The investing section of a cash flow statement provides an overview of a company's investment-related activities, including the purchase or sale of physical assets, securities, or other investments. This section is crucial for understanding a company's financial health and future prospects, as it indicates how much cash has been generated or spent on long-term investments. Positive cash flow in this section often indicates the sale of investments, while negative cash flow can signal investing in future growth. It is important to analyse this section in conjunction with the balance sheet and income statement to gain a comprehensive understanding of the company's financial position and strategies.

| Characteristics | Values |

|---|---|

| Definition | The amount of cash that has been generated or spent on various investment-related business activities |

| Purpose | To show how much cash comes in and goes out from investments |

| Types of Activities | Acquisition and disposal of long-term assets, loans made to third parties, proceeds from sales of fixed assets, purchase of investment securities, acquisition of another company, proceeds from sales of other business units |

| Calculation | Total cash inflows from investing activities – Total cash outflows from investing activities |

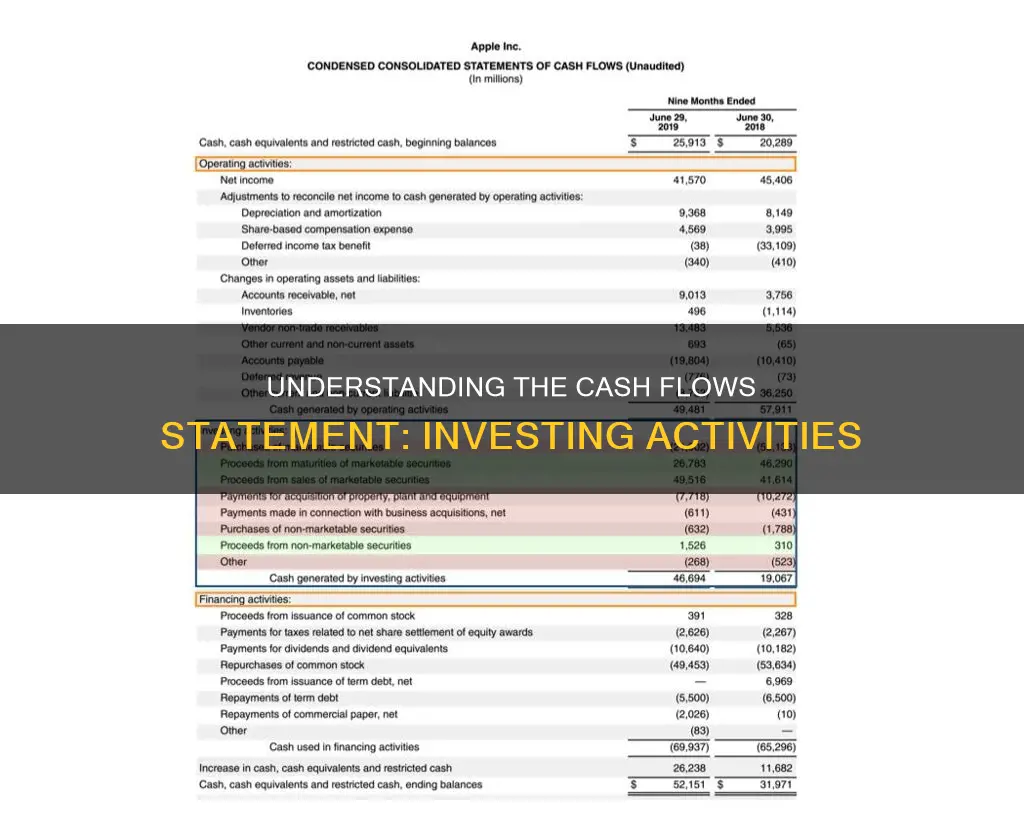

| Examples | Apple Inc.'s cash flow statement from November 2, 2023; Amazon's 2017 financial statements |

What You'll Learn

Long-term assets

The purchase of long-term assets is considered a cash outflow and results in negative cash flow in the investing section of the cash flow statement. This negative cash flow does not necessarily indicate poor financial health. Instead, it often signifies that the company is investing in its long-term growth and health. For example, a company may purchase new machinery or equipment to expand its operations, which will lead to negative cash flow in the short term but is expected to generate positive returns in the future.

On the other hand, the sale of long-term assets is considered a cash inflow and results in positive cash flow. This could include selling old machinery or equipment that is no longer needed.

The change in the value of long-term assets from one period to another is a clear indication of investing activities and should be reported in the cash flow statement. This information is crucial for analysts and investors who want to understand how much the company is investing in its future operations and growth.

In addition to the purchase and sale of long-term assets, investing activities also include capital expenditures (CapEx) and the acquisition or disposal of other businesses. These activities are all part of a company's long-term strategy and are expected to contribute to its future success and profitability.

Investments, Cash Flows, and the Impact of Gains

You may want to see also

Capital expenditures

In the context of the investing section of the cash flow statement, capital expenditures reflect the acquisition of fixed assets, plant and machinery, and other physical assets. This section also includes the proceeds from the sales of such assets.

An increase in capital expenditures indicates that a company is investing in future operations and growth. However, it also represents a reduction in cash flow in the short term. Therefore, investors and analysts closely monitor capital expenditures to understand a company's financial health and growth prospects.

Calculating Capital Expenditures:

Capex = PP&E (Ending) – PP&E (Beginning) + Depreciation

Where PP&E refers to property, plant, and equipment, and depreciation represents the allocation of the asset's cost over its useful life.

Overall, capital expenditures are a critical aspect of a company's financial strategy, and their management is essential for maintaining a healthy cash flow position and supporting the company's long-term growth.

Morris Invest: The Cash-Only Strategy Explained

You may want to see also

Investment securities

The investing activities section of a cash flow statement provides a detailed account of the cash inflows and outflows resulting from these investment activities. It primarily covers the acquisition and disposal of long-term assets, such as property, plant, and equipment, and investments in marketable securities. For example, if a company invests in a new factory building to expand its operations, the purchase would be recorded as a cash outflow from investing activities. Conversely, if the company sells old machinery it no longer needs, the cash received would be recorded as a cash inflow.

The calculation of cash flow from investing activities is straightforward. It involves subtracting total cash outflows from total cash inflows related to investing activities to determine the net cash flow. This calculation provides stakeholders with valuable information about the company's financial health and growth prospects.

It is important to note that negative cash flow from investing activities is not always a negative indicator of a company's financial performance. It often signifies that the company is making strategic investments in long-term assets, research, or other activities crucial to its health and continued growth. Therefore, when analysing a company's financial health, it is essential to consider the cash flow statement in conjunction with other financial statements, such as the balance sheet and income statement.

Temporary Investments: Are They Really Cash?

You may want to see also

Mergers and acquisitions

If a merger involves the purchase of another company's assets, these are accounted for in the investing section. Any purchases of fixed assets, such as property or machinery, are also reflected as cash outflows in the investing section. However, these are only separated from the rest of the target company's assets if the purchase was structured as an asset sale. If the merger was effectuated via a stock sale, the entry generally appears as "investment in the target company".

The cash flow statement is an important document that reveals a company's investment performance and capital allocation decisions. It is useful in measuring how effectively a company manages its cash from operating activities and its financing activities.

Strategies for Investing Uninvested Cash in a VA529 Plan

You may want to see also

Liquidity

The investing section of the cash flow statement details the cash inflows and outflows from investing activities, which primarily involve the acquisition and disposal of long-term assets and investments. This section includes transactions such as:

- Purchase of physical assets, fixed assets, or property, plant, and equipment (PP&E)

- Investment in securities, stocks, bonds, or other marketable securities

- Sale of securities, assets, or investments

- Loans made to third parties or the collection of loans

- Acquisition of another company or business units

- Proceeds from the sale of business divisions or mergers and acquisitions

These investing activities impact a company's liquidity by affecting its cash position. A positive cash flow from investing activities indicates that the company is generating more cash from these activities than it is spending. On the other hand, negative cash flow from investing activities does not always signify poor financial health. It could mean that the company is investing in long-term assets, research, or development activities that are crucial for its future growth and sustainability.

Analysing the cash flow statement helps stakeholders, investors, and creditors understand the company's liquidity and ability to meet its financial obligations. It provides a detailed picture of the company's cash management and highlights the sources and uses of cash within the organisation.

Non-Cash Investing Activities: Understanding the Intangible Investments

You may want to see also

Frequently asked questions

The investing section of a cash flow statement provides an overview of a company's investment-related activities, including the purchase or sale of physical assets, securities, or other investments. It shows how much cash has been generated or spent on these activities over a specific period.

The investing section includes transactions such as the purchase or sale of property, plant, and equipment (PPE), marketable securities, and investments in other companies. It also covers loans made to or received from third parties.

The investing section provides insights into a company's long-term financial health and growth strategies. It helps stakeholders, investors, and analysts assess the company's ability to invest in future growth, manage its assets, and make strategic financial decisions.