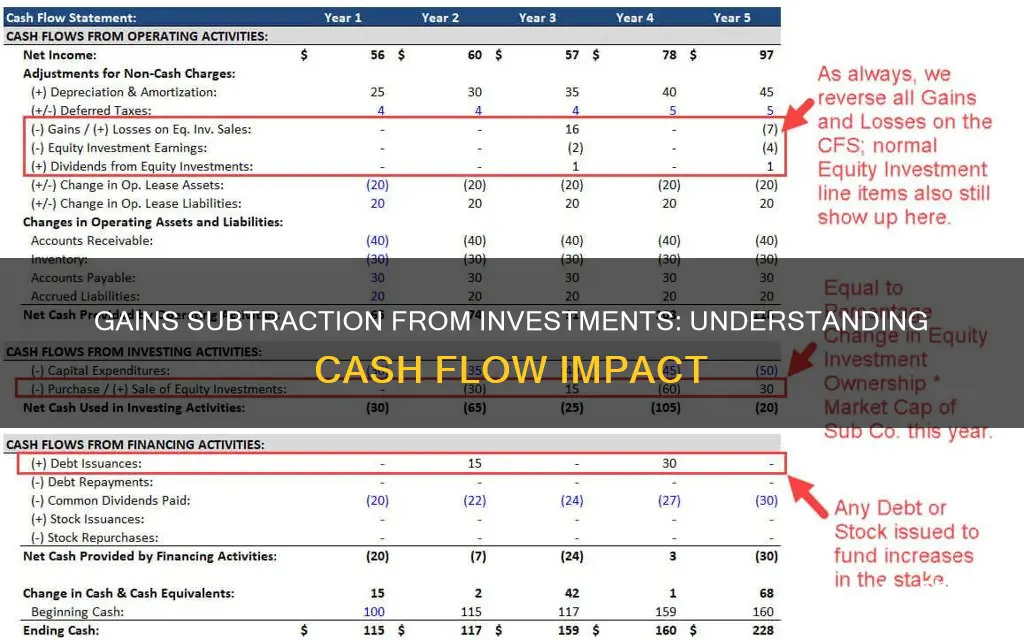

A cash flow statement is a financial statement that provides an overview of a company's financial health and operational efficiency. It is one of the three main financial statements, alongside the balance sheet and the income statement. The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. This paragraph will focus on the second section, cash flow from investing activities, and explain why gains from investments are subtracted.

Cash flow from investing activities (CFI) tracks the cash inflow and outflow from a company's investing activities, including purchases and sales of investments, as well as earnings from investments. This section of the cash flow statement provides insights into how a company is allocating its cash for the long term. It is important to note that negative cash flow from investing activities does not always indicate poor financial health. Instead, it often signifies that the company is investing in assets, research, or other long-term development activities that are crucial for the company's health and continued operations.

When a company sells a long-term asset, such as property, plant, or equipment, the difference between the sale price and the book value or carrying value of the asset is considered a gain. This gain is included in the net income reported in the operating activities section of the cash flow statement. To avoid double-counting this gain, it is subtracted from the net income reported in the operating activities section. By doing so, the cash flow statement provides a more accurate representation of the company's financial position and helps investors make informed decisions.

| Characteristics | Values |

|---|---|

| Purpose | To track the inflow and outflow of cash, providing insights into a company's financial health and operational efficiency |

| Main Components | Cash from operating activities, investing activities, and financing activities |

| Calculation Methods | Direct method and indirect method |

| Operating Activities | Cash received from the sale of goods and services, salary and wage payments, payments to suppliers |

| Investing Activities | Cash flow from the purchase or sale of assets, loans, or payments related to mergers and acquisitions |

| Financing Activities | Cash from investors and banks, as well as payments to shareholders, including dividends and stock repurchases |

What You'll Learn

- Investing activities include the purchase and sale of physical assets, securities, and loans

- Negative cash flow from investing activities can indicate a company's long-term growth strategy

- Capital expenditures are a popular measure of capital investment used in stock valuation

- A company's cash flow statement should be considered alongside its balance sheet and income statement

- Cash flow from investing activities is one of the three sections of a company's cash flow statement

Investing activities include the purchase and sale of physical assets, securities, and loans

Investing activities are a crucial component of a company's cash flow statement, providing insights into the business's investment strategies and their impact on cash flow. These activities encompass the purchase and sale of physical assets, securities, and loans, with the primary objective of generating income or supporting the long-term health and performance of the company.

Physical assets refer to tangible items such as property, plant, and equipment (PP&E), which are often referred to as capital expenditures. The purchase of physical assets involves an outflow of cash, resulting in negative cash flow. On the other hand, the sale of these assets generates cash inflow and is considered a positive cash flow.

Securities, on the other hand, include marketable securities such as stocks, bonds, and other financial instruments. The purchase of securities leads to a decrease in cash flow, as cash flows out of the business to cover the cost. Conversely, the sale of securities results in an increase in cash flow, even if the sale incurs a loss. This is because the business still receives cash from the sale, leading to a net positive impact on cash flow.

Loans are another aspect of investing activities. Lending money to vendors or customers falls under this category and represents a negative cash flow as cash flows out of the business. However, when loans are collected, it results in a positive cash flow as the business receives the loaned amount along with any interest accrued.

It is important to note that negative cash flow from investing activities does not always indicate poor financial health. In some cases, it may reflect a company's strategic decision to invest in research and development, acquire new equipment, or expand its operations, all of which have the potential to drive future growth and profitability.

The cash flow statement is a critical tool for assessing a company's financial health and decision-making. It bridges the gap between the income statement and the balance sheet, providing a comprehensive view of the company's cash management and financial stability.

Fidelity Branches: Can You Deposit Cash?

You may want to see also

Negative cash flow from investing activities can indicate a company's long-term growth strategy

Negative cash flow from investing activities can indicate that a company is investing in its long-term growth strategy. This is particularly true if the company is in an established industry that requires periodic investment in long-term assets such as property, plant, and equipment.

A negative cash flow from investing activities can be a positive sign that a company is positioning itself for future growth. For example, a company may invest in fixed assets, property, plant, and equipment to grow its business, which will show as a negative cash flow in the short term. However, this investment may help the company generate more cash flow in the long term.

A company's cash flow statement can reveal what phase the business is in. For instance, if it is an early startup, its cash flow statement may show that it is purchasing facilities or equipment to scale up its operations.

It is important to note that negative cash flow from investing activities does not always indicate poor financial health. It is often a sign that the company is investing in assets, research, or other long-term development activities that are crucial to the company's health and continued operations.

When evaluating a company with negative cash flow from investing activities, investors should review the entire cash flow statement and all its components to determine if the negative cash flow is a positive or negative development.

Cash is Not King: Exploring Investment Alternatives

You may want to see also

Capital expenditures are a popular measure of capital investment used in stock valuation

Capital expenditures, or CapEx, are a popular measure of capital investment used in stock valuation. They refer to the funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment. CapEx is often used to undertake new projects or investments and can include repairing a roof, purchasing equipment, or building a new factory.

CapEx is important for companies to grow and maintain their business by investing in new property, plant, equipment, products, and technology. Financial analysts and investors pay close attention to a company's capital expenditures as they can have a significant impact on cash flow, even though they don't initially appear on the income statement.

CapEx can be found on a company's cash flow statement under "investing activities." An increase in capital expenditures means the company is investing in future operations. However, capital expenditures are a reduction in cash flow, and companies with significant capital expenditures are typically in a state of growth.

The calculation of free cash flow deducts capital expenditures. Free cash flow is one of the most important calculations in finance and serves as the basis for valuing a company. The formula for free cash flow is:

FCF = Cash from Operations – Capital Expenditures

Capital expenditures are also used in calculating free cash flow to equity (FCFE), which is the amount of cash available to equity shareholders. The greater the CapEx for a firm, the lower the FCFE.

In summary, capital expenditures are a popular measure of capital investment used in stock valuation as they provide insight into a company's future operations and financial health.

Unlocking Cash Flow Assets: Strategies for Smart Investing

You may want to see also

A company's cash flow statement should be considered alongside its balance sheet and income statement

A company's cash flow statement is one of its most important financial reports, providing an overview of its financial health and operational efficiency. It is one of three key financial statements, alongside the balance sheet and the income statement. These documents should always be considered together to gain a full picture of a company's financial situation.

The cash flow statement details the inflow and outflow of cash, tracking the liquidity available to a company to fund its operating expenses and pay down its debts. It is a measure of a company's cash management and its ability to generate cash. The statement is divided into three sections: operating activities, investing activities, and financing activities.

Operating activities include any spending or sources of cash that are part of a company's day-to-day business operations. This includes cash received from the sale of goods and services, salary and wage payments, and payments to suppliers for inventory or goods needed for production.

Investing activities report the cash generated by or spent on investment activities, including the purchase of physical assets, investments in securities, or the sale of securities or assets. This section is crucial as it indicates how a company is allocating cash for the long term, including investments in the health and performance of the company.

Financing activities include the sources of cash from investors and banks, as well as the way cash is paid to shareholders, such as through dividends or stock repurchases.

The cash flow statement is a dynamic tool that provides insight into a company's operations, financial health, and future prospects. It is a valuable resource for investors, creditors, and analysts to assess the company's financial well-being and make informed decisions.

By considering the cash flow statement alongside the balance sheet and income statement, a comprehensive understanding of the company's financial position can be achieved. The balance sheet provides an overview of a company's assets, liabilities, and owner's equity at a specific date, while the income statement details the company's revenues and expenses during a period. Together, these statements offer a detailed view of the company's financial performance, health, and future outlook.

How Cash App Investing Works for Beginners

You may want to see also

Cash flow from investing activities is one of the three sections of a company's cash flow statement

A cash flow statement is a financial report that details the inflow and outflow of cash in a company during a reporting period. It is one of the three main financial statements used by financial leaders, alongside the income statement and balance sheet. The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Cash flow from investing activities (CFI) is one of the sections of a company's cash flow statement that details the cash generated by or spent on investment activities. This includes the purchase of physical assets, investments in securities, or the sale of securities or assets. These investments can be made to generate income or they may be long-term investments in the health or performance of the company.

Negative cash flow from investing activities does not always indicate poor financial health. It often means that the company is investing in assets, research, or other long-term development activities that are important for the company's health and continued operations. For example, a company may invest in fixed assets such as property, plant, and equipment to grow the business. While this may signal negative cash flow from investing activities in the short term, it may help the company generate cash flow in the longer term.

The total cash flow from investing in an accounting period is calculated by adding together both the positive and negative investing activities listed on the cash flow statement.

Cash in Your Investment Allocation: Wise or Unwise?

You may want to see also

Frequently asked questions

Subtracting gains from investments in cash flow is done to accurately calculate the net cash flow from investing activities. This involves tracking both the cash inflows and outflows from investment activities, such as the purchase or sale of assets, securities, or investments. By subtracting the gains (cash inflows) from the investments (cash outflows), we can determine the overall impact of these activities on the company's financial position.

Examples of gains from investments include proceeds from the sale of long-term assets, such as physical assets or securities, as well as earnings or dividends from investments. These gains represent the positive cash flow resulting from investing activities.

Subtracting gains from investments is crucial for understanding a company's financial health and making informed investment decisions. While negative cash flow from investing activities can indicate poor performance, it is not always a negative sign. It could signal that the company is investing in its long-term health, growth, and future operations. Therefore, analysing the cash flow statement in conjunction with other financial statements provides a comprehensive view of the company's financial well-being.