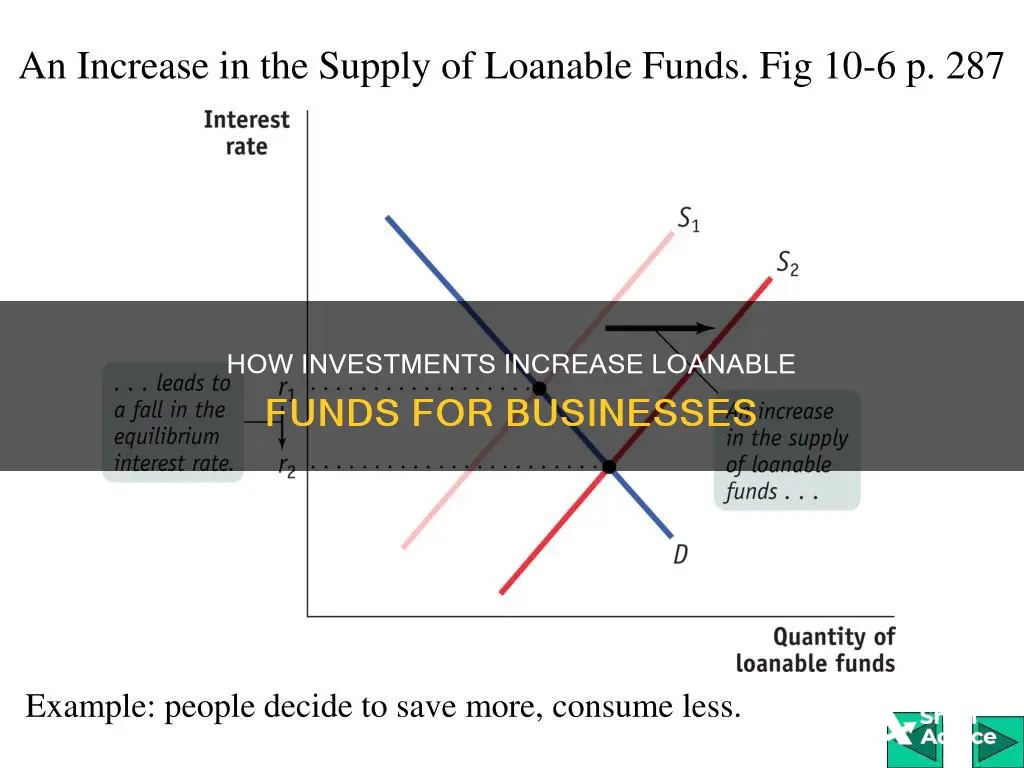

The demand and supply of capital occur in capital markets, where firms are typically demanders of capital, and households are suppliers. Loanable funds are the funds available for borrowing, consisting of household savings and/or bank loans. When firms decide to expand their capital stock, they can finance their purchases in several ways, including borrowing funds from a bank. The interest rate is a critical factor in a firm's decision to acquire and hold capital. The interest rate is determined by the forces of demand and supply in the loanable funds market. The demand for loanable funds is downward-sloping, and the supply is upward-sloping. When the demand for loanable funds increases, the interest rate goes up, and when the supply of loanable funds increases, the interest rate declines. The interest rate is the cost of demanding or borrowing loanable funds and the rate of return from supplying or lending them. Thus, an increase in investment increases loanable funds by increasing the demand for capital in the loanable funds market, which, in turn, increases the interest rate.

What You'll Learn

The relationship between interest rates and loanable funds

The interest rate on a loan determines the additional amount that the borrower must pay back to the lender on top of the loan's original sum. This interest rate is influenced by the interaction of supply and demand for loanable funds. When demand for loanable funds is high relative to supply, the interest rate increases, and when supply is high relative to demand, the interest rate decreases.

The demand for loanable funds is influenced by factors such as increased consumer and business confidence, favourable changes in government policies, and economic growth. On the other hand, the supply of loanable funds is determined by the amount of savings in the economy, which can be influenced by factors such as interest rates themselves, consumer income, and expectations of future inflation.

Additionally, interest rates play a crucial role in coordinating savings and investment in an economy. Higher interest rates incentivise saving by offering higher returns, while lower interest rates may discourage saving as individuals seek alternative investment opportunities with potentially higher yields.

Gold Mutual Funds: Best Investment Options for You

You may want to see also

How increased investment affects the demand for loanable funds

The demand for loanable funds is influenced by the interest rate. When interest rates are low, the cost of borrowing is lower, which makes it easier for firms to acquire capital and encourages spending. This leads to an increase in demand for loanable funds. Conversely, when interest rates are high, borrowing becomes more expensive, and individuals and businesses tend to spend less. This results in a decrease in the demand for loanable funds.

The relationship between interest rates and the demand for loanable funds can be understood through the concept of opportunity cost. When interest rates are low, individuals and firms have a lower opportunity cost for not lending their money. They may choose to spend it on consumer items or invest in risky projects that offer higher potential returns. On the other hand, when interest rates are high, the opportunity cost of not lending money increases. This encourages individuals and firms to lend their money, increasing the supply of loanable funds available in the market.

The demand for loanable funds is also influenced by factors such as consumer and business confidence, government policies, investment incentives, economic growth, and monetary policies. For example, if businesses are confident about the future performance of the economy, they will be more inclined to invest in projects, leading to an increase in the demand for loanable funds. Similarly, government policies that influence savings, such as changes to inheritance taxes or pensions, can impact the availability of funds for lending, thereby affecting the demand for loanable funds.

It is important to note that the demand for loanable funds is not solely determined by the interest rate. Other factors, such as the marginal efficiency of capital, also play a role in shaping the demand curve for loanable funds. The marginal efficiency of capital refers to the rate of return that could be earned with additional capital. As the marginal efficiency of capital declines, the demand for loanable funds may decrease even if interest rates remain unchanged.

In summary, the demand for loanable funds is influenced by a combination of factors, including interest rates, opportunity costs, consumer and business confidence, government policies, and the potential return on investment. These factors collectively shape the demand curve for loanable funds and determine the equilibrium interest rate in the market.

Bond Fund Strategies: Dynamic Investing for Maximum Returns

You may want to see also

The impact of higher interest rates on spending

Higher interest rates can have a significant impact on spending, particularly consumer spending. When interest rates are high, the cost of borrowing money increases, leading to a reduction in spending. This is because higher interest rates make it more expensive to buy goods and services, causing consumer spending to decrease.

For example, consider a consumer who wants to purchase a house or a car. With high-interest rates, the cost of borrowing money to make these purchases increases, leading to a decrease in demand for these goods. This is due to the increased expense associated with the higher interest rates.

Similarly, businesses are also affected by higher interest rates. They may choose to borrow money to invest in new projects or expand their operations. However, with higher interest rates, the cost of borrowing increases, making these investments less attractive. As a result, businesses may decide to postpone or cancel their investment plans, reducing their spending.

Additionally, high-interest rates can impact the overall capital structure of the economy. Entrepreneurs, who typically need to borrow money to start their businesses, may find it challenging to obtain financing if the interest rate is too high. This can hinder the formation of new businesses and slow down economic growth.

Furthermore, high-interest rates can lead to an increase in savings. As the cost of borrowing increases, individuals spend less and save more. Additionally, the return on high-interest savings accounts becomes more appealing, encouraging individuals to deposit their money in these accounts. This shift in behaviour can further reduce spending in the economy.

It is important to note that central banks, such as the Federal Reserve, play a crucial role in manipulating interest rates to influence monetary policy. They can lower interest rates to make borrowing more affordable and stimulate spending, or raise interest rates to curb spending and slow down the economy if it is overheating.

In summary, higher interest rates have a direct impact on spending by making borrowing more expensive. This leads to reduced consumer spending, decreased business investments, and a potential slowdown in economic growth. Additionally, higher interest rates can encourage increased savings, further reducing spending in the economy. Central banks carefully monitor and adjust interest rates to achieve their monetary policy objectives.

Closed-End Funds: When to Invest for Maximum Returns

You may want to see also

How investment tax credits influence the demand for loanable funds

Investment tax credits are a federal tax incentive for businesses to invest. They allow individuals or businesses to deduct a certain percentage of investment costs from their taxes. These credits are in addition to normal allowances for depreciation.

The basic objective of investment tax credits has changed over time. Initially, they were introduced in 1962 to protect American businesses from emerging foreign competition. Today, they are used to encourage investment in areas like pollution control, energy conservation, green technology, and other methods of economic development.

The availability of investment tax credits can increase the demand for loanable funds. This is because tax credits effectively reduce the cost of investment, making it more attractive for firms to invest in new projects. With a higher demand for investment, there will be a corresponding increase in the demand for loanable funds, which are often used to finance these investments.

The demand for loanable funds is influenced by interest rates. When interest rates are low, firms are more likely to borrow to finance their investments, leading to an increase in the demand for loanable funds. On the other hand, when interest rates are high, borrowing becomes more expensive, reducing the demand for loanable funds.

The impact of investment tax credits on the demand for loanable funds can be significant, especially when combined with low-interest rates. In this scenario, firms have two incentives to invest: the tax credits reduce the overall cost of investment, and the low-interest rates make borrowing cheaper. As a result, firms are more likely to pursue new projects, leading to an increased demand for loanable funds.

In summary, investment tax credits can influence the demand for loanable funds by making investments more attractive to firms. This increased demand for investment can be met through borrowing, leading to an increase in the demand for loanable funds. However, the impact of investment tax credits on the demand for loanable funds also depends on other factors, such as interest rates and the overall economic conditions.

Maximizing HSA Funds for FI: Where to Invest Wisely

You may want to see also

The role of central banks in manipulating interest rates

Central banks play a crucial role in manipulating interest rates to achieve specific economic objectives and ensure a stable, sustainable economy. They do not directly set interest rates for loans like mortgages, auto loans, or personal loans. Instead, they influence the cost of borrowing by adjusting the policy rate, which is the rate at which commercial banks borrow from the central bank. By lowering the policy rate, central banks reduce the cost of borrowing for commercial banks, which then pass these savings on to their customers, making borrowing more affordable.

One of the primary tools central banks use to manipulate interest rates is open market operations. They buy or sell government securities, injecting or removing money from the economy. When a central bank wants to increase the money supply, it purchases government bonds from commercial banks, providing them with more cash to lend. This, in turn, puts downward pressure on interest rates. Conversely, when the central bank wants to reduce the money supply, it sells government securities, absorbing excess cash from the economy and making borrowing more expensive.

Another mechanism central banks employ is the manipulation of reserve requirements. By adjusting the amount of funds that commercial banks must keep in reserve, central banks can influence the amount of money available for lending. Lowering the reserve requirement allows banks to lend out more money, increasing the money supply and putting downward pressure on interest rates. On the other hand, raising the reserve requirement reduces the funds available for lending, tightening the money supply and potentially leading to higher interest rates.

Additionally, central banks can implement quantitative easing programs during dire economic times. They create new money and use it to purchase assets and securities, such as government bonds, from commercial banks. This increases the reserves of the banking system, encouraging banks to lend more and helping to drive down long-term interest rates.

The manipulation of interest rates by central banks has a significant impact on the economy. Lower interest rates encourage borrowing, increase spending, and stimulate economic growth. On the other hand, higher interest rates can curb inflation, stabilize the currency, and reduce the risk of asset bubbles forming.

Best TSP Funds to Invest in Now

You may want to see also

Frequently asked questions

Loanable funds are the most common way that major economic investments are funded. When a firm or an individual wants to make a major investment, they usually need to take out a loan. These funds are, therefore, sums of money saved by lenders that are available for borrowers to use.

The interest rate is the cost of borrowing loanable funds. When the interest rate is high, the cost of borrowing is higher, which results in people spending less. When the interest rate is low, the opposite is true. Therefore, an increase in the interest rate will reduce the demand for loanable funds.

An increase in investment will lead to an increase in the demand for loanable funds. This will cause the interest rate to increase as the price for borrowing will rise.

The loanable funds market is a macroeconomic concept that behaves like a typical product market with supply and demand curves. The "product" in this case is an amount of loanable funds. The market for loanable funds is where those who have loanable funds sell to those who want to borrow them.

An increase in consumer and business confidence will increase the demand for loanable funds. This is because higher confidence will lead to more investment, which will require more funds.