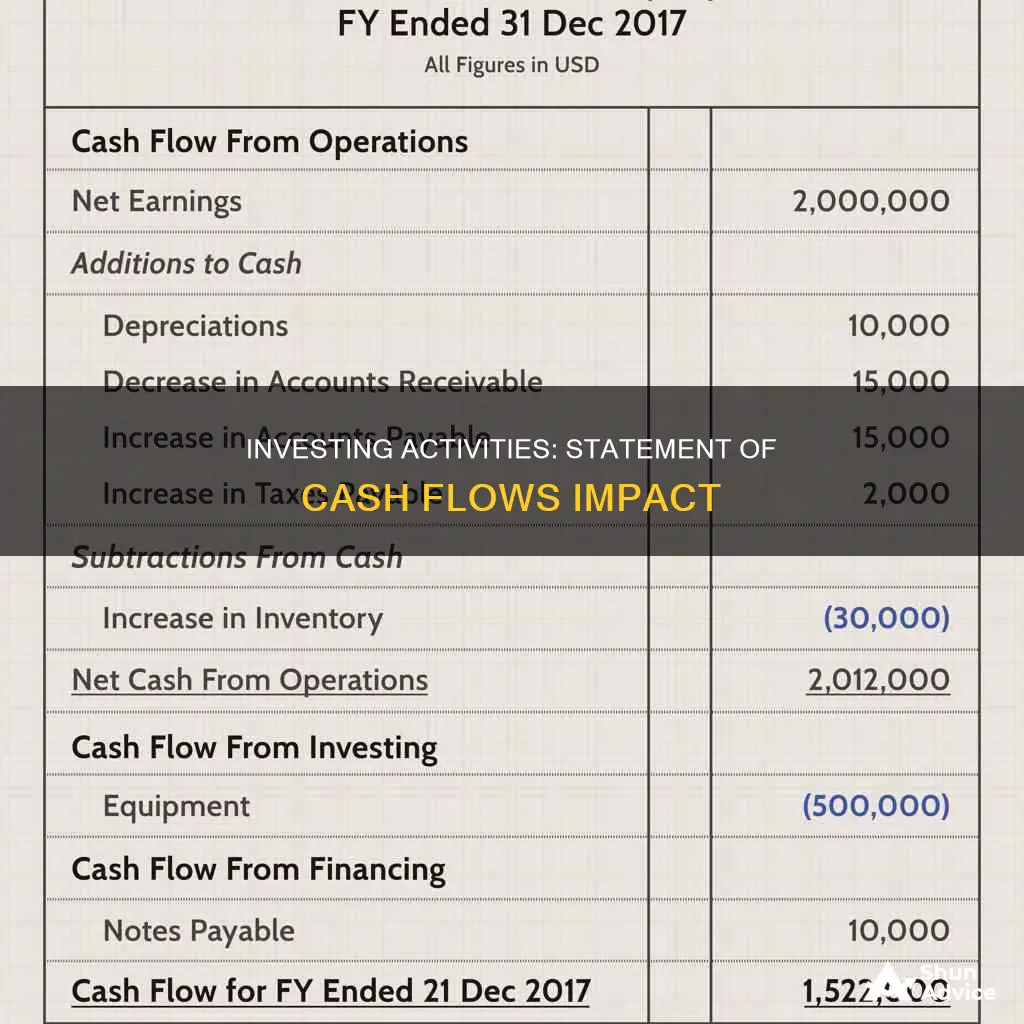

A company's cash flow statement is a crucial financial report that details the inflow and outflow of cash over a specific period, providing insights into its financial health and operational efficiency. It is one of the three main financial statements, alongside the balance sheet and income statement, and is used by investors, creditors, and analysts to assess the company's performance and stability. The cash flow statement is divided into three sections: operating activities, investing activities, and financing activities.

Operating activities detail the cash flow generated from the company's regular goods or services, including revenue and expenses. Investing activities include the cash flow from purchasing or selling assets, such as physical or non-physical property. Financing activities cover the cash flow from debt and equity financing, including transactions with investors, banks, and shareholders.

The cash flow statement helps determine a company's ability to manage its cash position, meet its financial obligations, and fund its operations and investments. It is an essential tool for investors, creditors, and analysts to make informed decisions about the company's financial health and potential.

| Characteristics | Values |

|---|---|

| Purpose | To provide a detailed picture of what happened to a business’s cash during a specified period |

| Main Sections | Operating activities, investing activities, and financing activities |

| Calculation Methods | Direct method and indirect method |

| Use | To evaluate a company's financial health and operational efficiency |

| Types of Cash Flows | Cash flow from operations, cash flow from investing, and cash flow from financing |

What You'll Learn

- Cash flow from investing activities includes the acquisition and disposal of non-current assets

- It also includes the purchase and sale of physical and non-physical property

- Investing activities are one of the three sections of a cash flow statement

- It is a useful indicator of a company's financial health and operational efficiency

- It can be calculated using the direct or indirect method

Cash flow from investing activities includes the acquisition and disposal of non-current assets

Cash flow from investing activities is one of the sections of a company's cash flow statement. It details the cash inflows and outflows resulting from investment activities, including the acquisition and disposal of long-term, non-current assets. These activities can generate either negative or positive cash flow.

Non-current assets, also known as long-term assets, are expected to deliver value in the future. They include physical property, such as real estate and vehicles, and non-physical property, like patents. The acquisition of non-current assets is considered a cash outflow, while the disposal of these assets is considered a cash inflow.

For example, if a business owner invests in a new factory building to expand their operations, that purchase would be considered a cash outflow from investing activities. Conversely, if they sell some old machinery that the company no longer needs, the cash received from the sale would be a cash inflow from investing activities.

Other investing activities that impact cash flow include the purchase and sale of investment securities, bonds, debentures, and stocks, as well as loans made to and received from third parties.

It is important to note that cash flow from investing activities does not include short-term investments or cash equivalents, which are classified under operating activities, or cash flows from financing activities.

Cash App Investing: Are There Any Fees Involved?

You may want to see also

It also includes the purchase and sale of physical and non-physical property

Investing activities are one of the three sections of a company's cash flow statement, the other two being operating activities and financing activities. This section includes the purchase and sale of physical and non-physical property.

Physical Property

Physical property refers to tangible assets such as real estate, vehicles, equipment, machinery, and buildings. These are often referred to as capital expenditures (CapEx) and are considered long-term investments that are crucial for the company's operations and growth. For example, a company may invest in new office equipment such as computers and printers to accommodate a growing number of employees.

Non-Physical Property

Non-physical property, on the other hand, includes intangible assets such as patents, copyrights, software, and marketable securities. The sale or purchase of these assets can generate positive or negative cash flow, respectively. For instance, proceeds from the sale of marketable securities would be considered a positive cash flow, while purchases of such securities would result in negative cash flow.

It's important to note that the cash flow statement provides valuable insights into a company's financial health and operational efficiency. A negative cash flow from investing activities does not necessarily indicate poor financial health. It often signifies that the company is making long-term investments in assets, research, or other development activities that are crucial for its future growth and performance.

Understanding Proceeds From Equipment Sales: Cash From Investing?

You may want to see also

Investing activities are one of the three sections of a cash flow statement

The investing activities section of the cash flow statement includes cash flow from purchasing or selling assets, such as physical property (real estate, vehicles) and non-physical property (patents). It also includes cash flow from the sale of investment securities and the purchase of fixed assets.

The cash flow statement bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities for a specific period. It is a valuable tool for investors, creditors, and business leaders to understand a company's financial health, operational efficiency, and liquidity.

The cash flow statement can be prepared using two methods: the direct method and the indirect method. The direct method involves listing all cash receipts and payments during the reporting period, while the indirect method starts with net income and adjusts for changes in non-cash transactions.

The investing activities section of the cash flow statement is important because it shows how a company is allocating cash for the long term. It can indicate whether a company is investing in assets, research, or other long-term development activities that are crucial for its health and continued operations.

Cash App Investment Options: Where to Put Your Money

You may want to see also

It is a useful indicator of a company's financial health and operational efficiency

A cash flow statement is a crucial indicator of a company's financial health and operational efficiency. It provides a detailed picture of the inflow and outflow of cash over a specific period, known as the accounting period. This statement is particularly useful for investors, business owners, managers, and entrepreneurs as it offers valuable insights into the company's performance and financial position.

The cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities. Operating activities reflect the cash flow generated from the company's regular goods or services, including revenue and expenses. Investing activities involve the purchase or sale of assets, such as physical property or patents, using free cash. Financing activities detail the cash flow from debt and equity financing, including sources of cash from investors and banks, as well as payments to shareholders.

By analyzing the cash flow statement, stakeholders can assess the company's ability to manage its cash position and generate cash to meet its financial obligations. It provides insights into the liquidity and sources of cash, as well as the free cash flow available for further investment. A positive cash flow, where inflows exceed outflows, indicates the company's ability to remain solvent, reinvest in its business, and pursue growth opportunities.

However, it is important to note that negative cash flow does not always imply poor financial health. It could be a result of the company's strategic decision to expand its operations or invest in long-term growth initiatives. Therefore, it is essential to analyze trends in cash flow over time and consider the context of the business's goals and operational needs.

Overall, the cash flow statement is a powerful tool for evaluating a company's financial health and operational efficiency, providing critical information for decision-making and strategic planning.

Cash Investment: Revenue or Asset?

You may want to see also

It can be calculated using the direct or indirect method

The cash flow statement is one of the three main financial statements that a business uses, alongside the balance sheet and income statement. It is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

The cash flow statement can be calculated using either the direct or indirect method. The direct method is one of two accounting treatments used to generate a cash flow statement. It uses actual cash inflows and outflows from the company's operations, instead of modifying the operating section from accrual accounting to a cash basis. Accrual accounting recognises revenue when it is earned, rather than when the payment is received from a customer. Conversely, the direct method measures only the cash that has been received and the cash payments or outflows. The inflows and outflows are then netted to arrive at the cash flow.

The direct method is also known as the income statement method. It provides more detail about the operating cash flow accounts, although it is time-consuming. It is also unpopular with companies because it requires a reconciliation report to check the accuracy of the operating activities.

The indirect method is the other option for completing a cash flow statement. It is more commonly employed, particularly among larger firms, due to its ease of use and direct connection to the balance sheet. This method uses increases and decreases in balance sheet line items to modify the operating section of the cash flow statement from the accrual method to the cash method of accounting. It starts with net income and adjusts for accrual impacts during the reporting period. Common adjustments include depreciation and amortization.

The total cash generated from operating activities is the same under both the direct and indirect methods, though the information is presented differently.

Operating vs Investing: Where Do Customers Fit in Cash Flow?

You may want to see also