Inventories are a crucial aspect of business operations, representing goods and materials that a company holds for future sale or production. While they are not typically considered investments in the traditional sense, they play a significant role in a company's short-term financial strategy. The classification of inventories as short-term investments is often based on their liquidity and the company's ability to convert them into cash within a relatively short period. This classification is essential for financial reporting and analysis, as it impacts a company's balance sheet and cash flow statements. Understanding the nature of inventories as short-term assets is vital for businesses to manage their finances effectively and make informed decisions regarding their operations.

What You'll Learn

- Inventory Classification: Determining which inventory items are considered short-term investments

- Cost Basis: Understanding the cost of inventory items for tax and financial reporting

- Turnover Ratios: Analyzing inventory turnover to assess liquidity and efficiency

- Inventory Management: Strategies to optimize inventory levels and reduce holding costs

- Financial Reporting: How inventory is treated in financial statements and accounting practices

Inventory Classification: Determining which inventory items are considered short-term investments

When classifying inventory, it's crucial to understand which items are considered short-term investments. This classification is essential for accurate financial reporting and analysis, as it impacts how these items are valued and reported on a company's balance sheet. Short-term investments are typically those that are highly liquid and can be quickly converted into cash without significant loss of value. These investments are usually held for a relatively short period, often less than a year, and are intended to provide a source of liquidity or income in the near future.

Inventory items can be classified as short-term investments if they meet specific criteria. Firstly, the items should be easily convertible into cash, such as raw materials, work-in-progress, or finished goods that are ready for immediate sale. These items are considered short-term because they can be sold or used up within a short period, often within a fiscal quarter or year. For example, a manufacturing company might classify its raw materials and work-in-progress inventory as short-term investments, as they are essential for production and can be quickly transformed into finished goods for sale.

Secondly, the classification of inventory as a short-term investment depends on the company's operational and sales strategies. Items that are part of the company's regular business operations and are expected to be sold or used up within a short period should be classified accordingly. For instance, a retail business might consider its stock of popular, fast-moving goods as short-term investments, as they are likely to be sold quickly and replenish the shelves frequently.

To determine which inventory items qualify as short-term investments, companies should consider factors such as the nature of the item, its intended use, and the company's sales and production cycles. Items that are not part of the core business operations or are expected to be held for a more extended period should be classified as long-term investments or other categories. For example, a company might classify its inventory of unique, custom-made products as long-term, as they are not easily convertible into cash and may take longer to sell.

In summary, classifying inventory as short-term investments involves assessing the liquidity, operational relevance, and expected sales or usage period of each item. This classification is vital for financial reporting, as it ensures that the company's balance sheet accurately reflects the value of its assets and liabilities. By carefully evaluating inventory items, companies can provide a clear picture of their short-term financial health and make informed decisions regarding their inventory management strategies.

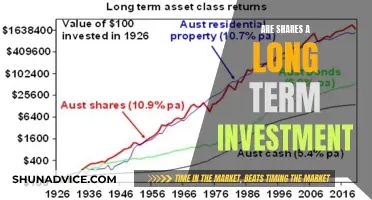

Unlocking the Secrets: How Long is Long-Term Investing?

You may want to see also

Cost Basis: Understanding the cost of inventory items for tax and financial reporting

The cost basis of inventory items is a critical concept for businesses, especially when it comes to tax and financial reporting. It refers to the original cost of the goods that a company purchases and holds in its inventory. Understanding this cost is essential as it directly impacts a company's financial health and tax obligations. When a business sells its inventory, the cost basis is used to determine the profit or loss, which is a key metric for assessing financial performance.

For tax purposes, the cost basis of inventory is crucial. It is used to calculate the cost of goods sold (COGS), which is a deductible expense for businesses. COGS is a significant factor in determining a company's taxable income, and thus, its tax liability. Accurately tracking and valuing inventory can lead to significant tax savings or potential penalties if not managed properly.

Financial reporting also heavily relies on the cost basis of inventory. In financial statements, inventory is typically valued at the lower of its cost or market value. This means that if the market value of the inventory decreases, the company must adjust its cost basis accordingly. This adjustment impacts the company's net income and overall financial position. For instance, if a company overestimates its inventory cost, it may report higher profits than it actually has, which could lead to inaccurate financial assessments.

To manage inventory costs effectively, businesses often employ various methods. One common approach is the Weighted Average Cost Method, where the average cost of all units in stock is used to value the inventory. This method provides a more accurate representation of the cost basis, especially when dealing with multiple purchase transactions. Another strategy is the Last-In-First-Out (LIFO) method, which assumes that the most recently purchased inventory items are sold first, thus affecting the cost basis calculation.

In summary, the cost basis of inventory is a fundamental concept that businesses must grasp to ensure accurate tax and financial reporting. It involves tracking the original cost of goods, which then influences profit calculations, tax liabilities, and overall financial health. Effective inventory management techniques, such as weighted average costing and LIFO, can help businesses optimize their cost basis and make informed financial decisions.

Understanding Short-Term Investments: Strategies for Quick Financial Growth

You may want to see also

Turnover Ratios: Analyzing inventory turnover to assess liquidity and efficiency

When evaluating a company's liquidity and efficiency, inventory turnover ratios are a critical metric to consider. These ratios provide insights into how well a business manages its inventory, which is a significant asset for many organizations. The inventory turnover ratio measures the number of times a company sells and replaces its inventory during a specific period, typically a year. A higher turnover ratio indicates that the company is selling its inventory more frequently, which can be a sign of strong sales performance and efficient inventory management.

To calculate the inventory turnover ratio, you divide the cost of goods sold (COGS) by the average inventory value for the period. The COGS is the total cost of producing or purchasing the goods sold during the accounting period. By comparing the COGS to the average inventory, you can determine how quickly the inventory is being converted into sales. For instance, if a company has a high COGS and a low average inventory, it suggests that the inventory is being sold rapidly, and the business might be experiencing strong demand for its products.

However, interpreting inventory turnover ratios requires a nuanced approach. A high turnover ratio is generally desirable, as it indicates efficient inventory management and reduced holding costs. It suggests that the company is not carrying excess stock and is effectively managing its resources. On the other hand, a low turnover ratio could imply overstocking, which may lead to increased holding costs, potential obsolescence, and reduced cash flow. Therefore, it is essential to compare the ratio with industry averages and historical data to understand its significance.

Industry standards and trends play a crucial role in analyzing inventory turnover. Different industries have varying norms for inventory management due to factors like product nature, seasonality, and customer demand patterns. For instance, a retail business might have higher inventory turnover compared to a manufacturing company, as retail often deals with perishable goods and frequent sales cycles. By benchmarking against industry peers, companies can assess their performance and identify areas for improvement.

In summary, analyzing inventory turnover ratios is a powerful tool for assessing a company's liquidity and operational efficiency. It provides insights into sales performance, holding costs, and overall inventory management. By understanding the ratio and comparing it to industry standards, businesses can make informed decisions to optimize their inventory strategies, ensuring they meet customer demands while maintaining financial health. This analysis is a vital component of financial management and can significantly impact a company's long-term success.

Unlocking Long-Term Wealth: ETFs as a Strategic Investment Strategy

You may want to see also

Inventory Management: Strategies to optimize inventory levels and reduce holding costs

Understanding the nature of inventories as short-term investments is crucial for effective inventory management. This perspective highlights the dynamic and fluid nature of inventory, emphasizing the need for strategic approaches to optimize levels and minimize holding costs. Here's an exploration of strategies to achieve this:

- Accurate Demand Forecasting: At the heart of successful inventory management lies accurate demand forecasting. This involves analyzing historical sales data, market trends, and external factors influencing demand. By employing sophisticated forecasting techniques, such as exponential smoothing or time series analysis, businesses can predict future demand with greater precision. This enables them to align inventory levels with actual demand, reducing the risk of excess stock or stockouts.

- Just-In-Time (JIT) Inventory Management: JIT is a strategy that focuses on minimizing inventory holding costs by ensuring that materials and products arrive just in time for production or customer demand. This approach requires close collaboration with suppliers and efficient production processes. By reducing the time inventory spends in storage, JIT minimizes holding costs, improves cash flow, and reduces the risk of obsolescence.

- ABC Analysis: This classification system categorizes inventory items based on their value and consumption rate. Items are assigned to A, B, or C categories, with A items being the most valuable and critical. A-items require more frequent monitoring and reordering to ensure they are always available. B-items are moderately valuable and should be managed to avoid stockouts. C-items, less valuable, may be managed with less stringent controls. This strategy helps optimize inventory levels by focusing resources on the most critical items.

- Dynamic Reordering and Safety Stock: Implementing dynamic reordering systems that trigger purchases based on actual usage or depletion rates can prevent stockouts. Safety stock, a buffer of extra inventory to account for variability in demand or supply, is also crucial. The safety stock level should be carefully calculated based on demand forecasts and lead times. Regularly reviewing and adjusting safety stock levels ensures that businesses can meet unexpected demand spikes without incurring excessive holding costs.

- Technology Integration: Utilizing inventory management software and systems can significantly enhance efficiency. These tools provide real-time visibility into inventory levels, sales, and reordering needs. Automation of inventory processes, such as picking, packing, and shipping, can further reduce holding costs and human error. Additionally, integrating supply chain management systems can optimize the entire inventory lifecycle, from procurement to distribution.

- Continuous Monitoring and Adjustment: Inventory management is an ongoing process that requires constant vigilance. Regularly reviewing inventory turnover ratios, lead times, and holding costs allows businesses to identify areas for improvement. Adjusting strategies based on market dynamics and customer feedback ensures that inventory levels remain optimized.

Understanding Short-Term Investments: Are They Cash Equivalents?

You may want to see also

Financial Reporting: How inventory is treated in financial statements and accounting practices

The treatment of inventory in financial statements is a critical aspect of financial reporting, especially for businesses that rely on the sale of goods. When it comes to the question of whether inventories are short-term investments, the answer is nuanced and depends on various factors. Firstly, inventories are typically classified as current assets on a company's balance sheet, indicating that they are expected to be converted into cash or used within one year. This classification is based on the assumption that inventories will be sold or used in the normal course of business operations.

In accounting practices, the valuation of inventories is a complex process. Companies often use different methods to determine the cost of goods sold and the value of their inventory. The most common methods include the First-In, First-Out (FIFO) method, the Last-In, First-Out (LIFO) method, and the Weighted Average Cost method. FIFO assumes that the oldest inventory items are sold first, while LIFO considers the most recently acquired items. The Weighted Average Cost method calculates the average cost per unit of inventory. These methods impact the financial statements as they influence the cost of goods sold and, consequently, the gross profit margin.

Financial analysts and investors closely examine inventory levels and turnover rates to assess a company's liquidity and financial health. A high inventory turnover ratio indicates efficient management of inventory, suggesting that the company sells its inventory quickly and may have lower holding costs. Conversely, a low turnover ratio could imply excess inventory, potential obsolescence, or issues with sales and marketing. Therefore, understanding the inventory turnover and its implications is essential for financial reporting and analysis.

Additionally, the treatment of inventories in financial statements can vary depending on the industry and the specific business model. For instance, companies in the retail industry may have more frequent inventory turnover due to high sales volumes, while manufacturers might have longer lead times and more complex inventory management. In such cases, companies may need to adjust their accounting practices to reflect the unique nature of their inventory and its impact on cash flow and financial stability.

In summary, while inventories are generally considered short-term assets, the treatment and valuation in financial reporting require careful consideration. Accounting practices and methods, such as FIFO, LIFO, and weighted average cost, play a significant role in determining the financial impact of inventory. Understanding these practices is crucial for investors and financial analysts to make informed decisions and assess a company's overall financial health and performance.

Understanding Short-Term Investments: A Brainly Guide

You may want to see also

Frequently asked questions

Inventories typically consist of goods that are intended for sale in the ordinary course of business, raw materials, and work-in-process items. These are not considered short-term investments as they are not liquid assets and are not easily convertible to cash within a short period.

Inventories are reported at the lower of cost or market value on a business's balance sheet. This means that companies must consider the cost of acquiring and holding the inventory and compare it to the current market prices to ensure accurate valuation.

Yes, inventories are classified as current assets on a company's balance sheet. However, they are not considered short-term investments because they are not readily convertible to cash and are intended for future sale.

Efficient inventory management is crucial for a business's success. Overstocking can lead to increased holding costs and potential obsolescence, while understocking may result in lost sales. Balancing inventory levels is essential to ensure cash flow, reduce costs, and maintain a healthy financial position.