Lifecycle funds are a type of mutual fund that automatically adjusts its asset allocation to match an investor's risk tolerance as they near retirement. They are also known as target date funds or age-based funds. These funds are designed to lower risk as the investor gets closer to retirement, typically by increasing the percentage of bonds and other fixed-income investments. The main advantage of lifecycle funds is their convenience, offering a set-and-forget retirement plan. They also provide instant diversification among and within asset classes and are less volatile. However, critics argue that lifecycle funds are too conservative and are based on the flawed assumption that younger investors can handle more risk. Additionally, they may have higher fees compared to simple index funds and may not be suitable for investors with complex portfolios or those who prefer a more active investment approach.

| Characteristics | Values |

|---|---|

| Type of fund | Lifecycle funds are usually mutual funds |

| Risk | Lifecycle funds are designed to reduce risk as the investor nears retirement |

| Effort | Lifecycle funds are a "set it and forget it" investment |

| Asset allocation | Lifecycle funds are balanced funds, holding both stocks and bonds |

| Glide path | Lifecycle funds follow a glide path, generally becoming less aggressive as the years go by |

| Cost | Lifecycle funds are usually low-cost |

| Diversification | Lifecycle funds provide instant diversification among asset classes |

| Volatility | Lifecycle funds are less volatile |

| Control | Lifecycle funds automatically rebalance and reallocate assets |

| Tax efficiency | Lifecycle funds are inappropriate for taxable accounts |

| Fees | Lifecycle funds usually have higher fees than simple index funds |

What You'll Learn

- Lifecycle funds are designed to be used by investors with specific goals that require capital at set times

- Lifecycle funds are also known as age-based funds or target-date retirement funds

- Lifecycle funds are a set it and forget it investment

- Lifecycle funds are a type of mutual fund

- Lifecycle funds are not always available in all accounts

Lifecycle funds are designed to be used by investors with specific goals that require capital at set times

A lifecycle fund is a "fund of funds", meaning its only holdings are other mutual funds. It is a balanced mutual fund, holding both stocks and bonds. Lifecycle funds are also known as "age-based funds" or "target-date retirement funds".

A lifecycle fund is a set-and-forget investment that automatically adjusts during its life to match an investor's risk tolerance as they near retirement. This is done by automatically rebalancing to maintain its desired asset allocation over time. The funds are designed to lower risk as the desired retirement date approaches. This usually means that the percentage of bonds and other fixed-income investments increases.

For example, suppose you invest in a lifecycle fund with a target retirement date of 2050. At first, the fund will be aggressive, holding 80% stocks and 20% bonds. Each year, there will be more bonds and fewer stocks in the fund. By 2035, halfway to the retirement date, the fund would be 60% stocks and 40% bonds. Finally, by the target retirement date of 2050, the fund would reach 40% stocks and 60% bonds.

The main benefit of lifecycle funds is that they do the work for investors, protecting them from making poor rebalancing decisions. However, they are a "'one-size-fits-all' strategy and may be too conservative for some investors.

Investing in Amazon: Top Funds to Consider

You may want to see also

Lifecycle funds are also known as age-based funds or target-date retirement funds

Lifecycle funds are asset-allocation funds in which the share of each asset class is automatically adjusted to lower risk as the desired retirement date approaches. This usually means that the percentage of bonds and other fixed-income investments increases over time.

A young investor saving for retirement would typically choose a lifecycle fund with a target date that is 30 to 40 years away. However, an older investor who is nearing retirement age might select a lifecycle fund with a target date that is 15 years in the future. Accepting higher volatility can help to stretch retirement funds over the 20 or more years of old age most individuals can expect.

Lifecycle funds are based on the idea that young investors can handle more risk, but this is not always true. Younger workers usually have less money saved and less experience. As a result, they are more vulnerable to unemployment during recessions. A young investor who takes on high levels of risk might be forced to sell stocks at the worst possible time.

The main benefit of lifecycle funds is that they do the work for investors, offering a "set it and forget it" investment strategy. They protect investors from making poor rebalancing decisions. Over time, an automatically rebalanced portfolio of stocks and bonds has historically performed better than the average investor and almost as well as a pure stock portfolio, with less volatility.

Invest Wisely: Low-Cost Index Funds for Long-Term Gains

You may want to see also

Lifecycle funds are a set it and forget it investment

Lifecycle funds are a type of mutual fund that automatically adjusts its asset allocation over time to match an investor's risk tolerance as they near retirement. They are also known as "age-based funds" or "target-date retirement funds". The main advantage of investing in lifecycle funds is that they offer a "set it and forget it" investment strategy, which means they can be left to run on autopilot with minimal intervention from the investor. This makes them a convenient and passive approach to investing for retirement.

Lifecycle funds are designed to lower risk as the investor gets closer to their retirement age. Initially, the fund may be more heavily weighted towards stocks, but over time, it will gradually shift towards a more conservative mix of investments, such as bonds and other fixed-income assets. This helps to preserve capital and reduce the impact of potential losses as the investor enters retirement.

The automatic adjustment of asset allocation in lifecycle funds is based on the traditional advice that investors should take on less risk as they approach retirement age. This strategy aims to protect investors from poor rebalancing decisions and has been shown to perform better than the average investor over several decades. By automatically implementing a "buy low, sell high" strategy, lifecycle funds can help investors avoid the common mistake of buying stocks when the market is high and selling after it has fallen.

While lifecycle funds offer a simple and low-maintenance investment solution, they may not be suitable for everyone. One criticism is that they are a "`one-size-fits-all`" strategy and do not take into account individual circumstances, such as other sources of retirement income or varying risk tolerances. Additionally, some investors may find the fees associated with lifecycle funds to be relatively high compared to simple index funds. It is important for investors to carefully consider the pros and cons of lifecycle funds before deciding if they align with their investment goals and risk appetite.

Invest in Your Future: IRA Funds and You

You may want to see also

Lifecycle funds are a type of mutual fund

Lifecycle funds are designed for investors with specific goals who require capital at set times, typically for retirement, though they can also be used for other financial goals with a defined timeline, such as saving for a child's college education. When investing in a lifecycle fund, an individual selects a fund with a target date that corresponds to their desired retirement year or another financial goal. The fund managers then make all the decisions about asset allocation, diversification, and rebalancing.

As the target date approaches, lifecycle funds automatically shift towards a more conservative mix of investments to preserve capital and ensure investors don't face significant losses as they near or enter retirement. This shift is known as the fund's glide path. For example, a lifecycle fund with a target retirement date of 2050 may start with an aggressive allocation of 80% stocks and 20% bonds, gradually moving towards a more conservative mix of 40% stocks and 60% bonds by the target retirement date.

While lifecycle funds offer the benefit of convenience and a passive investment strategy, they may not be suitable for all investors. One criticism of lifecycle funds is that they are based on the idea that younger investors can handle more risk, which may not always be true. Additionally, lifecycle funds may have higher fees compared to simple index funds, and they may not be available in all types of investment accounts. Some investors may also prefer a more active and customised investment strategy that takes into account their unique financial circumstances, rather than a one-size-fits-all approach.

Investing in Index Funds: A Beginner's Guide to Getting Started

You may want to see also

Lifecycle funds are not always available in all accounts

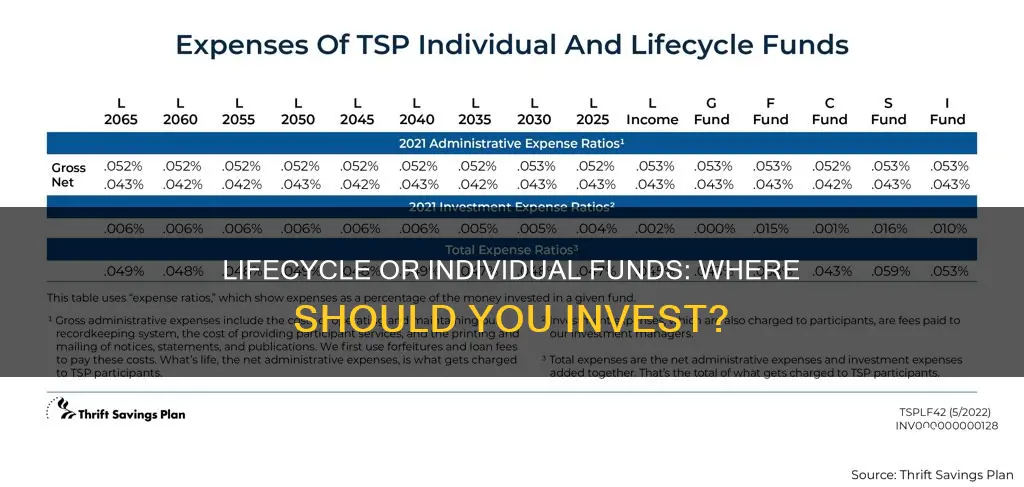

For example, the Thrift Savings Plan (TSP) for employees of the federal government offers lifecycle funds. These funds are designed to be a simple, one-size-fits-all solution for federal employees, allowing them to have all their money in a single fund that changes automatically as they approach retirement. However, as people approach retirement, their investment needs may change, and a one-size-fits-all solution may no longer be appropriate.

It is important to note that lifecycle funds are not tailored to individual circumstances. They are based on the idea that investors should take less risk as they get older, but this may not always be true. Younger investors may be able to handle more risk, while older investors may have different retirement plans and income sources that make a more aggressive investment strategy more suitable. Therefore, it is crucial to consider your unique needs and goals when making investment choices.

HDFC Mutual Fund: Offline Investment Guide

You may want to see also

Frequently asked questions

Lifecycle funds are asset-allocation funds in which the share of each asset class is automatically adjusted to lower risk as the desired retirement date approaches. They are also known as "age-based funds" or "target-date retirement funds."

Lifecycle funds offer the advantage of convenience. Investors can put their investing activities on autopilot with just one fund. They are also low-cost, low-maintenance, and reasonably well-allocated among various asset classes.

Lifecycle funds are based on the idea that young investors can handle more risk, but this is not always true. They are also a ""one-size-fits-all" strategy and do not take into account individual circumstances. They may also be too conservative, with some funds investing about 80% in bonds that barely return more than inflation.

This depends on your individual circumstances and investment goals. If you are looking for a convenient, low-maintenance option, then lifecycle funds may be a good choice. However, if you want more control over your investments and are willing to actively manage your portfolio, then individual funds may be a better option.