Active managers make investment decisions by tracking the performance of an investment portfolio and using their own judgment, experience, and analytical research to make buy, hold, and sell decisions about the assets in it. Their goal is to outperform a designated benchmark, such as the S&P 500, while also accomplishing additional goals like managing risk, limiting tax consequences, or adhering to environmental, social, and governance (ESG) standards. Active managers may use investment analysis, research, forecasts, and quantitative tools to inform their decisions, and their approach can range from strictly algorithmic to entirely discretionary.

| Characteristics | Values |

|---|---|

| Goal | Outperform the benchmark index |

| Investment decisions | Based on market trends, fundamental analysis, technical analysis, and quantitative analysis |

| Strategies | Extensive research, analysis, and using their judgment to select investments |

| Investment opportunities | Undervalued stocks, companies with strong fundamentals, niche markets, and smaller companies |

| Risk management | Adjusting investment strategies, reducing exposure to high-risk assets, and seeking safer investments |

| Diversification | Investing in a wide range of sectors, industries, geographies, and market capitalizations |

| Fees | Higher fees than passive management due to research, analysis, and trading costs |

| Performance | Difficulty in consistently outperforming the benchmark index |

| Human error | Decisions based on emotions, biases, or incorrect information |

What You'll Learn

- Active managers use extensive research, analysis, and their own judgement to select investments

- Active management aims to beat the market and achieve alpha through specific investments

- Active managers can make active asset allocation decisions using a mix of equities, bonds, and other asset classes

- Active managers can outperform benchmarks over specific time periods, especially in specialised sectors or regions

- Active managers can uncover hidden opportunities in volatile markets

Active managers use extensive research, analysis, and their own judgement to select investments

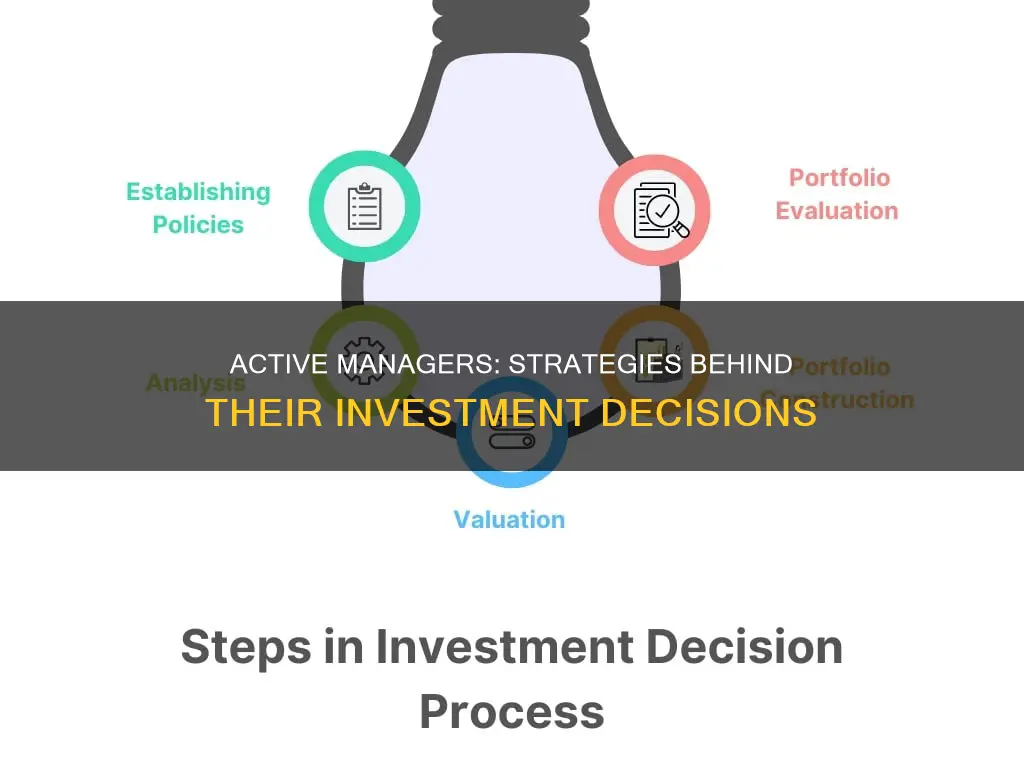

Active managers rely on a variety of strategies to make investment decisions, including fundamental analysis, technical analysis, and quantitative analysis. Fundamental analysis involves evaluating a company's financial health, competitive position, and growth potential by examining financial statements and competitive advantages. Technical analysis focuses on identifying patterns and trends in stock prices and volume to predict future price movements, while quantitative analysis involves using statistical models and machine learning algorithms to identify patterns and relationships in market data.

The ability to adjust to changing market conditions is a key advantage of active management. Active managers can quickly respond to shifts in economic indicators, political events, or industry-specific news by adjusting their investment strategies. For example, they can reduce exposure to interest-rate-sensitive stocks when interest rates rise. Active management also provides opportunities for diversification by investing in various sectors, industries, and geographies, as well as companies with different market capitalisations.

However, active management comes with higher fees to cover the costs of research, analysis, and trading. It can be challenging for active managers to consistently outperform the benchmark index, and they may face difficulties in identifying undervalued stocks and avoiding overvalued ones. Additionally, active management carries the risk of human error, as decisions may be influenced by emotions, biases, or incorrect information.

Understanding the Domestic Saving-Investment Imbalance

You may want to see also

Active management aims to beat the market and achieve alpha through specific investments

Active management involves a hands-on approach where investment managers make decisions with the goal of beating the market and achieving alpha through specific investments. Active managers use a variety of strategies to achieve higher returns, including extensive research, analysis, and using their judgment to select investments they believe will outperform the market.

Active management aims to beat the market and achieve alpha by investing in specific securities that are expected to outperform the benchmark index. Alpha refers to the excess return above the benchmark index's return. Active managers strive to achieve better returns through the specific investments they select. They actively adjust their portfolios by investing more or less in particular stocks, bonds, or sectors.

Active managers conduct in-depth research on individual companies or sectors, analysing financial statements, market trends, and economic indicators to make informed decisions. They also use various risk-assessment tools and metrics to gauge overall risks, such as equity market risk, interest rate risk, credit risk, and liquidity risk. This enables them to reduce exposure to high-risk assets and seek safer investments to protect investors' capital.

Additionally, active managers can uncover hidden opportunities, especially during volatile market conditions. They have the flexibility to adapt to changing market conditions, unlike passive managers who are mandated to strictly follow a benchmark. Active managers can exploit market inefficiencies, such as in emerging markets or niche sectors, where their expertise and knowledge can be leveraged to find the best investment ideas.

Overall, active management offers the potential for higher returns, the ability to adjust to market conditions, and the opportunity for diversification. However, it also comes with drawbacks, including higher fees, the difficulty of consistently outperforming the market, and the risk of human error.

Kroger Savings Club: A Smart Investment Strategy

You may want to see also

Active managers can make active asset allocation decisions using a mix of equities, bonds, and other asset classes

Active managers use a hands-on approach to investment decision-making, aiming to outperform the market or a specific benchmark. They employ various strategies, including extensive research, analysis, and using their judgment to select investments they believe will beat the market.

One key benefit of active management is the ability to make tactical asset allocation decisions. This involves dynamically adjusting portfolio allocations to capture short-term opportunities and protect investors' capital against risks based on market conditions. Active managers can increase or decrease their investments in a particular stock, bond, or sector as they see fit.

For example, if the Federal Reserve increases interest rates, active managers can reduce their exposure to interest-rate-sensitive stocks, such as utilities, and increase their holdings in sectors that benefit from higher rates, such as financials. This flexibility allows active managers to respond quickly to changing market conditions.

Additionally, active managers can identify investment opportunities in less efficient markets, such as emerging markets, small-cap stocks, or fixed-income securities. They can exploit market inefficiencies by using their knowledge, flexibility, and expertise to find the best ideas in these markets.

The success of active management depends on the manager's ability to identify investment opportunities and mitigate risks. Active managers use various risk-assessment tools and metrics to gauge overall risks, such as equity market risk, interest rate risk, credit risk, and liquidity risk. By proactively identifying and assessing potential risks, they can reduce exposure to high-risk assets and seek safer investments to protect their investors' capital.

While active management offers these benefits, it also comes with drawbacks, such as higher fees and the difficulty of consistently outperforming the market. It is important for investors to carefully consider the advantages and disadvantages of active management before making investment decisions.

Portfolio Variance: Impact of 20% Investment Strategy

You may want to see also

Active managers can outperform benchmarks over specific time periods, especially in specialised sectors or regions

Active managers can and do outperform benchmarks over specific time periods, especially in specialised sectors or regions. This is because active managers have the flexibility to adapt to changing market conditions and invest in a wide range of sectors, industries, and geographies. They can identify investment opportunities across various sectors and invest in companies with different market capitalisations to enhance portfolio diversification.

For example, active managers can invest in emerging markets where information can be harder to find, companies are less well-researched, and expertise is needed to find the best ideas. A 2017 study of 126 emerging market funds found that stock pickers delivered returns of 31.8% after fees over a ten-year period, compared to 7.7% for a passive alternative.

Similarly, active managers can focus on smaller companies that may be attractively valued and fast-growing but are often omitted from indices that are biased towards large-caps. A 2010 study found that active managers' largest holdings consistently outperformed the market and their lower-conviction positions by 1.2-2.6% per quarter.

Active managers can also make active asset allocation decisions using a mix of equities, bonds, and other asset classes. They can reduce exposure to high-risk assets and seek safer investments to protect investors' capital. This is particularly important in volatile markets, where active managers can have the edge in finding opportunities likely to outperform the market.

Overall, while active managers may struggle to consistently outperform benchmarks, they can certainly do so over specific time periods, especially in specialised sectors or regions.

Savings, Investment, and Productivity: The Interplay for Economic Growth

You may want to see also

Active managers can uncover hidden opportunities in volatile markets

Active managers use a hands-on approach to investment decision-making, aiming to beat the market or a specific benchmark. They conduct extensive research and analysis, and use their judgment and experience to select investments they believe will outperform. They can also make active asset allocation decisions, using a mix of equities, bonds, and other asset classes.

In volatile markets, active managers can adjust their portfolios in real time to reduce risk or take advantage of opportunities. They use various risk-assessment tools and metrics to gauge overall risks, such as equity market risk, interest rate risk, credit risk, and liquidity risk. By doing this, they can reduce exposure to high-risk assets and seek safer investments to protect investors' capital.

Active management is particularly advantageous in niche markets, such as emerging markets and small-company stocks, where assets are less liquid and less researched. Information can be harder to find in these markets, and companies may be less well-known, providing more opportunities for active managers to uncover hidden gems.

Additionally, active managers can provide better resource allocation. Passive investing can encourage inefficient allocation by deploying capital towards the biggest firms rather than those generating the best returns. Active managers, on the other hand, have a fiduciary duty to act in their clients' best interests, typically by investing in a small number of companies they believe are undervalued.

Building a Solid Investment Portfolio: RIA Strategies

You may want to see also

Frequently asked questions

Active management is a strategy used by fund managers to make investment decisions based on market trends, fundamental analysis, technical analysis, and quantitative analysis with the goal of outperforming the benchmark index.

The benefits of active management include the potential for higher returns, the ability to adjust to market conditions, and the opportunity for diversification.

Active managers rely on analytical research, personal judgment, and forecasts to make decisions on what securities to buy, hold, or sell. They may also use investment analysis, research, and forecasts, which can include quantitative tools, as well as their own judgment and experience.

The drawbacks of active management include higher fees, difficulty in consistently outperforming the market, and the risk of human error.

Active management involves fund managers making investment decisions with the aim of outperforming the benchmark index, while passive management aims to replicate the performance of the benchmark index by investing in the same stocks and in the same proportion. Passive management also tends to have lower fees, lower turnover, and lower taxes.