Investing is a great way to grow your money and build wealth. There are many options for investing, from low-risk choices such as CDs and money market accounts to medium-risk options like corporate bonds, and even higher-risk picks such as stock index funds. Each option has its own set of returns and risk factors, allowing investors to create a well-rounded and diversified portfolio that matches their financial goals and risk tolerance.

When considering how and where to invest, it is important to evaluate your financial situation, risk tolerance, time horizon, knowledge of investing, and the amount you can invest. It is also recommended to consult a qualified professional for investment advice tailored to your specific circumstances.

1. High-yield savings accounts: These accounts offer higher interest rates compared to traditional bank savings accounts, providing accessible vehicles for your cash while also giving you the option to earn interest on your balance.

2. Certificates of Deposit (CDs): CDs are issued by banks and offer higher interest rates than savings accounts, making them ideal for investors seeking higher yields without taking on excessive risk.

3. Long-term corporate bond funds: Corporations raise money by issuing bonds, which can be packaged into bond funds. These funds offer cash flow and are suitable for investors looking to reduce overall portfolio risk while still achieving a return.

4. Dividend stock funds: Dividend stocks are those that pay out a portion of the company's profits to shareholders. Buying individual stocks can be risky, but investing in a group of dividend stocks through a stock fund can reduce that risk while providing income.

5. Value stock funds: These funds invest in stocks that are more bargain-priced in the market, offering potential for attractive long-term returns.

6. Small-cap stock funds: Small-cap funds invest in stocks of smaller companies with strong growth prospects. While these stocks tend to be riskier, investing in a diversified small-cap fund can help mitigate some of the risks.

7. Real Estate Investment Trusts (REITs): REITs are a popular way to invest in real estate. They pay out dividends and can provide diversified exposure to real estate without the headaches of property management.

8. S&P 500 index funds: An S&P 500 index fund is based on a diverse range of large American companies, providing broad exposure to the stock market and offering higher potential returns than traditional banking products.

9. Nasdaq-100 index funds: These funds offer exposure to some of the biggest and most stable tech companies, allowing investors to benefit from the growth of the tech industry without having to pick individual stocks.

10. Rental housing: Investing in rental properties can be a great way to generate regular cash flow, but it requires a willingness to manage properties and deal with tenants.

| Characteristics | Values |

|---|---|

| Risk tolerance | High, Moderate, Low |

| Investment goals | Short-term, Long-term |

| Investment style | DIY, Professional guidance |

| Investment account type | Taxable accounts, Tax-deferred accounts, Tax-free accounts, Dividend Reinvestment Plan (DRIP) Accounts, Retirement accounts, Health Savings Accounts (HSAs), Education Savings Accounts (529 Plans) |

| Investment amount | Lump sum, Smaller amounts over time |

| Investment options | Stocks, Bonds, Mutual funds, Index funds, Exchange-traded funds (ETFs), Blue-chip stocks, Dividend stocks, Growth stocks, Defensive stocks, Low-volatility stocks, Quality factor ETFs, High-yield savings accounts, Certificates of deposit (CDs), 401(k) or workplace retirement plan, Individual stocks, Robo-advisors |

What You'll Learn

Set clear investment goals

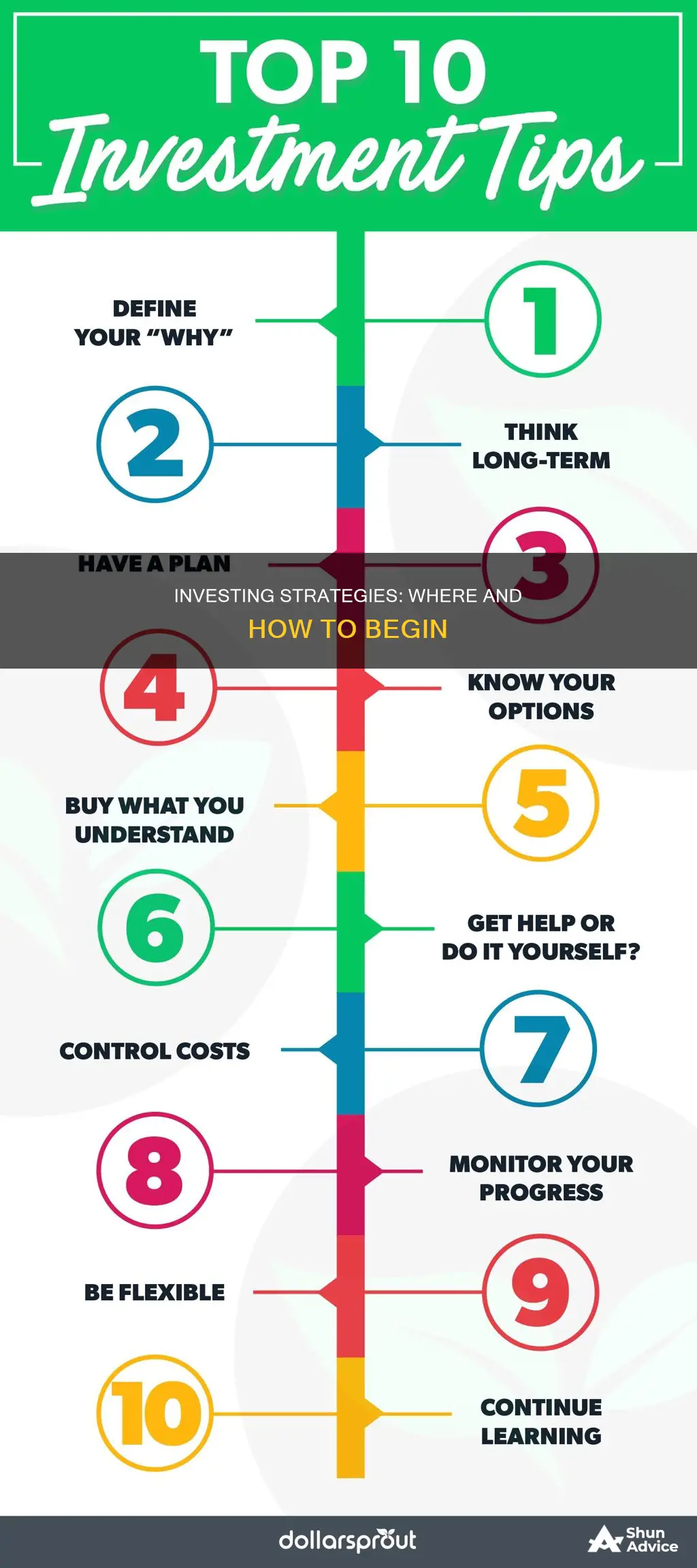

Setting clear investment goals is a crucial step in achieving financial success. Here are some tips to help you establish clear and effective investment goals:

Know Your Priorities

Before setting specific investment goals, take time to reflect on what matters most to you. Consider your life goals and priorities, such as starting a family, buying a home, or retiring early. This introspection will help you identify the areas you want to focus your financial efforts on.

Define Your Goals Using the SMART Framework

Use the SMART framework to set clear and effective investment goals:

- Specific: Make your goals detailed and clear. For example, "I want to save for a down payment on a house" is more specific than just "I want to save money."

- Measurable: Define measurable criteria to track your progress and determine if you're on the right path. For instance, decide on a specific amount you want to save each month.

- Achievable: Ensure your goals are realistic and achievable, given your financial situation and resources.

- Relevant: Ensure your goals align with your life priorities and are meaningful to you.

- Time-based: Assign a timeline to each goal. For example, decide if you want to achieve a particular goal in the short term (less than five years), medium term (5-10 years), or long term (more than 10 years).

Choose the Right Investments for Your Goals

Different types of investments are suitable for different time horizons:

- Short-term goals: Focus on preserving your capital with low-risk investments such as money market funds and high-yield savings accounts.

- Medium-term goals: Depending on your risk tolerance, you may stick with low-risk investments or allocate a small portion of your portfolio to higher-quality stocks or dividend-paying stocks through an ETF.

- Long-term goals: Goals beyond five years are typically considered long-term, allowing you to take on more risk. Stocks are usually the best investment for long-term goals as part of a diversified portfolio. Index funds that track broad market indexes, such as the S&P 500, have historically performed well over time.

Regularly Review and Adjust Your Goals

Investment goals should be dynamic and reviewed periodically. Life circumstances change, and your investment strategy should adapt accordingly. Conduct regular reviews to ensure your investments align with your current goals, risk tolerance, and time horizons.

Consult a Financial Professional

If you need help setting and achieving your investment goals, consider consulting a financial advisor or a robo-advisor. They can provide guidance and help you make informed decisions based on your unique circumstances.

Apple's Excess Cash Strategy: Investing for Future Growth

You may want to see also

Determine how much you can afford to invest

Before investing, it's important to take stock of your financial situation and set clear investment goals. This means budgeting for essential expenses, such as housing, utilities, groceries, and debt payments, as well as emergency funds and financial goals like paying off debt or saving for a down payment on a home.

It's recommended that individuals save at least 15% of their income for retirement, although this can be adjusted if it's not financially feasible. Other budgeting strategies, such as the 50/30/20 strategy, suggest putting 20% of your income towards debt repayment, savings, and investments.

When determining how much to invest, it's crucial to consider your income, debt balances, and emergency savings. If you're struggling to make ends meet, prioritize building an emergency fund or paying off high-interest debt.

Investing is about finding the right balance between your financial priorities and your tolerance for risk. Traditionally high-risk investments, such as cryptocurrency or growth-focused stocks, offer more volatility, while safer options include treasury bonds, money market funds, and dividend-paying stocks.

Remember, investing should be re-evaluated regularly, especially when your financial situation changes or market conditions fluctuate.

Cash App Investing: How to Make an Investment Request

You may want to see also

Assess your risk tolerance

Risk tolerance is a crucial aspect of investing, as it determines the type and amount of investments an individual chooses. It refers to the degree of risk an investor is willing to take on, given the potential for losses in the value of their investments. All investments carry some level of risk, and understanding your risk tolerance helps you plan your investment portfolio effectively.

Time Horizon

The time horizon refers to how long you plan to invest for. If you have a long-term financial goal, such as retirement, you may be willing to take on more risk with the potential for higher returns. On the other hand, if you have a short-term goal, such as saving for a down payment on a house, you may prefer lower-risk investments that provide more stable returns.

Investment Goals

Your investment goals will influence your risk tolerance. For example, if you are aiming for substantial capital appreciation, you may need to take on more risk. In contrast, if your goal is to preserve your principal investment, lower-risk options may be more suitable.

Age

Your age can impact your risk tolerance. Generally, younger investors have a longer time horizon and may be more comfortable taking on higher-risk investments. As investors get closer to retirement age, they may become more conservative to protect their accumulated wealth.

Income and Financial Situation

Your income and overall financial situation play a role in determining your risk tolerance. If you have a stable income, sufficient emergency funds, and other sources of funds, such as a pension or Social Security, you may be more tolerant of risk. Additionally, investors with larger portfolios can often withstand higher levels of risk, as the percentage loss is relatively smaller compared to smaller portfolios.

Anxiety and Comfort Level

Your emotional and psychological comfort with risk is an important consideration. Some people are comfortable with market volatility and the potential for losses, while others may experience high anxiety. It's crucial to be honest with yourself about your ability to handle risk and the impact it may have on your well-being.

Risk Assessment Tools

There are online risk assessment tools and questionnaires available that can help you quantify your risk tolerance. These tools can provide valuable insights, but it's important to remember that they may be biased towards certain financial products or services.

Market and Economic Conditions

Risk tolerance can change over time due to market and economic conditions. It's important to periodically reassess your risk tolerance, especially during turbulent market conditions, to ensure your investment strategy remains aligned with your comfort level and financial goals.

Seeking Professional Advice

Consulting a financial advisor or professional can be beneficial in understanding your risk tolerance and creating a suitable investment plan. They can provide guidance and help you access a range of financial instruments and platforms. However, it's important to remember that even with professional advice, investing carries inherent risks.

Cash Flow Statement: Understanding Investment Changes

You may want to see also

Choose an investment account

There are several types of investment accounts, each with its own purpose. Here are some of the most common ones:

- Standard brokerage account: This is a taxable brokerage account or a non-retirement account that provides access to a broad range of investments, including stocks, mutual funds, bonds, and exchange-traded funds. You can open this account as an individual or jointly with someone else. There are no limits on contributions, and money can be withdrawn at any time, although there may be tax implications.

- Retirement accounts: These include traditional IRAs and Roth IRAs, as well as specialty accounts like SEP IRAs, SIMPLE IRAs, and Solo 401(k)s. They offer tax benefits but have specific rules, such as contribution limits and early withdrawal penalties.

- Investment accounts for kids: Examples include custodial brokerage accounts, UGMA, and UTMA accounts, which allow adults to gift money to minors. The money is transferred to the child when they reach the age of majority (18 or 21). Another option is a Roth or traditional IRA for children with earned income.

- Education accounts: 529 savings plans and Coverdell Education Savings Accounts (ESAs) are used for education expenses. Contributions are not tax-deductible, but qualified distributions are tax-free.

- ABLE accounts: These accounts are similar to 529s but are designed for individuals with disabilities. They offer tax advantages and protect access to public benefits like Medicaid.

When choosing an investment account, consider your savings goals, eligibility, and account ownership preferences. Additionally, seek guidance from financial professionals and conduct thorough research to make informed decisions.

Cash Allocation Strategies: Investing Your Money Wisely

You may want to see also

Pick your investments

Picking your investments is a crucial step in the investment process. Here are some detailed guidelines and factors to consider when selecting your investments:

Risk Tolerance and Investment Style

Before choosing specific investments, it's essential to assess your risk tolerance and investment style. Are you comfortable with taking on more risk for potentially higher returns, or do you prefer a more conservative approach? Active investing involves researching and constructing your portfolio, requiring time and knowledge. On the other hand, passive investing is a more hands-off approach, often utilising investment vehicles like mutual funds or robo-advisors.

Diversification

Diversifying your investments across different asset classes, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate, is a fundamental strategy to reduce risk. Diversification ensures that your portfolio is not overly exposed to any single investment or asset class, minimising potential losses.

Investment Goals and Time Horizon

Align your investments with your financial goals and time horizon. For long-term goals, such as retirement, a more aggressive approach with a higher proportion of stocks or stock funds may be suitable. In contrast, for short-term goals, consider less risky investments like savings accounts, certificates of deposit (CDs), or short-term bonds.

Research and Analysis

Conduct thorough research and analysis when selecting individual stocks or other investments. Evaluate the company's financial health, industry position, growth prospects, and dividend history. Consider seeking advice from financial professionals or using robo-advisors to assist in investment selection and portfolio management.

Investment Accounts

Choose the appropriate investment account for your needs. For retirement savings, consider options like 401(k) plans or Individual Retirement Accounts (IRAs). For non-retirement goals, taxable brokerage accounts offer flexibility. Compare fees, features, and investment options when selecting an account provider.

Monitor and Rebalance

Regularly monitor the performance of your investments and make adjustments as needed. Over time, the weightings of different assets in your portfolio may drift from your desired allocation. Rebalancing involves buying or selling certain investments to return your portfolio to its intended allocation, maintaining your desired level of risk and return potential.

Remember, investing carries inherent risks, and there is no one-size-fits-all approach. Always assess your personal circumstances, conduct thorough research, and, if needed, seek advice from qualified professionals before making any investment decisions.

Preventing Cash Crunch in Illiquid Investments: Strategies for Success

You may want to see also

Frequently asked questions

There are many places to invest your money, including the stock market, real estate, mutual funds, exchange-traded funds (ETFs), bonds, high-yield savings accounts, peer-to-peer lending, small businesses, and precious metals.

The best place for you to invest your money will depend on your financial goals, risk tolerance, and investment timeline. For example, if you are investing for retirement, you will likely want to choose a different investment vehicle than if you are investing for a short-term goal.

To get started with investing, you will need to open a brokerage account and fund it with money that you are comfortable investing. You can then use this money to purchase stocks, bonds, mutual funds, ETFs, or other investment vehicles. You can also use a robo-advisor, which is a low-cost, automated service that can help you manage your investments.