University endowments are formed when donors gift large sums of money or other economic assets to generate financial support for a nonprofit institution. While charitable donations are the primary source of funds for endowments, the money is then invested in various asset classes, such as fixed-income securities, bonds, hedge funds, and real estate. The bulk of investment returns are held indefinitely to ensure the institution's survival and autonomy. University endowment funds are an important source of revenue for many higher education institutions, and in the US, some of the wealthiest institutions have endowments worth billions of dollars. This naturally raises the question of whether universities use alternative investments for their endowments.

| Characteristics | Values |

|---|---|

| Purpose | To generate financial support for a nonprofit institution |

| Fund Composition | Monetary donations, invested in various asset classes |

| Investment Types | Fixed income securities, bonds, hedge funds, real estate, private equity, etc. |

| Investment Horizon | Long-term |

| Investment Decision-Making | Managed by teams of finance professionals, university investment offices, or chief investment officers |

| Endowment Types | Restricted, unrestricted, term, quasi |

| Spending Rate | Up to 5% of the endowment's total asset value annually |

| Tax Status | Private nonprofit colleges and universities are typically exempt from taxes |

What You'll Learn

- The benefits of alternative investments for university endowments

- Types of alternative investments for university endowments

- The history of university endowment investment strategies

- The impact of alternative investments on university finances

- The role of investment professionals in managing university endowments

The benefits of alternative investments for university endowments

University endowments are a crucial source of revenue for many higher education institutions, and alternative investments can play a significant role in enhancing these endowments. By exploring alternative investment opportunities, universities can diversify their portfolios and unlock a range of benefits.

One of the key advantages of alternative investments is their potential to generate higher returns. Alternative investments, such as private equity, hedge funds, and real estate, often offer higher return prospects compared to traditional asset classes. This is exemplified by the "Yale Model" of endowment investing, pioneered by David Swenson, which involves allocating a significant portion of the endowment to alternative assets. By embracing this strategy, Yale University achieved substantial returns, with their endowment becoming one of the largest in the nation.

Another benefit of alternative investments is their ability to provide portfolio diversification. By investing in a range of alternative assets, universities can reduce their exposure to the volatility of any single asset class or market. This diversification helps to mitigate risks and stabilize the endowment's performance over time.

Additionally, alternative investments can offer universities access to unique opportunities and niche markets. For example, investing in private equity allows universities to participate in the growth of private companies, which may provide higher returns than public markets. Hedge funds, on the other hand, can employ a variety of strategies, including arbitrage and event-driven approaches, that are not typically accessible through traditional investments.

The long-term nature of university endowments also aligns well with alternative investments. Assets such as real estate or private equity investments often require a longer time horizon to realize their full potential. Universities, with their focus on intergenerational wealth transfer, can afford to take a long-term perspective, which may result in more substantial returns over time.

Furthermore, alternative investments can help universities manage their cash flow. Certain alternative assets, such as bonds or fixed-income securities, can provide a steady stream of income through regular interest or dividend payments. This predictable cash flow can assist universities in meeting their ongoing financial obligations and supporting their day-to-day operations.

In conclusion, alternative investments offer universities the potential for higher returns, portfolio diversification, access to unique opportunities, long-term growth, and stable cash flow. By incorporating these investments into their endowments, universities can strengthen their financial position and better support their teaching, research, and public service missions.

Millionaires' Secrets: Where They Invest Their Money

You may want to see also

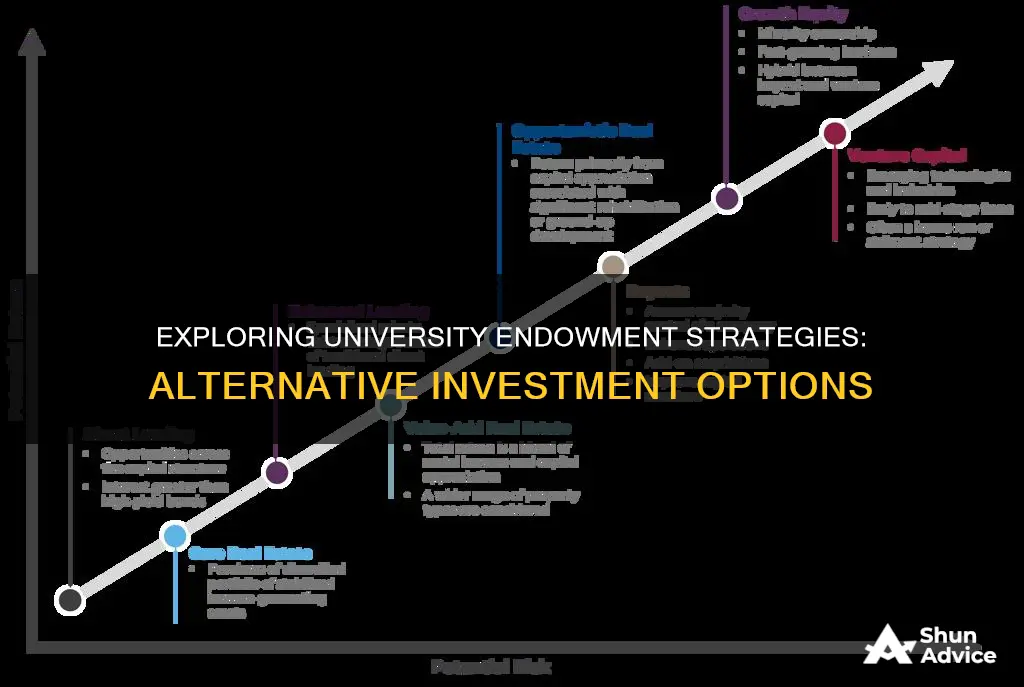

Types of alternative investments for university endowments

University endowments are a crucial source of funding for many higher education institutions, supporting teaching, research, and public service missions. These endowments are typically funded by donations and are designed to be self-sustaining by not paying out the entire fund balance. While the specific investment strategies may vary, alternative investments form a significant portion of university endowments. Here are the types of alternative investments commonly utilised by universities:

- Hedge Funds: Hedge funds are a popular alternative investment for university endowments. They are designed to perform inversely to the overall market, providing downside protection. There are different hedge strategies, including event-driven, relative value/arbitrage, and directional approaches.

- Private Equity: Private equity involves owning a stake in a private company that is not publicly listed or traded. Given that over 99% of US companies are privately held, private equity is a significant component of endowment portfolios.

- Venture Capital: Venture capital is another type of alternative investment where endowments invest in start-ups or small businesses with high growth potential.

- Real Assets: Real assets, such as real estate, precious metals, commodities, and natural resources like oil, are intrinsic to endowment portfolios. These assets have historically offered an 'inflation hedge' and provide diversification.

- Other Alternative Investments: Endowments may also explore other alternative investment opportunities, including various types of hedge strategies, private investments, and non-traditional asset classes.

By incorporating these alternative investments into their portfolios, university endowments aim to generate consistent income, preserve capital, and combat inflation over the long term.

No Cash for Investments? Here's Why and What to Do

You may want to see also

The history of university endowment investment strategies

In the US, the prominence of university endowments emerged towards the end of the 19th century, with several private universities recognising the importance of financial capital for their autonomy and survival. The philanthropy of individuals like Leland Stanford, Andrew Carnegie, and John D. Rockefeller played a significant role in expanding the financial safety net of these universities, and their endowments remain among the wealthiest in the US today.

Over time, university endowment investment strategies have evolved to include various asset classes. Endowments are typically formed when donors gift substantial sums of money or economic assets to support nonprofit institutions. These monetary donations are then added to diversified fund portfolios and invested in assets such as fixed-income securities, bonds, hedge funds, real estate, and more. The "Yale Model" of modern-day endowment investing, pioneered by David Swenson, revolutionised investing by increasing exposure to alternative assets.

Today, university endowments in the US hold significant financial power, with the top five Ivy League colleges boasting a combined endowment value of over $200 billion as of 2021. These endowments are managed by investment professionals and play a crucial role in supporting the long-term financial health and survival of academic institutions.

Non-Cash Assets: When Your Partner Brings More Than Money

You may want to see also

The impact of alternative investments on university finances

University endowments are a crucial source of revenue for many higher education institutions, with some universities relying on them for their financial health. They are comprised of money or other financial assets donated to academic institutions, which are then invested to generate income for a specific purpose.

Endowments are often invested in various asset classes, including fixed-income securities, bonds, hedge funds, and real estate. The income generated from these investments is used to finance a portion of the university's operating or capital requirements, such as professorships, scholarships, and research. In recent years, there has been a trend towards increasing exposure to alternative investment assets, such as private equity, hedge funds, and real estate. This strategy, known as the "Yale Model", has been credited with revolutionizing investing and boosting returns for many endowments and foundations.

Secondly, alternative investments offer a level of diversification to university endowments, reducing the risk associated with investing in traditional asset classes. By allocating a portion of their endowment to alternative investments, universities can mitigate the impact of market volatility and reduce the likelihood of significant losses.

Additionally, alternative investments can provide universities with access to unique opportunities and sectors that may not be available through traditional investments. This allows universities to support specific areas within the institution, such as research or specific programs, that may have otherwise been challenging to fund.

However, there are also challenges associated with alternative investments. Firstly, they often carry a higher level of risk and may not always be successful. Universities must carefully consider their investment strategies and ensure proper management of these assets to balance risk and return.

Furthermore, alternative investments can be less liquid than traditional investments, making it more difficult for universities to access their funds in times of need. This lack of flexibility can be a significant concern, especially during economic downturns or unexpected expenses.

Overall, alternative investments have had a substantial impact on university finances, offering the potential for higher returns and diversification. However, universities must carefully navigate the challenges associated with these complex investment strategies to ensure the long-term health and stability of their endowments.

Dividends from Investments: Operating Cash Flow Activity?

You may want to see also

The role of investment professionals in managing university endowments

Investment professionals play a crucial role in managing university endowments, ensuring that donations are invested wisely to generate long-term financial support for the institution. University endowments are comprised of monetary gifts or other financial assets donated by benefactors to support academic institutions. These endowments are intended to provide a perpetual source of funding for various purposes, such as professorships, scholarships, research, and public service missions.

The role of investment professionals is essential to the successful management of these endowments. They are responsible for developing and implementing investment strategies that align with the university's goals and the donors' intentions. This involves diversifying the endowment funds across various asset classes, such as fixed-income securities, bonds, hedge funds, private equity, real estate, and more. By investing in a range of assets, investment professionals aim to balance risk and return to generate sustainable financial support for the university.

In larger endowments, a chief investment officer (CIO) typically leads a team of investment professionals. The CIO manages the assets, oversees daily operations, and works closely with the board of trustees to develop risk mitigation strategies and investment policies. The CIO also hires external investment fund managers who provide expertise and oversight for different portions of the endowment. These fund managers make investment decisions, monitor fund performance, and advise on how and where to invest the endowment's assets.

The investment strategies employed by these professionals are crucial in ensuring the long-term health of the endowment. They aim to generate consistent returns while also preserving the principal amount to maintain the endowment's purchasing power over time. This involves navigating market volatility and making strategic decisions to balance risk and return.

Additionally, investment professionals work within the legal and regulatory framework governing endowments. They ensure compliance with tax regulations and donor restrictions. In the case of restricted endowments, where donors specify the use of funds, investment professionals collaborate with university administrators to ensure that the endowment income is utilized according to the donor's stipulations.

Overall, the role of investment professionals is critical in managing university endowments effectively. Their expertise in financial markets, investment strategies, and risk management helps to maximize the impact of endowment funds, providing a stable source of financial support for the university's operations, research, and student assistance.

HSA Investment or Cash: Which Option is Better?

You may want to see also

Frequently asked questions

University endowments are donations of money or other financial assets given to academic institutions to provide ongoing financial support.

Alternative investments for university endowments can include private equity, hedge funds, real estate, fixed-income securities, and bonds.

Alternative investments can provide higher returns and help boost the financial health of educational institutions. They can also reduce the risk of market volatility by diversifying the investment portfolio.

Universities with large endowments typically have investment offices led by chief investment officers (CIOs) who manage the assets and make investment decisions. They may also hire external investment fund managers to provide oversight and advice on alternative investments.

Yes, there are risks associated with any investment, including alternative investments. Universities need to ensure that they comply with the donor's restrictions and intentions. Additionally, there may be legal and accounting implications if the endowment funds are used for purposes other than what they were intended for.