Franklin India Prima Fund is an open-ended mid-cap equity scheme that falls under the Franklin Templeton Mutual Fund House. It was launched on December 1, 1993, and has a suggested investment horizon of more than 3 years. The fund has a very high-risk rating and is suitable for investors who are willing to invest for at least 3-4 years and are seeking high returns while also being prepared for potential moderate losses. The fund's investment objective is to provide medium to long-term capital appreciation, with a focus on investing in medium-sized companies. The minimum investment required is ₹5000, with a minimum additional investment of ₹1000 and a minimum SIP investment of ₹500. The fund can be purchased directly from the Franklin Templeton Mutual Fund website or through platforms like MF Central and MF Utility.

What You'll Learn

Where to buy the fund

Franklin India Prima Fund can be purchased directly from the website of the fund house, Franklin Templeton Mutual Fund. You can also buy mutual funds through platforms like MF Central and MF Utility, among others. If you are uncomfortable buying mutual funds online, you can seek help from a mutual fund distributor. Most banks also act as mutual fund distributors, so you can connect with your bank for assistance.

Smart Mutual Fund Investments with 10 Lakhs

You may want to see also

Investment objective

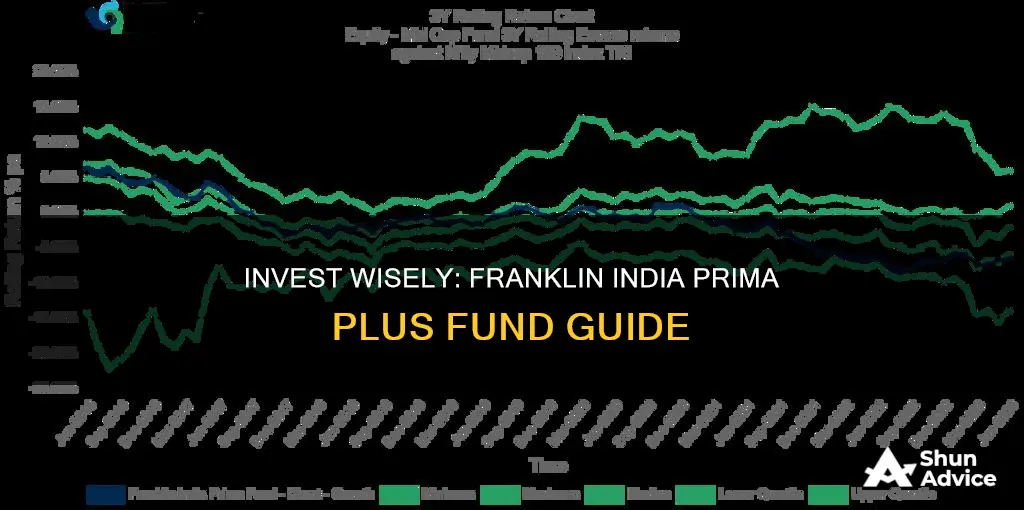

Franklin India Prima Fund is an open-ended mid-cap equity scheme that offers medium to long-term capital appreciation as its primary objective and income as its secondary objective. It is benchmarked against the NIFTY Midcap 150 Total Return Index.

The fund has a very high risk category, according to SEBI's Riskometer. It is suitable for investors who are looking to invest money for at least 3-4 years and are seeking high returns. These investors should also be prepared for the possibility of moderate losses in their investments.

The fund has a minimum investment of Rs 5000, with a minimum additional investment of Rs 1000 and a minimum SIP investment of Rs 500. It has an exit load of 1% if redeemed within 1 year. The fund's expense ratio is 1.76%, which is higher than the category average of 1.34%.

The asset allocation of the fund comprises around 96.84% in equities, 0.0% in debts, and 3.16% in cash and cash equivalents. The fund largely follows a growth-oriented style of investing and invests across market capitalisations. As of 31-Jul-2024, the fund had invested 96.84% in Equity and 3.16% in Cash & Cash Eq.

Best Vanguard Funds for Your Taxable Investment Portfolio

You may want to see also

Capital gains taxation

If you sell your mutual fund units in the Franklin India Prima Fund within one year of the date of investment, short-term capital gains tax will be applied, and the entire amount of gain is taxed at a rate of 20%. If you sell your mutual fund units after one year, long-term capital gains tax will be applied. For long-term capital gains, gains up to Rs 1.25 lakh in a financial year are exempt from tax, while gains over Rs 1.25 lakh are taxed at a rate of 12.5%.

Dividends are added to the income of the investors and taxed according to their respective tax slabs. If an investor's dividend income exceeds Rs. 5,000 in a financial year, the fund house also deducts a TDS of 10% before distributing the dividend.

How Investments Increase Loanable Funds for Businesses

You may want to see also

Risk analysis

Market Risk

The fund primarily invests in medium-sized companies, which tend to be more vulnerable to stock price fluctuations. When stock prices fall, these funds can experience more significant drops compared to those investing in larger companies. Therefore, investors should be prepared for severe ups and downs during their investment journey.

Time Horizon

Franklin India Prima Fund is suitable for investors with a long-term investment horizon. The fund managers advise investing for at least seven years to achieve gains that beat the inflation rate and returns from fixed-income options. Withdrawing investments before this period may result in losses.

Investment Risk

As an equity fund, Franklin India Prima Fund carries a higher risk than fixed-income investments. Investors should be aware that there is a possibility of losing their entire investment if the mutual fund units are sold within a year of purchase. Even after holding the units for a year, gains above a certain threshold are taxed at a rate of 12.5%.

Dividend Risk

Dividends are taxed according to the investor's income tax slab. Additionally, if an investor's dividend income exceeds ₹5,000 in a financial year, the fund house deducts a TDS of 10% before distributing the dividend.

Performance Risk

While the fund has delivered 19.97% returns since its inception, its recent performance has been average compared to its peers. The fund's standard deviation and beta values indicate higher volatility and less predictable performance. The Sharpe and Treynor ratios also suggest poor risk-adjusted returns, meaning the fund has taken on more risk for the returns generated.

Portfolio Risk

The fund has a significant investment in mid-cap stocks, which are generally riskier than large-cap stocks. The portfolio's high exposure to mid-cap and small-cap stocks increases the overall risk of the fund.

In conclusion, the Franklin India Prima Fund carries a very high risk, as indicated by SEBI's Riskometer. Investors should carefully consider their risk tolerance and investment goals before investing in this fund. While it offers the potential for high returns, it also comes with the possibility of moderate to significant losses.

ETFs: Diversified, Low-Cost, and Easy to Trade

You may want to see also

Investment time horizon

The Franklin India Prima Fund is an open-ended mid-cap equity scheme that has been in operation since December 1993. It is a high-risk fund that primarily focuses on medium to long-term capital appreciation, with income as a secondary objective.

When considering investing in the Franklin India Prima Fund, it is important to evaluate your investment time horizon. This fund is designed for investors who are willing to commit their capital for a minimum of 3-4 years. The suggested investment horizon is greater than 3 years, as this helps to reduce the downside risk and makes the returns more predictable.

Investing in mid-cap funds like the Franklin India Prima Fund carries a higher risk compared to larger companies. These funds tend to experience more significant fluctuations when stock prices fall. Therefore, investors should be prepared for more severe ups and downs during their investment journey.

Additionally, it is crucial to note that this fund carries a warning regarding its redemption policy. Investors are advised against investing in this fund if they anticipate needing to redeem their investment within a time frame of fewer than seven years.

In summary, the Franklin India Prima Fund is suitable for investors with a long-term investment horizon, typically greater than 3-4 years. It is important to be aware of the higher risk and volatility associated with mid-cap funds and to ensure that you are comfortable with the potential for moderate losses during your investment journey.

HOA Fund Investment Strategies: A Guide to Smart Investing

You may want to see also

Frequently asked questions

Franklin India Prima Fund is an open-ended mid-cap equity scheme that aims to provide medium to long-term capital appreciation as a primary objective and income as a secondary objective.

You can buy mutual funds directly from the website of the fund house. For example, Franklin India Prima Fund can be purchased from the website of Franklin Templeton Mutual Fund. You can also buy mutual funds through platforms like MF Central and MF Utility. If you are uncomfortable buying mutual funds online, you can seek help from a mutual fund distributor, such as a bank.

The minimum investment required is Rs. 5000, with a minimum additional investment of Rs. 1000 and a minimum SIP investment of Rs. 500.

The NAV of Franklin India Prima Fund as of 11th October 2024 was Rs. 2790.7656.

According to SEBI's Riskometer, investing in Franklin India Prima Fund is considered Very High risk. It is important to note that this fund invests in medium-sized companies, which tend to experience more severe ups and downs than funds that invest in larger companies.