Corporate investing is a way to put your business's surplus cash to good use. Instead of letting cash pile up in a bank account, businesses can invest it to generate additional revenue. This can also help reduce tax obligations. However, it's important to carefully consider your risk appetite before investing, as there is always a chance of losing money. Here are some options for how to invest corporate cash:

- Bank deposit accounts: These provide liquidity, convenience, and security, with many being insured.

- Short-term government securities: Treasury notes and bills are considered extremely safe and have very limited interest rate risk.

- Commercial paper: This is a short-term debt instrument issued by large, stable companies, offering better yields than treasury securities.

- Cash management funds: These funds invest in secure short-term investments to provide stable value and better yields than a company could get on its own.

- Money market accounts: These accounts offer higher interest rates than regular savings accounts but usually require higher minimum investments.

- Corporate bonds: These are longer-term debt securities that offer potentially higher yields than government securities but carry varying degrees of credit risk.

- Real estate: Investing in property provides an opportunity for a passive income stream from rental income, and only half the gains are taxed.

- Stocks or corporate-class funds: Investing inside your corporation allows you to take advantage of low corporate tax rates, and you can withdraw gains tax-free using the Capital Dividend Account.

| Characteristics | Values |

|---|---|

| Purpose | Generate additional revenue, reduce tax obligations, or prepare for potential market shocks |

| Investment Types | Real estate, stocks, corporate-class funds, corporately-owned whole life insurance, business investments, money markets, bonds, cash management funds, commercial paper, corporate bonds, foreign currency deposits, treasury securities, mutual funds, certificates of deposit, etc. |

| Tax Implications | Corporate tax rates are lower than personal tax rates; profits can be withdrawn tax-free via the Capital Dividend Account |

| Risk | All investments carry some degree of risk, but certain options are considered safer than others (e.g., government securities, money market funds) |

| Liquidity | Some investments offer higher liquidity than others; consider how quickly you may need to access the funds |

| Returns | Returns vary depending on the investment type and level of risk; some options provide stable, low returns, while others offer higher potential gains |

| Time Horizon | The investment time horizon should align with the business's financial goals and cash flow needs |

| Expert Advice | Seeking advice from financial advisors, accountants, or independent financial advisors can help maximize tax efficiency and make informed decisions |

| Employee Retention | Investing in employees through bonuses or 401(k) contributions can boost morale and reduce employee turnover |

| Reinvesting in the Business | Reinvesting in the business can support long-term growth and success |

Money markets

Money market accounts are a type of bank deposit that provides liquidity, convenience, and security for companies. They are similar to bank accounts but offer a slightly higher interest rate. Money market accounts are often insured, providing an additional layer of safety for businesses. These accounts are suitable for companies that require quick access to their cash reserves while also seeking to generate returns from their cash balances.

Money market accounts are typically used for funds that need to remain immediately available, while companies can place cash predicted to not be needed in the short term in higher-yielding accounts. This strategy allows companies to optimise the return on their cash balances while maintaining liquidity. Money market accounts are also useful for companies with fluctuating cash flows, as they provide easy access to funds when needed.

Money market accounts may have some restrictions, such as a maximum number of transactions within a specified period or minimum deposit requirements. These restrictions are important to consider when evaluating the suitability of money market accounts for a company's cash management strategy.

Money market funds are another type of investment option for companies. These funds hold secure short-term investments, aiming to provide stable value for the invested money while offering better yields than a company could achieve on its own. Money market funds are often included in cash management funds, along with ultra-short bond funds and tax-free short-term funds.

Money market accounts and funds offer businesses a way to balance liquidity and return on their cash holdings. By utilising these tools, companies can effectively manage their cash reserves, ensuring accessibility when needed while also generating returns to support their financial goals.

Corporations' Cash Investment Strategies: Unlocking Business Growth

You may want to see also

Bonds

Corporate bonds are issued by companies that want to raise additional cash. They are often used as an alternative to diluting ownership through stock issues or taking out traditional loans. The money raised from bond sales can be used for various purposes, such as buying new assets, investing in research and development, refinancing, or funding mergers and acquisitions.

Corporate bonds can be purchased on the primary market through a brokerage firm, bank, bond trader, or broker. Some corporate bonds are also traded on the over-the-counter (OTC) market, offering good liquidity. The OTC market allows investors to buy and sell bonds quickly and easily, which is particularly useful for those who plan to actively manage their bond portfolio.

Before investing in corporate bonds, it is essential to understand some basics, such as how they are priced, the associated risks, and the interest rates they offer. Bond ratings, assigned by major agencies like Standard & Poor's, Moody's, and Fitch, play a crucial role in assessing the risk of default by the issuing company. Bonds with ratings of BBB- or lower by S&P and Fitch, or Baa3 or lower by Moody's, are considered junk bonds and carry a higher risk of default.

Corporate bonds offer stability and capital preservation during volatile market conditions. They provide predictable interest payments and clear terms. The interest rates on corporate bonds are generally higher than those on government securities but come with varying degrees of credit risk depending on the issuer's financial stability.

When investing in corporate bonds, it is important to consider the credit ratings, interest rates, and diversification of your portfolio. Corporate bonds are ideal for preserving wealth that you plan to use within the next five years or less. Over longer periods, the returns on corporate bonds may not match the potential wealth accumulation of stock ownership. Additionally, the interest earned on corporate bonds may be subject to taxes, making tax-free government bonds a more attractive option for taxable accounts.

Retirement Investing: Strategies for Your Cash Reserves

You may want to see also

Stock market

Investing in the stock market is a way to put your business's surplus cash to good use. Instead of keeping it in the bank, you can put it into investments to generate additional revenue.

Advantages of Investing in the Stock Market

Investing in the stock market can help you:

- Generate more money that can be reinvested into your business

- Diversify into other securities and assets to give your business multiple revenue streams

- Give your surplus cash a chance to grow instead of leaving it in a low-interest savings account

Disadvantages of Investing in the Stock Market

There are also some disadvantages and risks associated with investing in the stock market:

- You could lose money if the investment market crashes

- May not be suitable if you need instant access to your cash to bolster cash flow

- May not be ideal if you're planning to make significant investments in your business in the near future

How to Invest in the Stock Market

If you decide to invest your corporate cash in the stock market, here are the steps you can follow:

- Decide if you want to invest on your own or with help: You can choose to practice investing with fake money using a paper trading account, pick stocks and stock funds on your own, or get help from a robo-advisor.

- Choose a broker or robo-advisor: Evaluate brokers based on factors such as costs, investment selection, investor research, tools, and customer service access.

- Pick a type of investment account: Consider the different types of investment accounts, such as a standard brokerage account or a Roth IRA, which offers significant tax benefits.

- Learn the difference between investing in stocks and funds: You can invest in individual stocks or stock mutual funds/exchange-traded funds (ETFs), which allow you to purchase small pieces of many different stocks in a single transaction.

- Set a budget: Determine how much money you want to invest, considering the share prices or minimum investment amounts.

- Focus on long-term investing: Remember that stock market investments are typically for the long term, and avoid the habit of compulsively checking your stocks' performance several times a day.

- Manage your stock portfolio: Regularly revisit your portfolio to ensure it aligns with your investment goals, adjusting as needed to maintain diversification and align with your risk tolerance.

Investments, Cash Flows, and the Impact of Gains

You may want to see also

Real estate

There are endless ways to invest in real estate, from taking out a home mortgage to building a property empire. Here are some strategies for adding real estate exposure to your investments:

REITs are public companies that raise funds by selling shares of stock and issuing bonds. They then use the proceeds to purchase and lease out real estate assets like shopping malls, office buildings, apartment buildings, and warehouses. REITs are required to pay out nearly all of their after-tax profits to investors as dividends.

REITs take the hassle out of owning real estate as management handles all the ownership and rental logistics. You can buy and sell shares of REIT stock in the market via a brokerage account, like any other public company. This makes REITs one of the most liquid real estate investments available.

Crowdfunding Real Estate Platforms

Crowdfunding real estate investing platforms allow investors to take a more hands-on approach by investing in specific real estate development projects rather than large, generic portfolios of properties. These platforms pool money from multiple investors to fund development projects and generally require investors to commit to real estate investments for longer periods of time.

Invest in Your Own Home

Primary residences are the most common way people invest in real estate. You take out a mortgage, make monthly payments, and gradually build ownership of your home. With luck and strong demand in your local market, you can cash in on the equity when you sell.

Invest in Rental Properties

If you're looking to make a major commitment to real estate investing, consider purchasing rental properties. Rentals can offer steady cash flow and the possibility of appreciation over time, but they are one of the most labor-intensive methods.

There are two main ways to make money with rental properties: long-term rentals, which are generally rented out for at least a year and provide a steady monthly cash flow; and short-term rentals, which cater to rotating tenants and can be listed on sites like Airbnb.

Invest in Real Estate by Flipping Properties

You don't have to buy rental properties to maximize your profit from real estate investing. Buying and flipping properties is a common strategy, although it takes a lot of work. It involves renovating homes and identifying up-and-coming neighbourhoods to sell your purchases at a premium.

REIGs are ideal for people who have some capital and want to own rental real estate without the hassle of hands-on management. REIGs are a pool of money from multiple investors, similar to a small mutual fund, that is invested in rental properties. A company buys or builds a set of apartment blocks or condos, and a single investor can own one or multiple units. The company collectively manages all the units, handling maintenance, advertising vacancies, and interviewing tenants.

Online Real Estate Platforms

Online real estate investing platforms are for those who want to join others in investing in a relatively large commercial or residential deal. The investment is made via crowdfunding, which pools resources from investors looking for opportunities and investors seeking financial backing for real estate projects. This allows for diversification into real estate without putting up a large stake.

Invest Cash Safely: Strategies for Secure Financial Growth

You may want to see also

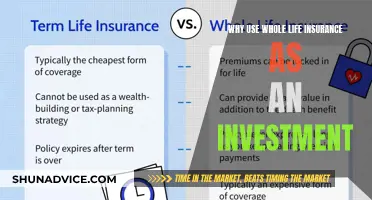

Corporately-owned whole life insurance

Corporate-owned life insurance (COLI) is a unique insurance policy designed for businesses. Unlike standard life insurance policies, which typically benefit family members, COLI benefits the company directly. This setup has significant financial and ethical consequences for both the company and its employees.

COLI is a life insurance policy taken out by a company on the lives of its employees, where the company pays the premiums and is the primary beneficiary. If the insured employee passes away, the death benefit is paid out to the company, not the employee's family or other personal beneficiaries.

COLI is typically used for several purposes:

- Key Person Insurance: This protects the company against financial loss if a key employee, such as an executive or specialist, dies. The death benefit can help offset the costs of recruiting, hiring, and training a replacement, as well as any potential lost business or profits.

- Funding Employee Benefits: The cash value growth within a COLI policy can help fund future employee benefits, such as retirement plans.

- Tax Benefits: While the premiums paid by the company are not tax-deductible, the death benefits are generally tax-free, and the growth in the policy's cash value is tax-deferred.

- Balance Sheet Improvement: The cash value of a COLI policy can be recorded as an asset on the company's balance sheet, enhancing its financial position.

COLI has a complex history and has been used by companies in the past to exploit tax loopholes. Today, there are strict regulations and requirements in place to prevent misuse, and companies must demonstrate an insurable interest in the employee's life before taking out a COLI policy.

Unlocking Cash Flow Secrets for Smart Investments

You may want to see also

Frequently asked questions

Corporate investing is a way to put your business's surplus cash to good use. Instead of simply holding all your cash in the bank, you can put some of it into investments to generate additional revenue.

Some of the advantages of corporate investing include:

- Diversifying into other securities and assets to give your business multiple revenue streams.

- Potentially generating more money that can be reinvested into your business.

- Giving your surplus cash a chance to grow rather than leaving it in a savings account with a low-interest rate.

As with all investments, there is a chance you could lose money. Even if you choose to invest cautiously, you could still lose money if the investment market crashes. Corporate investing may not be suitable if you need instant access to your cash or if you're planning to make significant investments in your business soon.

Some of the most popular options include funds, trusts, pensions, individual stocks, bonds, and commodities.

Depending on the size of your business, your corporate tax obligations will differ. For example, micro-entities will only have to pay tax on investments once they have been sold, whereas small companies will be taxed on investments such as stocks and shares once they have been realised. You will also need to consider whether investments will push you over the capital gains tax threshold.