The S&P 500 is an index composed of about 500 large, publicly traded U.S. companies. It is widely considered a proxy for the overall health of the U.S. stock market. While you can't invest directly in the index, you can buy individual stocks of companies in the S&P 500 or invest in an S&P 500 index fund or exchange-traded fund (ETF) that tracks the index.

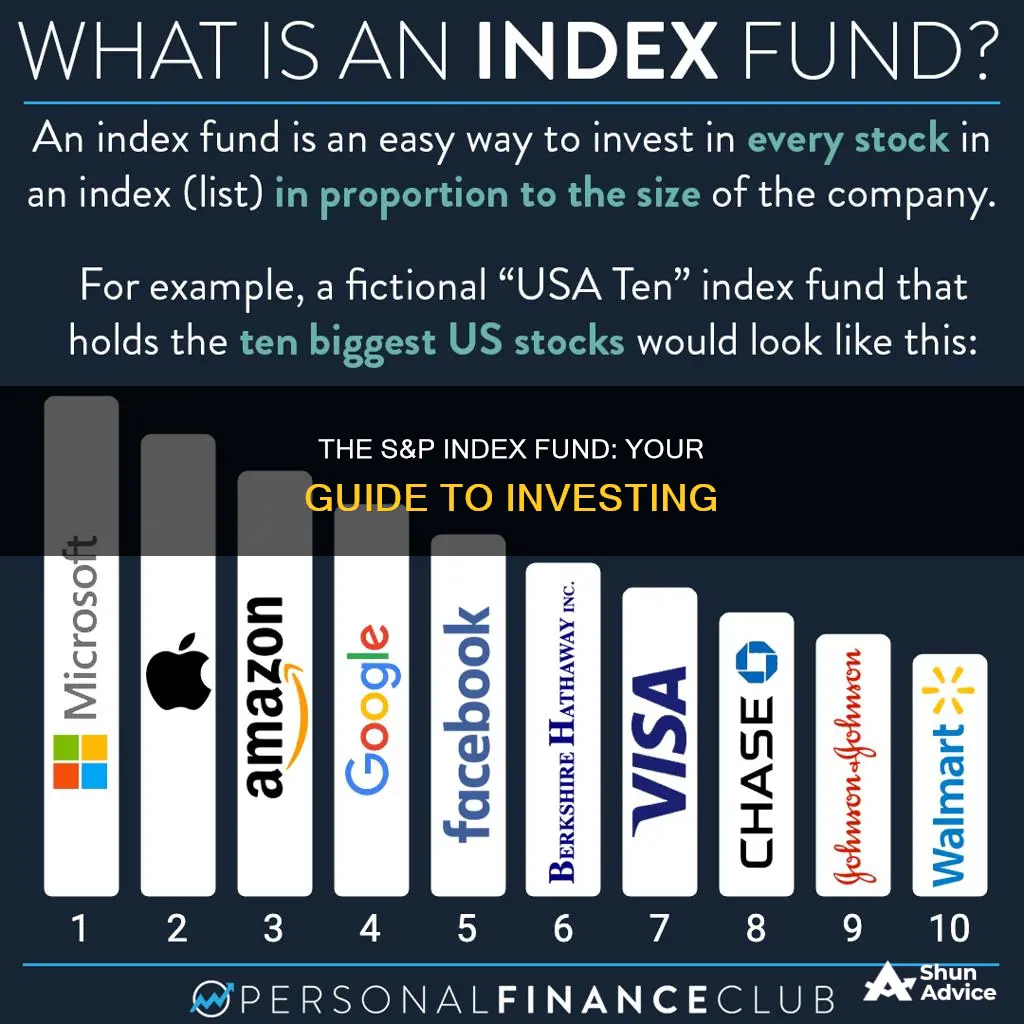

Index funds are a type of investment that aims to match the performance of a specific market index, like the S&P 500. They are a basket of securities set up to mirror the performance of a market index. This means it's a way to invest in a broad range of stocks or bonds with just one fund, often at a lower cost.

Index funds can be purchased in almost every investment account type, such as a brokerage account, IRA, health savings account (HSA), or 401(k).

| Characteristics | Values |

|---|---|

| Index tracked | S&P 500 |

| Number of companies in the index | 500 |

| Type of fund | Mutual fund or exchange-traded fund (ETF) |

| Investment options | Individual stocks, index fund, or ETF |

| Diversification | High |

| Risk | Low |

| Cost | Low |

| Returns | Consistent long-term returns |

| Investment accounts | Brokerage account, individual retirement account (IRA), 401(k), 529 plan, UGMA/UTMA custodial account, Roth IRA, health savings account (HSA) |

| Investment goals | Retirement, education savings, health expenses, etc. |

| Index fund types | Broad market funds, sector funds, domestic funds, international funds, bond funds |

| Buying options | DIY, with active help from a financial professional, or through a broker |

| Investment amount | Depends on the fund; some funds have minimum investment amounts |

| Fund performance | Depends on the fund and the index it tracks |

What You'll Learn

Index funds vs individual stocks

Index funds and individual stocks are two distinct investment options with their own advantages and disadvantages. Here is a detailed comparison between the two:

Index Funds

Index funds are a type of investment fund that tracks the performance of a particular stock market index, such as the S&P 500. An index fund provides investors with a diversified portfolio of stocks that aims to match the returns of the underlying index. The S&P 500, for example, is composed of 500 large public U.S. companies, and investing in an S&P 500 index fund gives exposure to these companies without the need to purchase individual stocks.

Advantages of Index Funds:

- Instant Diversification: Index funds provide instant diversification by investing in a broad range of companies within the index. This reduces the risk associated with investing in individual stocks.

- Low Cost: Index funds generally have low expense ratios, making them a cost-effective option for investors.

- Passive Investment Strategy: Index funds are passively managed, meaning they require less active trading and research compared to individual stocks.

- Long-Term Returns: Historically, the S&P 500 index has provided consistent long-term returns, making it a reliable investment option.

Disadvantages of Index Funds:

- Limited Control: Investors have less control over the specific stocks they invest in since index funds are pre-selected.

- Underperformance: In some cases, index funds may underperform compared to individual stock investments, especially if a particular stock is outperforming the market.

- Management Fees: Index funds, especially actively managed ones, may have management fees that reduce overall returns.

Individual Stocks

Investing in individual stocks involves purchasing shares of a single company. This approach allows investors to focus their capital on specific companies they believe will perform well.

Advantages of Individual Stocks:

- Higher Potential Returns: Investing in individual stocks can lead to higher returns, especially if the company experiences significant growth.

- Commission-Free Options: There are commission-free trading options available for stock investments.

- Direct Ownership: Investing in individual stocks gives investors direct ownership and voting rights in the company.

Disadvantages of Individual Stocks:

- Higher Risk: Investing in individual stocks is riskier since the performance of the investment is tied to a single company.

- More Research Required: Picking winning stocks requires extensive research and monitoring of company performance.

- Time-Intensive: Following individual stocks and analyzing the market takes considerable time and effort.

Both index funds and individual stocks have their advantages and considerations. Index funds offer instant diversification, lower costs, and a passive investment strategy, making them suitable for investors seeking broad market exposure and long-term returns. On the other hand, individual stocks provide the potential for higher returns and direct ownership but come with higher risk and require more research and active management. Ultimately, the choice between index funds and individual stocks depends on an investor's risk tolerance, investment goals, and the amount of time they can dedicate to managing their portfolio.

Explore Mutual Funds for Your Defence Sector Investment

You may want to see also

Mutual funds vs ETFs

Mutual funds and exchange-traded funds (ETFs) are two popular investment options for those looking to diversify their portfolios. While both are professionally managed collections, or "baskets", of individual stocks or bonds, there are some key differences between the two.

Similarities between Mutual Funds and ETFs

Mutual funds and ETFs are similar in that they both offer exposure to a wide variety of asset classes and niche markets, providing more diversification than individual stocks or bonds. They are also both overseen by professional portfolio managers and are generally considered less risky than investing in individual stocks and bonds. Additionally, both mutual funds and ETFs can be used to gain exposure to the S&P 500, an index composed of about 500 leading U.S. companies.

Differences between Mutual Funds and ETFs

One of the main differences between mutual funds and ETFs is how they are traded. Mutual funds can only be purchased at the end of each trading day, based on a calculated price known as the net asset value (NAV). On the other hand, ETFs trade like stocks and can be bought and sold on a stock exchange throughout the day, resulting in price changes throughout the trading day. This means that the price at which you buy or sell an ETF may differ from the prices paid by other investors.

Another difference lies in the minimum investment requirements. ETFs do not require a minimum initial investment and can be purchased for the price of one share, which can range from as little as $50 to a few hundred dollars. In contrast, mutual funds typically have higher minimum investment requirements, often in the range of $500 to $5,000, and are purchased as flat dollar amounts rather than share prices.

Mutual funds and ETFs also differ in their management style. While both can be actively or passively managed, most ETFs are passively managed and track a market index or sector sub-index. Mutual funds, on the other hand, are usually actively managed, with fund managers making decisions about how to allocate assets. Actively managed funds tend to have higher fees and expense ratios due to their higher operations and trading costs.

Additionally, ETFs are often considered more tax-efficient than mutual funds. ETFs may generate fewer capital gains for investors due to their lower turnover and ability to use the in-kind creation/redemption process to manage the cost basis of their holdings. In contrast, a sale of securities within a mutual fund may trigger capital gains for shareholders, even if they have an unrealized loss on the overall investment.

Whether you choose to invest in mutual funds, ETFs, or a combination of both depends on your investment goals and preferences. If you value intraday trading, tax efficiency, and lower minimum investment requirements, then ETFs may be the better option. On the other hand, if you prefer the simplicity of buying and selling at the end of the trading day, the ability to set up automatic transactions, and the potential for higher returns offered by actively managed funds, then mutual funds may be more suitable.

A Guide to Investing in the 1517 Fund: Strategies and Benefits

You may want to see also

How to choose an S&P 500 index fund

When choosing an S&P 500 index fund, there are a few key criteria to keep in mind. Here are some factors to consider:

- Expense ratio: Index funds are passively managed, so the expense ratios (the fees you pay for the fund's upkeep) should be relatively low. Since all S&P 500 index funds perform similarly, the fees can make a significant difference in your returns. Look for funds with expense ratios of 0.10% or lower.

- Sales load: If you're investing in mutual funds, check if the fund manager charges a sales load or commission. This is less common with ETFs.

- Minimum investment: Different funds have different minimum investments for taxable accounts and IRAs. Ensure the fund you choose aligns with the amount you have available to invest and that you can purchase additional shares as needed. Some funds have no minimum investment, while others may require a minimum of $3,000 or more.

- Dividend yield: Investing in large-cap companies through an index fund may come with dividend perks. Compare the dividend yields between funds, as higher dividends can boost your returns.

- Inception date: If you prefer funds with a solid track record, consider the inception date. Older funds will show how they performed during bull and bear markets.

- Brokerage account: Choose a brokerage account that matches your investment goals and allows you to trade your desired fund without transaction fees. If you plan to buy an ETF, look for a broker that offers commission-free trades.

Remember, you only need one S&P 500 index fund in your portfolio, as they all aim to replicate the performance of the S&P 500 index. When in doubt, consider going with a low-cost fund like the Fidelity 500 Index Fund, Schwab S&P 500 Index Fund, or Vanguard 500 Index Admiral Fund, all of which have low expense ratios.

Maximizing Scholarship Funds: Investment Strategies for Students

You may want to see also

How to invest in the S&P 500

The S&P 500 is an index that tracks the performance of the 500 largest publicly traded companies listed on the US stock market. It is widely recognised as a proxy for the overall health of the US stock market.

You can't invest directly in the S&P 500 index itself, but there are a few ways to gain exposure to the index:

- Buying individual stocks: You can buy stocks in the companies that are included in the S&P 500. However, this approach does not provide the same level of diversification as other methods and requires more research and understanding of individual companies.

- Investing in an S&P 500 index fund: You can invest in a mutual fund or exchange-traded fund (ETF) that tracks the performance of the S&P 500. This option provides instant diversification and is generally considered less risky than purchasing individual stocks directly. Index funds can be purchased through a brokerage account, IRA, or 401(k).

- Trading S&P 500 futures: You can invest in S&P 500 futures, which are indirect investments in the index's performance. Investors can take long or short positions based on their expectations of future results.

Factors to Consider when Choosing an S&P 500 Investment

When deciding how to invest in the S&P 500, there are several factors to consider:

- Investment goals: Determine your investment goals and choose an account type that aligns with those goals. For example, if you are saving for retirement, you may choose a different account than if you are saving for your child's education.

- Risk tolerance: Consider your risk tolerance and choose investments that match your comfort level. The S&P 500 is considered less risky than investing in individual stocks due to its diversification, but there are still risks associated with market volatility.

- Fees and expenses: Compare the fees and expenses associated with different investment options, such as expense ratios, trading costs, and investment minimums. These can vary significantly between different funds and brokers.

- Diversification: The S&P 500 consists of large-cap US stocks, so investing in this index alone may not provide adequate diversification for your portfolio. Consider including other types of investments, such as mid- and small-cap companies, international companies, bonds, and cash.

- Investment horizon: If you are investing for the long term, short-term market volatility is less of a concern. Focus on finding investments that align with your long-term goals and avoid trying to time the market.

Gold Fund Investment: A Smart and Secure Financial Move

You may want to see also

Pros and cons of investing in the S&P 500

Investing in the S&P 500 can be an attractive option for both seasoned investors and beginners. As one of the most renowned stock market indices globally, the S&P 500 offers exposure to a broad range of leading companies across various industries. Here are some of the pros and cons of investing in the S&P 500:

Pros of Investing in the S&P 500

- Diversification: The S&P 500 provides instant diversification by encompassing 500 large-cap U.S. stocks from various sectors, reducing the risk associated with investing in individual stocks.

- Long-Term Growth: Historically, the S&P 500 has shown strong long-term growth potential, outperforming many other investment options. While short-term fluctuations may occur, the underlying trend has been upward due to the growth of the U.S. economy.

- Accessibility: The S&P 500 is accessible to a wide range of investors through index funds, exchange-traded funds (ETFs), or mutual funds, making it suitable for both individual investors and those with limited investment knowledge.

- Professional Management: The S&P 500 is managed by a committee that ensures the index accurately represents the U.S. large-cap stock market. This provides investors with confidence in the index's composition.

Cons of Investing in the S&P 500

- Market Volatility: While the S&P 500 has shown long-term growth, it is susceptible to market volatility and can experience significant declines during downturns.

- Lack of Individual Stock Selection: Investing in the S&P 500 means giving up control over individual stock selection, potentially missing out on gains from stocks that outperform the broader market.

- Concentration in U.S. Stocks: The S&P 500 is heavily weighted towards U.S.-based companies, resulting in limited exposure to international markets and reducing the diversification benefits of global investments.

- Inclusion of Underperforming Stocks: Despite periodic reviews by the committee, there may be instances where underperforming stocks remain in the index for a period, impacting overall performance.

Venture Capital Funds: Smart Investment for Future Growth

You may want to see also

Frequently asked questions

The S&P 500 is an index composed of 500 of the largest publicly traded companies in the US. It is widely used as a proxy for the overall health of the US stock market.

You can't invest directly in the S&P 500. However, you can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF.

An index fund is a basket of securities set up to mirror the performance of a market index. ETFs are generally more liquid, trading throughout the day like stocks on the exchange; you can only buy or sell index funds at one point in the day, after other trading has ended.

Pros

- The S&P 500 is considered an essential benchmark for the US stock market.

- It captures the pulse of the US economy, representing over 500 of the largest US companies.

Cons

- It omits the majority of SMEs that comprise the majority of the US economy.

- There is a disproportionate weighing on the side of larger companies.

Some popular S&P 500 index funds and ETFs include:

- Fidelity ZERO Large Cap Index

- Vanguard S&P 500 ETF

- SPDR S&P 500 ETF Trust

- iShares Core S&P 500 ETF

- Schwab S&P 500 Index Fund