When it comes to corporate financial statements, understanding the nuances of investment interest expense is crucial. This paragraph aims to shed light on the separate treatment of investment interest expense, a key component of a company's financial health. It highlights the importance of recognizing and reporting this expense separately, as it directly impacts a company's profitability and overall financial performance. By exploring this topic, we can gain valuable insights into how companies manage their financial obligations and make informed decisions regarding investments and expenses.

What You'll Learn

- Tax Implications: How investment interest affects corporate tax liability and deductions

- GAAP vs. Tax Rules: Differences in accounting and tax treatment of investment interest

- Compliance and Reporting: Ensuring accurate reporting of investment interest expenses

- Strategic Planning: Using investment interest data for financial planning and decision-making

- Industry Comparisons: Analyzing investment interest ratios across industries for benchmarking

Tax Implications: How investment interest affects corporate tax liability and deductions

The tax implications of investment interest can significantly impact a corporation's financial health and tax strategy. When a company incurs interest expenses related to investments, it may be eligible for specific tax treatments and deductions, which can either reduce its taxable income or increase its tax deductions. Understanding these implications is crucial for effective financial planning and compliance.

One key aspect is the distinction between investment interest and other types of interest expenses. Investment interest is typically associated with borrowing used to finance investments or business activities. For tax purposes, corporations can claim investment interest as a deduction against their taxable income. This deduction is designed to encourage businesses to invest while providing a financial incentive. The amount of investment interest that can be deducted is generally limited to the company's investment income, ensuring that the tax benefit is proportional to the investment's profitability.

However, there are certain rules and limitations to consider. The Internal Revenue Code (IRC) imposes a cap on the amount of investment interest that can be deducted in a year. This cap is calculated based on the company's investment income and is adjusted annually for inflation. If a corporation's investment interest exceeds this cap, it may be subject to alternative tax treatments or carry forward the excess interest to future years. Additionally, the investment interest deduction is not allowed for certain types of investments, such as those in tax-free municipal bonds or certain private placements.

Furthermore, the tax treatment of investment interest can vary depending on the corporation's tax status. For example, in the United States, a pass-through entity, such as an S-corporation or a partnership, may not be able to deduct investment interest directly. Instead, the interest expense is allocated to the partners or shareholders, who then claim it as a deduction on their personal tax returns. This can result in a different tax treatment compared to traditional C-corporations.

In summary, investment interest expenses can have significant tax implications for corporations. By understanding the rules and limitations surrounding investment interest deductions, companies can optimize their tax strategies and ensure compliance with tax regulations. Proper planning and consultation with tax professionals are essential to navigate the complexities of investment interest tax treatments and maximize the potential benefits for the business.

Foreign Investment and Interest Rates: A Global Economic Relationship

You may want to see also

GAAP vs. Tax Rules: Differences in accounting and tax treatment of investment interest

The treatment of investment interest expenses can vary significantly between Generally Accepted Accounting Principles (GAAP) and tax rules, which can be a complex area for businesses to navigate. This difference often arises due to the distinct objectives of financial reporting and tax compliance.

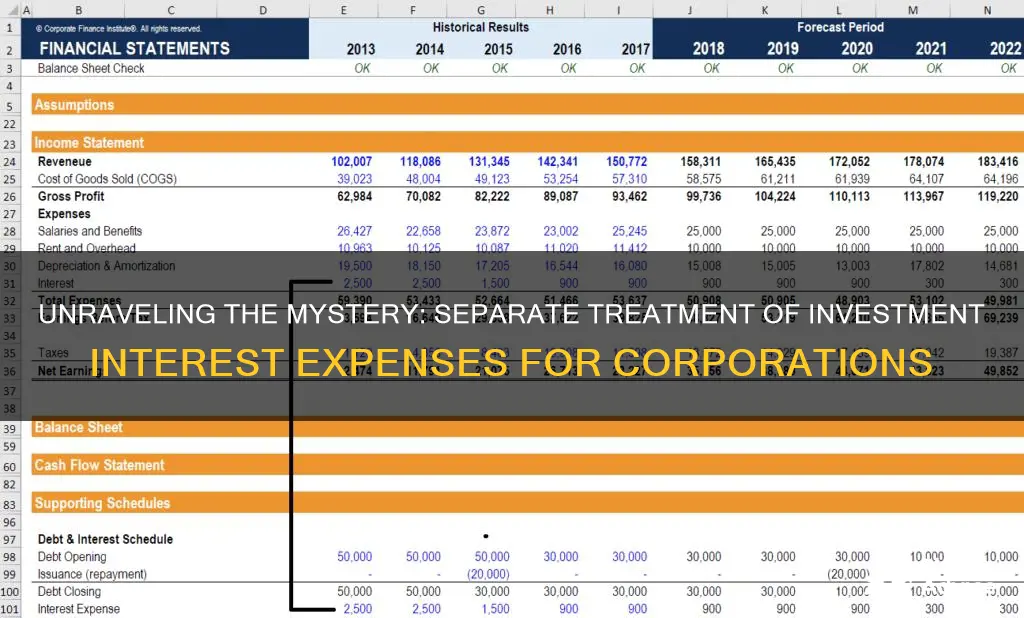

Under GAAP, investment interest expense is typically reported as a separate line item on the income statement. This is because GAAP focuses on providing a comprehensive view of a company's financial performance and position. By separately stating investment interest, companies can offer stakeholders a clearer understanding of the costs associated with their investment activities. This presentation allows for better analysis of the financial impact of investments and can facilitate more informed decision-making.

In contrast, tax rules often take a different approach. When calculating taxable income, investment interest expenses are generally deductible, but they are not always separately stated. Tax regulations aim to provide a framework for determining a company's liability to income tax. While investment interest is deductible, it is often grouped with other business expenses, and the deduction is applied at the end of the tax year. This means that the tax treatment of investment interest can be less transparent and may not provide the same level of detail as GAAP reporting.

The key difference lies in the timing and purpose of these rules. GAAP emphasizes timely and detailed financial reporting to support decision-making, while tax rules focus on determining tax liability and compliance. As a result, companies must carefully consider how to present investment interest expenses to meet both accounting and tax requirements.

Understanding these differences is crucial for financial professionals and business owners. It highlights the importance of ensuring that financial statements and tax returns are prepared with the appropriate level of detail and accuracy. By recognizing the distinct treatment of investment interest expenses, companies can better manage their financial reporting and tax obligations, ensuring compliance with both GAAP and tax regulations.

Understanding S-Corp Investment Interest Expense: Impact on Shareholder Basis

You may want to see also

Compliance and Reporting: Ensuring accurate reporting of investment interest expenses

Accurate reporting of investment interest expenses is a critical aspect of corporate financial compliance and transparency. When a company engages in various financial activities, it's essential to separately state and report investment interest expenses to provide stakeholders with a clear understanding of the company's financial health and performance. This practice ensures that investors, creditors, and regulatory bodies receive the necessary information to make informed decisions.

For publicly traded companies, the requirements for reporting investment interest expenses are often more stringent. These companies must adhere to specific accounting standards and regulations, such as those set by the Financial Accounting Standards Board (FASB) or the International Financial Reporting Standards (IFRS). These standards mandate that investment interest expenses should be presented in the income statement, clearly distinguishing them from other operating expenses. This separation allows for a more accurate assessment of the company's financial performance related to its investment activities.

The process of ensuring compliance begins with proper documentation and categorization of expenses. Companies should maintain detailed records of all interest-bearing investments, including the associated interest income and expenses. This information is crucial for accurate financial reporting and can be used to calculate the net investment income, which is essential for tax purposes and financial analysis. By separately stating these expenses, companies can provide a comprehensive view of their financial activities, enabling stakeholders to evaluate the impact of investment decisions.

Furthermore, companies should establish robust internal controls to verify the accuracy of investment interest expense reporting. This includes regular reviews of financial statements, cross-referencing with investment records, and implementing procedures to detect and rectify any discrepancies. Internal audits can play a vital role in identifying potential errors or fraudulent activities related to investment interest expenses. By maintaining a high level of accuracy, companies can ensure compliance with reporting standards and build trust with their investors.

In summary, accurate reporting of investment interest expenses is essential for corporate compliance and transparency. It enables companies to provide stakeholders with a clear and detailed view of their financial activities, particularly those related to investments. By adhering to accounting standards and implementing robust internal controls, companies can ensure the separate statement of investment interest expenses, fostering better decision-making and maintaining the integrity of their financial reporting.

Understanding Investment Interest Expense: How It Affects Adjusted Gross Income

You may want to see also

Strategic Planning: Using investment interest data for financial planning and decision-making

When it comes to strategic planning, understanding and utilizing investment interest data is crucial for financial planning and decision-making, especially for corporations. Investment interest expense is a significant financial item that can greatly impact a company's overall financial health and strategic direction. Here's how this data can be leveraged:

Financial Analysis and Planning: Investment interest expense data provides valuable insights into a company's financial performance and stability. By analyzing this information, corporations can identify trends, assess the impact of interest payments on their cash flow, and make informed decisions about future investments. For instance, a company might compare its interest expenses to industry averages to gauge its competitive position and identify areas for improvement. This analysis can guide strategic planning by helping companies set realistic financial goals and allocate resources effectively.

Risk Management: Interest expenses are a critical component of financial risk management. High interest payments can strain a company's cash flow, especially during economic downturns or periods of increased borrowing. By separately stating investment interest expenses, corporations can better understand the potential risks associated with their investment activities. This enables them to implement strategies to mitigate these risks, such as diversifying investment portfolios, negotiating better loan terms, or exploring alternative financing options.

Strategic Investment Decisions: Investment interest data is essential for making strategic investment choices. Companies can evaluate the potential returns on investment against the associated interest costs. This analysis allows for a more nuanced understanding of the financial implications of various investment opportunities. For example, a corporation might decide to invest in a project with a higher potential return but a correspondingly higher interest expense, ensuring that the overall financial impact is carefully considered.

Performance Evaluation: Separately stating investment interest expenses facilitates the evaluation of the financial performance of different business units or projects. This is particularly useful for large corporations with diverse investment portfolios. By comparing the interest expenses to the returns generated by various investments, companies can identify underperforming assets and make adjustments to optimize their financial strategies. This data-driven approach ensures that resources are allocated efficiently, supporting the company's long-term goals.

In summary, investment interest expense data is a powerful tool for strategic planning and decision-making. It enables corporations to make informed choices, manage financial risks, and optimize their investment portfolios. By carefully analyzing this information, companies can ensure that their financial strategies are robust and aligned with their overall business objectives. This level of financial insight is invaluable for maintaining a competitive edge in today's complex business environment.

Maximizing Returns: Understanding Send-Home Investment Interest

You may want to see also

Industry Comparisons: Analyzing investment interest ratios across industries for benchmarking

When comparing companies across different industries, analyzing investment interest ratios can provide valuable insights for benchmarking and evaluating financial performance. This analysis allows investors and analysts to understand how efficiently companies manage their investments and the associated costs. By comparing these ratios, one can identify industry trends, assess the impact of interest expenses on profitability, and make informed decisions regarding investments.

Industry comparisons of investment interest ratios involve examining the relationship between a company's investment activities and its financial performance. This ratio analysis is particularly useful when assessing the efficiency of capital allocation and the impact of interest expenses on overall profitability. For instance, in the technology sector, companies often invest heavily in research and development, and the investment interest ratio can reveal how these investments translate into financial gains or losses. A high ratio might indicate significant interest expenses relative to investment returns, prompting further investigation into the company's financial management.

In contrast, industries like utilities or consumer staples may have different investment profiles. These sectors often focus on stable, long-term investments in infrastructure or brand development. Here, a lower investment interest ratio could suggest more stable and predictable cash flows, which is an attractive characteristic for investors seeking consistent returns. By comparing these ratios, investors can identify industries with more favorable interest expense management, especially during economic downturns when interest rates are typically higher.

To perform these industry comparisons, one should gather financial data from multiple companies within each industry. This data should include investment figures, interest expenses, and other relevant financial metrics. By calculating and analyzing the investment interest ratio for each company, a comparative picture of the industry's performance emerges. For instance, a study of the retail industry might reveal that, on average, companies in this sector have a lower investment interest ratio, indicating more efficient management of investment-related costs.

Furthermore, industry comparisons can highlight best practices and potential areas of improvement. For example, if a particular industry consistently demonstrates lower investment interest ratios, it may indicate more effective strategies for managing investments and interest expenses. This knowledge can guide investors in making informed decisions, especially when considering investments in companies from these high-performing industries. In summary, industry comparisons of investment interest ratios are a powerful tool for benchmarking and understanding the financial health and efficiency of companies across various sectors.

Investing Made Fun: Teaching Kids About Money and Growth

You may want to see also

Frequently asked questions

Investment interest expense is a crucial component of a company's financial reporting, as it represents the cost associated with borrowing funds for specific investments or projects. Separately stating this expense allows investors and analysts to understand the financial impact of these investments and assess the company's overall financial health.

Investment interest expense is specifically tied to the funds allocated for investments, such as acquiring or financing other businesses, real estate, or financial assets. It provides insights into the financial resources dedicated to these strategic initiatives. Regular interest expense, on the other hand, is associated with general borrowing and day-to-day operations.

Disclosure of investment interest expense separately is essential for transparency and accurate financial analysis. It enables stakeholders to evaluate the company's investment strategies, assess the financial burden, and understand the potential impact on profitability. This level of detail is particularly valuable for long-term investors and those interested in the company's capital allocation decisions.

In many jurisdictions, investment interest expense can be deducted from taxable income, but there are specific rules and limitations. Companies should consult tax regulations to understand the eligibility criteria and any restrictions on deductions. Properly accounting for and disclosing investment interest expense is crucial to ensure compliance with tax laws.

Investment interest expense can influence various financial ratios, such as debt-to-equity ratio and interest coverage ratio. A higher investment interest expense may impact the company's debt capacity and profitability. Investors should consider this expense when analyzing financial ratios and making investment decisions.