Amanah Saham Bumiputera (ASB) is a unit trust fund with a fixed price of RM1 per unit. It was launched in 1990 and is one of the best-performing funds under Amanah Saham Nasional Berhad (ASNB), a subsidiary of Permodalan Nasional Berhad (PNB). Each eligible investor can invest up to a maximum of 200,000 units. ASB provides an opportunity for Bumiputera citizens in Malaysia to save and invest with a relatively low risk and long-term investment instrument, offering consistent and competitive returns. While ASB is only available to Bumiputera citizens, non-Bumiputera citizens can invest in Amanah Saham Malaysia (ASM), which has a similar low-risk investment strategy. In this article, we will discuss how to invest in ASB using the Employees Provident Fund (EPF) and explore the benefits and considerations of this investment option.

| Characteristics | Values |

|---|---|

| Investment type | Unit trust fund |

| Unit price | RM1 per unit |

| Maximum investment | 200,000 units |

| Upfront fees | 0% |

| Annual management fee | 0.35% |

| Withdrawal options | RM500 a month online, or in-person for larger amounts |

| Overdraft facility | Yes |

| Investment options for those with no funds | Yes |

| EPF funds investment | Not possible |

What You'll Learn

EPF Members' Investment Scheme

The EPF Members Investment Scheme (MIS) allows Employees Provident Fund (EPF) members to diversify their retirement savings by investing a portion of their savings. Under the scheme, members can transfer up to 30% of their excess savings in Account 1 for investments via appointed Fund Management Institutions (FMIs), including Unit Trust Management Companies and Asset Management Companies.

To be eligible for the scheme, members must be below 55 years of age, have sufficient savings with the EPF, and be either Malaysians, Permanent Residents, or Non-Malaysians registered as EPF members before 1 August 1998.

Applications for the EPF Members Investment Scheme can be made through an FMI's agent, counter, or the i-Akaun (Member) platform. It's important to note that applications cannot be revoked once submitted, and all investment risks are assumed by the members. The amount invested under this scheme is not entitled to EPF's annual dividend, and members below 55 years old cannot make additional investments using their own funds.

One of the key benefits of the EPF Members Investment Scheme is the reduction of upfront fees charged by FMIs. Effective 1 May 2020, EPF members investing under MIS were entitled to a 12-month fee reduction, ending 30 April 2021. During this period, no upfront fees were imposed by FMIs for investments transacted through i-Invest via EPF i-Akaun, while the upfront fee for investments made through agents was reduced from a maximum of 3% to 1.5%.

The i-Invest platform is an online, self-service tool that facilitates investments through the EPF Member Investment Scheme in approved unit trust funds. It provides various comparison tools and information to assist members in making informed investment decisions. Members can enjoy the convenience of lower fees, efficient execution of investment decisions, and greater functionality through the i-Invest platform.

Overall, the EPF Members Investment Scheme offers EPF members the flexibility to diversify their retirement savings and enhance their financial future by investing through appointed FMIs.

Cash Dividends: Investing Activity or Not?

You may want to see also

EPF i-Invest platform

The EPF i-Invest platform is a self-service online platform that allows eligible members to invest in unit trust funds offered by EPF-approved Fund Management Institutions (FMIs). The platform is accessible through the i-Akaun (Member) portal.

EPF members below 55 years old can fund their investments directly from their savings under Account 1, with a sales charge ranging from 0% to 0.5% of the transaction amount. Members can transfer up to 30% of the amount in excess of their Basic Savings in Account 1 to be invested in approved funds.

To start investing through the EPF i-Invest platform, follow these steps:

- Log in to your EPF i-Akaun.

- Select 'Investment' on the menu bar.

- On the buy screen, select your preferred FMI and choose your fund(s). The minimum amount to start investing is RM1,000.

- Complete your transaction.

It is important to note that members are advised to exercise caution when making investment decisions and are encouraged to seek professional advice if needed.

Cash Reserves: Smart Investment Strategy or Missed Opportunities?

You may want to see also

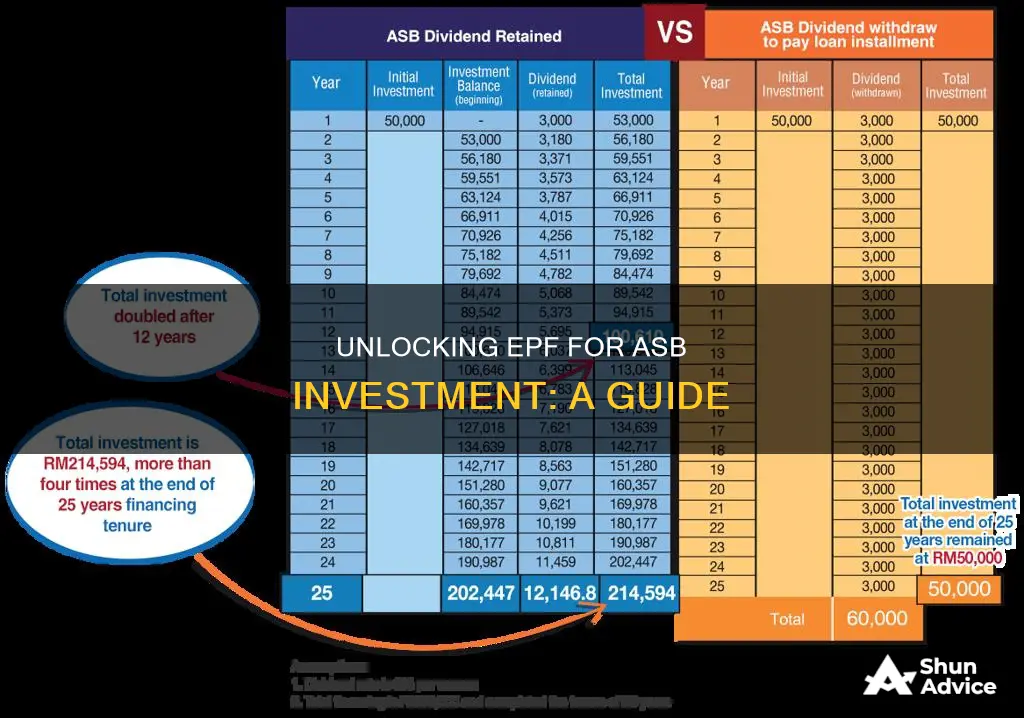

ASB loans

With an ASB loan, you can borrow up to RM200,000 to invest in ASB right away, allowing you to leverage your savings to generate larger profits. If you are confident in your ability to consistently repay your ASB loan, it can be an attractive option to get started with investing. In the best-case scenario, you may only need to make loan payments for the first year if your loan repayments are less than your annual returns. Subsequently, you can let the ASB returns from the following years pay off the loan while also earning some extra returns.

It is important to carefully consider your financial situation and ability to service the loan before taking out an ASB loan. While it can provide an opportunity to boost your investments, it is crucial to ensure that you can manage the repayments comfortably.

Investing Excess Cash: Strategies for Smart Financial Planning

You may want to see also

ASB2

- No initiation fee: There is no cost to join.

- Low management fees: The annual management fee is only 0.35%, significantly lower than other equity unit trust funds.

- Easy withdrawal: Investors can easily withdraw their funds both online and in person.

- Overdraft facility: ASB2 shares can be used as collateral to apply for an overdraft facility.

- Investment options for those with no funds: ASNB provides options for those who want to invest but don't have the funds to start.

One such option is the EPF Members' Investment Scheme, which allows Employees Provident Fund (EPF) members to invest up to 30% of their excess savings in Account 1. Through the EPF i-Invest platform or by visiting an ASNB branch or agent, individuals can invest in ASB2 and other funds.

Another option is the Salary Deduction Scheme, where investors can automatically deduct a portion of their monthly salary to invest in ASB2. This scheme is available for unitholders in both the public and private sectors, with different application processes for each.

Cash App Investing: A Guide to Getting Started

You may want to see also

ASM

Amanah Saham Malaysia (ASM) is a unit trust fund open to all Malaysians. It is managed by Amanah Saham Nasional Bhd (ASNB), a subsidiary of Permodalan Nasional Bhd (PNB).

To invest in ASM, you will need to register for an ASNB account by visiting an ASNB branch or agent. You can then make subsequent investments online through your bank's online banking app or the myASNB portal.

The EPF Members' Investment Scheme allows Employees Provident Fund (EPF) members to invest up to 30% of their excess savings in Account 1. You can invest online through the EPF i-Invest platform or by visiting an ASNB branch or agent.

While you can't use your EPF funds to invest in ASM, you can invest in other funds offered by ASNB, such as ASB2, ASB3 Didik, ASM3, and ASM2 Wawasan.

Understanding Owner Cash Investments: Reporting and Strategies

You may want to see also

Frequently asked questions

Amanah Saham Bumiputera (ASB) is a unit trust fund with a fixed price of RM1 per unit. It was launched in 1990 to help Bumiputera citizens in Malaysia save and invest with relatively low risk and long-term investment instruments. Advantages of investing in ASB include no upfront fees, low management fees, consistent returns, and quick withdrawal.

The Employees Provident Fund (EPF) is a comprehensive investment fund established in 1951 to help Malaysians save for their retirement. It offers various benefits such as annual dividends, multiple withdrawal options, and tax exemptions on returns. EPF members can also invest in other funds, including Amanah Saham Bumiputera 2 (ASB2).

You can use the EPF Members' Investment Scheme to invest up to 30% of your excess savings in Account 1. The EPF i-Invest platform allows you to invest online, or you can visit an ASNB branch or agent (excluding Pos Malaysia and Maybank). Note that you cannot use EPF funds to invest directly in ASB, but you can invest in ASB2 and other approved funds.

ASB is limited to Bumiputera citizens in Malaysia, with a maximum investment of 200,000 units per investor. Non-Bumiputera citizens of specific descent or Muslim converts may also be eligible. EPF, on the other hand, is available to employed individuals, self-employed Malaysian citizens, and business owners employing Malaysian and non-Malaysian residents.