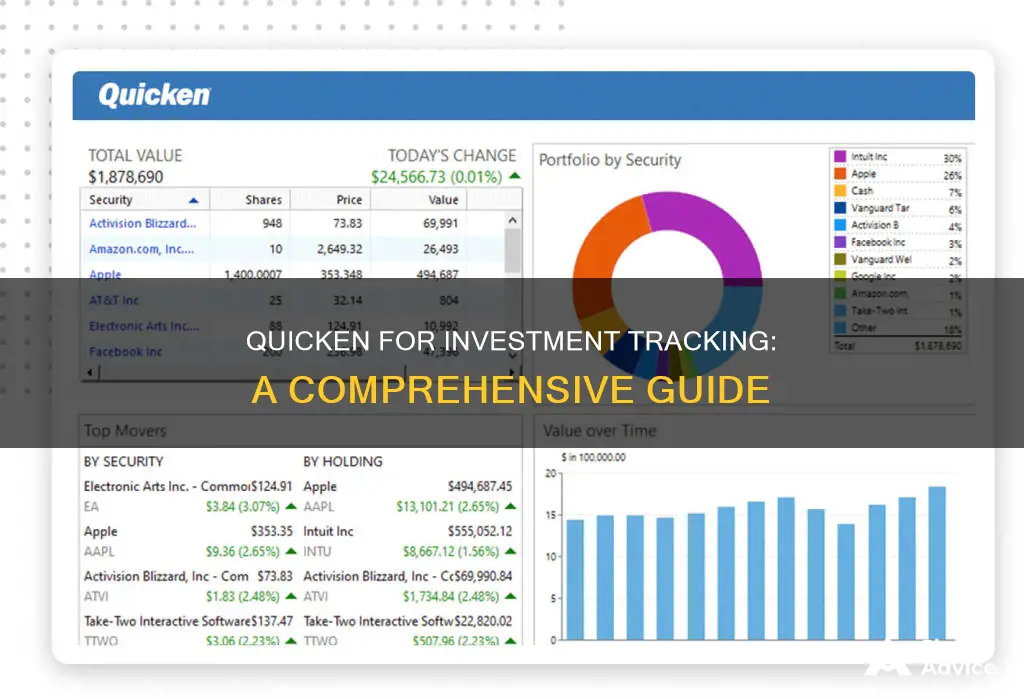

Quicken is a financial application that enables you to access your online investment accounts from your desktop. It offers a range of investment tracking features, from Simple Tracking, which provides a straightforward view of investment positions, to Detailed Tracking, which includes transaction data. Quicken allows you to monitor your investments across multiple brokerages and account types, including brokerage, 401(k)s, IRAs, options, bonds, ETFs, mutual funds, and more. You can also add private equities and partnerships that aren't publicly traded. With Quicken, you can track both liquid and long-term holdings, view performance metrics, and gain insights into your portfolio's true market returns. Additionally, Quicken enables you to export tax-related data to tax preparation software and provides investment tips to help you grow your net worth.

| Characteristics | Values |

|---|---|

| Number of accounts | One account to see all your accounts |

| Account types | Standard brokerage account, 401(k)s, IRAs, options, bonds, ETFs, mutual funds |

| Account management | Add, edit, and delete accounts |

| Data tracking | Track positions and transactions |

| Data sources | Data can be entered manually or downloaded automatically |

| Data updates | Security prices are updated automatically |

| Data security | Data is protected with 256-bit encryption |

| Data privacy | Personal data is not sold |

| Pricing | $2.99/month starting price |

What You'll Learn

Sync with mobile and web apps

Quicken offers a mobile app and a web app that can be synced with your desktop data, allowing you to monitor your investments on the go. The apps are free and designed to give you ultimate financial control anytime, anywhere. They sync with your desktop software, allowing you to access and manage your finances remotely.

To set up syncing on your desktop, open Quicken and go to the Mobile & Web tab. Click "Get Started" and select the accounts you want to sync to your mobile device. You will then be prompted to enter your bank password(s) and click "Done". Finally, click "Sync Now" under the Mobile & Web tab, and sign in to your mobile app with your Quicken ID.

The mobile app is available for iPhone, iPad, and Android devices. It allows you to receive customizable alerts and notifications about your account balances, fees, and spending patterns. You can also add attachments, such as photos of receipts, to your transactions.

The web app is accessible on any computer or tablet with a web browser and an internet connection. It offers a customizable dashboard where you can drag and drop modules to organize the app according to your preferences.

Both the mobile and web apps provide you with real-time access to your financial information, allowing you to monitor your investments, track transactions, and view your portfolio performance on the go.

Understanding Initial Cash Investment: First Steps for Entrepreneurs

You may want to see also

Monitor all accounts at once

Quicken allows you to monitor all your investment accounts at once, from all your brokerages and retirement plans, with the convenience of a single, combined view. This feature makes it far easier to see your true risk level, allocations, and performance. You can track both liquid and retirement holdings, including brokerage, 401(k)s, IRAs, options, bonds, ETFs, mutual funds, and more. Quicken gives you a truly comprehensive view of your portfolio.

To set up your investment accounts in Quicken, launch the application on your computer and click the "Investing" tab. Then, click "Add Investing Accounts" in the Investment and Retirement Accounts section. The Account Setup wizard will open, and you can select the type of investment account you want to create, such as a standard brokerage account. Click "Next", and then select "The Account is Held at the Following Institution" and enter the name of your financial institution. You can then log in to your financial institution and enter your username and password for your online account. Finally, click "Next" and then "Finish" to complete the process. Repeat this process for all your accounts.

You can also add manual" brokerage accounts if you hold publicly traded securities in a brokerage account that doesn't permit automatic connections. All you need to do is manually enter your buy/sell transactions, and Quicken will update your position and continue to download security prices each time you refresh the software or app. This way, you can still see your portfolio's current value, even for accounts that don't have automatic connections.

Quicken also offers a Simple Tracking feature for customers who want a straightforward view of their investments without the complexity of transaction data. This feature only tracks your positions and does not include detailed transaction information. When creating a new account, you can choose between Simple Tracking and Detailed Tracking to suit your preferences.

Unlocking Cash Flow Secrets for Smart Investments

You may want to see also

Add manual brokerage accounts

If you hold publicly traded securities in a brokerage account that doesn't allow automatic connections, you can still add it to Quicken by manually entering your buy/sell transactions. To add these "manual" brokerage accounts, follow these steps:

- In Quicken, go to the Accounts menu and select "+ Add Account".

- Choose "Offline Account".

- Select "Brokerage" as the type of account you want to add. You can choose from various account types, including 401(k), IRA, and more.

- Enter your account information, including the account name, type, the date you want to start tracking your balance, cash balance, and primary use.

- Click "Done" to complete the setup.

Once you've set up your offline brokerage account, Quicken will update your position and continue to download security prices whenever you refresh the software or app. This way, you can always see your portfolio's current value, even for accounts that don't have automatic connections.

If you're using Quicken for Mac, you can also choose to link your online brokerage accounts for automatic updates. However, if your brokerage isn't supported for online connection, you can set up an offline account by following the steps outlined above.

Salesforce Superpowers for Investment Firms: Strategies Unveiled

You may want to see also

Include private equities and partnerships

If you hold investments in partnerships and private equities that aren’t publicly traded, you can still add them to Quicken. You will have to keep track of them manually, but it's a great way to see all your investments in one place. This is important because it allows you to see those “side” investments for what they are—a crucial part of your whole portfolio.

To create these securities, go to Tools > Security List > Add Security and click on the "Click Here" link at the bottom. To avoid incorrect quote downloads, leave the Symbol blank. Then, go to Tools > Add Account and select the Offline Account tab to create one or more brokerage accounts to hold the securities. You can organise the securities into these offline accounts however you want by going to an account and buying the security there. If you receive one periodic statement for several of these securities, you will probably want to put them in the same account.

You can establish each security either by buying a new security in your Account(s) – you type in the name and Quicken begins the interview process – or you can establish a new security by going to Tools > Security List > Add Security. Either approach brings you to the same interview. Since these securities are non-public, Quicken won't find a match to the name you've typed in, so you'd click the link at the bottom of the "Add Security to Quicken" window to make this a "manual" security.

For private equity funds, you will receive a Net Asset Value (NAV) report every quarter, half-year, or year. You can then adjust the value manually to reflect the value reported in these updates. If you label it “Increase (or Decrease) in value”, the value in Quicken will always represent the most recent NAV plus any capital you’ve added since, and your historical Quicken data will represent those changes over time.

Public Zcash Investment: A Beginner's Guide to Getting Started

You may want to see also

Customise your portfolio view

Customising your portfolio view is an important feature of Quicken. The ability to view your investments in a way that makes sense to you is a key part of managing your finances.

Quicken allows you to group your portfolios by type, brokerage, or asset class (domestic bonds, large-cap stock, etc.), or you can create your own categories to group your holdings. For example, you may want to compare the performance of your blue-chip holdings with your tech stocks or cryptocurrencies. Alternatively, you may want to view the stocks you've set aside for your children separately from your own portfolio.

You can also view your investments by account and security, or just by security. You can switch between viewing the value of holdings, performance metrics, and realised gains, grouped in whichever way you prefer. You can also look at each account individually, grouped by type (e.g. retirement and non-retirement accounts), or all together.

If you want a straightforward view of your investments, you can select Simple Tracking when setting up your account. This feature only tracks your positions and does not track transaction data. It gives you a simple overview of your investments without the complexity of detailed transaction information.

Quicken also allows you to track manual brokerage accounts. If you hold publicly traded securities in an account that doesn't permit automatic connections, you can manually enter your buy/sell transactions. Quicken will update your position and continue to download security prices, so you can see your portfolio's current value.

You can also add private equities and partnerships that aren't publicly traded. You'll have to keep track of these manually, but Quicken lets you add them so you can see your whole portfolio at once.

Using the PE Ratio: A Guide for Smart Investing

You may want to see also

Frequently asked questions

Launch Quicken on your computer, then click the "Investing" tab. Click "Add Investing Accounts" and select the type of investment account you want to create. You can then log in to your financial institution and enter your username and password. The data in your investment account will automatically download into Quicken.

Quicken allows you to access your online investment accounts from your desktop and helps you manage your finances more efficiently by providing an accurate view of your total net worth.

Yes, you can manually enter your buy/sell transactions for publicly traded securities held in a brokerage account that doesn't permit automatic connections. Quicken will then update your position and continue to download security prices.

Yes, you can monitor all your investment accounts, including brokerage, 401(k)s, IRAs, options, bonds, ETFs, and mutual funds, in one place with a single, combined view.

Yes, you can sync Quicken with companion web and mobile apps to monitor your investments on the go. You can refresh the app as often as you like to download the latest stock prices and keep your publicly traded holdings up to date.