A positive investment portfolio is important for several reasons. Firstly, it helps individuals evaluate the performance of their investments against their financial goals and objectives. By conducting regular reviews, investors can identify areas that require adjustments to achieve their long-term goals and build a portfolio that gives them the highest probability of accomplishing desired returns without unnecessary risks. Secondly, a positive investment portfolio enables individuals to assess the level of risk in their investments. By evaluating asset allocation, diversification, and risk exposure, investors can ensure their portfolio aligns with their financial objectives while minimising potential losses. Thirdly, a positive investment portfolio allows individuals to assess the tax efficiency of their investments. Taxes can significantly impact investment returns, especially for high-net-worth individuals. By evaluating tax strategies and the impact of turnover on taxes, investors can optimise their portfolio for tax efficiency and improve after-tax returns. Lastly, a positive investment portfolio helps individuals stay disciplined and focused on their long-term financial goals. Market volatility and short-term fluctuations can tempt investors to make emotional decisions that may harm their financial prospects. Regular portfolio reviews enable investors to maintain a long-term perspective and discipline in their investment choices.

| Characteristics | Values |

|---|---|

| Diversification | Not putting all your eggs in one basket |

| Risk tolerance | Ability to accept investment losses in exchange for higher returns |

| Investment objectives | Financial goals |

| Time horizon | How long you have to invest |

| Tax efficiency | Optimising tax efficiency to improve after-tax returns |

| Management expenses | Paying reasonable fees for the value provided |

What You'll Learn

Diversification of investments to reduce risk

Diversification is a key concept in portfolio management. It is the process of spreading investments across different asset classes, industries, and geographic regions to reduce the overall risk of an investment portfolio. The idea is that by holding a variety of investments, the poor performance of any one investment can be offset by the better performance of another, leading to a more consistent overall return.

Diversification aims to include assets that are not highly correlated with one another. This means that a portfolio constructed of different kinds of assets will, on average, yield higher long-term returns and lower the risk of any individual holding or security.

There are many ways to diversify a portfolio. Here are some strategies to consider:

- Diversifying across sectors and industries: For example, investing in transportation, technology, media, or consumer staples.

- Diversifying across companies: Holding shares in multiple companies within an industry can help reduce company-specific risk.

- Diversifying across asset classes: Different asset classes such as stocks, bonds, real estate, or cryptocurrency act differently based on broad macroeconomic conditions. For instance, rising interest rates usually negatively impact bond prices but may result in increases in rent for real estate.

- Diversifying across borders: Investing in companies and holdings across different countries can provide protection against legislative changes and economic downturns in a specific country or region.

- Diversifying across time frames: Assets with longer time frames, such as long-term bonds, tend to have higher risk but may also deliver higher returns.

It is important to note that diversification does not guarantee against losses and may result in lower portfolio-wide returns. Additionally, managing a diverse portfolio can be time-consuming and incur more transaction fees and brokerage commissions. However, diversification is a valuable tool for reducing risk and pursuing long-term financial goals.

Building a Socially Responsible Investment Portfolio: Doing Well by Doing Good

You may want to see also

Risk tolerance and asset allocation

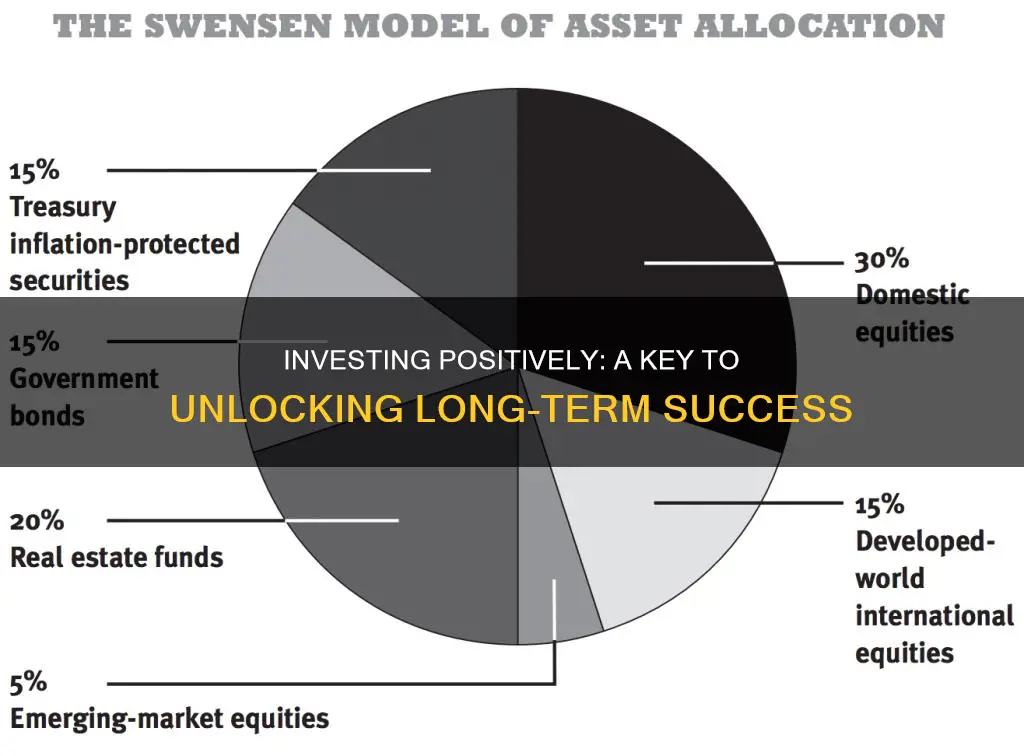

Asset allocation is the mix of stocks, bonds, and other assets within a portfolio. It is crucial because it helps balance risks and rewards based on financial goals, risk tolerance, and investment horizon. The three main asset classes are equities, fixed income, and cash and cash equivalents, each with different risk profiles and return potentials.

There is no one-size-fits-all formula for asset allocation, and it may change over time. However, a common guideline is to subtract your age from 100 or 110 to determine the percentage of stocks in your portfolio. For example, a 30-year-old might allocate 70%-80% to stocks and the rest to bonds. As investors age, they typically reduce their exposure to stocks and increase their allocation to less risky assets like bonds and cash.

It's important to regularly rebalance your portfolio to maintain the desired asset allocation. This involves buying or selling certain assets to return the portfolio to its original makeup or a more comfortable level of risk.

Building an Investment Portfolio: Where to Begin?

You may want to see also

Long-term financial goals

- Identify your retirement needs: Think about the likely expenses you'll have as a retiree. How much might you receive from Social Security? Will you have rent or mortgage payments? How much should you save for retirement to cover your estimated retirement budget? You can build your monthly savings plan around your expected future needs and compare these needs to your current income to determine if your goals are realistic.

- Start saving for retirement: Consider opening a retirement account and making small contributions to start saving for retirement early on. To maximize your savings, consider using a compound interest account, which pays interest on your initial deposit, recurring contributions, and past interest earnings. A good rule of thumb is to save 15% of your pretax income each year (or as close to that goal as your budget allows).

- Save for a house down payment: Real estate is usually an appreciating asset, meaning it earns value over time. Purchasing a home instead of spending money on rent can be a great way to eliminate future expenses. The money you'll need to save for a down payment will depend on the cost of your desired home and type of mortgage you get. A down payment of at least 20% on a conventional loan can lower your interest rate and eliminate the need for private mortgage insurance.

- Pay off credit card debt: Credit cards can give you quick access to funds when you need them, but carrying that debt from month to month can quickly wipe out your financial progress. In an ideal world, you'll pay off your credit card before the due date each month without accruing any interest.

- Increase your earning potential: Evaluate where you want to be in five years and take steps to secure your financial future. Talk to your boss about your career aspirations. There may be training they can recommend to help grow your career and your earning potential. If your current employer is unable or unwilling to help, consider upskilling on your own by getting certifications independently or entering a graduate program.

When investing for long-term goals, it's important to consider your risk tolerance and time horizon. Generally, the longer your time horizon, the more risk you can take on. For example, if your goal is more than 10 years away, you can afford to take on more risk by investing heavily in stocks, which have the potential for higher returns but come with greater volatility. If your goal is within the next two years, it's best to keep your money in a low-risk savings account so that you don't have to worry about the impact of market fluctuations.

Building an Ally Investment Portfolio: A Guide

You may want to see also

Tax efficiency and impact on returns

Tax efficiency is a vital aspect of investing that can significantly impact an investor's after-tax returns. Taxes can be one of the biggest expenses on investments, so it is important to understand how to minimize them.

There are two main types of investment accounts: taxable and tax-advantaged. Taxable accounts, such as brokerage accounts, offer more flexibility than tax-advantaged accounts but are also subject to different tax rates depending on how long the asset is held. Tax-advantaged accounts, such as IRAs and 401(k)s, provide upfront tax breaks or allow investments to grow tax-free. Due to their annual contribution limits, it is not practical for every investor to rely solely on tax-advantaged accounts.

A good way to maximize tax efficiency is to put the right investments in the right accounts. Investments that lose a lot of earnings to taxes are better suited to taxable accounts, while investments that lose more of their returns to taxes are good candidates for tax-advantaged accounts. For example, municipal bonds are tax-efficient because they are exempt from federal taxes and so are good candidates for taxable accounts. Conversely, corporate bonds, which have no tax-free provisions, are better off in tax-advantaged accounts.

Another strategy for tax efficiency is tax-loss harvesting, which involves selling investments that have experienced a loss to offset capital gains and reduce taxable income. This can be done by realizing losses on some investments to minimize tax liabilities on gains made by others.

Asset location is another strategy, which refers to the placement of different investments across taxable and tax-advantaged accounts. Tax-inefficient investments, such as bonds that generate interest income, can be placed in tax-advantaged accounts to minimize their tax impact. Tax-efficient investments like stocks with long-term capital gains potential can be held in taxable accounts, where they benefit from long-term capital gains tax rates.

Qualified dividends and long-term capital gains are subject to lower tax rates compared to ordinary income. Investors may prefer to hold investments that generate qualified dividends or long-term capital gains in taxable accounts to take advantage of these lower rates.

Tax efficiency is especially important for high-net-worth individuals or those in higher tax brackets, as they stand to gain the most from tax-efficient strategies.

Where to Find National Savings and Investments

You may want to see also

Regular portfolio reviews

Preparation

Before the review, it is crucial to ensure your portfolio is ready. This means having a clear understanding of your goals, risk tolerance, and time horizon. It also involves selecting only your best work that aligns with your brand and the specific purpose of the review. Keep the design simple and cohesive, and ensure your work flows nicely from one piece to the next.

Feedback

Feedback is essential for growth, so actively seek it during the review process. Be open to criticism and don't take it personally. Try to attend reviews in person or via video call, as this allows you to capture the reviewer's honest and unprocessed thoughts. Record the session if possible, so you can refer back to it later.

Observation

During the review, focus on observing how the reviewer interacts with your portfolio. Set a timer based on the reviewer's average visit time to simulate a real-world situation. This will help you understand how your portfolio is likely to be perceived by potential clients or recruiters.

Discussion

Once the observation period is over, open the floor for discussion. Ask questions that relate to the goal of your portfolio. For example, if your goal is to get hired, you could ask the reviewer if they would consider hiring you based on your portfolio and why. This will provide valuable insights and help you identify areas for improvement.

Processing Feedback

After the review, take time to process the feedback and make it your own. Understand that different reviewers will have different perspectives and may provide contradicting advice. It is essential to filter the feedback through your own goals and make changes that align with your unique situation.

Continuous Improvement

Crafting the Perfect Investment Portfolio: Strategies for Success

You may want to see also

Frequently asked questions

A positive investment portfolio is important because it helps you build wealth over time and achieve your financial goals. By investing in a variety of assets, you can reduce the impact of market volatility and protect your portfolio from significant losses. Additionally, a positive investment portfolio allows you to manage risk and maximize returns by diversifying your investments.

A positive investment portfolio offers several benefits, including:

- Risk reduction: By diversifying your investments across different asset classes, you can minimize the risk of losing money.

- Long-term wealth accumulation: A well-diversified and positively performing investment portfolio can help you build wealth over time, maximizing your returns and helping you achieve your financial goals.

- Peace of mind: A positive investment portfolio that aligns with your risk tolerance can give you peace of mind, knowing that your investments are working hard for you without keeping you up at night.

Creating a positive investment portfolio involves several steps:

- Define your goals and risk tolerance: Start by understanding your financial goals and how much risk you are comfortable taking. This will help you determine the right mix of assets for your portfolio.

- Diversify your investments: Invest in a variety of asset classes, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate. Diversification helps to reduce risk and maximize returns.

- Regularly monitor and rebalance: Periodically review your portfolio's performance and make adjustments as needed to ensure it remains aligned with your goals and risk tolerance.