Investment trusts are a great way to boost your returns, thanks to low charges and transparency. They are listed companies with shares that trade on the stock market. Buying and selling investment trusts is no different from trading in any other shares on the London Stock Exchange. You can either pay a professional investment advisor to buy them for you or buy them on your own, which is cheaper. You can buy shares in an investment trust via a stockbroker or an online platform. You can also invest in investment trusts through your ISA with another provider or self-invested personal pension (SIPP).

What You'll Learn

- Buying shares: You can buy investment trust shares via a stockbroker, online platform, or directly from investment houses

- Costs: There are fees and charges associated with buying and selling investment trust shares

- Tax: You can hold your shares in an ISA wrapper, which has favourable tax treatment

- Voting: As a shareholder, you can hold the company to account and vote at Annual General Meetings (AGM)

- Selling: You can sell an investment trust at any time via your stockbroker or online platform

Buying shares: You can buy investment trust shares via a stockbroker, online platform, or directly from investment houses

Buying shares in investment trusts

There are several ways to buy investment trust shares, each with its own advantages and disadvantages. Here are the three main options:

Stockbrokers:

You can buy investment trust shares through a stockbroker, either online or in person. Stockbrokers are regulated professionals who can help you buy and sell shares. This option may be more expensive than other methods, but it can provide you with expert advice and guidance.

Online platforms:

Online investing platforms have become a popular choice for buying investment trust shares. These platforms often offer lower fees than traditional brokers and allow you to hold all your investments in one place. However, you may have to pay a small fee for holding trusts and dealing charges per trade.

Directly from investment houses:

Some investment houses allow you to invest in their trusts directly, either as a straightforward investment or as part of an Individual Savings Account (ISA). This option may be more cost-effective, but it might also limit your investment choices. Buying directly from investment houses may also involve additional charges, such as selling and administration fees.

When deciding how to buy investment trust shares, it's important to consider your personal circumstances, investment goals, and preferences. Each option has its own set of advantages and disadvantages, so be sure to research and understand the costs and benefits of each before making a decision.

Additional considerations:

- Tax implications: Consider the tax implications of each option. For example, investing through an ISA can provide tax benefits, while income from shares owned personally may be taxed at your marginal tax rate.

- Diversification: Think about how each option can help you diversify your portfolio. Online platforms and stockbrokers may offer a wider range of investment choices, allowing for greater diversification.

- Costs and fees: Compare the costs and fees associated with each option, including transaction costs, management charges, account fees, and platform fees. These can vary significantly between different brokers and platforms.

Retirement Planning: A Team Effort for Long-Term Success

You may want to see also

Costs: There are fees and charges associated with buying and selling investment trust shares

When buying investment trust shares, there are two types of charges to consider: transaction costs and management charges.

Transaction charges vary depending on the amount of money involved. On top of a charge for buying and selling the shares, there may be separate account and platform fees to pay. A 2017 study showed that an investor with £15,000 in investment trust shares could pay between £15 and £120 a year in fees to their stockbroker. At £100,000, the cheapest platform cost £30 a year and the most expensive £430.

In addition to transaction costs, shareholders in investment trusts pay an annual management charge of between 0.4% and 1.5% of their investment. Some trusts charge additional fees if performance is good, which can increase the overall cost.

If you use a stockbroker to buy and sell investment trust shares, you will incur stockbroker's commission. However, if you use a cheap broker, this cost should be relatively small. On top of this, you will also lose a small amount due to the difference between the bid and offer prices of the trust's shares. You will also have to pay stamp duty of 0.5% on purchases.

The advantage of using an online platform to buy and sell investment trust shares is that you can hold all your investments in one place. However, you may have to pay a small fee for holding trusts, and dealing charges can range from £5 to £12.50.

Stash Investing: Millions of Users

You may want to see also

Tax: You can hold your shares in an ISA wrapper, which has favourable tax treatment

When buying shares in investment trusts, you can hold these shares in an Individual Savings Account (ISA) wrapper, which offers favourable tax treatment. This means that your money is in an account that 'wraps' around your investments or savings to offer some protection from tax, as long as the money stays within the wrapper.

With an ISA, you are contributing money that you have already paid income tax on, and you are sheltering any growth and dividends from capital gains tax or further income tax. There are different types of ISAs, including cash ISAs, stocks and shares ISAs, and innovative finance ISAs. You can only pay into one of each type of ISA in each tax year, but as long as you remain under your allowance, you can open and hold a mix of these ISA types every tax year. The ISA allowance for the 2022/23 tax year is £20,000. The tax year runs from 6 April to 5 April the following year, at which point the allowance resets (and you cannot carry forward any unused allowance from the previous tax year).

You will not pay any income tax on money saved in an ISA, as long as you do not pay in more than your allowance each tax year. This applies not only to basic-rate taxpayers but also to higher-rate and additional-rate taxpayers. To open an ISA, you need to be 16 or older (18 for a stocks and shares ISA) and be a resident in the UK.

The Lifetime ISA is another option for those saving for their first home or retirement. Anyone can contribute to this type of ISA, but only the account holder can access the money. You can save up to £4,000 each tax year in a Lifetime ISA and will receive a 25% government bonus on contributions.

Another option for holding shares is a self-invested personal pension (SIPP). While a SIPP has better tax benefits, such as a 20% tax relief and a higher annual allowance, the funds are locked away until you turn 55. With an ISA, you have more flexibility to access your funds.

Songs: The New Investment Avenue

You may want to see also

Voting: As a shareholder, you can hold the company to account and vote at Annual General Meetings (AGM)

As a shareholder, you can hold the company to account and vote at Annual General Meetings (AGMs). This is one of the most important shareholder rights, as it allows you to have a say in the company's major decisions and hold the company accountable for its actions. Shareholders typically vote on matters such as the election of the board of directors, approving significant corporate actions (like mergers and acquisitions), and adopting changes to the company's bylaws.

Shareholders of common stock usually have voting rights, with one vote per share. This means that the more shares you own, the more voting power you have. However, it's important to note that not all shareholders are eligible to vote. Only "investors of record" are allowed to vote at the annual company meeting, and to be considered an "investor of record," you must purchase your shares before the record date of the meeting.

If you cannot attend the AGM in person, you can still participate in the voting process by voting by proxy. This means you can appoint someone else to vote on your behalf, usually by mail, phone, or online. Proxy votes must be cast before a set cutoff time, typically 24 hours before the shareholder meeting.

The voting process may vary depending on the company and the type of shareholder you are (registered owner or beneficial owner). As a shareholder, you will receive instructions on how to vote, and it's important to follow these instructions carefully to ensure that your vote is counted.

By exercising your voting rights, you can influence the company's direction and hold its management accountable. Therefore, it is essential to stay informed about the company's proposed decisions and analyse any proposals presented for a vote to make informed choices that align with your interests as a shareholder.

Will Rogers' Timeless Investing Wisdom

You may want to see also

Selling: You can sell an investment trust at any time via your stockbroker or online platform

Selling an investment trust is as simple as buying one. You can sell an investment trust at any time via your stockbroker or online platform.

Selling via a stockbroker

A stockbroker is a regulated broker or registered investment adviser. You can use a stockbroker to buy and sell shares.

Selling via an online platform

Most people use a do-it-yourself investment platform to buy investment trusts, as this is efficient and cheap. With the online platform market having grown rapidly in recent years, there is now a broad range of credible low-cost options for buying investment trusts. It is worth taking the time to make sure you pick the best option for you, as this could save you a lot of money in the long run.

When selling an investment trust via an online platform, you may have to pay dealing charges, which can range from £5 to £12.50.

Retirement Investing: Navigating Your Golden Years

You may want to see also

Frequently asked questions

You can buy shares in an investment trust via a stockbroker or an online platform. You can also invest through your ISA with another provider or self-invested personal pension (SIPP).

Investment trusts are a great way to boost your returns, thanks to low charges and transparency. Fees for investment trusts tend to be lower than funds, which means your returns are not as affected by charges.

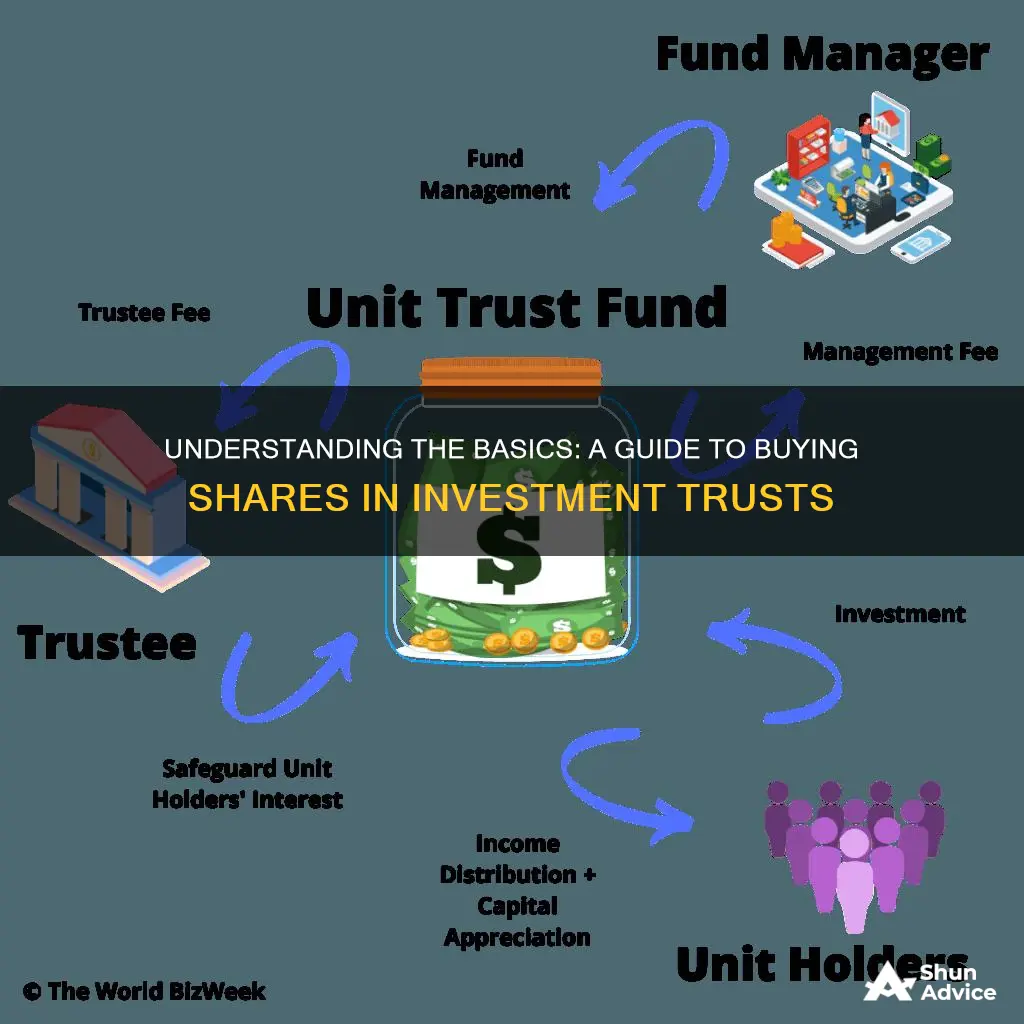

Investment trusts are run as public limited companies. They issue a fixed number of shares at launch and are known as closed-ended funds. In contrast, unit trusts are open-ended funds and continue to issue new units in response to demand.

Capital is at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Each investment trust has its own investment objective and the level and type of risks vary depending on what assets the trust invests in.

Selling an investment trust is as easy as buying one. You can do so at any time via your stockbroker or online platform.