Angel investment networks have become a popular avenue for startups seeking funding, but their effectiveness is often questioned. These networks, which connect startups with angel investors, claim to provide a streamlined process for securing capital. However, the success of these networks is a matter of debate, with some startups finding it challenging to secure funding through these platforms. This article aims to explore the inner workings of angel investment networks, examining their benefits, potential drawbacks, and the factors that contribute to their overall success or failure.

What You'll Learn

Angel Investment Networks: Structure and Benefits

Angel investment networks have gained significant traction as a means to connect startups with potential investors, offering a structured approach to the traditionally informal and personal world of angel investing. These networks provide a platform where investors can discover and evaluate investment opportunities, and startups can gain access to a wider pool of capital and mentorship. The structure of an angel investment network typically involves a centralized platform or a series of events where investors and entrepreneurs converge. This structured environment facilitates efficient deal-making and networking, which is particularly beneficial for startups that may not have the resources to engage in extensive personal networking.

The primary benefit of these networks is the ability to streamline the investment process. Startups can submit their business plans and financial projections to the network, which then uses a structured evaluation process to identify the most promising opportunities. This process often involves a series of filters, such as industry focus, company stage, and growth potential, ensuring that investors can quickly identify investments that align with their criteria. By doing so, networks help investors manage their time and resources more effectively, as they can focus on a curated list of potential deals.

For startups, angel investment networks provide a valuable gateway to the investment community. These platforms offer a streamlined way to connect with multiple investors, increasing the chances of securing funding. Additionally, networks often provide mentorship and guidance, connecting startups with experienced investors who can offer valuable advice on business development, strategy, and industry trends. This mentorship component is crucial for startups, as it can help them navigate the challenges of scaling and growing their businesses.

Angel investment networks also foster a sense of community and collaboration among investors. These networks often organize events, webinars, and workshops, creating opportunities for investors to share insights and best practices. Such knowledge-sharing can lead to more informed investment decisions and potentially reduce the risks associated with angel investing. Furthermore, the collaborative environment can lead to the formation of investment syndicates, where multiple investors pool their resources to invest in a single startup, providing even greater financial support and expertise.

In summary, angel investment networks offer a structured and efficient approach to connecting startups with investors, providing numerous benefits for both parties. Startups gain access to a wider investor network, mentorship, and a streamlined evaluation process, while investors benefit from a curated list of opportunities, knowledge-sharing, and the potential for collaborative investments. This structured environment not only accelerates the investment process but also enhances the overall quality of deals, making angel investment networks a valuable tool in the startup ecosystem.

Seeking Investors for Your Farm?

You may want to see also

Success Stories: Real-World Impact of Networks

Angel investment networks have indeed proven to be a powerful catalyst for success, offering a unique blend of resources, connections, and expertise that can propel startups and entrepreneurs to new heights. These networks, often comprising experienced investors, mentors, and industry experts, provide a supportive ecosystem that goes beyond financial backing. Here are some success stories that illustrate the tangible impact of these networks:

Story 1: Accelerating Growth and Exit

A tech startup, specializing in AI-powered software, joined an angel investment network seeking seed funding. The network's investors not only provided the necessary capital but also offered strategic guidance. Through the network's mentorship program, the founders learned about market validation techniques and product-market fit. This knowledge, coupled with the network's connections, helped them secure additional funding from venture capitalists. As a result, the startup experienced rapid growth, expanding its team and product offerings. Within three years, the company was acquired by a prominent tech giant, showcasing the network's ability to accelerate growth and facilitate successful exits.

Story 2: Access to Mentorship and Industry Insights

An early-stage startup in the healthcare sector struggled with product development and market positioning. A member of the angel investment network, recognizing their potential, connected them with a renowned industry mentor. This mentor provided invaluable guidance on product strategy, clinical trials, and regulatory compliance. The startup's leadership team also participated in the network's weekly webinars, gaining insights from successful entrepreneurs and healthcare experts. This mentorship and knowledge-sharing environment allowed the startup to refine their product and develop a robust go-to-market strategy. As a result, they secured a series A investment and are now poised for significant market expansion.

Story 3: Building a Community and Fostering Collaboration

An angel investment network focused on sustainable energy startups organized a series of hackathons and networking events. These events brought together diverse teams of engineers, designers, and business professionals. By fostering a collaborative environment, the network encouraged participants to form cross-functional teams and develop innovative solutions. One such team, comprising members from different networks, went on to win a prestigious startup competition. The network's support and exposure led to a successful seed investment round, enabling the team to launch their product. This story highlights how networks can create a community that accelerates innovation and facilitates collaboration.

Story 4: Overcoming Challenges and Navigating Complexities

A startup in the fintech space faced regulatory challenges and investor skepticism. The angel investment network's legal and compliance experts provided pro bono support, helping the startup navigate the complex regulatory landscape. Through the network's resources, the founders learned about industry best practices and developed a robust compliance framework. This support, combined with the network's investor confidence, attracted strategic investors and facilitated a successful funding round. The startup's ability to overcome challenges and gain investor trust is a testament to the network's comprehensive support system.

These success stories demonstrate that angel investment networks are not just about financial investments but also about building a supportive ecosystem. By providing mentorship, industry insights, and a collaborative environment, these networks empower entrepreneurs to turn their visions into reality. The impact goes beyond financial gains, fostering a community of innovators and driving positive change across various industries.

Retirement Investing: Navigating the Cautionary Tales

You may want to see also

Selection Criteria: How Angels Choose Startups

When it comes to angel investment networks, the question of their effectiveness is a valid one, especially for startups seeking funding. These networks, comprising groups of wealthy individuals who invest in early-stage companies, can be a powerful resource for entrepreneurs. However, the success of securing funding through these networks relies heavily on the selection criteria and the due diligence process that angels employ.

Angels typically have a specific set of criteria they use to evaluate potential investments. These criteria often include the startup's growth potential, market fit, team capabilities, and financial projections. For instance, they might look for a clear and innovative solution to a problem, a strong and passionate team with relevant expertise, and a well-defined market strategy. Angels often seek to identify companies with a unique value proposition that can disrupt an industry or solve a significant pain point for customers.

One of the key factors in the selection process is the startup's ability to demonstrate a clear understanding of its target market. Angels want to see that the company has conducted thorough market research and can articulate how its product or service will capture a significant share of that market. Financial health is also crucial; angels will scrutinize financial statements, cash flow projections, and historical performance to assess the startup's ability to generate revenue and manage expenses.

Additionally, the team's experience and track record play a vital role. Angels often invest in teams they believe can execute their vision. They seek founders with a strong work ethic, adaptability, and the ability to make quick decisions. The network of connections and industry experience of the team members can also be a significant factor in attracting angel investment.

Another critical aspect is the startup's valuation and the terms of the investment. Angels need to feel that the valuation is fair and that the terms, including ownership and control, are reasonable. They will carefully negotiate these aspects to ensure their investment is protected while also supporting the company's growth. In summary, angel investment networks can be highly effective, but the success of securing funding depends on the startup's ability to meet the rigorous selection criteria set by angels, which includes demonstrating market understanding, financial viability, and a strong team.

Unlocking the Power of Equity: A Guide to Buying an Investment Home

You may want to see also

Network Building: Strategies for Effective Connections

Network building is a crucial aspect of angel investing, and it's a strategy that can significantly impact the success of your investment ventures. When it comes to angel investment networks, the effectiveness of these connections can indeed be a game-changer for startups and investors alike. Here are some strategies to help you build and utilize these networks effectively:

Engage in Industry Events: One of the most traditional yet powerful ways to build a network is by attending industry conferences, meetups, and networking events. These gatherings provide an opportunity to meet potential investors, entrepreneurs, and industry experts. Prepare an elevator pitch that highlights your investment criteria and the value you bring to the table. Be proactive in initiating conversations and showing genuine interest in others' projects. Remember, building relationships takes time, so follow up with meaningful connections after the event to maintain and strengthen these ties.

Utilize Online Platforms: In today's digital age, online platforms and social media networks have become invaluable tools for angel investors. LinkedIn, for instance, offers a vast professional network where you can connect with investors, entrepreneurs, and industry professionals. Engage in relevant groups, participate in discussions, and share insightful content related to angel investing. Additionally, consider joining angel investment-specific groups or forums where you can connect with like-minded individuals and share your expertise. Online networking allows you to expand your reach and connect with a diverse range of professionals.

Mentorship and Collaboration: Building a network is not just about making connections but also about nurturing relationships. Offer mentorship to aspiring entrepreneurs and provide guidance based on your investment experience. This not only helps others but also positions you as a valuable resource within your network. Collaborate with other angel investors to form investment syndicates, which can increase your collective influence and investment power. By working together, you can share insights, due diligence processes, and even co-invest in promising startups.

Stay Informed and Share Knowledge: Keep yourself updated on industry trends, emerging technologies, and successful investment strategies. Share this knowledge within your network to establish yourself as a thought leader. Create a blog, podcast, or newsletter to showcase your insights and attract like-minded investors. By sharing valuable information, you not only help your network but also position yourself as a go-to resource for investment opportunities and industry insights.

Follow-up and Relationship Maintenance: Building a network is an ongoing process that requires consistent effort. After initial connections, follow up with regular communication to nurture relationships. Send personalized updates on new investment opportunities or industry news that might be relevant to your network. Organize or participate in informal gatherings or virtual meetings to keep the connections strong and vibrant. Effective network building is about creating a mutually beneficial ecosystem where everyone can thrive.

Art as an Alternative Investment: A Guide to Buying Smart

You may want to see also

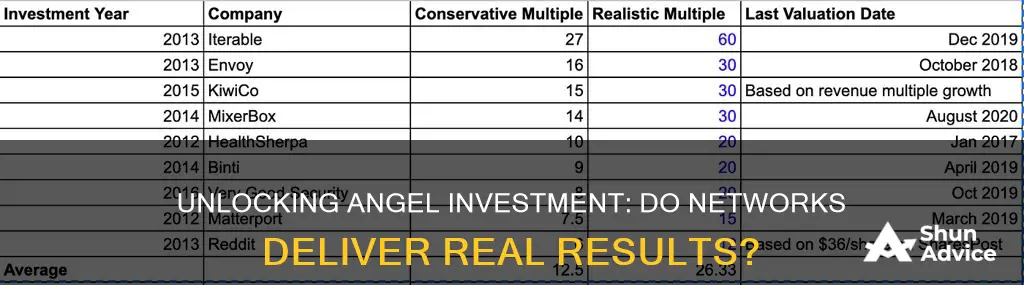

ROI: Return on Investment for Angel Investors

Angel investment networks have gained significant traction as a means to connect early-stage startups with investors, offering a potential solution to the challenges of accessing capital. These networks often claim to provide a streamlined process for investors to discover and support promising ventures, but the question remains: do they truly deliver on their promise of generating a positive return on investment (ROI)?

The concept behind angel investment networks is to create a platform where startups can pitch their ideas to a diverse group of accredited investors, increasing the chances of finding the right match. These networks typically charge a fee for their services, which can range from a percentage of the investment raised to a flat fee. While they offer convenience and a broader reach, it's essential to consider the potential drawbacks.

One of the primary concerns is the quality and diversity of startups presented to investors. Angel investment networks may not always conduct thorough due diligence, leading to a higher risk of fraud or poor investment decisions. Startups might exaggerate their potential, and investors might not have the time or resources to conduct extensive research, making it challenging to assess the true value and viability of each opportunity.

Additionally, the success of angel investment networks relies heavily on the network's ability to match investors with startups that align with their investment criteria. Investors seek specific characteristics in startups, such as industry potential, team expertise, and market fit. If the network fails to curate a diverse and relevant pool of opportunities, investors might find it challenging to achieve their desired ROI.

To maximize ROI, angel investors should focus on a strategic approach. This includes conducting thorough research and due diligence, diversifying their portfolio across multiple sectors and stages of startups, and actively participating in the network's curation process. By doing so, investors can increase their chances of finding high-potential startups and making informed decisions.

In conclusion, while angel investment networks provide a valuable service by connecting startups with investors, their effectiveness in delivering a positive ROI depends on various factors. Investors should approach these networks with a critical eye, ensuring that the network's due diligence processes are robust and that the opportunities presented align with their investment goals. With the right strategies and careful consideration, angel investors can navigate these networks successfully and potentially achieve their desired returns.

GME Investors: Who's In?

You may want to see also

Frequently asked questions

Angel investment networks can be highly effective in connecting startups with potential investors. These networks often have a vast network of accredited investors, providing startups with a platform to pitch their ideas and secure funding. The success rate can vary depending on the network's reputation, the quality of the startup's pitch, and the timing of the investment opportunity. Many successful startups attribute their initial funding to connections made through such networks.

Joining an angel investment network offers several advantages. Firstly, it provides access to a diverse pool of investors, increasing the chances of finding a suitable match for a startup's funding needs. These networks often have a rigorous screening process to ensure investor quality. Additionally, they may offer mentorship programs, industry insights, and networking opportunities, which can be invaluable for startups. Many networks also provide resources and tools to help entrepreneurs refine their business plans and investment pitches.

While angel investment networks can be beneficial, there are a few potential drawbacks to consider. Firstly, the competition can be intense, as many startups may be vying for the same limited number of investor opportunities. This can make it challenging for startups to stand out and secure funding. Secondly, not all networks are created equal, and some may have less reputable investors or less stringent screening processes. Due diligence is essential to ensure the network's credibility and the investors' suitability for the startup's needs. Lastly, the success of securing funding also depends on the startup's own preparedness, market fit, and business strategy.