Investing in an IRA is a great way to save for retirement. IRAs are individual retirement accounts that offer tax advantages. There are two main types: traditional IRAs and Roth IRAs. Both types offer tax breaks, but in different ways. With a traditional IRA, you don't pay taxes on your contributions until you withdraw the money. On the other hand, with a Roth IRA, you've already paid taxes on your contributions, so you won't pay taxes when you withdraw the money in retirement.

When it comes to investing your IRA funds, there are a few things to consider. First, think about your risk tolerance and investment timeframe. If you're comfortable with risk and have a long investment horizon, you may want to allocate a larger portion of your portfolio to stocks. If you're closer to retirement or have a lower risk tolerance, you may want to adjust your allocation by investing in bonds and short-term investments.

You can invest in a variety of assets with your IRA, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and even alternative investments like futures contracts. It's important to diversify your portfolio to minimize risk. You can also choose to invest in a target-date fund or use a robo-advisor, which can help manage your investments for you.

Additionally, consider the fees associated with your investments, as these can impact your returns over time. By understanding your investment options and making informed decisions, you can effectively invest your IRA funds for the future.

| Characteristics | Values |

|---|---|

| Types of IRA | Traditional IRA, Roth IRA |

| Tax advantages | Yes |

| Age limit | No |

| Early withdrawal | Possible, but may incur taxes and fees |

| Investment options | Individual stocks, mutual funds, exchange-traded funds (ETFs), robo-advisors, target-date funds, etc. |

| Contribution limit (2024) | $7,000 ($8,000 for individuals aged 50 or older) |

| Annual contribution requirement | No |

| Investment fees | Yes, but aim to minimise |

| Investment selection | Based on risk tolerance, time horizon, financial situation, etc. |

What You'll Learn

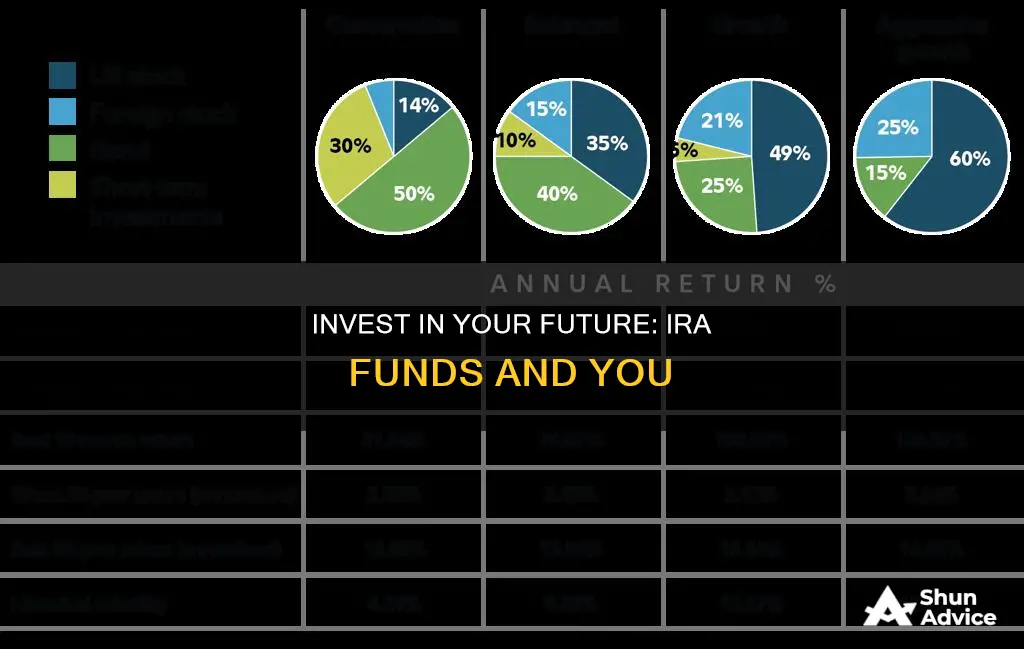

Understand asset allocation

Understanding asset allocation is a key part of investing your IRA funds for the future. Asset allocation is simply how your money is divided among different types of investments, including stocks, bonds, and cash. For example, if you invest $10,000 in an IRA account and $6,000 of it is in stock funds and $4,000 of it is in bond funds, your asset allocation is 60/40.

It's important to keep in mind that stocks, also known as equities, will likely provide the biggest return over time and also carry the most risk. On the other hand, bonds and other fixed-income investments are relatively safe compared to stocks and help balance out the risk. As such, your asset allocation should depend on your tolerance for risk.

One rule of thumb for calculating your risk tolerance is to subtract your age from 100 (or 110 if you're willing to take on more risk). The resulting number is the percentage of your portfolio that should be allocated to stocks. For example, if you're 30 years old, 70%-80% of your portfolio should be in stocks. However, you may want to adjust this number based on your personal preferences and risk tolerance.

As you get closer to retirement, it's generally recommended to reduce the percentage of stocks in your portfolio and increase investments in bonds and short-term investments. This is because you want to balance the need for growth with the need to protect your savings. However, it's important to remember that growth is still important, even during retirement, as you'll need your money to last for several decades.

When determining your asset allocation, it's crucial to consider your financial situation and goals. If your goal is retirement in 20 years, you may be able to take on more risk in your retirement account compared to an account you use to pay your monthly bills. Additionally, if the outlook for your financial situation seems uncertain, it may be prudent to have a relatively lower allocation to stocks.

To help you choose the right asset allocation, you can use tools and resources provided by online brokers or financial institutions. These tools can assist you in analysing your current portfolio, assessing your financial situation, and making informed investment decisions.

Cannabis Investment Opportunities: Vanguard Mutual Fund Options

You may want to see also

Consider your risk tolerance

When investing your IRA funds, it's important to consider your risk tolerance. This will help you determine how much risk you're comfortable with and how to allocate your investments accordingly. Here are some factors to consider when thinking about your risk tolerance:

Time Horizon

Think about how long you plan to invest your money. If you're investing for the long term, you may be able to take on more risk, as you'll have more time to recover from any potential losses. On the other hand, if you're investing for a shorter period, you may want to take a more conservative approach to reduce the risk of significant losses.

Ability to Tolerate Risk

Everyone has a different level of comfort when it comes to risk. Some people are comfortable with taking on more risk in pursuit of higher returns, while others prefer a more stable and secure investment strategy. Consider your own financial situation and how much risk you're personally willing to take.

Rules of Thumb

There are some rules of thumb you can use to guide your decision-making. One common rule is to subtract your age from 100 (or 110 if you're willing to take more risk). The resulting number is the percentage of your portfolio that should be allocated to stocks. For example, if you're 30 years old, you would allocate 70% to 80% of your portfolio to stocks. You can then adjust this allocation based on your personal preferences and risk tolerance.

Age and Risk Tolerance

Your age can also play a role in determining your risk tolerance. Generally, when you're younger, you may be more comfortable taking on more risk since you have more time to recover from any potential losses. As you get closer to retirement, you may want to gradually reduce the percentage of stocks in your portfolio and increase investments in bonds and short-term investments. However, it's important to note that growth still matters during retirement, as your retirement savings may need to last for several decades.

Financial Situation

Consider your financial goals and priorities when assessing your risk tolerance. If you're investing for retirement, you may be able to take on more risk compared to investing for shorter-term goals. Additionally, if your financial situation seems uncertain, you may want to lower your allocation to stocks to reduce the potential impact of losses.

Historical Performance

When deciding how much risk to take on, it can be helpful to look at historical performance data. This can give you an idea of how different investment strategies have performed over time and help you understand the potential risks and returns associated with different levels of risk.

Professional Guidance

If you're unsure about your risk tolerance or how to allocate your investments, consider seeking guidance from a financial advisor or using a robo-advisor service. These professionals can help you assess your risk tolerance and provide personalized recommendations based on your goals and financial situation.

Unlocking Private Equity: The Power of Fund of Funds

You may want to see also

Think about mutual funds

Mutual funds are a popular investment option for IRAs because they are easy and offer diversification. However, they often perform no better than average. If you have the expertise and time to pick individual stocks, you may be able to achieve higher returns.

If you don't want to choose and manage your investments, you can opt for a robo-advisor, which will choose low-cost funds and rebalance your portfolio for a fraction of the cost of hiring a human financial advisor.

- Index funds and ETFs: With these funds, you're buying a basket of investments rather than the stock of just one company. For example, an S&P 500 index fund invests in some of the largest US companies. Index funds and ETFs are usually well-diversified and have lower fees.

- Dividend stock funds: Companies that pay dividends tend to be in mature industries and generate a lot of cash, allowing them to distribute money to shareholders. Dividend stock funds are attractive in a Roth IRA because of their relative safety and the fact that dividends are not subject to tax.

- Value stock funds: Value stock funds include stocks that are more value-priced than the rest of the market, helping you find stocks that are relative bargains. They tend to be less volatile than the rest of the market and often have good returns over time. Many value stocks also pay dividends.

- Nasdaq-100 index funds: These funds focus on the largest names trading on the Nasdaq exchange, which is full of tech firms like Amazon, Apple, and Meta Platforms. Nasdaq-100 index funds offer high exposure to these top players and the potential for strong returns if tech stocks perform well.

- Target-date funds: These funds are a good choice for investors who don't want to actively manage their portfolio. You choose the year when you want to access the money, and the fund automatically adjusts your asset allocation over time, moving from riskier, high-return assets to safer, low-return assets as you get closer to your target date.

When choosing mutual funds for your IRA, it's important to consider your risk tolerance and the number of years until you retire. Mutual funds can provide a well-diversified portfolio with reduced risk and the potential for solid gains.

Gilt Funds: When to Invest for Maximum Returns

You may want to see also

Know when to seek professional help

If you don't have any interest in selecting investments yourself, you might want to outsource this task to a professional. There are two main ways to get low-cost portfolio management: target-date funds and robo-advisors.

A target-date fund is a mutual fund designed to work towards the year its investors plan to retire. The fund is named accordingly, so if you plan to retire around 2050, you would select a target-date fund with 2050 in its title. It will then do all the work for you, rebalancing as needed and taking an appropriate amount of risk as you age. These funds are very popular in 401(k)s and tend to have higher expense ratios, but through an IRA, you can shop around for a wider selection of low-cost options. You put all of your IRA money into a single fund and don't need to diversify among target-date funds.

Robo-advisors, on the other hand, are computer-powered investment managers. To use a robo-advisor, you would need to open an IRA account at one of these companies, such as Betterment or Wealthfront. They charge an annual management fee to build and manage an ETF portfolio for you, based on your age, risk tolerance, and other factors. Most services will have you fill out an initial questionnaire.

No matter what you choose, it's a good idea to take steps to minimise all types of investment fees. Left unchecked, these expenses can quickly start to eat into your portfolio's returns. Make sure your IRA offers competitive commissions and an abundance of low-cost investment options.

Axis Small Cap Fund: Smart Investing Strategies for Beginners

You may want to see also

Explore different types of futures contracts

Futures contracts are agreements to buy or sell a commodity, asset, or security at a predetermined price and future date. They are financial derivatives that allow investors to speculate on the direction of a security, commodity, or financial instrument. They can also be used to hedge against unfavourable price changes.

There are several types of futures contracts:

Agricultural Futures

These were the original type of futures contracts, available at markets like the Chicago Mercantile Exchange. They include grain futures, as well as tradable futures contracts in fibres (such as cotton), lumber, milk, coffee, sugar, and livestock.

Energy Futures

Energy futures provide exposure to common fuels and energy products, such as crude oil and natural gas.

Metal Futures

Metal futures trade in industrial metals, such as gold, steel, and copper.

Currency Futures

Currency futures provide exposure to changes in exchange rates and interest rates of different national currencies.

Financial Futures

Financial futures trade in the future value of a security or index. For example, there are futures for the S&P 500 and Nasdaq indexes, as well as debt products like U.S. Treasury bonds and German Bundesobligation (BOBL) bonds.

Mutual Funds: A Smart Investment Strategy?

You may want to see also

Frequently asked questions

There are two main types of individual retirement accounts (IRAs): traditional IRAs and Roth IRAs. Traditional IRAs allow you to save money on taxes now, but you will have to pay taxes when you withdraw the money. On the other hand, Roth IRAs are taxed the opposite way — you pay taxes on the money you put in, but your withdrawals in retirement are tax-free.

In 2024, the contribution limit for IRAs is $7,000 for people under 50 years old and $8,000 for those 50 and older.

This depends on your risk tolerance and investment goals, but generally, a mix of stocks, bonds, and mutual funds or exchange-traded funds (ETFs) is recommended. You can also invest in individual stocks or choose a low-cost robo-advisor to manage your investments for you.

You can open an IRA online by choosing a provider and deciding how you want to fund it. You can fund your IRA by transferring money from a bank account, rolling over a 401(k), or transferring existing IRA assets.