Negative cash flow is when a company spends more money than it makes in a given period. This is common for new businesses, which often have high start-up costs and take time to generate sufficient income. Negative cash flow is not always a bad thing, as it may indicate that a company is investing in its future growth and profitability. However, if it continues long-term, a company will run out of funds.

Negative cash flow from investing activities specifically refers to when a company spends more on its investing activities than it receives from them. This could mean the company is acquiring other businesses, making strategic investments, or buying or improving fixed assets such as buildings, machinery, or technology.

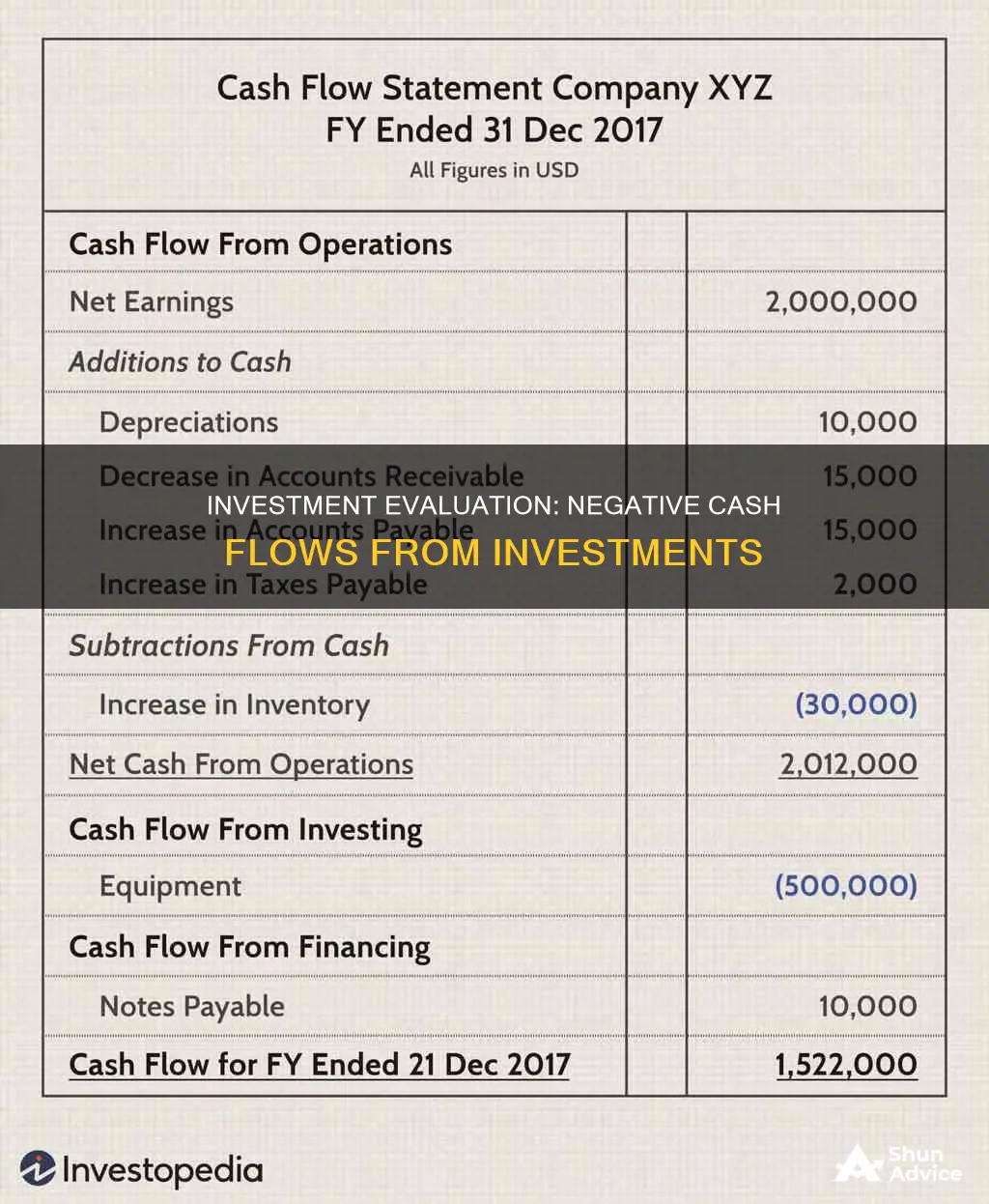

To evaluate whether negative cash flow from investing activities is positive or negative, investors should review the company's entire cash flow statement and financial situation.

| Characteristics | Values |

|---|---|

| Definition | When there is more cash leaving than entering a business |

| Common Occurrences | New businesses, young companies, temporary business setbacks, seasonal businesses |

| Causes | High startup costs, late customer payments, operational issues, high capital expenditures, low revenues |

| Effects | Inability to cover expenses, difficulty in reinvesting cash into the business, hindrance to business growth |

| Solutions | Negotiate payment terms, apply for small business loans, use business credit cards, reduce operating expenses, increase sales |

What You'll Learn

- Negative cash flow as a result of investment in long-term assets

- Negative cash flow as a result of poor timing of income and expenses

- Negative cash flow as a result of a company's expansion

- Negative cash flow as a result of a company's investment in fixed assets

- Negative cash flow as a result of a company's poor financial health

Negative cash flow as a result of investment in long-term assets

Negative cash flow from investing activities is not always a bad sign for a company. It can indicate that a company is investing in long-term assets that will contribute to its future growth.

Negative Cash Flow from Investing Activities

Negative cash flow from investing activities is when a company spends more cash on investments than it generates from them in a specific period. This is common for new businesses with high start-up costs and established businesses that are expanding.

Long-Term Assets

Long-term assets, also known as non-current assets, are expected to deliver value and benefits in the long run (usually over a year). They are highly illiquid, meaning they cannot be easily or quickly converted into cash. Examples include property, plant, and equipment (PP&E).

When Negative Cash Flow Is Positive

A company's negative cash flow from investing activities can be a positive sign when it indicates that management is investing in the long-term health of the company. This could mean investing in long-term fixed assets, research, or other long-term development activities that are important to the company's health and continued operations.

Evaluating Negative Cash Flow

To determine whether negative cash flow is positive or negative, investors should review the company's entire cash flow statement and particular situation in detail. It is important to analyse the company's phase of the corporate lifecycle, the cause of the negative cash flow, the type of capital investments being made, and the funding source.

Examples

Exxon Mobil's negative cash flow from investing activities was due to investing in property, plant, and equipment. This was a positive sign as it indicated the company was investing in its future growth.

Amazon's negative cash flow from investing activities was due to high capital expenditures and debt financing, which was used to reinvest profits in innovative products and expand its distribution network. This was also a positive sign as it attracted growth investors.

Strategizing Initial Investment: Deciding Your First Cash Flow

You may want to see also

Negative cash flow as a result of poor timing of income and expenses

Negative cash flow can sometimes be the result of poor timing of income and expenses. This can occur when a company's bills are due before a customer pays an invoice, resulting in a lack of cash on hand to cover expenses. This situation can be challenging for businesses, as it hinders their ability to reinvest cash into their operations and impedes their growth prospects.

To address this issue, businesses can negotiate payment terms with customers and vendors. For instance, shortening the number of days for customer payments and requesting longer payment terms from vendors can help improve cash flow. Additionally, businesses can explore options such as small business loans, credit cards, or financing through debt to manage their cash flow effectively.

It's important to note that negative cash flow is not uncommon, especially for new and growing businesses. However, if it persists over an extended period, it can be detrimental to a company's financial health and sustainability. Therefore, businesses should regularly monitor their cash flow patterns, make informed decisions about expenses and investments, and implement effective cash flow management strategies to ensure long-term success.

E*Trade Cash Balance Program: Investing Strategies for Beginners

You may want to see also

Negative cash flow as a result of a company's expansion

Negative cash flow is when there is more cash leaving a business than entering it. This is common among new businesses, which often have high start-up costs and take time to generate cash inflows that exceed investments. However, negative cash flow does not always imply a loss for a business.

A company's negative cash flow may be the result of its expansion. This is known as temporary negative cash flow. Once a business is established, healthy, and profitable, it may adopt an expansion strategy. This can involve increasing salaries, hiring new employees, providing dividend growth to shareholders, and incurring other overhead costs. These additional costs can lead to negative cash flow, but usually only for a short period.

It is important to distinguish between temporary negative cash flow and chronic negative cash flow. Temporary negative cash flow can be the result of a company's expansion, seasonal demands, or unforeseen market situations. On the other hand, chronic negative cash flow occurs when a company is constantly reporting negative cash flow due to overinvesting or losing money over time. This can lead to serious issues for the business, including unpaid bills and increased layoffs.

To determine whether a company's negative cash flow is a cause for concern, investors should review the company's cash flow statement and assess the company's lifecycle stage, the cause of the negative cash flow, the type of capital investments it is making, and the funding source.

Understanding Cash Flow from Sales of Investments

You may want to see also

Negative cash flow as a result of a company's investment in fixed assets

Negative cash flow is when a business has more outgoing money than incoming money. This means that expenses cannot be covered by sales alone, and the business must rely on money from financing and investments. Negative cash flow is common for new businesses, but it cannot be sustained long-term. Over time, a business with chronic negative cash flow will run out of funds if it cannot earn enough profit to cover expenses.

Younger companies are more likely to experience negative cash flow from assets due to their investment in fixed assets like land or equipment. This type of negative cash flow indicates that the company is putting more money into its long-term success than it is earning. However, this is not always a bad thing, as it could be a sign that the company is positioning itself for future growth.

For example, a company may invest in fixed assets such as property, plant, and equipment to grow its business. This will result in negative cash flow from investing activities in the short term, but it may help the company generate cash flow in the long term.

It's important to note that negative cash flow from investing activities does not always indicate poor financial health. It is often a sign that the company is investing in assets, research, or other long-term development activities that are crucial for the health and continued operations of the company.

Cash Allocation Strategies: Investing Your Money Wisely

You may want to see also

Negative cash flow as a result of a company's poor financial health

Negative cash flow is when more cash is leaving a business than entering it. While this is not always indicative of poor financial health, it can be a warning sign that a company's management is not efficiently using its assets to generate revenue.

Young companies often experience negative cash flow as they reinvest profits to finance growth. This can be a positive sign, as these reinvestments may accelerate revenue and increase margins in the future. However, if a company is constantly reporting negative cash flow, it may be a sign of overinvestment or losses, which can lead to serious issues such as unpaid bills and layoffs.

There are several reasons why a company may experience negative cash flow as a result of poor financial health. Firstly, the company may be facing cash flow issues, affecting its ability to pay suppliers on time. This can strain relationships with vendors and lead to a deterioration in the quality of goods or services provided. In some cases, vendors may even cut off the supply, disrupting the company's operations and damaging its reputation.

Another consequence of poor financial health is an increased reliance on expensive financing options. Businesses may resort to taking out loans or using credit lines to cover expenses, which often come with high-interest rates and fees. Over time, excessive debt can lead to financial instability and even insolvency.

Additionally, poor cash flow management can result in difficulty paying employees on time, leading to reduced morale, decreased productivity, and employee retention issues.

To address these issues, businesses must identify cash flow problems early on by regularly analysing financial statements, monitoring accounts receivable and payable, and utilising cash flow projections. Implementing strategies such as optimising the billing and invoicing process, negotiating better terms with vendors, and reducing unnecessary expenses can help improve cash flow and maintain financial stability.

Cash Advance Investment Strategies: A Guide to Getting Started

You may want to see also

Frequently asked questions

Investment is considered negative cash flow when a company spends more on its investing activities than it receives from them. In other words, when there is more cash leaving than entering a business. This can be due to a company's investment in long-term assets, such as property, equipment, or acquisitions.

Negative cash flow is a bad sign when it is chronic and long-term. A company that continuously experiences negative cash flow will eventually face serious issues, such as unpaid bills and increased layoffs.

Negative cash flow is not always a negative indicator. For young or growing companies, it is common to have temporary negative cash flow due to heavy investment in resources, which may offer high returns in the long term. It can also be a positive sign if a company is investing in its future growth and expects to generate higher returns in the future.