Exchange-Traded Funds (ETFs) have gained popularity as a long-term investment strategy due to their low costs, diversification, and flexibility. ETFs offer investors a way to gain exposure to a broad market index or a specific sector, making them an attractive option for those seeking to build a diversified portfolio over time. This paragraph will explore whether ETFs are a good long-term investment, considering their benefits and potential drawbacks.

What You'll Learn

- Historical Performance: ETFs have shown consistent long-term growth, outpacing traditional stocks

- Diversification: ETFs offer broad market exposure, reducing risk through diversification

- Low Costs: ETFs typically have lower fees, making them cost-effective for long-term investors

- Liquidity: ETFs are highly liquid, allowing investors to buy or sell easily

- Tax Efficiency: ETFs may result in lower capital gains taxes over time

Historical Performance: ETFs have shown consistent long-term growth, outpacing traditional stocks

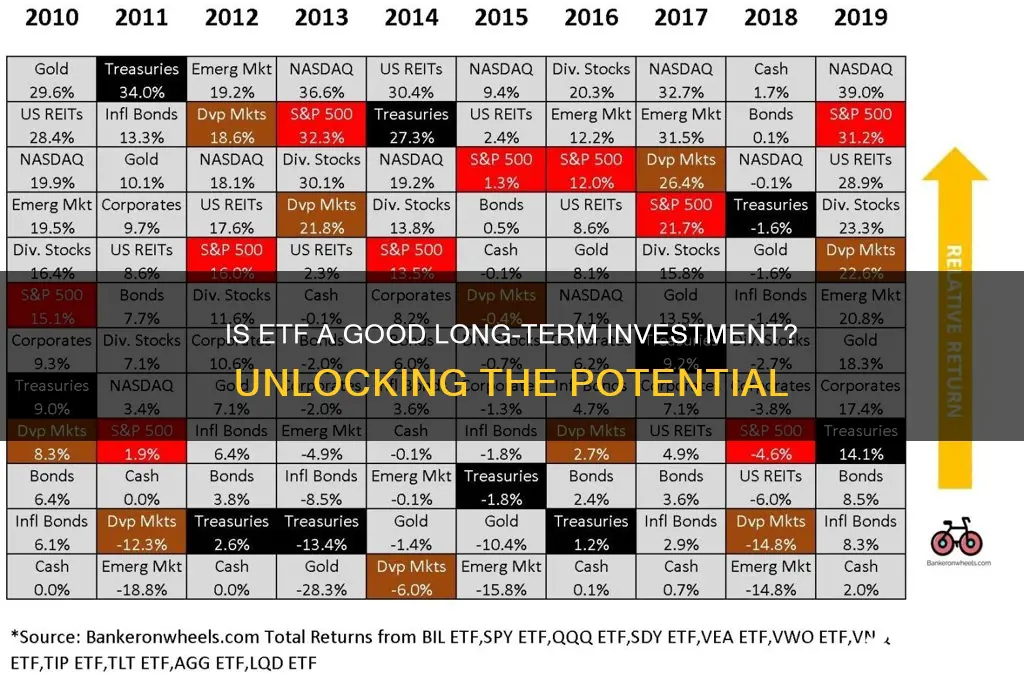

Exchange-Traded Funds (ETFs) have indeed demonstrated remarkable historical performance, making them an attractive long-term investment option for many investors. When compared to traditional stocks, ETFs have consistently shown the ability to outpace the market over extended periods. This is primarily due to their unique characteristics and the way they are structured.

One of the key advantages of ETFs is their diversification. ETFs typically track an index, such as the S&P 500 or a specific sector, and hold a basket of securities that represent the entire index. This diversification reduces risk because it minimizes the impact of individual stock performance on the overall fund. As a result, ETFs have historically shown more stable and consistent growth, even during market downturns. For instance, during the 2008 financial crisis, while many individual stocks suffered significant losses, ETFs that tracked broad market indices managed to maintain their value, providing investors with a safety net during turbulent times.

The historical data also reveals that ETFs have consistently outperformed traditional stocks in the long run. This is evident in the fact that many ETF providers have been able to consistently meet or exceed their benchmark indices' performance over extended periods. For example, the SPDR S&P 500 ETF (SPY) has historically provided returns that closely mirror those of the S&P 500 index, often outpacing the performance of individual stocks within the index. This consistent outperformance is a result of the efficient management and low costs associated with ETFs, which allow them to track their underlying indices more closely.

Furthermore, the long-term growth of ETFs can be attributed to their ability to provide exposure to a wide range of assets. ETFs can offer access to various markets, sectors, and asset classes, allowing investors to diversify their portfolios across different industries and geographic regions. This diversification further enhances the potential for long-term growth, as it reduces the impact of any single market event or economic downturn.

In summary, the historical performance of ETFs, characterized by consistent long-term growth and outperformance of traditional stocks, makes them a compelling investment choice. Their diversification, efficient management, and ability to provide broad market exposure contribute to their success in the long run. As investors seek stable and reliable investment options, ETFs continue to be a popular and attractive choice, offering a balanced approach to portfolio management.

Unlocking Long-Term Care: A Guide to Residence Investment Strategies

You may want to see also

Diversification: ETFs offer broad market exposure, reducing risk through diversification

When considering long-term investments, Exchange-Traded Funds (ETFs) are often recommended due to their ability to provide broad market exposure and reduce risk through diversification. ETFs are investment funds that track an index, sector, commodity, or other assets, and they offer investors a way to gain access to a diverse range of securities in a single transaction. This diversification is a key advantage of ETFs, as it allows investors to spread their risk across multiple assets, sectors, or markets.

The concept of diversification is simple: by holding a variety of investments, an investor can minimize the impact of any single investment's poor performance on the overall portfolio. ETFs excel in this regard because they bundle together a large number of securities, such as stocks, bonds, or commodities, into a single investment vehicle. This means that investors can gain exposure to an entire market or sector without having to buy and manage individual securities. For example, an investor could purchase an ETF that tracks the S&P 500, instantly diversifying their portfolio across 500 large-cap U.S. companies, thus reducing the risk associated with any single stock's performance.

In the context of long-term investing, diversification is particularly important as it helps to smooth out the volatility of individual investments over time. ETFs provide a way to achieve this diversification on a large scale, making them a popular choice for investors seeking to build a robust and resilient portfolio. By holding a wide array of assets, ETFs can help investors weather market downturns and benefit from the long-term growth potential of various markets and sectors.

Furthermore, ETFs often have lower expense ratios compared to actively managed mutual funds, making them a cost-effective way to achieve diversification. This is because ETFs are passively managed, tracking an index rather than actively selecting individual securities, which reduces management costs. Lower costs mean more of the investment returns can be retained by the investor, further enhancing the long-term performance of the portfolio.

In summary, ETFs offer a powerful tool for investors looking to diversify their portfolios and manage risk effectively. By providing broad market exposure and a cost-efficient way to invest in a variety of assets, ETFs are well-suited for long-term investment strategies, allowing investors to build a robust and resilient financial portfolio.

Understanding Short-Term Investment Strategies: A Comprehensive Guide

You may want to see also

Low Costs: ETFs typically have lower fees, making them cost-effective for long-term investors

When considering long-term investments, cost efficiency is a critical factor, and Exchange-Traded Funds (ETFs) excel in this regard. ETFs are designed to track the performance of a specific index, sector, or asset class, and they offer a unique advantage in terms of expense ratios. These funds typically have lower management fees compared to actively managed mutual funds, which can significantly impact the overall returns over time.

The cost-effectiveness of ETFs is primarily due to their passive investment strategy. Instead of employing a team of fund managers to actively select and manage individual securities, ETFs mirror an index, which is a more straightforward and less resource-intensive approach. As a result, the expenses associated with fund management, trading, and administration are lower, and these savings are often passed on to investors in the form of reduced fees.

For long-term investors, this lower cost structure can be a substantial benefit. Over time, the cumulative effect of these reduced fees can lead to higher net returns. For instance, if an ETF has an expense ratio of 0.05% per year, compared to a mutual fund with a 1.00% expense ratio, the ETF could potentially deliver an additional 0.5% in returns annually. This advantage becomes even more significant over longer investment periods, where the impact of these savings compounds.

Additionally, ETFs often have lower minimum investment requirements, making them accessible to a broader range of investors. This accessibility further contributes to their cost-effectiveness, as smaller investors can benefit from the diversification and low costs associated with ETFs without the need for large initial investments.

In summary, ETFs' low costs are a compelling reason for long-term investors to consider them. The reduced expense ratios, combined with passive management and accessibility, make ETFs an attractive option for those seeking cost-efficient, diversified investments with the potential for strong long-term performance.

Understanding Short-Term Investments: A Balance Sheet Guide

You may want to see also

Liquidity: ETFs are highly liquid, allowing investors to buy or sell easily

ETFs, or Exchange-Traded Funds, are known for their exceptional liquidity, which is a significant advantage for investors. This liquidity refers to the ease and speed with which investors can buy or sell ETFs on the stock market. Unlike traditional mutual funds, which may have a fixed schedule for trading, ETFs can be traded throughout the day, similar to individual stocks. This real-time trading capability provides investors with the flexibility to enter or exit positions promptly, ensuring they can react to market changes or adjust their portfolios as needed.

The high liquidity of ETFs is particularly beneficial for investors who require quick access to their funds or those who prefer a more dynamic investment approach. For instance, if an investor needs to raise cash for an emergency or wants to capitalize on a sudden market opportunity, ETFs offer a straightforward solution. They can simply sell their ETFs and convert them into cash without the delays often associated with other investment vehicles.

Moreover, the liquidity of ETFs is facilitated by the fact that they are listed on stock exchanges, which have robust trading mechanisms. These exchanges provide a platform where buyers and sellers can meet, ensuring a continuous and efficient market for ETFs. As a result, investors can execute trades swiftly and at prices that closely reflect the fund's net asset value (NAV), which is calculated based on the value of the underlying securities.

This high liquidity also contributes to the overall attractiveness of ETFs as a long-term investment strategy. Investors can easily adjust their exposure to various assets or markets without incurring significant costs or delays. For example, an investor could gradually increase their ETF holdings over time, taking advantage of dollar-cost averaging, or quickly reduce their position if market conditions change.

In summary, the liquidity of ETFs is a key feature that makes them an attractive investment option. It enables investors to manage their portfolios actively, providing the flexibility to respond to market opportunities or unforeseen circumstances. This liquidity, combined with the cost-effectiveness and diversification benefits of ETFs, makes them a compelling choice for both short-term traders and long-term investors seeking efficient and accessible investment vehicles.

Maximizing Returns: Understanding Investment Percentage Strategies

You may want to see also

Tax Efficiency: ETFs may result in lower capital gains taxes over time

When considering long-term investments, tax efficiency is a crucial factor that can significantly impact an investor's overall returns. Exchange-Traded Funds (ETFs) offer a unique advantage in this regard, making them an attractive option for those seeking to optimize their tax strategy. One of the key benefits of ETFs is their ability to provide tax efficiency through a process known as "tax-loss harvesting."

Tax-loss harvesting is a strategy where investors sell investments that have experienced losses to offset capital gains. By realizing losses, investors can reduce their taxable income, thus lowering their overall tax liability. ETFs facilitate this process because they often hold a diverse range of securities, allowing investors to generate losses across different holdings. This diversification enables investors to implement tax-loss harvesting more effectively, as it provides a broader opportunity to identify and sell losing positions.

Over time, the accumulation of capital gains can become a significant concern for investors. Traditional investment vehicles may result in substantial capital gains, which are subject to taxation. However, ETFs can help mitigate this issue. ETFs typically have lower expense ratios compared to actively managed mutual funds, and they often have lower turnover rates, which means fewer transactions and reduced transaction costs. As a result, ETFs may generate fewer taxable events, leading to lower capital gains taxes for investors.

Additionally, ETFs are structured as index funds, which means they aim to replicate the performance of a specific market index. This replication process often involves holding a large number of securities, ensuring a more even distribution of gains and losses. By diversifying the holdings, ETFs can help investors avoid the concentration of capital gains in a few specific assets, further reducing the potential tax burden.

In summary, ETFs offer tax efficiency through tax-loss harvesting, lower expense ratios, and the ability to diversify gains and losses. These factors contribute to making ETFs a potentially attractive long-term investment option, especially for investors who are mindful of tax implications and seek to optimize their overall investment strategy. Understanding these tax advantages can be a key consideration when evaluating the suitability of ETFs for individual investment portfolios.

Unlocking Long-Term Wealth: A Comprehensive Guide to Smart Investing

You may want to see also

Frequently asked questions

An Exchange-Traded Fund (ETF) is a basket of securities that trade on an exchange like a stock. It offers diversification across various assets, such as stocks, bonds, or commodities, and can be bought and sold throughout the trading day. ETFs are similar to mutual funds but with the added benefit of flexibility and lower costs due to their electronic trading nature.

Yes, ETFs can be an excellent long-term investment strategy for several reasons. Firstly, they provide instant diversification, reducing the risk associated with individual stocks. Secondly, ETFs often have lower expense ratios compared to actively managed funds, making them cost-effective over time. Additionally, ETFs can be a great way to gain exposure to specific markets, sectors, or asset classes, allowing investors to build a well-rounded portfolio.

Historically, ETFs have shown impressive long-term performance, often outpacing individual stocks. ETFs track specific indexes, and their performance is closely tied to the overall market or a particular sector. While individual stocks can be volatile in the short term, ETFs provide a more stable and consistent return over extended periods. This is because they offer a diversified approach, mitigating the impact of individual stock performance.

Absolutely! ETFs are powerful tools for wealth accumulation. By investing in ETFs that track broad market indexes, investors can benefit from the overall growth of the market. Over time, this can lead to significant wealth accumulation. Additionally, ETFs allow investors to take advantage of compounding returns, where earnings are reinvested to generate further growth, further enhancing long-term wealth building.

While ETFs offer many benefits, there are still risks to consider. Market risk is inherent in any investment, and ETFs are no exception. The performance of an ETF is tied to the underlying assets it tracks, so market fluctuations can impact its value. Additionally, some ETFs may have specific risks associated with their underlying assets, such as sector-specific risks or currency fluctuations in international ETFs. Diversification within an ETF can help mitigate these risks, but careful research and monitoring are essential for long-term success.