Investing in foreign securities can be a powerful way to diversify your portfolio and tap into global markets, but it requires careful consideration and research. This guide will provide an overview of the key steps and considerations for investors looking to venture into international markets. From understanding the regulatory environment and currency fluctuations to assessing risk and selecting the right investment vehicles, this article will offer valuable insights to help you navigate the complexities of investing in foreign securities.

What You'll Learn

- Regulations and Compliance: Understand foreign investment laws and tax implications

- Market Research: Analyze global economic trends and political stability

- Diversification Strategies: Spread investments across regions and asset classes

- Currency Risk Management: Protect against exchange rate fluctuations

- Local Brokerage Platforms: Identify and use reputable international trading platforms

Regulations and Compliance: Understand foreign investment laws and tax implications

When considering investing in foreign securities, it's crucial to navigate the complex web of regulations and tax implications that come into play. Each country has its own set of laws and rules governing foreign investments, and understanding these is essential to ensure compliance and avoid potential pitfalls.

One of the primary considerations is the legal framework within which foreign investments operate. Many countries have specific legislation that outlines the rules for foreign investors, including restrictions on ownership, reporting requirements, and the types of investments that are permitted. For instance, some nations may have restrictions on foreign ownership of certain industries, such as real estate or banking, while others might require foreign investors to register with local authorities and provide detailed financial information. It is imperative to research and understand these laws to ensure that your investment strategy adheres to the legal requirements of the country in which you are investing.

Taxation is another critical aspect that investors must grasp. Foreign investments can trigger various tax considerations, including withholding taxes, capital gains taxes, and tax treaties. Withholding taxes are often applied to dividends, interest, and other income generated from foreign securities, and these rates can vary significantly between countries. Capital gains taxes may also apply when selling foreign investments, and the tax treatment can differ based on the holding period and the investor's tax residency. Additionally, tax treaties between countries can provide relief by preventing double taxation and establishing clear guidelines for tax obligations. Investors should consult tax professionals to understand their tax liabilities and explore strategies to optimize their tax position.

Furthermore, investors should be aware of the reporting requirements associated with foreign investments. Some countries mandate regular reporting, such as annual filings or periodic updates, to local financial authorities. These reports may include details about the investment, its performance, and any changes in ownership. Non-compliance with reporting obligations can result in penalties and legal consequences, so it is essential to stay informed and meet these requirements.

In summary, investing in foreign securities requires a thorough understanding of the regulatory environment and tax implications. Investors must research and comply with foreign investment laws, which can vary widely, and be mindful of the tax obligations associated with their investments. Seeking professional advice from legal and tax experts can provide valuable guidance in navigating these complexities and ensuring a successful foreign investment strategy.

Pension Plans: Cash, Investments, and Your Retirement Future

You may want to see also

Market Research: Analyze global economic trends and political stability

When considering how to invest in foreign securities, a comprehensive market research process is essential to navigate the complexities of global markets. This involves a deep dive into both economic trends and political stability, which are key factors influencing investment decisions. Here's a structured approach to guide your analysis:

Economic Trends:

- Global Economic Indicators: Start by examining leading economic indicators on a global scale. This includes tracking GDP growth rates, inflation rates, and interest rates set by major central banks. For instance, the Federal Reserve's decisions in the United States can significantly impact global markets. Understanding these trends helps investors anticipate shifts in market sentiment and adjust their investment strategies accordingly.

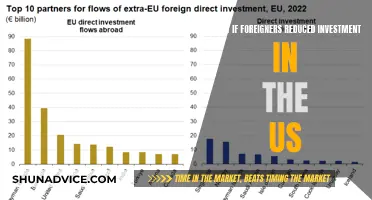

- Trade and Financial Flows: Analyze international trade patterns and financial flows. Identify which countries are major exporters and importers, and how these trade relationships impact their economies. For example, a country heavily reliant on exports might experience economic fluctuations based on global demand and trade policies.

- Market Volatility: Assess the volatility of various markets. Some economies might be more stable and less prone to sudden shifts, while others could present higher risks but also potential rewards. This analysis is crucial for risk management and determining the appropriate allocation of funds across different countries.

Political Stability:

- Government Policies and Regulations: Research the political landscape of the countries you're interested in. Understand the regulatory environment, including tax policies, foreign investment regulations, and any trade barriers. Favorable policies can attract investors, while restrictive ones might deter them.

- Political Risk Assessment: Evaluate the political risk associated with each country. This includes assessing the likelihood of political instability, changes in government, or policy shifts that could impact businesses and investments. Tools like political risk ratings and country risk assessments can provide valuable insights.

- International Relations: Consider the geopolitical relationships between countries. Tensions or alliances can influence trade agreements, investment flows, and market sentiment. For instance, trade wars or diplomatic breakthroughs can have far-reaching effects on global markets.

Combining Economic and Political Analysis:

- Risk-Adjusted Returns: Integrate both economic and political data to assess the potential returns on foreign investments while considering the associated risks. This holistic approach allows investors to make informed decisions, especially when comparing investment opportunities across different nations.

- Diversification: Market research should also focus on diversifying your portfolio across various regions. This strategy mitigates country-specific risks and provides a more balanced approach to investing in foreign securities.

- Long-Term Perspective: Remember that global markets are interconnected, and short-term fluctuations often have long-term implications. A long-term investment strategy, supported by thorough market research, can help navigate the complexities of international investing.

Robinhood App: A Beginner's Guide to Investing

You may want to see also

Diversification Strategies: Spread investments across regions and asset classes

Diversification is a key strategy for investors looking to spread their risk and maximize returns. When it comes to investing in foreign securities, diversification across regions and asset classes is essential. Here's a breakdown of how to approach this:

Geographical Diversification:

Investing globally allows you to tap into different markets and economic environments. Here's how to diversify by region:

- Developed Markets: These countries (e.g., USA, Japan, Western Europe) typically offer stable economies, strong legal frameworks, and established financial markets. They provide a solid foundation for your portfolio but may offer lower potential returns compared to emerging markets.

- Emerging Markets: These countries (e.g., Brazil, India, South Africa) are experiencing rapid economic growth, but come with higher risk due to political instability, less developed financial systems, and potential currency fluctuations.

- Frontier Markets: These are less developed economies with potential for high growth but even greater risk. They often have limited market liquidity and higher transaction costs.

Asset Class Diversification:

Diversifying across different asset classes is crucial to managing risk. Here's a breakdown:

- Stocks: Invest in individual companies across various sectors and industries. This provides exposure to different parts of the economy.

- Bonds: Government, corporate, and municipal bonds offer diversification through fixed income investments. Bonds generally provide lower risk than stocks but lower potential returns.

- Real Estate: Consider investing in real estate investment trusts (REITs) or direct property investments. Real estate can offer diversification and potential income through rental yields or capital appreciation.

- Commodities: Invest in physical commodities like gold, silver, oil, or agricultural products. This adds a different risk-return dimension to your portfolio.

Combining Geographical and Asset Class Diversification:

The ideal approach is to combine both strategies for optimal diversification:

- Global Stock Portfolios: Invest in a mix of developed and emerging market stocks across various sectors.

- International Bond Funds: Diversify your fixed-income investments by including global bond funds that hold government and corporate bonds from different countries.

- Real Estate ETFs: Consider exchange-traded funds (ETFs) that track global real estate indices, providing exposure to properties worldwide.

- Commodity Futures: Include a small allocation to commodity futures to capture the performance of physical commodities.

Important Considerations:

- Risk Tolerance: Assess your risk tolerance and investment goals. More aggressive investors might tolerate higher risk for potentially higher returns, while conservative investors may prefer a more balanced approach.

- Fees and Costs: Be mindful of the fees associated with international investments, including transaction costs, currency conversion fees, and management fees.

- Tax Implications: Understand the tax consequences of investing in foreign securities in your jurisdiction.

Remember, diversification doesn't guarantee profit or protect against losses in a declining market. However, it can help smooth out returns over the long term and reduce the impact of any single investment's performance.

Stash App: Investing Made Easy for Beginners

You may want to see also

Currency Risk Management: Protect against exchange rate fluctuations

Currency risk is an inherent challenge when investing in foreign securities, as exchange rates can significantly impact the value of your investments. This risk arises from the volatility of currencies, which can fluctuate based on various economic and geopolitical factors. To effectively manage this risk, investors should employ several strategies to safeguard their portfolios.

One common approach is to invest in currency-hedged securities. These are financial instruments where the returns are protected against currency fluctuations. For instance, investors can opt for exchange-traded funds (ETFs) or mutual funds that are specifically designed to track a foreign market but are denominated in a stable currency, often the US dollar. By doing so, investors can benefit from the growth of the foreign market without the added complexity of currency conversion and potential losses.

Another strategy is to use currency derivatives, such as currency forwards or options. These financial instruments allow investors to lock in an exchange rate for a future transaction, thereby protecting themselves against adverse currency movements. For example, if an investor is planning to invest in a foreign company's stock, they can enter into a currency forward contract to fix the exchange rate for the purchase, ensuring that the investment's value remains stable in their home currency.

Diversification is also a powerful tool for managing currency risk. By spreading investments across multiple countries and currencies, investors can reduce the impact of any single currency's volatility. A well-diversified portfolio can provide a more stable return, even if some investments are affected by currency fluctuations. This approach requires careful research and selection of securities to ensure a balanced and robust portfolio.

Additionally, investors should stay informed about global economic trends and geopolitical events that can influence currency values. Regularly monitoring these factors can help investors anticipate potential currency shifts and make informed decisions. Staying updated on economic calendars and following reputable financial news sources can provide valuable insights to navigate the dynamic world of international investing.

In summary, managing currency risk is crucial for investors looking to venture into the realm of foreign securities. By utilizing currency-hedged securities, derivatives, diversification, and staying informed, investors can effectively protect their portfolios from the challenges posed by exchange rate fluctuations. These strategies empower investors to make confident decisions, ensuring their investments remain resilient in a complex and ever-changing global market.

Smart Ways to Invest Your Extra Cash

You may want to see also

Local Brokerage Platforms: Identify and use reputable international trading platforms

When it comes to investing in foreign securities, utilizing local brokerage platforms that offer access to international markets can be a strategic choice. These platforms provide a gateway to a global investment landscape, allowing investors to diversify their portfolios and potentially benefit from various economic regions. Here's a guide on how to identify and make the most of reputable international trading platforms:

Research and Selection: Begin by researching local brokerage firms that specialize in international trading. Look for companies with a strong reputation and a proven track record in the industry. Check their website for details on the markets they cover, the types of securities they offer, and any associated fees or commissions. Reputable platforms often provide comprehensive information to ensure investors can make informed decisions. Consider factors such as regulatory compliance, security measures, and customer support to ensure a safe and reliable trading environment.

Platform Features and Tools: Evaluate the platform's features and tools to ensure they meet your investment needs. Look for platforms that offer a user-friendly interface, real-time market data, advanced charting capabilities, and a range of order types. Some platforms may provide additional resources such as research reports, news feeds, or educational materials to assist investors in making informed choices. A well-equipped platform can enhance your trading experience and provide valuable insights to navigate the global market.

Security and Regulatory Compliance: International trading involves dealing with different legal and regulatory frameworks. Ensure that the local brokerage platform complies with the relevant securities regulations in your country and the countries of the securities you intend to invest in. Robust security measures, such as encryption and two-factor authentication, are essential to protect your personal and financial information. Additionally, check for platforms that offer secure fund transfers and have a strong reputation for safeguarding client assets.

Customer Support and Education: Reliable customer support is crucial when trading internationally. Choose platforms that offer responsive and knowledgeable support teams to assist with any queries or issues. Look for platforms that provide educational resources, such as webinars, tutorials, or market analysis, to help investors understand the dynamics of foreign markets. Educated investors can make more confident decisions and adapt to the unique characteristics of international trading.

Diversification and Risk Management: When investing in foreign securities, diversification is key to managing risk. Local brokerage platforms can help you build a well-diversified portfolio by offering access to various markets and asset classes. Consider investing in a range of securities, including stocks, bonds, and ETFs, across different countries and sectors. Regularly review and rebalance your portfolio to ensure it aligns with your investment goals and risk tolerance.

By utilizing local brokerage platforms that facilitate international trading, investors can gain exposure to global markets, diversify their portfolios, and potentially benefit from economic growth in various regions. Remember to conduct thorough research, compare platforms, and seek professional advice when needed to make informed investment decisions in the international securities market.

Understanding Unrestricted Cash and Investments: Definition and Details

You may want to see also

Frequently asked questions

Before you begin, it's crucial to educate yourself about the global financial markets and the specific country or region you're interested in. Research and understand the economic, political, and regulatory environment of the foreign market you want to invest in. This knowledge will help you make informed decisions and manage potential risks.

Selecting a reputable and experienced brokerage firm is essential for a smooth investment process. Look for firms that offer a wide range of international investment options, including stocks, bonds, and mutual funds from various countries. Ensure they provide access to global markets, competitive fees, and excellent customer support. Many online brokers now offer services for international investing, making it more accessible to individual investors.

Yes, tax laws can vary significantly between countries, and investing in foreign securities may have different tax implications. It's important to understand the tax treaties and regulations in both your home country and the country of the investment. Consult with a tax professional or financial advisor who specializes in international investments to ensure you comply with tax laws and take advantage of any available tax benefits or deductions.

Investing in foreign securities carries several risks that you should be aware of. These include political risks, such as changes in government policies or economic instability; currency risks, as exchange rate fluctuations can impact the value of your investments; and market risks, which are similar to those in domestic markets but may be amplified due to less liquidity or higher volatility. Diversification is key to managing these risks, so consider spreading your investments across different countries and asset classes.