In 2019, Warren Buffett's company Berkshire Hathaway disclosed that it owned Amazon stock worth $860.6 million. This was a notable move as Buffett, Chairman and CEO of Berkshire Hathaway, had previously expressed his aversion to investing in tech stocks. In an interview, he admitted that he had been an idiot for not investing in Amazon, calling its founder and CEO Jeff Bezos something special. Despite his admiration, Buffett's lack of technical know-how and his adherence to his investing principles kept him from investing in Amazon earlier.

| Characteristics | Values |

|---|---|

| Amazon investment made by | Todd Combs or Ted Weschler |

| Current Amazon investment | $947 million |

| Amazon as % of Berkshire's portfolio | 0.5% |

| Amazon as % of S&P 500 | 4% |

| Amazon as % of Nasdaq 100 | 7% |

| Amazon stake increase | 11% |

| Berkshire's 4th largest holding | Kraft Heinz |

| Berkshire Hathaway's stake in Apple | $48 billion |

What You'll Learn

Berkshire Hathaway's Amazon stake

Berkshire Hathaway Inc., the conglomerate holding company chaired and led by CEO Warren Buffett, has raised eyebrows in recent years with its investment in Amazon. Berkshire Hathaway's stake in Amazon was first announced in May 2019, and it has since grown significantly.

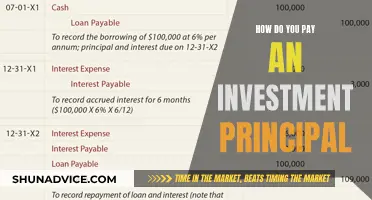

Buffett himself has been a vocal admirer of Amazon and its founder Jeff Bezos, but he has also admitted that he does not fully understand the cloud market, which Amazon leads through its Amazon Web Services division. Despite this, Berkshire Hathaway has become a significant shareholder in Amazon, with its stake worth $904 million at the end of the first fiscal quarter in March 2019, and increasing to $947 million by the end of the second quarter. This represents a stake of slightly more than 0.1% of Amazon's shares outstanding and less than 0.2% of Berkshire's market capitalization.

The decision to invest in Amazon was made by either Todd Combs or Ted Weschler, Berkshire's portfolio managers, each of whom manage about $13 billion in equity investments. The investment in Amazon is notable because it marks a departure from Berkshire Hathaway's traditional focus on insurance and value investing. Amazon's high valuation and ability to sustain a high growth rate have been a cause for concern for many investors, but Berkshire's managers are confident in the company's long-term potential.

The Amazon investment is not the first time that Combs and Weschler have made significant investments that have heralded major Berkshire commitments. Their initial investments in Precision Castparts and Apple led to Berkshire's $32.1 billion purchase of Precision Castparts and a stake in Apple worth close to $48 billion.

Investments: Paying with Potential

You may want to see also

Buffett's investment strategy

Warren Buffett is known as one of the world's most successful investors, amassing a fortune through a long-term, value-based investment strategy. Here is an overview of Buffett's investment strategy, focusing on the topic of whether he would invest in Amazon.

Buffett's Investment Philosophy:

Buffett subscribes to the Benjamin Graham school of value investing, which involves seeking out securities with prices that are unjustifiably low compared to their intrinsic worth. He focuses on the fundamentals of a company as a whole rather than the intricacies of stock market supply and demand. Some key factors Buffett considers include company performance, debt, and profit margins. He typically invests in companies that have been established for at least ten years and avoids those he doesn't fully understand, such as many technology companies.

Buffett's Investment Tips:

Buffett advises investors to take a patient and disciplined approach. He suggests waiting for a reasonable valuation before investing and then buying more when the market corrects, rather than panicking and selling. He emphasizes the importance of understanding the business behind a stock and investing in companies you believe in for the long term.

Buffett and Amazon:

Warren Buffett has famously passed on investing in companies like Amazon and Google, admitting that he didn't have enough knowledge about the internet industry to confidently analyse their stocks. He has a great deal of respect for Amazon and its founder, Jeff Bezos, but investing in tech companies falls outside his self-proclaimed "circle of competence". Buffett prefers to focus on traditional industries like retail, insurance, and finance, and looks for companies with a durable competitive advantage, strong brand, high barriers to entry, or a loyal customer base.

Buffett's Top Holdings:

As of 2024, some of Buffett's notable investments through his company, Berkshire Hathaway, include:

- Bank of America

- American Express

- Occidental Petroleum

- Apple

- Coca-Cola

The Mortgage-Investing Conundrum: Seeking Financial Freedom

You may want to see also

Jeff Bezos' miracle work

Jeff Bezos's work at Amazon has been described as a "business miracle". Starting as an online bookseller, Bezos grew Amazon into an "everything store", with a market cap of over $950 billion. This growth has resulted in a $1.7 trillion value creation for investors.

Bezos's miracle work is also reflected in his philanthropic initiatives. In 2021, CNN host Van Jones received $100 million from Bezos as part of a surprise philanthropic initiative. Jones described getting the call as a "transformative moment". He has since invested the "miracle money" in various initiatives to disrupt poverty and the prison industry in Black and brown communities.

Bezos's miracle work also extends to his other ventures, such as Amazon Web Services (AWS). AWS has been a commanding leader in cloud services, with Bezos at the forefront of its growth. However, the company's dominance is now being challenged by rivals Microsoft and Google.

Overall, Jeff Bezos's work, particularly at Amazon, has been characterised as miraculous due to his incredible vision, execution, and value creation. His philanthropic efforts and other ventures further showcase his impact beyond the business world.

Advisor Fees: Navigating the Fair Percentage

You may want to see also

Buffett's tech investments

Warren Buffett is a value investor, and his investment approach revolves around identifying undervalued companies with strong fundamentals and long-term potential. He has often spoken about how important it is for investors to have an area of expertise.

Buffett has been averse to investing in tech stocks, claiming he doesn't understand tech companies and prefers to leave them in the too hard pile. He has said that he doesn't worry about missing out on investments that are outside his circle of competence. However, Buffett has made some notable tech investments, most prominently in Apple, but also in Amazon.

Buffett's largest holding is Apple, which he considers to be an exception to his general rule about tech companies. Apple's strong and enduring competitive advantages, including brand strength, product ecosystem, and financial stability, align with Buffett's investment principles. Apple's ability to combine innovation with the sustainability of its moats makes it a compelling investment for the legendary investor.

In recent years, Buffett's firm, Berkshire Hathaway, has also been investing in Amazon. As of the end of 2021, Berkshire Hathaway owned 0.11% of the tech giant, representing 0.5% of Berkshire's portfolio. While this is a small holding relative to the rest of the market, it indicates a shift in Buffett's strategy and a recognition that the world has changed. Amazon, like Apple, has evolved beyond being just a tech company and has a powerful brand name and competitive edge beyond technology.

The Magic of Compounding: Unlocking the Secret to Wealth

You may want to see also

Buffett's Amazon admiration

Buffetts Amazon admiration

Warren Buffett, Chairman and CEO of Berkshire Hathaway, has long admired Amazon founder Jeff Bezos, even working with him on a joint healthcare venture. In 2018, Buffett said of Bezos:

> I've watched Amazon from the start. I think what Jeff Bezos has done is something close to a miracle...

Buffett has also praised the business itself, saying:

> I've always admired Jeff... I met him 20 years ago or so, and I thought he was something special, but I didn't realise you could go from books to what's happened there.

Buffett's investment company, Berkshire Hathaway, has owned Amazon stock for nearly three years. While Buffett himself was not the one to make the initial purchase, he has said that he has "been a fan" of Amazon.

Buffett has often spoken about the importance of having an area of expertise when it comes to investing. He has said that:

> Intelligent investing is not complex... what an investor needs is the ability to correctly evaluate selected businesses... You don't have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence.

It seems that Amazon fell outside of Buffett's circle of competence, and he has admitted that he made the wrong call in not investing in the company. However, he has also said that he doesn't consider this a terrible mistake, as Amazon was outside of his circle of competence.

Finding Your Investment Soulmate

You may want to see also

Frequently asked questions

Yes, Warren Buffett's company Berkshire Hathaway has owned Amazon stock since 2019.

Buffett has said that he underestimated Amazon's founder and leader, Jeff Bezos, and that he lacked the technical know-how to recognise the potential of the company.

As of 2022, Berkshire Hathaway owns 0.11% of Amazon, which represents 0.5% of Berkshire's portfolio.

It is believed that the decision to invest in Amazon was made by one of Berkshire's two portfolio managers, Todd Combs or Ted Weschler.

Berkshire Hathaway owns shares in American Express, Costco, The Coca-Cola Company, Visa, and Verizon, among others.