Simple interest is a straightforward way of calculating the cash flows associated with an investment or deposit. It is calculated using the formula A = P(1 + rt), where A is the total accrued amount, P is the principal amount of money invested, r is the interest rate per period, and t is the number of periods. The rate of interest is typically given as a percentage and must be divided by 100. For example, if you invest $10,200 at a rate of 3.5% for 548 days, you will earn $535.99 in interest. Simple interest does not take into account the power of compounding, where interest is earned on the total balance, including previous interest.

| Characteristics | Values |

|---|---|

| Formula | A = P(1 + rt) |

| P | Principal amount of money invested |

| r | Interest rate per period |

| t | Number of time periods |

| r and t | Typically in the same units of time, usually years |

What You'll Learn

Simple interest formula

The simple interest formula is used to calculate the total value for principal and interest that will accrue over a particular period of time. The formula is A = P(1 + rt), where A is the total accrued amount, P is the principal amount of money (e.g. to be invested), r is the interest rate per period, and t is the number of periods.

For example, if you invest $10,000 at an interest rate of 5% per year for 2 years, the total accrued amount would be $11,000. This is calculated as follows: A = P(1 + rt) = $10,000(1 + (0.05 x 2)) = $10,000(1 + 0.1) = $10,000(1.1) = $11,000.

The simple interest formula can also be written as S.I. = (P x R x T)/100, where P = Principal, R = Rate of Interest in % per annum, and T = Time, usually calculated as the number of years. For example, if you invest $10,000 at an interest rate of 5% per year for 2 years, the simple interest would be $1,000. This is calculated as follows: S.I. = (P x R x T)/100 = ($10,000 x 0.05 x 2)/100 = ($10,000 x 0.1)/100 = $1,000.

It's important to note that simple interest does not take into account the power of compounding, or interest-on-interest. In the example above, the 5% interest is earned on the initial $10,000 balance each year, rather than on the growing balance. This means that the total accrued amount after 2 years would be $11,000, not $11,050 as it would be with compound interest.

Investments: Earning Interest and Growing Your Money

You may want to see also

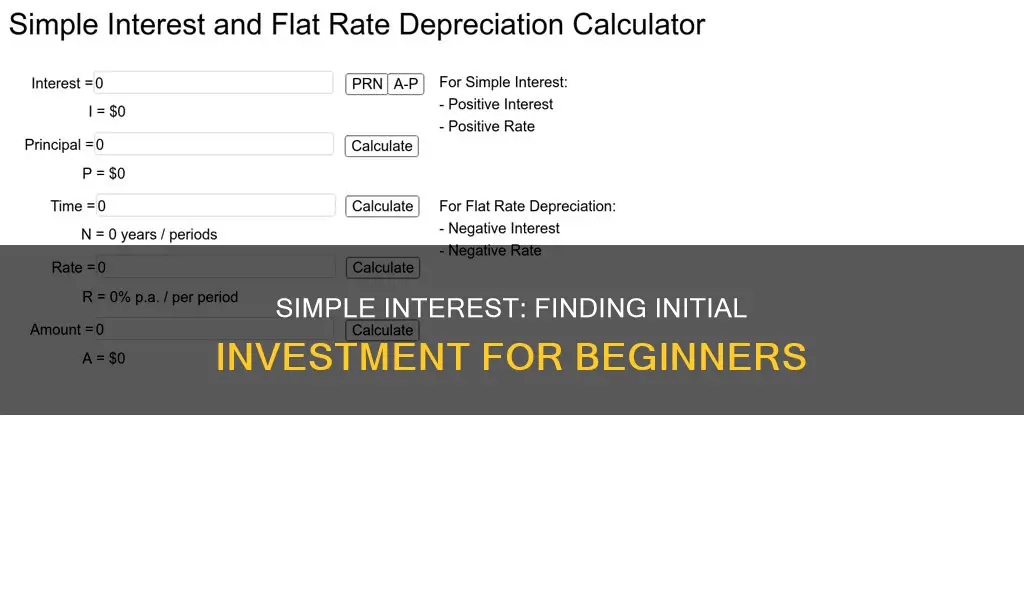

Calculating the principal

To calculate the principal, or the initial investment, in simple interest, you can use the formula A = P(1 + rt). In this formula, A is the total accrued amount, which is the principal plus interest, or P + I. P is the principal amount of money invested, r is the interest rate per period, and t is the number of time periods.

For example, if you invest $10,200 for 548 days at a rate of 3.5% with no compounding, you can calculate the total accrued amount as follows:

A = P(1 + rt)

A = 10,200(1 + (0.035 * 1.50137))

A = 10,200(1 + 0.052548)

A = 10,200(1.052548)

A = 10,735.99

Since your total principal plus interest is $10,735.99, you can subtract the original principal of $10,200 to get the amount of interest: $10,735.99 - $10,200 = $535.99.

You can also use the formula S.I. = (P × R × T)/100, where P = Principal, R = Rate of Interest in % per annum, and T = Time, usually calculated as the number of years. For example, if you invest $1,000 at an annual interest rate of 5% for 10 years, the value of the investment after 10 years will be $1,628.89.

Time to Double Your Money at 10% Interest

You may want to see also

Calculating the rate

To calculate the rate of interest, you need to know the initial investment, also known as the principal amount. This is the amount that was initially borrowed or invested. Once you have this figure, you can use the following formula: S.I. = (P x R x T)/100, where P = Principal, R = Rate of Interest in % per annum, and T = Time, usually calculated as the number of years.

For example, if you invest $10,000 for five years at a rate of 5%, you would calculate the simple interest as follows: S.I. = ($10,000 x 5% x 5)/100 = $2,500. So, the total value of your investment after five years would be $12,500.

It's important to note that simple interest does not take into account the power of compounding, or interest-on-interest. In the example above, you would earn $500 in interest in the first year ($10,000 x 5%). In the second year, you would earn interest on $10,500 ($10,000 + $500), and so on. This is known as compound interest and can result in a higher total value for your investment over time.

To calculate compound interest, you can use the formula F = P (1 + i)n, where F represents the future amount of money, P is the present dollar amount or initial investment, i is the annual interest rate (expressed as a decimal), and n is the number of years the initial investment will be paying interest. Using the same example as above, if you invest $10,000 for five years at a rate of 5% with compound interest, you would calculate the future value as follows: F = $10,000 (1 + 0.05)5 = $12,762.82. So, the total value of your investment after five years with compound interest would be $12,762.82.

Investments: Compounding Interest Options for Your Money

You may want to see also

Calculating the time

To calculate the time it takes for an investment to reach a certain value, you can use the simple interest formula: A = P(1 + rt). In this formula, A represents the total accrued amount, P is the principal amount of money invested, r is the interest rate per period, and t is the number of time periods.

For example, let's say you invest $10,000 at an annual interest rate of 5%. To calculate how long it will take for your investment to reach $15,000, you can rearrange the formula to solve for time (t). First, subtract the principal amount from the total accrued amount to find the interest earned: $15,000 - $10,000 = $5,000. Next, plug the known values into the formula: $5,000 = $10,000(1 + 0.05t). Divide both sides of the equation by $10,000: 0.5 = 1 + 0.05t. Subtract 1 from both sides: 0.5 - 1 = 0.05t - 1, which simplifies to -0.5 = 0.05t. Finally, divide both sides by 0.05 to find the value of t: t = -10.

In this example, the time it takes for your investment to reach $15,000 is negative, indicating that it is not possible to reach that amount with the given principal and interest rate. This is because the interest rate is not high enough to overcome the initial investment.

Now, let's consider a different scenario. Suppose you invest $5,000 at an annual interest rate of 8%. To determine how long it will take for your investment to double in value, you can use the same formula. First, find the total accrued amount by multiplying the principal by two: $5,000 x 2 = $10,000. Next, plug the known values into the formula: $10,000 = $5,000(1 + 0.08t). Divide both sides by $5,000: 2 = 1 + 0.08t. Subtract 1 from both sides: 1 = 0.08t. Finally, divide both sides by 0.08 to find the value of t: t = 12.5.

In this case, it will take approximately 12.5 years for your investment to double in value. By manipulating the simple interest formula and solving for time, you can make informed decisions about your investments and understand the relationship between principal, interest rate, and time.

Interest Rates: Impacting Investment Patterns and Decisions

You may want to see also

Calculating the final investment value

To calculate the final investment value, you can use the simple interest formula: A = P(1 + rt).

A is the total accrued amount, which is principal plus interest or P + I. P is the principal amount of money invested at an interest rate R% per period for t, the number of time periods. R is the rate of interest in % per annum. T is the time, usually calculated as the number of years.

For example, let's say you invest $10,200 with a rate of 3.5% for 548 days. First, convert days to years: 548 / 365 = 1.50137. Then, plug the numbers into the formula: A = 10,200(1 + (0.035 * 1.50137).A = 10,200(1 + 0.052548). A = 10,200(1.052548). A = 10,735.99.

So, the total accrued amount is $10,735.99. To find the interest earned, subtract the original principal of $10,200: 10,735.99 - 10,200 = 535.99. Therefore, the interest earned is $535.99.

Budget Surplus Impact: Interest Rates and Investments

You may want to see also

Frequently asked questions

The formula for calculating simple interest is A = P(1 + rt), where A is the total accrued amount, P is the principal amount of money invested, r is the interest rate per period, and t is the number of periods.

The formula for calculating the initial investment is F = P (1 + i)n, where F represents the future amount of money, P is the present dollar amount or initial investment, i is the annual interest rate (expressed as a decimal), and n is the number of years the initial investment will be paying interest.

Simple interest refers to the straightforward crediting of cash flows associated with some investment or deposit. For instance, 1% annual simple interest would credit $1 for every $100 invested, year after year. Simple interest does not take into account the power of compounding, or interest-on-interest, where after the first year the 1% would actually be earned on the $101 balance, adding up to $1.01.