Understanding the initial investment and cash flow is crucial for any business project. Initial cash flow is the total money available when a project or business is in the planning stages and includes any loans or investments made. It is usually a negative figure as launching a business requires capital investment. This initial investment outlay is factored into the discounted cash flow analysis used to evaluate project feasibility.

Calculating the initial investment involves netting all incremental cash flows at time zero, subtracting outflows from inflows. Fixed capital, working capital, salvage value, tax rate, and book value are considered when calculating initial cash flows.

The initial investment is vital for capital budgeting decisions, helping to estimate future cash flows and make choices that increase shareholder wealth. It includes capital expenditures, working capital requirements, and after-tax proceeds from disposed-of assets.

Accurate estimation of initial investment and future cash flows is essential for making informed decisions about projects and businesses.

| Characteristics | Values |

|---|---|

| Definition | Initial investment is the amount required to start a business or project. |

| Synonyms | Initial investment outlay, initial outlay, initial cash flow, initial investment capital |

| Calculation | Initial Investment = CapEx + ΔWC + D |

| Components | Fixed capital, working capital, salvage value, tax rate, book value |

| Considerations | Fixed capital, working capital, salvage value, tax rate, book value |

| Use | To evaluate the feasibility of a project |

What You'll Learn

Fixed capital, working capital, salvage value, tax rate, and book value

When determining the initial investment for a project or business, it is crucial to consider various factors, including fixed capital, working capital, salvage value, tax rate, and book value. These elements provide a comprehensive understanding of the upfront costs and the overall financial health of the venture.

Fixed capital refers to the acquisition and maintenance of long-term assets, such as buildings or intellectual property. These are strategic investments that serve the business's long-term plans. On the other hand, working capital involves deploying financial resources for day-to-day operations, including short-term assets and liabilities. Working capital ensures smooth business operations and is essential for meeting operational objectives.

Salvage value represents the residual value of an asset at the end of its useful life. It is calculated by considering the purchase price of the asset and its total depreciation over time. This value is essential when determining the initial investment as it can offset the initial cash flow. For example, if a company is replacing old equipment, the salvage value of the old equipment can be factored in by selling it, and the capital gains tax on the sale will also be considered.

Book value, also known as adjusted cost base (ACB), is calculated by adding all contributions made by an investor into a mutual fund, plus reinvested fund distributions, minus any withdrawals. It is essential for tax purposes, helping determine whether an investor has realised a capital gain or loss on a particular holding. However, book value is not a reliable measure of investment performance as it can be higher than the market value even when a profit has been made.

Lastly, the tax rate is a critical consideration in investment decisions. It directly impacts the after-tax returns and cash flows of a project. A higher tax rate will result in lower after-tax cash flows, while a lower tax rate will increase the attractiveness of the investment.

Operating vs Investing: Where Do Customers Fit in Cash Flow?

You may want to see also

Capital expenditures

There are two main types of capital expenditures:

- Maintenance CapEx: This involves spending on maintaining the current level of a company's operations. For example, refurbishing an old factory, overhauling machinery, or upgrading office spaces.

- Growth CapEx: This type of CapEx enables an increase in future growth. For instance, a manufacturing company might invest in advanced machinery to boost production capacity and improve product quality.

The calculation of capital expenditures is a complex process that requires a good understanding of both current financial needs and future growth projections. Here are some common methods used to calculate CapEx:

- Historical Data Analysis: Companies can use past spending patterns to forecast future CapEx requirements. For example, if a company has consistently spent 10% of its revenue on machinery upgrades, it can use this historical data to estimate future expenditures.

- Zero-Based Budgeting: This approach requires justifying every expense for each new period. It involves a detailed analysis of each potential investment, ensuring only necessary and strategically aligned expenditures are approved.

- Scenario Analysis: This method involves creating multiple financial models based on different assumptions about future market conditions, technological advancements, and competitive dynamics. By comparing these scenarios, companies can make more informed investment decisions.

The impact of CapEx on a company's financial health is significant. Wise CapEx decisions are critical to a company's financial well-being, and many businesses try to maintain historical CapEx levels to demonstrate their continued investment in growth. CapEx can also impact a company's tax liabilities, as depreciation expenses reduce taxable income, and the resulting tax savings can be reinvested into new capital projects.

In summary, capital expenditures are a vital aspect of financial planning and analysis, helping companies maintain and grow their operations by investing in long-term physical assets.

QuickBooks: Recording Non-Cash Investing and Financing Activities

You may want to see also

Net cash flow from disposed assets

When a company disposes of an asset, it can impact the gains on disposals and accumulated depreciation. The most common form of disposal is the sale of the asset, which can have a substantial effect on the company's finances. This transaction is recorded as an asset disposal, also known as de-recognition, and involves removing the asset cost and any accumulated depreciation and impairment losses from the balance sheet.

To calculate the net cash flow from disposed assets, the company needs to consider the difference between the disposal proceeds and the carrying value of the asset. If the disposal proceeds exceed the carrying value, a gain on disposal is recognised. On the other hand, if the disposal proceeds are less than the carrying value, the company incurs a loss on disposal.

The net cash flow from disposed assets is typically presented in the "investing activities" section of the cash flow statement. This section includes cash flows associated with the acquisition and disposal of non-current assets and other investments, excluding cash equivalents. It's important to note that companies have some flexibility in how they present certain items in the cash flow statement, such as interest expense or income.

Overall, understanding net cash flow from disposed assets is crucial for financial professionals as it provides valuable insights into the company's financial health and performance. Accurate recording and reporting of asset disposals are essential to ensure transparency and make informed business decisions.

Cashing in on Investments: A Meryl Lynch Guide

You may want to see also

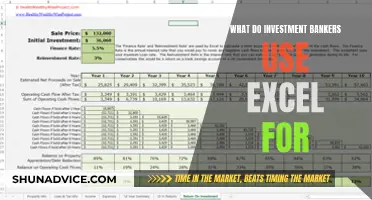

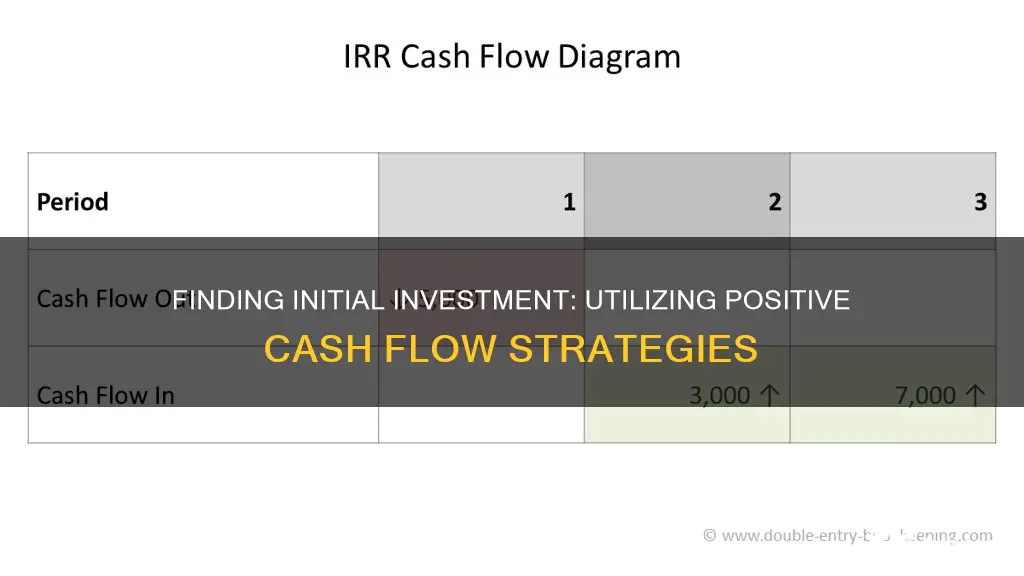

Discounted cash flow analysis

Discounted cash flow (DCF) analysis is a method used to determine the value of an investment, business, or project by estimating its future cash flows. It is a widely used technique in investment finance, real estate development, corporate financial management, and patent valuation.

DCF analysis involves calculating the present value of expected future cash flows using a discount rate. The discount rate reflects the cost of capital and acts as an interest rate on future cash inflows, bringing them back to their current value. This analysis is crucial in evaluating the feasibility of a project or investment, as it helps determine whether the future cash flows will be greater than the initial investment.

The basic formula for DCF is:

> DCF = CF1 / (1 + r)^1 + CF2 / (1 + r)^2 + ... + CFn / (1 + r)^n

Where:

- DCF = Discounted Cash Flow

- CF1, CF2, ... CFn = Cash Flow for each year

- R = Discount rate

To conduct a DCF analysis, the following steps are typically involved:

- Forecast the expected cash flows from the investment over its lifetime.

- Select an appropriate discount rate based on factors such as the cost of financing or opportunity cost.

- Discount the forecasted cash flows back to the present value using the selected discount rate.

- Calculate the net present value (NPV) by subtracting the upfront cost of the investment from the sum of the discounted cash flows.

DCF analysis can be applied to various scenarios, such as valuing a business, evaluating potential projects, pricing bonds, or analysing stocks. It is a powerful tool for investors, analysts, and financial managers to make informed decisions about investments and capital expenditures.

However, it is important to note that DCF analysis relies on estimates of future cash flows, which may not always be accurate. Therefore, it is crucial to make solid estimates and diversify investments to mitigate potential risks.

Investing Cash: Strategies for Smart Money Allocation

You may want to see also

Forecasting errors

Under-committing

Cash flow forecasting is a critical business tool that requires sufficient time and resources. It is often a mistake to delegate this task to junior employees who may lack the necessary understanding of company finances, or to senior staff who are overloaded with other responsibilities. Under-committing to cash flow forecasting can lead to inaccurate predictions and potential financial difficulties.

Being overly optimistic

Overestimating sales and underestimating negative events and their impact is a common pitfall in cash flow forecasting. It is important to create both best-case and worst-case scenarios and test them thoroughly. Projections should be based on past experience and thorough research to ensure a realistic view of future prospects.

Lack of communication

Developing effective communication channels across all members and areas of an organisation is crucial for creating an exhaustive cash flow projection. Staff and management should review the tentative projection to ensure that all initiatives and potential cash flow sources and requirements are accounted for.

Late loans

It is advisable to seek loans early on if there is a foreseeable need for additional funding. A strong cash flow projection will demonstrate to loan officers that your business is a good credit risk. Many people overestimate the availability of loans and grants, which can lead to devastating consequences when funding falls short.

Not updating forecasts

It is essential to regularly compare actual cash flow with predictions to make necessary adjustments. While a perfect cash flow projection may not be achievable initially, reviewing and updating forecasts based on actual results will help minimise significant variances.

Not accounting for growth periods

Growth requires extra cash reserves, and failing to plan for growth periods can result in cash flow issues. Cash flow forecasting can help map out a growth strategy and identify areas where additional cash may be needed, such as labour, management, accounting, and product development. It is also important to consider indirect costs, debt payments, and working capital in growth forecasts.

Not considering tax changes

Taxes can fluctuate due to legislative changes, sales volume, employee numbers, and superannuation. Ancillary taxes like payroll tax and fringe benefits tax can also impact cash flow. Regular consultations with tax advisors are essential to maximise deductions and avoid penalties and interest from late or incorrect payments.

Forgetting that timing is everything

Cash flow forecasting should account for the timing of large one-off payments and allow for longer lead times on collections during certain times of the year, such as holidays. Planning for these fluctuations will help avoid cash flow surprises.

Using a "set and forget" approach

While automation is convenient for some tasks, a "set and forget" approach to cash flow forecasts can be risky. Cash flow forecasts should be able to accommodate various events and changes, such as promotions, hiring, and capital purchases. They are dynamic tools that help set realistic goals and ensure adequate resources are available to achieve them.

Not allowing for late payments

Assuming that all customers will pay on time is unrealistic. Effective cash flow forecasting takes a conservative approach by planning for late payments to avoid financial surprises.

Strategies for Cashing Out Investments: A Comprehensive Guide

You may want to see also

Frequently asked questions

The initial investment is the total amount of money required to start a business or project, including the funds needed for equipment, capital expenditures, and working capital. It is an important factor in evaluating the feasibility of a project and is typically a negative number due to the high costs of starting a business.

The initial investment can be calculated by netting all incremental cash flows at the beginning of the project. This involves subtracting all cash outflows from cash inflows at the time when the firm makes the capital expenditure. The formula is: Initial Investment = CapEx + ΔWC + D, where CapEx is capital expenditure, ΔWC is the change in working capital, and D is the net cash flow from disposed assets.

Initial cash flow refers to the money available at the planning stage of a project or business and is usually a negative figure. It includes all upfront costs, such as capital expenditures and working capital requirements. Cash flow from investing activities, on the other hand, is a section of the cash flow statement that reports the cash inflows and outflows from the acquisition and disposal of long-term assets, investments, and other business units.