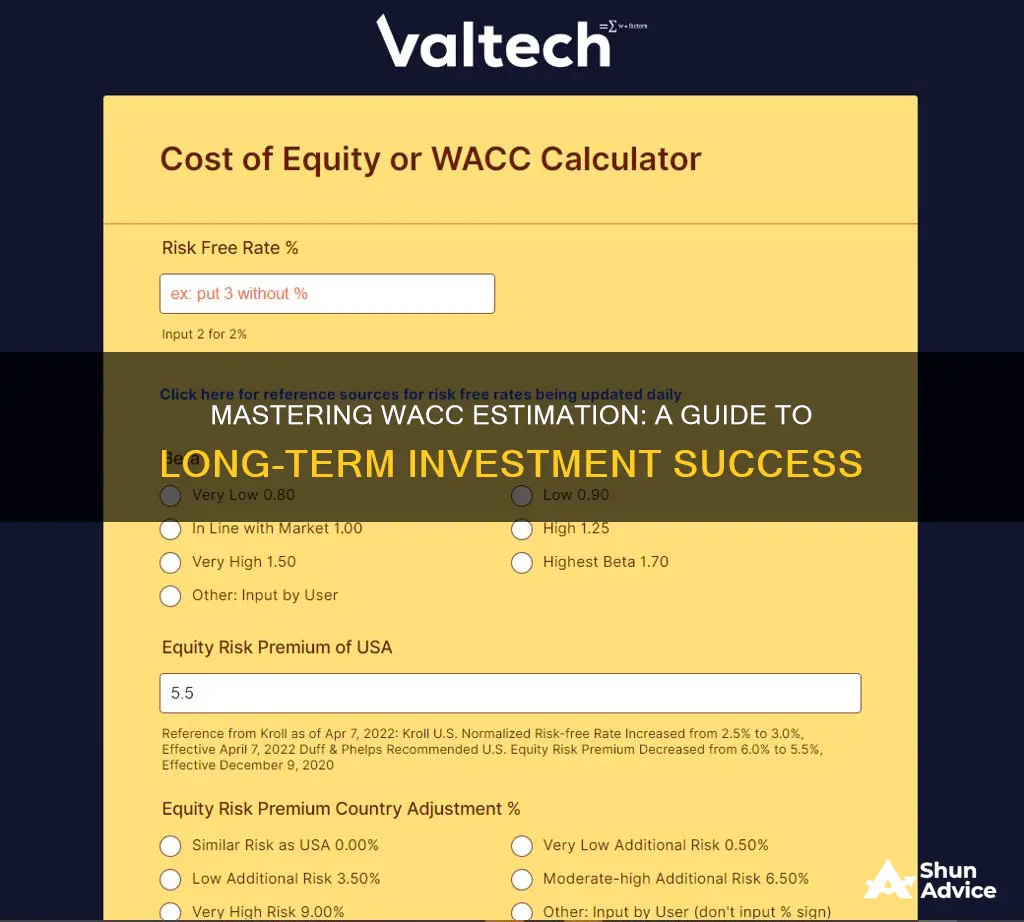

When making long-term investment decisions, understanding the Weighted Average Cost of Capital (WACC) is crucial. WACC is a financial metric that represents the cost of capital to a company, taking into account the cost of debt and the cost of equity. Estimating WACC is essential for evaluating the attractiveness of potential investments, as it provides a benchmark for assessing the profitability of projects. This guide will explore the key steps and considerations involved in calculating WACC, offering insights into how investors can use this metric to make informed decisions about long-term investments.

What You'll Learn

- Discounted Cash Flows: Calculate the present value of future cash flows to determine the investment's value

- Capital Structure: Analyze the company's debt-to-equity ratio to understand its financing mix and WACC

- Cost of Equity: Estimate the required return on investment by considering market expectations and risk

- Tax Shield: Consider the impact of tax deductions on the cost of debt and overall WACC

- Risk-Adjusted Rates: Use risk-free rates and adjust for project-specific risk to estimate WACC

Discounted Cash Flows: Calculate the present value of future cash flows to determine the investment's value

Discounted Cash Flow (DCF) analysis is a powerful tool for evaluating the value of long-term investments. It involves calculating the present value of a series of future cash flows, which provides an estimate of the investment's worth today. This method is particularly useful for assessing the attractiveness of projects with long-term cash flow generation, such as business expansions, property developments, or equity investments.

The process begins with forecasting the future cash flows that the investment will generate. These cash flows should be estimated over a reasonable period, typically covering the investment's entire lifespan. It is crucial to be conservative and realistic in these projections to ensure the DCF analysis provides an accurate representation of the investment's value. Cash flows can be categorized into different types, such as operating cash flows, capital expenditures, and terminal value (the value of the investment at the end of the forecast period).

Once the cash flows are estimated, the next step is to determine the appropriate discount rate, often referred to as the weighted average cost of capital (WACC). WACC is a critical component of DCF analysis as it reflects the cost of capital for the investment. It is calculated by weighing the cost of each source of capital (debt and equity) by their respective proportions in the capital structure and then averaging these costs. The WACC represents the minimum return an investor expects for bearing the risk of the investment.

After establishing the WACC, the present value of each future cash flow is calculated using this discount rate. The present value (PV) of a future cash flow is determined by dividing the cash flow by (1 + WACC)^n, where 'n' is the number of periods until the cash flow is received. This calculation essentially discounts the future cash flow back to its present value, considering the time value of money. The sum of these present values represents the total present value of the investment's future cash flows.

Finally, the investment's value is determined by comparing the total present value of the cash flows to the initial investment cost. If the present value of the cash flows exceeds the initial investment, the project is considered financially viable and potentially profitable. This DCF analysis provides a comprehensive framework for assessing the attractiveness of long-term investments by considering the time value of money and the cost of capital. It is a widely accepted method in financial decision-making, offering a clear and structured approach to evaluating investment opportunities.

Long-Term Investments: Navigating the Misconception of Current Liabilities

You may want to see also

Capital Structure: Analyze the company's debt-to-equity ratio to understand its financing mix and WACC

Analyzing a company's capital structure is a crucial step in estimating its Weighted Average Cost of Capital (WACC), which is essential for making long-term investment decisions. One of the key metrics to examine is the debt-to-equity ratio, which provides valuable insights into a company's financing mix. This ratio is calculated by dividing a company's total debt by its total equity. A higher debt-to-equity ratio indicates that the company has a larger portion of its capital financed through debt, while a lower ratio suggests a more equity-oriented financing structure.

By examining this ratio, investors and analysts can understand the relative weight of debt and equity in the company's capital structure. A higher debt-to-equity ratio might imply that the company is taking on more financial risk, as interest payments and principal repayments are required to be made, regardless of the company's performance. On the other hand, a lower ratio could indicate a more stable and conservative financing strategy, where the company relies more on equity financing.

The debt-to-equity ratio is a critical component in the WACC calculation because it directly influences the cost of debt and the cost of equity. When a company has a higher debt-to-equity ratio, it may have to pay a higher interest rate to attract lenders, which increases the cost of debt. This, in turn, will impact the overall WACC, making it higher. Conversely, a lower debt-to-equity ratio can lead to lower interest payments and a more favorable WACC.

To estimate WACC, one should consider the following steps: First, calculate the debt-to-equity ratio by dividing total debt by total equity. Then, research and determine the company's cost of debt and cost of equity. The cost of debt is typically the interest rate on the company's debt, while the cost of equity can be estimated using various models such as the Capital Asset Pricing Model (CAPM). Finally, apply the capital structure weights to these costs to calculate the WACC. This process allows investors to assess the company's financing mix and its potential impact on long-term investment decisions.

In summary, analyzing a company's debt-to-equity ratio is a fundamental step in understanding its capital structure and estimating WACC. This analysis provides valuable insights into the company's financing strategy and its potential financial risks. By considering this ratio alongside other financial metrics, investors can make more informed decisions regarding long-term investments and assess the overall financial health of the company.

Understanding Short-Term Investments: A Balance Sheet Guide

You may want to see also

Cost of Equity: Estimate the required return on investment by considering market expectations and risk

The Cost of Equity is a critical component in estimating the Weighted Average Cost of Capital (WACC) for long-term investment decisions. It represents the return investors expect on a company's equity, taking into account the market's assessment of the company's risk and the potential for growth. Here's a step-by-step guide to estimating the cost of equity:

- Determine Market Expectations: Start by analyzing the market's expectations for the company's equity. This involves studying the historical performance of similar companies in the same industry and understanding the current market sentiment. You can use financial metrics such as the price-to-earnings (P/E) ratio, which compares a company's stock price to its earnings per share. A higher P/E ratio might indicate higher market expectations for growth and, consequently, a higher required return.

- Assess Risk: Risk is a key factor in determining the cost of equity. There are two primary types of risk to consider: systematic risk (market risk) and unsystematic risk (specific to the company). Systematic risk refers to the overall market volatility and cannot be diversified away. It is often measured using the beta coefficient, which indicates the volatility of a company's stock relative to the market. A beta of 1 means the stock moves in line with the market, while a beta greater than 1 suggests higher volatility. Unsystematic risk, on the other hand, can be reduced through diversification and is specific to the company's operations and industry.

- Capital Asset Pricing Model (CAPM): The CAPM is a widely used model to estimate the cost of equity. It states that the required return on an investment (equity) is equal to the risk-free rate plus a risk premium, which is a function of the systematic risk (beta). The formula is: Cost of Equity = Risk-Free Rate + Beta * (Market Risk Premium). The risk-free rate is the return on a risk-free investment, typically government bonds. The market risk premium is the difference between the expected market return and the risk-free rate.

- Market Risk Premium: Estimating the market risk premium involves analyzing historical market data. You can calculate it by examining the excess returns of the market index over the risk-free rate over a specific period. For example, if the market index returns 15% over a year, and the risk-free rate is 3%, the market risk premium would be 12%. This premium reflects the market's expected return for bearing systematic risk.

- Adjust for Company-Specific Factors: After obtaining the cost of equity using the CAPM, consider adjusting it based on company-specific factors. These factors might include the company's financial health, growth prospects, management quality, and competitive advantage. For instance, a company with a strong balance sheet and a unique product might have a lower cost of equity due to reduced systematic risk.

Estimating the cost of equity requires a comprehensive understanding of market dynamics, risk assessment, and financial analysis. It is a crucial step in calculating WACC, which in turn helps in making informed investment decisions, especially for long-term projects that require substantial capital.

Non-Operating Assets: Are They Short-Term Investments?

You may want to see also

Tax Shield: Consider the impact of tax deductions on the cost of debt and overall WACC

When evaluating long-term investment decisions, understanding the Weighted Average Cost of Capital (WACC) is crucial. One significant aspect to consider is the tax shield, which refers to the reduction in the cost of debt due to tax deductions. This concept plays a vital role in calculating WACC and assessing the financial viability of a project.

The tax shield arises from the fact that interest payments on debt are typically tax-deductible, reducing the company's taxable income. As a result, the actual cost of debt to the company is lower than the nominal interest rate. This reduction in cost directly impacts the WACC calculation, making it a critical factor for investors and financial analysts. For instance, if a company can claim a tax deduction of 30% on its interest expenses, the effective cost of debt is only 70% of the nominal rate, thus lowering the overall WACC.

To estimate the WACC, one must consider the company's capital structure, which includes the proportion of debt and equity financing. The tax shield should be calculated based on the company's marginal tax rate, which is the tax rate applicable to the last dollar of income. By applying the tax shield to the cost of debt, investors can determine the after-tax cost of debt, which is then used in the WACC formula.

The WACC formula takes into account the weighted average of the costs of debt and equity, considering the tax shield on debt. It is calculated as: WACC = (E/V * Re) + (D/V * Rd * (1 - t)), where E is the market value of equity, V is the total market value of capital, Re is the required return on equity, D is the market value of debt, Rd is the before-tax cost of debt, and t is the marginal tax rate. The tax shield effect is directly reflected in the (1 - t) term, ensuring that the WACC accurately represents the cost of capital after considering tax benefits.

In summary, the tax shield is a critical component in estimating WACC for long-term investment decisions. It reduces the cost of debt, which in turn lowers the overall WACC. By incorporating the tax shield into the WACC calculation, investors can make more informed decisions, ensuring that the project's financial viability is assessed accurately, especially when evaluating projects with significant debt financing. This detailed approach provides a comprehensive view of the project's cost of capital and its potential impact on profitability.

CDs: Long-Term Savings or Short-Term Strategy?

You may want to see also

Risk-Adjusted Rates: Use risk-free rates and adjust for project-specific risk to estimate WACC

When estimating the Weighted Average Cost of Capital (WACC) for long-term investment decisions, incorporating risk-adjusted rates is a crucial step. This approach ensures that the capital structure and the associated costs accurately reflect the project's specific risks. Here's a detailed guide on how to achieve this:

Understanding Risk-Adjusted Rates:

Risk-adjusted rates, also known as adjusted discount rates, are a way to account for the unique risks associated with a particular investment or project. This adjustment is essential because the cost of capital should reflect the additional risk taken on by the company. By doing so, you can make more informed decisions about whether a project is financially viable. The process involves modifying the risk-free rate to consider the project's specific risk factors.

Calculating the Risk-Adjusted Rate:

- Identify Risk Factors: Begin by identifying the specific risks associated with the project. These could include market risk, financial risk, operational risk, or any other factors that might impact the project's success. For instance, a new product launch might face market acceptance risk, while a construction project could be subject to supply chain disruptions.

- Determine the Risk Premium: For each identified risk factor, calculate the corresponding risk premium. The risk premium is the additional return required by investors to compensate for the extra risk. This can be estimated using historical data, industry benchmarks, or similar projects. For example, if the market risk premium is 5% and the project's market risk is higher, you would add this premium to the risk-free rate.

- Adjust the Discount Rate: Add the calculated risk premiums to the risk-free rate to obtain the adjusted discount rate. This rate represents the minimum return required by investors, taking into account the project's specific risks. The formula for this calculation is: Adjusted Discount Rate = Risk-Free Rate + (Risk Premium 1 + Risk Premium 2 + ...).

Estimating WACC:

Once you have the risk-adjusted rates, you can proceed to estimate the WACC. Here's how:

- Calculate the Weighted Cost of Each Capital Source: Determine the proportion of the project's capital that comes from each source (e.g., equity, debt, preferred stock). Then, calculate the weighted cost for each source by multiplying the cost of each source by its respective weight.

- Sum the Weighted Costs: Add the weighted costs of all capital sources to arrive at the WACC. The formula is: WACC = (Weight of Equity Cost of Equity) + (Weight of Debt Cost of Debt) + (Weight of Preferred Stock Cost of Preferred Stock).

By using risk-adjusted rates, you ensure that the WACC accurately reflects the project's risk profile, enabling more accurate investment decisions. This method provides a comprehensive view of the financial implications of a project, helping businesses allocate resources effectively while managing risk.

Maximizing Savings: The Power of Term Life Insurance and Investing

You may want to see also