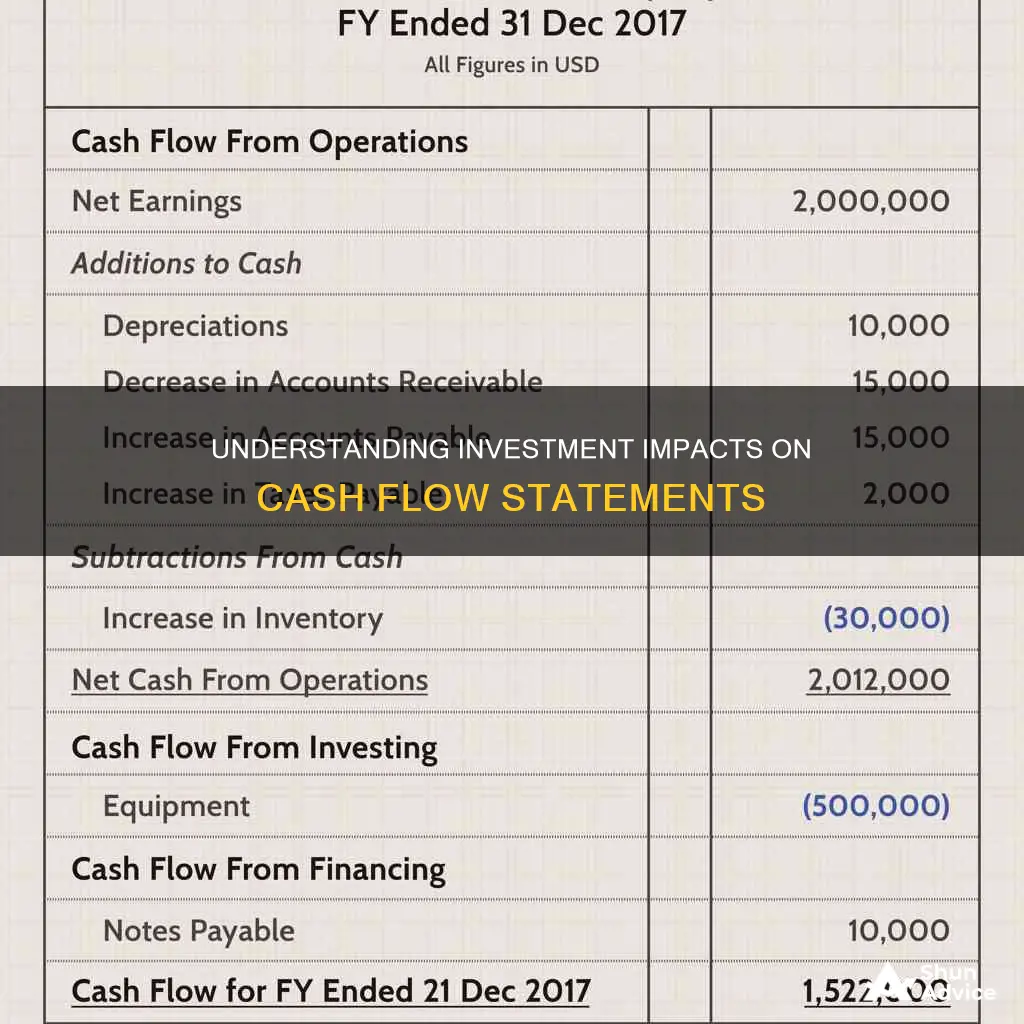

A cash flow statement is one of the three main financial statements that a company generates in an accounting period. It provides a detailed picture of what happened to a business's cash flow during a specified period, known as the accounting period. The statement is typically broken into three sections: operating activities, investing activities, and financing activities.

The investing activities section of a cash flow statement displays how much money has been used in or generated from making investments during a specific time period. This includes purchases of long-term assets, acquisitions of other businesses, and investments in marketable securities.

The cash flow statement is important as it helps stakeholders, including investors and financial professionals, assess a company's financial health and future prospects. It also helps business owners and managers understand business performance and make informed decisions about budgeting, hiring, and strategic initiatives.

| Characteristics | Values |

|---|---|

| Definition | The amount of cash generated or spent on various investment-related business activities during a specific time period. |

| Purpose | To provide a detailed picture of what happened to a business's cash during a specified period, known as the accounting period. |

| Sections | Operating activities, investing activities, and financing activities. |

| Importance | It is one of the three main financial statements and provides insights into a company's financial health and operational efficiency. |

| Calculation methods | Direct method and indirect method. |

| Positive cash flow | Indicates that a company has more money flowing into the business than going out. |

| Negative cash flow | May be caused by a company's decision to expand or invest in future growth, and does not necessarily indicate poor financial health. |

| Examples of activities | Purchase of long-term assets, acquisitions of other businesses, sale of assets, and investments in securities. |

What You'll Learn

The impact of investments on a company's cash position

The cash flow statement is one of the three main financial statements used to assess a company's financial health and performance, alongside the balance sheet and income statement. It provides an overview of the company's cash generation and spending over a specific period, typically broken down into three sections: operating activities, investing activities, and financing activities.

Investing activities can include a range of items, such as the purchase of physical assets like property, plants, and equipment (PP&E), as well as investments in securities or other businesses. These activities are important for a company's long-term growth and capital, and can indicate a company's strategy towards future growth and development. For example, a company may invest in research and development or acquire another business to expand its operations. These investments may result in negative cash flow in the short term but can lead to significant growth and gains in the long term if managed well.

On the other hand, positive cash flow from investing activities may indicate the sale of investments or assets, which can provide a company with additional cash to fund its operations, pay off debts, or reward shareholders. This could be a sign of effective asset management and financial flexibility.

Analysing the cash flow statement, particularly the investing activities section, provides valuable insights for investors, analysts, and financial professionals. It allows them to assess a company's financial health, investment strategies, and future prospects. By comparing the cash flow statement with the balance sheet and income statement, they can gain a comprehensive understanding of the company's financial position and make informed decisions about their investments.

In summary, the impact of investments on a company's cash position is reflected in the cash flow from investing activities section of the cash flow statement. Negative cash flow may signal expansion and future growth, while positive cash flow can indicate the sale of investments to free up cash. Analysing these trends is crucial for stakeholders to assess the company's financial health and future prospects, making it an essential tool in financial decision-making.

Cash Flow and Investing: What's the Real Relationship?

You may want to see also

How investments affect a company's financial health

Investments can have a significant impact on a company's financial health, and this is reflected in its cash flow statement. This statement provides an overview of a company's cash flow from three types of activities: operating, investing, and financing.

The investing activities section of a cash flow statement shows how a company's cash flow is impacted by the purchase or sale of long-term assets, investments in other companies, and acquisitions. These activities can include buying or selling physical assets such as real estate or vehicles, as well as non-physical assets like patents.

A negative cash flow from investing activities does not necessarily indicate poor financial performance. It could mean that the company is investing in long-term growth and development initiatives. For example, purchasing new equipment or investing in research and development may lead to short-term losses but could result in significant gains in the future if managed well.

On the other hand, a positive cash flow from investing activities often means that the company is selling off investments. This could be to use the money in other areas of the business or to increase its cash reserves.

By analyzing the cash flow statement, investors and analysts can gain insights into the company's investment strategies, financial standing, and future prospects. This information is crucial for making informed investment decisions and assessing the company's overall financial health.

Overall, investments can have a significant impact on a company's financial health, and this is reflected in the cash flow statement, which provides a detailed breakdown of cash inflows and outflows from investing activities.

Understanding E-Trade Cash Calls: What Investors Need to Know

You may want to see also

How investments influence a company's growth strategy

Investments can have a significant influence on a company's growth strategy, and this is reflected in the cash flow statement. The cash flow statement provides an overview of the company's financial health and operational efficiency, and investments are a key component of this.

Firstly, investments can impact the cash flow statement through capital expenditures (CapEx). CapEx refers to investments in long-term assets such as property, plant, and equipment (PPE). These investments are essential for the company's growth and expansion, as they allow for increased production and operational efficiency. However, they also result in a reduction in cash flow, as significant capital is invested in these long-term assets.

Secondly, investments can also influence the cash flow statement through the purchase or sale of securities or other financial assets. This includes investing in stocks, bonds, or other financial instruments. These investments can provide companies with additional sources of revenue and can be used to generate income or reinvest in the business. For example, companies may choose to invest in short-term marketable securities to boost profits.

Additionally, investments in research and development can also impact the cash flow statement. While these investments may lead to short-term losses, they can have significant long-term benefits for the company's growth and innovation. This is particularly important for companies in rapidly expanding industries or those developing new technologies.

Moreover, investments in mergers and acquisitions (M&A) are also reflected in the cash flow statement. M&A activities can be a key part of a company's growth strategy, allowing them to expand their market share, gain access to new resources, or diversify their product offerings. These investments are typically considered cash-out items in the short term.

Overall, the cash flow statement provides valuable insights into how a company allocates its cash for long-term growth. Negative cash flow from investing activities does not necessarily indicate poor financial health. Instead, it may signal that the company is investing in its future operations and potential for expansion.

Journaling a Large Cash Investment: A Step-by-Step Guide

You may want to see also

The relationship between investments and a company's balance sheet

The cash flow statement is one of the three main financial statements that a business uses, alongside the balance sheet and income statement. The cash flow statement provides an overview of the cash generated and spent during a specific period, acting as a bridge between the income statement and the balance sheet.

The balance sheet provides an overview of a company's assets, liabilities, and owner's equity as of a specific date. The income statement, on the other hand, provides an overview of a company's revenues and expenses during a period.

The cash flow statement is divided into three sections: operating activities, investing activities, and financing activities.

The investing activities section of the cash flow statement is particularly relevant to a company's balance sheet. This section includes the acquisition and disposal of non-current assets and other investments not included in cash equivalents.

Investing activities typically involve the purchase or sale of physical assets, investments in securities, or the sale of securities or assets. These activities can include:

- Purchases of fixed assets, such as property, plant, and equipment (PP&E)

- Purchases of investments, such as stocks or bonds

- Sale of fixed assets

- Sale of investment securities

- Acquisitions of other businesses

These investing activities have a direct impact on the company's balance sheet. The balance sheet reflects the changes in the company's assets, liabilities, and equity as a result of these investing activities. For example, if a company purchases a new building or invests in marketable securities, the value of its assets on the balance sheet will increase.

The balance sheet provides a snapshot of the company's financial position at a given point in time, while the cash flow statement shows the changes in cash flows over a specific period. By comparing the two, stakeholders can gain insights into the company's financial health and strategic decisions.

For instance, if a company has a negative cash flow from investing activities, it could indicate that the company is investing in long-term assets or growth initiatives. This information, when viewed in the context of the balance sheet, can help investors and analysts understand the company's strategy and potential for future growth.

In summary, the relationship between investments and a company's balance sheet is crucial for understanding the financial health and strategic direction of a company. The investing activities section of the cash flow statement directly impacts the assets, liabilities, and equity presented on the balance sheet, providing stakeholders with valuable information for decision-making and financial analysis.

Cash Investment: Revenue or Asset?

You may want to see also

How investments impact a company's income statement

An income statement is a financial report that shows a company's income and expenditures over a specific period, usually a quarter or a year. It is one of the three key financial statements used to evaluate a company's financial performance, alongside the balance sheet and the cash flow statement.

The income statement provides valuable insights into a company's operations, efficiency, management, and performance relative to its competitors. It is an essential tool for investors, creditors, and executives to understand a company's financial health and make informed decisions.

The income statement includes revenue, expenses, gains, and losses. Revenue is the company's income from sales or services, while expenses cover costs associated with creating and selling products, such as labour, parts, materials, depreciation, and administrative costs. Gains and losses refer to the net money made or lost from other activities, such as the sale of long-term assets.

The impact of investments on a company's income statement can be seen in the gains and losses section, particularly in the line item called "investment income or losses." This is where a company reports any profits or losses from investments made with surplus cash, separate from its usual line of business. This can include interest earned or lost on bonds, share buybacks, corporate spinoffs, acquisitions, and real estate transactions.

For example, if a company invests in real estate and generates rental income or capital gains from selling the property, this would be reflected in the income statement as investment income. On the other hand, if a company invests in stocks and sells them at a higher price, the profit would be considered a gain and included in the income statement. Similarly, if a company invests in mutual funds and receives dividends, this would be added to its investment income.

In summary, the income statement provides a comprehensive overview of a company's financial performance, including the impact of its investments. It is a valuable tool for stakeholders to assess the company's profitability, efficiency, and performance relative to its industry peers.

Dividends: Cash Flow from Investing?

You may want to see also

Frequently asked questions

A cash flow statement is one of the three main financial statements that summarises the amount of cash and cash equivalents entering and leaving a company over a specific period. It provides insights into a company's financial health and operational efficiency, and helps investors make better decisions.

Investments are reflected in the "investing activities" section of the cash flow statement, which details cash flow from the purchase or sale of assets, as well as investments in securities or other companies. These activities can impact the company's cash position and indicate its growth strategy and financial health.

Examples of investment activities include the purchase of physical assets such as property, plant, and equipment (PPE), acquisitions of other businesses, and investments in stocks, bonds, or other securities.