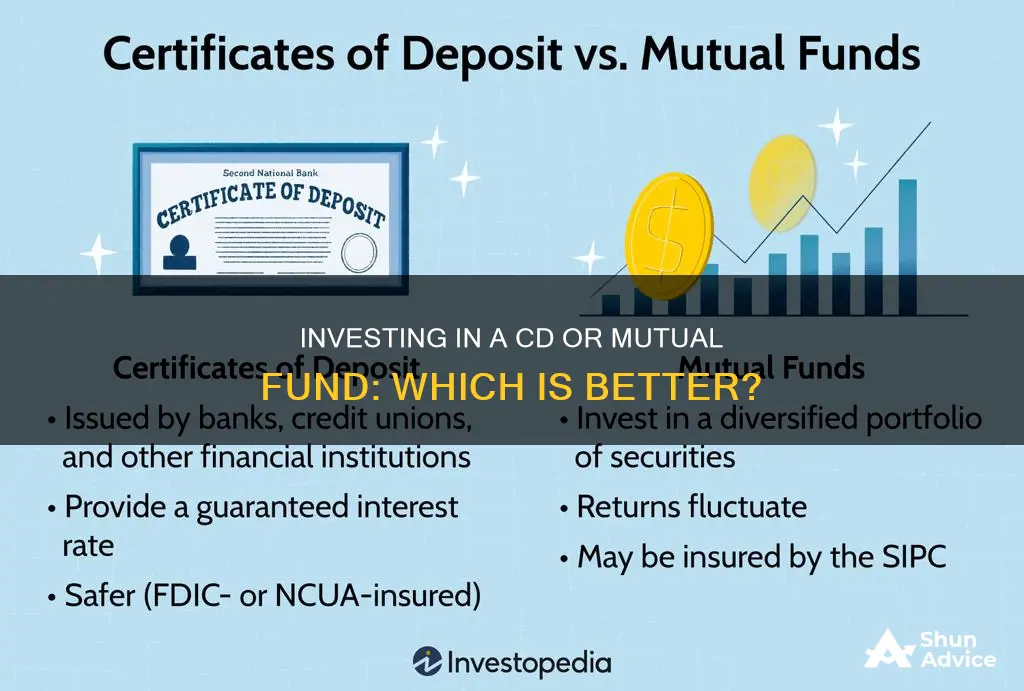

If you're looking to invest your money, you may be considering a certificate of deposit (CD) or a mutual fund. Both are useful investment vehicles that can grow your money, but they serve different purposes. CDs are insured deposit accounts that offer a fixed interest rate over a specified period, generally considered a safe option for savings you don't want to put at risk. On the other hand, mutual funds invest your money in a diverse pool of securities, offering the potential for much bigger returns but also carrying a higher risk. When deciding between the two, it's essential to understand your financial goals and circumstances to determine which option aligns better with your needs.

| Characteristics | Values |

|---|---|

| Risk | CDs are safer and have a guaranteed interest rate, but mutual funds have the potential for higher returns |

| Returns | CDs offer modest returns that may not outpace inflation, while mutual funds have higher growth potential |

| Time horizon | CDs are better for short-term goals, while mutual funds are better for long-term goals |

| Liquidity | CDs have low liquidity due to early withdrawal penalties, but mutual funds allow you to buy and sell shares at any time |

| Fees | Mutual funds charge annual fees (expense ratios), while CDs generally have no service fees |

| Investment type | CDs are insured deposit accounts with a fixed interest rate, while mutual funds invest in a diverse pool of securities |

| Diversification | Mutual funds offer diversification by investing in a wide range of securities, reducing overall risk |

| Suitability | CDs are suitable for risk-averse investors or those with short-term goals, while mutual funds are better for long-term wealth accumulation |

What You'll Learn

- CDs are insured deposit accounts with a fixed interest rate over a specified period

- Mutual funds offer greater liquidity and higher returns but are riskier than CDs

- CDs are better for short-term goals, while mutual funds are better for long-term goals

- Mutual funds are a more diverse pool of securities, while CDs are safer but offer lower growth potential

- Mutual funds are actively or passively managed, while CDs are issued by banks or credit unions

CDs are insured deposit accounts with a fixed interest rate over a specified period

Certificates of deposit (CDs) are insured deposit accounts that offer a fixed interest rate over a specified period. They are considered a safe investment option as they are insured by a bank or credit union, and in the US, most are also insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA). This means that your funds are protected by the US government if the issuing institution fails, up to a certain limit.

CDs are ideal for those with a low-risk appetite as they offer guaranteed returns. When you invest in a CD, you agree to keep your money in the account for a fixed period, and in exchange, the bank or credit union will pay you interest at a set rate. The longer the term, the higher the interest paid, and you can choose terms ranging from a few months to five years or more.

While CDs offer a low-risk investment option, there are some downsides to consider. Firstly, your money is locked in, and if you withdraw it before the maturity date, you will likely incur a penalty. This can be a hefty fee that may even exceed any gains you have made. Secondly, the interest rates offered by CDs may not always keep up with inflation, and your money could lose purchasing power if inflation increases during the term of your CD.

When deciding whether to invest in CDs or mutual funds, it is essential to consider your financial goals and risk tolerance. CDs are generally better suited for short- to medium-term savings goals, while mutual funds are typically used for longer-term goals like retirement.

Negative-Yield Bond Investment: Why Do Funds Take the Risk?

You may want to see also

Mutual funds offer greater liquidity and higher returns but are riskier than CDs

Mutual funds and certificates of deposit (CDs) are two of the main investment choices for people saving money for the future. While CDs are a safe, low-risk option, mutual funds offer greater liquidity and higher returns, albeit with greater risk.

Mutual funds offer a simple way to invest in stocks without needing any knowledge of investing. They are also a great way to diversify your investments as they may contain a large mix of stocks and bonds in different sectors and companies. The value of mutual funds can decrease, however, and you may lose money. Mutual funds also charge annual fees, known as expense ratios, which can eat into returns.

CDs, on the other hand, are insured deposit accounts that offer a fixed interest rate over a specified period. CDs are very low-risk as they are insured by a bank or credit union, and sometimes the federal government. However, once your money is in a CD, you can't access it for a set period of time without incurring a penalty.

While mutual funds offer greater liquidity than CDs, this comes with greater risk. If you are saving for the long term, such as for retirement, mutual funds are a better option as they offer the potential for higher returns. However, if you are saving for the short or medium term, CDs are a safer choice as they guarantee a modest return without the risk of losing your principal.

A Guide to Investing in Korean Mutual Funds

You may want to see also

CDs are better for short-term goals, while mutual funds are better for long-term goals

When it comes to investing, there are various options to consider, each with its own advantages and drawbacks. Two of the main choices for saving money for the future are certificates of deposit (CDs) and mutual funds. While both can be valuable investment vehicles, they serve different purposes and are more suitable for certain types of investors and financial goals.

CDs are better suited for short-term goals, typically ranging from a few months to five years or slightly longer. They offer a modest but guaranteed return with virtually no risk. When you invest in a CD, you agree to keep your money in the account for a specified period, during which it earns a fixed interest rate. The longer the term, the higher the interest paid, which is often higher than a regular savings account. However, the downside is that your money is illiquid, and early withdrawal usually incurs penalties. CDs are ideal for those who want a safe, low-risk option and are saving for short- or medium-term goals, such as a down payment on a car or a home.

On the other hand, mutual funds are better for long-term goals. They offer higher potential returns but come with higher risks. Mutual funds are a type of investment fund that pools money from multiple investors to purchase a diverse range of securities, including stocks, bonds, and other assets. The performance of mutual funds fluctuates with the market but tends to trend upwards over time. While diversification within the fund helps to mitigate risk, losses can still occur, and there are also annual fees associated with these funds. Mutual funds are a good choice for those with a longer time horizon who can tolerate price fluctuations and are willing to take on more risk for the potential of higher returns.

In summary, CDs are better for short-term goals, offering safety and modest returns, while mutual funds are better for long-term goals, providing the potential for higher returns but with greater risk. The choice between the two depends on your financial objectives, risk tolerance, and investment timeframe.

Utility Index Funds: When to Invest for Maximum Returns

You may want to see also

Mutual funds are a more diverse pool of securities, while CDs are safer but offer lower growth potential

When deciding between investing in a certificate of deposit (CD) or a mutual fund, it's important to understand the differences between the two. Both CDs and mutual funds are useful investment vehicles that can help grow your money, but they serve different purposes and offer distinct advantages.

Mutual funds offer a more diverse pool of securities, providing investors with access to a wide range of investments, such as stocks, bonds, and other assets. They are often chosen for their potential to deliver higher returns over the long term. For example, an S&P 500 index fund has a historical rate of return of around 10%. Mutual funds are ideal for investors with a longer time horizon, typically those saving for retirement, as they can ride out the market's ups and downs and benefit from the power of compound interest over time.

On the other hand, CDs are considered safer investments but typically offer lower growth potential. They are insured deposit accounts that provide a fixed interest rate over a specified period, usually ranging from a few months to five years or more. CDs are ideal for short- to medium-term financial goals, such as saving for a down payment on a car or a house. Your money is guaranteed to earn interest, albeit at a modest rate, and there is minimal risk of losing your principal investment. However, early withdrawal from a CD often incurs a penalty, and one of the risks associated with CDs is that inflation may rise during the term, reducing the purchasing power of your money.

While mutual funds offer greater diversification and higher growth potential, CDs provide a safer, more conservative option with guaranteed returns. The choice between the two depends on your financial goals, risk tolerance, and investment time horizon.

Bridgewater All-Weather Fund: A Guide to Investing

You may want to see also

Mutual funds are actively or passively managed, while CDs are issued by banks or credit unions

Mutual funds and CDs (certificates of deposit) are both investment vehicles with the potential to grow your money, but they work in very different ways. Mutual funds are actively or passively managed, while CDs are issued by banks or credit unions.

Actively managed mutual funds are run by professional money managers who buy and sell securities according to the fund's objectives. These funds usually have higher expense ratios than passively managed funds. Passively managed funds, on the other hand, aim to replicate the performance of a particular index, such as the S&P 500. They tend to have lower expense ratios, as they are not actively managed.

CDs, on the other hand, are issued by banks and credit unions and are insured deposit accounts that offer a fixed interest rate over a specified period. Most CDs are insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), which means your investment is protected up to a certain amount. This makes CDs a very low-risk investment option.

When deciding between mutual funds and CDs, it's important to consider your financial goals and risk tolerance. Mutual funds offer higher growth potential but come with higher risks. CDs, on the other hand, offer modest returns with little to no risk, making them suitable for short- to medium-term investment goals.

It's also important to consider the flexibility of each investment option. Mutual funds offer more flexibility, as you can generally buy and sell shares as often as you like. CDs, on the other hand, have less liquidity, as you may be subject to penalties if you withdraw your money before the maturity date.

In summary, mutual funds are actively or passively managed investment options that offer higher growth potential but come with higher risks. CDs, issued by banks or credit unions, offer modest returns with little to no risk and are suitable for short- to medium-term investment goals. The best option for you depends on your financial goals, risk tolerance, and investment horizon.

Small-Cap Funds: When to Invest and Why

You may want to see also

Frequently asked questions

A certificate of deposit (CD) is a financial product offered by a bank, credit union, or other financial institution. When you purchase a CD, you agree to keep your money invested for a certain period in exchange for a set interest rate. Mutual funds, on the other hand, are a diverse pool of securities, including stocks and bonds, that are actively or passively managed to meet specific goals.

CDs are insured deposit accounts that offer a fixed interest rate over a specified period and are thus considered low-risk investments. The main risk with CDs is missing out on higher interest rates if inflation rises during the locked-up period. Mutual funds are riskier as they are subject to market volatility and there is a chance of losing some or all of your money.

CDs offer modest, fixed returns that may not always outpace inflation. Mutual funds have the potential for significantly higher returns but there is no guaranteed return.

CDs generally do not have service fees unless you withdraw money early, which incurs a penalty. Mutual funds charge annual fees known as expense ratios, which can vary depending on the fund.