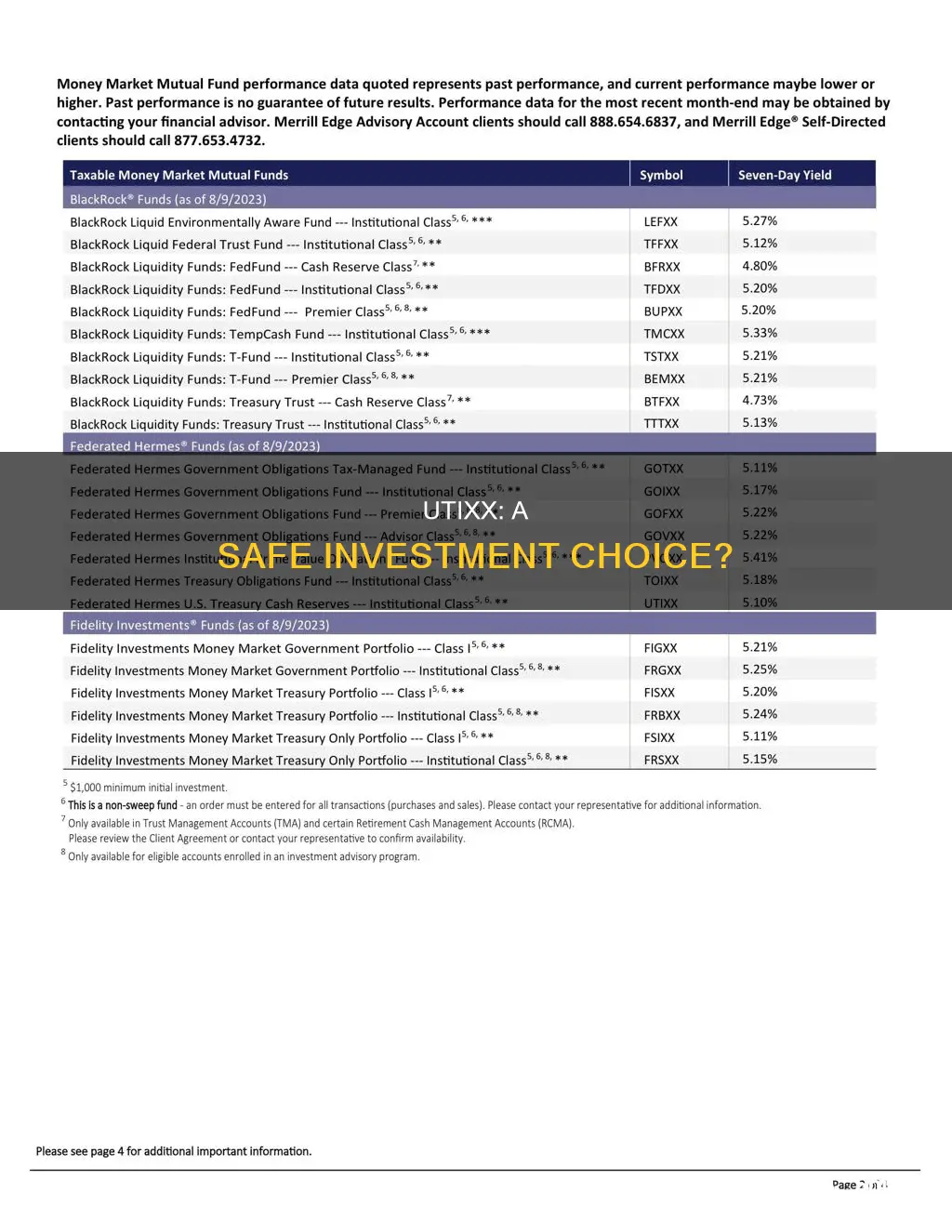

In the world of investing, the question of whether a particular opportunity is safe or not is a critical one. Today, we delve into the topic of 'Is UTIXX a safe investment?' UTIXX, a relatively new player in the market, has been generating interest among investors. However, the safety of any investment depends on various factors, including market conditions, company performance, and individual risk tolerance. This paragraph will explore the key considerations and provide insights to help investors make informed decisions about UTIXX.

What You'll Learn

- Market Performance: Analyze historical price trends and volatility of UTIXX

- Competitive Landscape: Assess UTIXX's position against competitors in the market

- Financial Health: Evaluate UTIXX's financial stability, revenue growth, and profitability

- Management Team: Assess the experience and track record of UTIXX's leadership

- Risk Factors: Identify potential risks and challenges facing UTIXX's business

Market Performance: Analyze historical price trends and volatility of UTIXX

UTIXX, a relatively new investment opportunity, has been generating interest among investors, but its market performance and safety as an investment are subjects of debate. To assess its safety, one must delve into the historical price trends and volatility of UTIXX.

Historical Price Trends: UTIXX, a digital asset or security, has experienced significant price fluctuations since its inception. Early investors might have seen substantial gains, but the market has also witnessed sharp declines. For instance, in its initial months, UTIXX saw a rapid rise in value, attracting many investors. However, this was followed by a sharp correction, causing a temporary loss of investor confidence. The price trends of UTIXX are characterized by a high level of volatility, which is a common trait among many new and emerging assets. This volatility can be attributed to various factors, including market speculation, regulatory news, and the overall sentiment of investors.

Volatility Analysis: Volatility is a critical aspect of assessing investment safety. UTIXX's price has shown extreme swings, with rapid increases and decreases in a short period. This volatility can be a double-edged sword; while it presents opportunities for significant gains, it also carries the risk of substantial losses. Investors need to be prepared for these rapid shifts in value, especially in the short term. A detailed analysis of historical data reveals that UTIXX's volatility has been consistently high, indicating a relatively risky investment. This high volatility might deter risk-averse investors who prefer more stable assets.

Long-Term Outlook: Despite the short-term volatility, some investors believe that UTIXX has the potential for long-term growth. The asset's unique features and the underlying technology it is associated with could attract more interest over time. However, this optimism is not yet reflected in the market, as the asset's price has struggled to maintain a consistent upward trend. The long-term safety of UTIXX remains uncertain, and investors should carefully consider the risks before committing.

In summary, UTIXX's market performance is characterized by significant price volatility, which is a red flag for risk-averse investors. While there are opportunities for substantial gains, the asset's short-term price swings can be concerning. Investors should conduct thorough research and consider their risk tolerance before investing in UTIXX or any similar asset. The historical data suggests that this investment might not be suitable for those seeking a stable, long-term return.

Understanding Investment Risk: Levels and Their Impact

You may want to see also

Competitive Landscape: Assess UTIXX's position against competitors in the market

The first step in evaluating UTIXX as a safe investment is to understand the competitive landscape and how it compares to its peers in the market. UTIXX, a company specializing in [insert industry/sector], operates in a highly competitive environment where several established players and new entrants vie for market share. To assess its position, we need to consider various factors that influence its competitive advantage and potential risks.

One key aspect is the company's market share and growth rate. UTIXX has been steadily increasing its market presence over the past few years, capturing a significant portion of the [target market/industry]. Its growth trajectory is impressive, with consistent revenue increases and a strong customer base. However, it's essential to compare this growth with that of its direct competitors. For instance, [Competitor A] has been a market leader for a long time and has a strong brand reputation. They have recently expanded their product line, which might pose a direct challenge to UTIXX's market share. On the other hand, [Competitor B] is a newer player but has gained traction quickly with its innovative approach and targeted marketing strategies. Analyzing these competitors' performance and growth rates will provide insights into UTIXX's relative position and potential risks.

Another critical factor is the company's competitive advantage and unique selling points. UTIXX's success can be attributed to its [insert unique features or strategies]. These factors set it apart from competitors and attract customers. For instance, UTIXX's [insert unique feature] has been a significant draw for investors, as it provides a competitive edge in terms of [insert benefit]. However, it's important to note that competitors might be working on similar strategies or have the potential to replicate UTIXX's unique offerings. A thorough analysis of the competitive landscape should include an assessment of these threats and how UTIXX plans to maintain its advantage.

Additionally, considering the overall market trends and industry dynamics is crucial. The [industry/sector] is experiencing rapid technological advancements and changing consumer preferences. UTIXX's ability to adapt and innovate will be vital for its long-term success. For example, the rise of [insert emerging trend] might impact the industry, and UTIXX's strategies to embrace or mitigate these changes will be a key differentiator. Understanding the market's overall health and growth prospects will help investors make an informed decision about UTIXX's safety and potential for growth.

In summary, assessing UTIXX's position in the market requires a comprehensive analysis of its competitors, unique strengths, and the broader industry trends. By evaluating its market share, growth rate, and competitive advantages against established and emerging competitors, investors can gain valuable insights. Additionally, staying updated on industry developments and understanding how UTIXX plans to navigate market changes will contribute to a more accurate assessment of its safety and investment potential. This detailed approach ensures that investors can make well-informed decisions regarding UTIXX's investment prospects.

Foreign Currency Investment in India: A Guide

You may want to see also

Financial Health: Evaluate UTIXX's financial stability, revenue growth, and profitability

When assessing the financial health of UTIXX as a potential investment, several key factors come into play. Firstly, examining the company's financial stability is crucial. UTIXX's balance sheet should reveal a strong financial position with manageable debt levels and a healthy equity ratio. A low debt-to-equity ratio indicates that the company has a robust financial foundation and is less vulnerable to economic downturns. Additionally, a review of its cash flow statements will provide insights into its ability to generate positive cash flow, which is essential for long-term sustainability.

Revenue growth is another critical aspect to consider. UTIXX's historical revenue trends and growth rates should be analyzed to understand its market performance. A consistent upward trajectory in revenue suggests a strong market position and the ability to generate profits. Investors often seek companies with a proven track record of revenue growth, as it indicates a healthy demand for their products or services. By studying UTIXX's financial statements, one can identify the drivers of revenue growth and assess the sustainability of such growth over time.

Profitability is a key indicator of a company's financial health and its ability to create value for shareholders. UTIXX's profit margins, including gross profit margin, operating profit margin, and net profit margin, should be evaluated. These metrics provide insights into the company's efficiency in generating profits from its revenue. A consistent improvement in profit margins over time could be a positive sign, indicating effective cost management and operational efficiency. Investors should also consider the company's return on investment (ROI) and return on equity (ROE) to gauge its overall profitability and how effectively it utilizes its assets and shareholders' capital.

Furthermore, a comprehensive analysis of UTIXX's financial statements should include an assessment of its liquidity and solvency. This involves examining its current ratio, quick ratio, and debt-service coverage ratio. These metrics provide a snapshot of the company's ability to meet its short-term financial obligations and its overall financial health. A well-managed liquidity position ensures that UTIXX can navigate economic challenges and maintain its operations during adverse market conditions.

In summary, evaluating UTIXX's financial health requires a thorough examination of its financial stability, revenue growth, and profitability. Investors should scrutinize the company's balance sheet, cash flow statements, and profit margins to make an informed decision. A comprehensive financial analysis will provide insights into the company's ability to generate consistent returns, manage its finances effectively, and navigate the competitive landscape, ultimately helping determine whether UTIXX is a safe and attractive investment opportunity.

Roofstock: Worth the Investment Risk?

You may want to see also

Management Team: Assess the experience and track record of UTIXX's leadership

When evaluating the safety of an investment in UTIXX, it's crucial to delve into the management team's expertise and history. The leadership of a company plays a pivotal role in its success and stability, especially in the volatile world of finance. UTIXX's management team should be thoroughly examined to ensure they possess the necessary skills and experience to navigate the challenges inherent in the industry.

The management team's collective experience is a key indicator of their ability to make sound decisions and steer the company through various market conditions. Investors should look for a diverse range of expertise within the team, including financial acumen, industry-specific knowledge, and a proven track record of successful leadership. A well-rounded management team with a history of adapting to changing market dynamics can provide a sense of reassurance to investors.

Assessing the individual members of the management team is essential. Each leader should have a clear understanding of their role and a history of effective decision-making. For instance, the CEO should demonstrate a strong vision and strategic direction, while the CFO should showcase financial expertise and a history of managing complex financial operations. A diverse skill set within the team ensures that various aspects of the business are adequately addressed.

The track record of the management team is another critical factor. Investors should scrutinize past performance and the strategies employed during different market cycles. Did the team successfully navigate economic downturns or industry disruptions? Were they able to capitalize on emerging trends and maintain profitability? A consistent history of adapting to market changes and demonstrating resilience is a positive sign.

Additionally, it is beneficial to review the management team's approach to risk management and decision-making processes. A well-defined risk assessment framework and a history of making calculated decisions can indicate a mature and responsible leadership style. Investors should also consider the team's ability to attract and retain top talent, as this reflects their overall competence and industry reputation.

In summary, evaluating the management team's experience and track record is essential for assessing the safety of an investment in UTIXX. A competent and experienced leadership team with a proven history of successful navigation through market challenges can inspire confidence in investors. This detailed analysis ensures that investors make informed decisions, considering the company's leadership capabilities as a crucial factor in their investment strategy.

Is the SMP 500 a Safe Investment Choice?

You may want to see also

Risk Factors: Identify potential risks and challenges facing UTIXX's business

Before delving into the risks, it's essential to understand the context of UTIXX and the factors that could influence its investment safety. UTIXX, a company in the technology sector, might face various challenges that could impact its performance and, consequently, the returns for investors. Here are some key risk factors to consider:

Market Competition and Technological Obsolescence: The technology industry is highly competitive, and UTIXX operates in a dynamic market. One of the primary risks is intense competition from established players and startups. Established companies might have a significant advantage in terms of brand recognition, customer base, and resources. Additionally, the rapid pace of technological advancement could lead to product or service obsolescence. If UTIXX fails to innovate and keep up with industry trends, it may lose its competitive edge, resulting in decreased market share and revenue.

Regulatory and Legal Challenges: Compliance with legal and regulatory requirements is crucial for any business. UTIXX might face challenges related to data privacy, cybersecurity, and industry-specific regulations. For instance, the company could be subject to strict rules regarding customer data protection, especially if it operates in sectors like finance or healthcare. Non-compliance with these regulations can lead to significant fines, legal battles, and reputational damage. Moreover, changes in government policies and legislation could impact the business model and profitability of UTIXX.

Economic and Market Volatility: Economic downturns and market fluctuations can significantly affect investment decisions. UTIXX's business might be susceptible to economic cycles, where a recession or a market downturn could lead to reduced consumer spending and business investments. This could result in decreased demand for UTIXX's products or services. Additionally, external factors like interest rate changes, currency fluctuations, and geopolitical events can introduce volatility in the market, potentially impacting the company's financial performance and investor confidence.

Operational and Management Risks: Effective management and operational efficiency are critical for a company's success. UTIXX should carefully assess the risks associated with its internal processes, supply chain management, and operational scalability. For instance, any disruptions in the supply chain could impact production and delivery, affecting customer satisfaction. Furthermore, management's ability to execute strategies, adapt to market changes, and make informed decisions is vital. Poor leadership or strategic missteps could lead to decreased productivity, employee morale, and overall business performance.

Financial and Cash Flow Risks: Analyzing financial health is essential for investors. UTIXX should consider the risks related to its financial management, including cash flow stability, debt levels, and profitability. Rapid expansion or aggressive investment strategies might lead to increased debt, which could become a burden during economic downturns. Additionally, the company should ensure that its financial reporting is accurate and transparent to maintain investor trust. Any financial missteps or scandals could have severe consequences for the company's reputation and investor confidence.

Understanding these risk factors is crucial for investors to make informed decisions about UTIXX. It is recommended to conduct thorough research, analyze the company's strategies, and consider seeking professional advice to assess the potential risks and rewards of investing in UTIXX.

Investment and Savings: Synonymous Expressions for Financial Equality

You may want to see also

Frequently asked questions

UTIXX is a digital asset and a decentralized platform that aims to revolutionize the way we interact with online content. It is built on blockchain technology, ensuring transparency and security. The platform offers a unique value proposition by providing a safe and efficient environment for users to buy, sell, and manage various digital assets. UTIXX's focus on user privacy, data protection, and a robust security infrastructure makes it an attractive and safe investment opportunity.

UTIXX prioritizes user security by implementing multi-signature wallets, cold storage for funds, and advanced encryption protocols. The platform's smart contract system is designed to prevent unauthorized transactions, ensuring that user funds remain safe. Additionally, UTIXX's team of cybersecurity experts continuously monitors and updates the system to mitigate potential risks, making it a reliable choice for investors.

While UTIXX strives for the highest level of security, like any investment, there are inherent risks. The cryptocurrency market is volatile, and the value of UTIXX tokens can fluctuate. It is essential for investors to conduct thorough research, understand the market dynamics, and diversify their investments. UTIXX's team also provides educational resources to help users make informed decisions and manage their risks effectively.

Yes, UTIXX allows users to withdraw their investments and digital assets at any time. The platform provides a seamless and secure process for fund withdrawals. Users can access their funds by connecting their wallets and following the withdrawal instructions. UTIXX's flexibility in terms of fund accessibility is a significant advantage, providing investors with the freedom to manage their investments according to their financial goals.