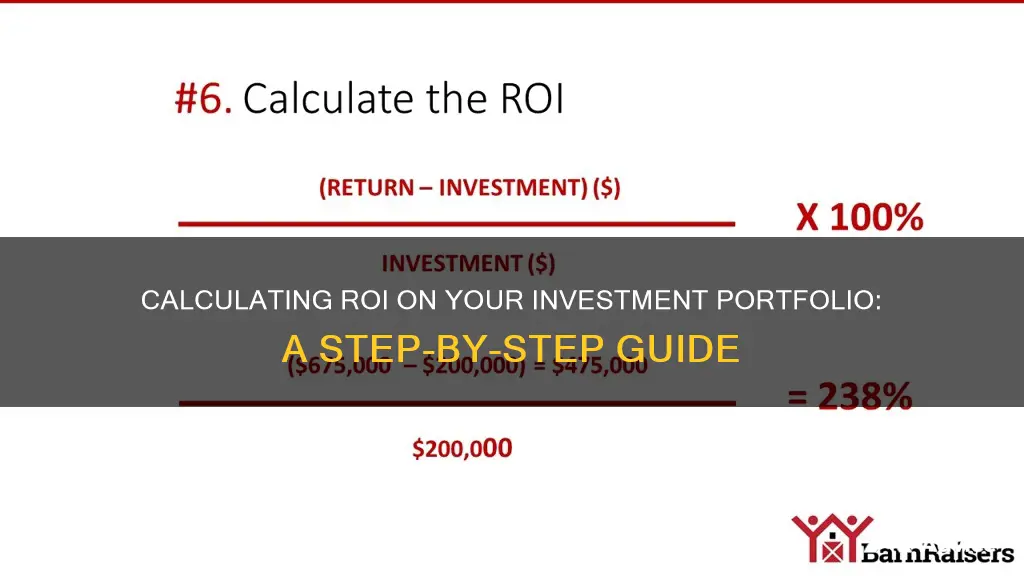

Return on Investment (ROI) is a profitability ratio that compares the net profits received from an investment to its original cost, expressed as a percentage. ROI is calculated by subtracting the initial cost of the investment from its final value, then dividing this new number by the cost of the investment, and finally multiplying it by 100. ROI is used to evaluate the forecasted profitability of different investments, including stocks, real estate, and business ventures. It is a simple and versatile metric, but it has limitations, including its inability to account for the time value of money and the risk associated with an investment.

| Characteristics | Values |

|---|---|

| Purpose | To evaluate the forecasted profitability of different investments |

| Formula | ROI = Net Income / Cost of Investment |

| ROI = Investment Gain / Investment Base | |

| ROI = (Gross Return – Cost of Investment) / Cost of Investment | |

| ROI = Net Return / Cost of Investment | |

| ROI = (Ending Value – Beginning Value) / Beginning Value | |

| Annualised ROI = [((Final value of investment − initial value of investment) / initial value of investment) × 100] | |

| Use | Can be used to measure the profitability of stock shares, to decide whether to purchase a business, or to evaluate the success of a real estate transaction |

| Benefits | Easy to calculate, universally understood, can be used to separate low- and high-performing investments |

| Limitations | Does not account for the length of time an investment is held, does not adjust for risk, susceptible to manipulation |

What You'll Learn

ROI for real estate investments

Return on investment (ROI) is a metric used by real estate investors to predict the profitability of a property investment. It is a useful tool for any investor, providing a concrete, factual look at how profitable a potential investment might be.

ROI is calculated by dividing the difference between the selling price and the investment price (aka the gains) by the investment price.

ROI = (Gain on investment – Cost of investment) / Cost of investment

For example, if an investor bought a vacant foreclosure house for $100,000 and knew that comparable homes in good repair could sell for $200,000, they would then spend $50,000 to renovate, planning to put it on the market for $200,000 when the repairs are completed. In this scenario, the ROI is 33.3%.

ROI = Net Profit ($200,000 − $150,000) ÷ Total Investment ($150,000) = .33 or 33.3%

It's important to note that this metric only provides an estimate and doesn't take into account variables that can't be controlled or predicted.

There are two primary methods for calculating ROI: the cost method and the out-of-pocket method.

The cost method calculates ROI by dividing the investment gain in a property by that property's initial costs.

For example, assume you bought a property for $100,000 in all cash. After repairs and improvements, which cost you an additional $50,000, the property is valued at $200,000.

This makes your gain in the property $50,000 (i.e., $100,000 gain in market value less $50,000 spent on costs).

To use the cost method, divide the gain by all the costs related to the purchase, repairs, and rehabilitation of the property.

Your ROI, in this case, is:

$50,000 ÷ $150,000 = 0.33, or 33%.

The out-of-pocket method is preferred by many real estate investors because it results in a higher ROI. It takes the current equity of the home divided by the current market value.

Using the numbers from the previous example, assume you bought the same property for the same price, but this time, you financed the purchase with a loan and a down payment of $20,000.

Your out-of-pocket expense is $20,000 plus the $50,000 for repairs and rehab, for a total of $70,000. With the value of the property at $200,000, your equity position, or potential profit, is $130,000.

Your ROI in this case is:

$130,000 ÷ $200,000 = 0.65, or 65%.

This is almost double the ROI of the first example. The difference is attributable to the loan: leverage as a means of increasing ROI.

It's important to remember that what one investor considers a "good" ROI may be unacceptable to another. A good ROI on real estate varies by risk tolerance—the more risk you're willing to take, the higher ROI you might expect. Conversely, risk-averse investors may happily settle for lower ROIs in exchange for more certainty.

In general, however, to make real estate investing worthwhile, many investors aim for returns that match or exceed the average returns on a major stock market index such as the S&P 500, which has historically averaged about 10%.

Kids' Guide to Saving, Investing, and Financial Worksheets

You may want to see also

ROI for stock shares

Return on Investment (ROI) is a profitability metric used to evaluate the efficiency of an investment or compare the efficiency of different investments. ROI is a versatile metric that can be applied to stocks, real estate, employees, and more.

ROI is calculated by dividing the net income from an investment by the original cost of the investment, then multiplying the result by 100. The formula for ROI is as follows:

ROI = (Net Income - Cost of Investment) / Cost of Investment x 100

When calculating the ROI of stock shares, it is important to consider total returns and total costs. Total returns for a stock result from capital gains and dividends, while total costs include the initial purchase price and any trading commissions paid.

For example, let's assume an investor bought 1,000 shares of Worldwide Wickets Co. at $10 per share. One year later, the investor sold the shares for $12.50 each and earned dividends of $500 over the one-year holding period. The investor also spent a total of $125 on trading commissions.

The ROI for this investor can be calculated as follows:

ROI = [($12.50 - $10) x 1,000 + $500 - $125] / ($10 x 1,000) x 100 = 28.75%

It is important to note that ROI does not take into account the holding period of an investment, which can be a limitation when comparing investment alternatives. To address this limitation, investors can calculate the annualized ROI, which takes into account the length of time the investment is held.

Transferring Funds: Ally Invest to Ally Savings

You may want to see also

Annualised ROI

The formula for annualised ROI is:

For example, if an investment is worth $2,000 at the beginning of the year and $5,000 at the end of the year, the annualised ROI would be:

So, the annualised ROI for this investment would be 150% over a period of one year.

It is important to note that the annualised ROI does not account for any potential price fluctuations, negative changes, or volatility of an investment. It also does not take into account the holding period of an investment, which can be an issue when comparing investment alternatives.

Building a Tax-Efficient Investment Portfolio: Strategies for Success

You may want to see also

ROI for business projects

Return on Investment (ROI) is a financial metric used to evaluate the profitability of an investment. It can be applied to anything that has a cost and the potential to derive gains, including stocks, real estate, employees, and business projects. ROI is calculated by subtracting the initial cost of the investment from its final value, then dividing this new number by the cost of the investment, and finally multiplying it by 100. The formula for ROI is typically written as:

ROI = (Net Profit / Cost of Investment) x 100

In the context of business projects, ROI can be a valuable tool for decision-making, prioritization, and resource allocation. It can help identify which projects are worth pursuing and which should be avoided. ROI can also be used to build a business case for a proposal, secure funding, and gain support from stakeholders.

When calculating ROI for a business project, it is important to consider all relevant costs and benefits. This includes both tangible and intangible factors, such as labour, materials, overhead, taxes, and any potential cost savings or increased efficiency. It is also crucial to distinguish between anticipated ROI, calculated before a project begins using estimated costs and revenues, and actual ROI, calculated after a project concludes using final costs and revenues.

Additionally, it is worth noting that ROI has some limitations. It does not account for the time frame of an investment, and it does not adjust for risk. As such, it should be used alongside other metrics and considerations when making investment decisions.

Overall, understanding how to calculate and interpret ROI for business projects can provide valuable insights into the potential profitability and success of those projects. It is a widely used tool that can help guide strategic decisions and improve resource allocation.

From Saving to Investing: Strategies for Your Financial Journey

You may want to see also

ROI for digital marketing

Return on investment (ROI) is a crucial metric for any business to understand, and digital marketing is no exception. With the majority of consumers now accessing the internet on their smartphones, tablets, and laptops, digital marketing has become an integral part of every business's marketing plan.

How to Calculate ROI for Digital Marketing

The basic formula for calculating ROI is:

ROI = (Net Profit / Total Cost) * 100

In the context of digital marketing, the formula becomes:

ROI = (Net Profit / Total Digital Marketing Costs) * 100

This formula can be used to calculate the ROI of specific digital marketing campaigns or overall digital marketing efforts.

Important Considerations for Digital Marketing ROI

When calculating ROI for digital marketing, it is essential to keep the following in mind:

- Understand your objectives: Before calculating ROI, it is crucial to define clear objectives and key performance indicators (KPIs) that align with your unique business goals. Not all aspects of a digital marketing campaign will have a direct monetary value, so focusing solely on revenue may not provide an accurate picture of its effectiveness.

- Identify the right KPIs: Common KPIs for digital marketing include unique monthly visitors, cost per lead, cost per acquisition, return on ad spend, average order value, customer lifetime value, lead-to-close ratio, branded search lift, average position, and non-brand click-through rate.

- Ensure accurate data collection: Inaccurate or inconsistent data collection methods can skew your KPI and ROI calculations. It is important to have a clean and centralized data collection system in place that aligns with your marketing strategy, goals, and objectives.

- Understand the bigger picture: While ROI is a crucial metric, focusing solely on it may not provide the full context of your digital marketing efforts. Understanding how your KPIs fit into the bigger picture can help you see patterns and correlations that impact your overall digital marketing success.

- Draw insights from KPIs: Analyzing your KPIs can provide valuable insights into the effectiveness of your digital marketing campaigns in attracting customers and generating conversions. For example, increased website traffic, improved session duration, and higher engagement on social media can all contribute to improved ROI.

Industry Benchmarks and Performance Evaluation

When evaluating the ROI of your digital marketing efforts, it is useful to consider industry benchmarks and your company's historical performance. Factors such as audience, company size, business goals, and industry standards can influence what is considered a good ROI. Additionally, analyzing your key performance indicators and their impact on ROI can provide valuable insights into the success of your marketing strategies.

Improving Digital Marketing ROI

- Use data-driven decisions: Leverage the wealth of data available to inform and optimize your digital marketing strategies. Tools like Google Analytics can provide valuable insights to make more informed decisions.

- Set clear ROI goals: Establish well-defined and measurable ROI goals that are specific, achievable, relevant, and time-bound. This will help guide your efforts and provide a benchmark for evaluating success.

- Avoid vanity metrics: Focus on metrics that directly correlate with ROI and provide meaningful insights into the performance and growth of your digital marketing campaigns.

- Utilize marketing automation tools: Marketing automation tools can help you accomplish more with less, reducing costs and increasing ROI. These tools can assist with repetitive tasks, data organization, repurposing data, and audience segmentation.

- Test and adjust your campaigns: Digital marketing offers numerous opportunities for A/B testing to optimize your campaigns. Test different aspects of your campaigns, such as copy, design, targeting, and channels, to continuously improve your ROI.

- Seek professional help: Digital marketing encompasses multiple channels and tactics, and managing them all effectively can be challenging. Consider partnering with a seasoned digital marketing agency that can provide the necessary resources, expertise, and technology to improve your ROI.

Building an Australian Investment Portfolio: Strategies for Success

You may want to see also

Frequently asked questions

ROI, or Return on Investment, is a metric used to evaluate the profitability of an investment relative to its cost. It is calculated as a ratio or percentage and is a widely used metric due to its simplicity and broad applicability.

The basic formula for ROI is: ROI = Net Income / Cost of Investment. Net income refers to the total profits received, and the cost of investment refers to the total amount spent. This formula can be modified to include a multiplier of 100 to express the ROI as a percentage.

One limitation of ROI is that it does not take into account the length of time an investment is held. A higher ROI over a longer period may be less desirable than a lower ROI over a shorter period. ROI calculations can also differ based on which costs are included, and it does not adjust for risk.