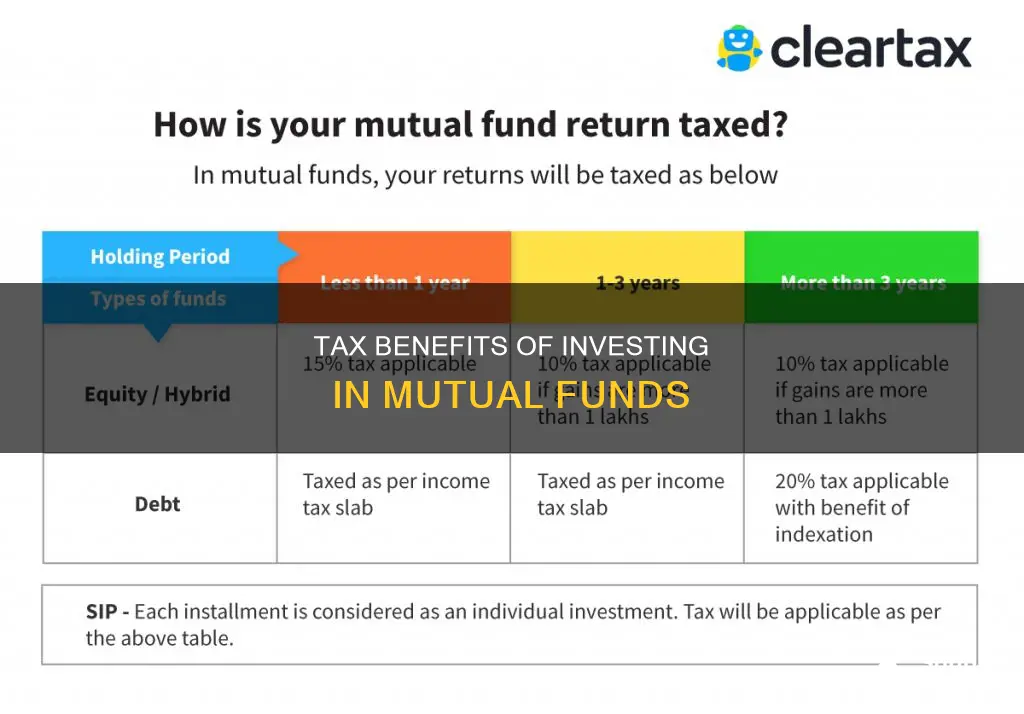

Mutual funds are a popular investment option, offering benefits such as affordable professional management, diversification, liquidity, and flexibility. However, like any other investment, mutual funds have tax implications that investors should be aware of. Understanding how mutual funds are taxed can help investors minimise their tax liability and maximise their returns. In this regard, it is important to distinguish between equity-oriented and debt-oriented mutual funds, as they are taxed differently, with equity-oriented schemes generally attracting lower taxes. Additionally, the duration of investment also impacts the amount of tax payable, with long-term capital gains typically attracting lower tax rates than short-term capital gains.

What You'll Learn

Tax-free dividends from ELSS funds

Dividends are payments, usually earnings, from a company to certain shareholders. Generally, companies must declare dividends before paying them. This is typically done by the company's board of directors. You may receive dividends if you own stocks, mutual funds, or exchange-traded funds (ETFs) that hold stocks in the fund.

Dividends from ELSS funds are tax-free for investors, providing an additional tax advantage. ELSS funds are mutual funds that put their money mostly into securities linked to equities. ELSS funds have a three-year lock-in period, the shortest among all tax-saving instruments under Section 80C. This means that once you invest in an ELSS fund, you must wait to withdraw the money for three years.

ELSS funds are an attractive investment choice for people who want to reduce their taxes and possibly increase their returns. They offer the dual benefit of tax savings under Section 80C and the opportunity for wealth creation through equity investments. However, like all investments, ELSS funds come with risks. It is important to understand your risk tolerance, investment horizon, and financial goals before investing.

A Guide to Investing in Calvert Funds Wisely

You may want to see also

Capital gains taxes on equity funds

Capital gains refer to the profits generated from selling an asset, such as stocks or real estate, for a higher price than its original value. Capital gains taxes are the taxes imposed on these profits, and they vary depending on the holding period of the asset and the taxpayer's income level.

In the context of equity funds, capital gains taxes apply when investors sell their mutual fund shares for a profit. The tax rate depends on whether the capital gain is classified as short-term or long-term. If the investor owned the mutual fund shares for more than a year before selling, the capital gain is typically considered long-term, and the tax rate is usually lower. On the other hand, if the investor owned the shares for a year or less, the capital gain is considered short-term, and the tax rate is generally higher.

For example, in the 2024-2025 tax year, single filers with a taxable income of $47,025 or less, joint filers with a taxable income of $94,050 or less, and heads of households with a taxable income of $63,000 or less are subject to a 0% tax rate on qualified long-term capital gains. Higher income levels may be taxed at 15% or 20% rates for long-term capital gains. Short-term capital gains, on the other hand, are taxed according to the ordinary income tax brackets, which range from 10% to 37%.

It is worth noting that capital gains taxes are only due after the investment is sold. Additionally, capital losses can be used to offset capital gains, reducing the overall tax liability.

Superannuation Fund: A Managed Investment Scheme?

You may want to see also

Capital gains taxes on debt funds

Debt mutual funds are investment instruments that primarily invest in fixed-income securities, such as bonds, treasury bills, and debentures. They are a preferred choice for conservative investors due to their relatively lower risk compared to market-linked assets. The tax rate on debt funds is determined by the investor's income tax slab.

Taxation of Debt Mutual Funds Before 1 April 2023

Prior to 1 April 2023, the taxation of debt mutual funds was based on the holding period rule:

- Short-Term Capital Gains (STCG): If the debt mutual fund unit was sold within 36 months (three years) of purchase, the gains were taxed at slab rates.

- Long-Term Capital Gain (LTCG): If the units were sold after 36 months, the gains were taxed at 20% with an indexation benefit. The indexation benefit adjusted the purchase cost for inflation, reducing the tax liability.

Taxation of Debt Mutual Funds After 1 April 2023

Budget 2023 amendments mean that specified mutual funds, including debt mutual funds, no longer receive indexation benefits when calculating LTCG. Consequently, debt mutual funds are now taxed at the applicable slab rates, bringing them in line with fixed deposits for taxation purposes. This change may impact the attractiveness of debt mutual funds as an investment option, as the tax burden on profits has increased.

Additionally, from 23 July 2024, LTCG held for more than 24 months will be taxed at 12.5%, and STCG will be taxed at the slab rate. These changes will negatively impact investors in the 20-30% tax bracket.

Types of Returns from Debt Mutual Funds

Debt mutual funds offer two types of returns:

- Dividends: Debt funds may pay out a portion of their profits to investors as dividends. These dividends are now taxable, added to the investor's total income, and taxed at the applicable slab rate.

- Capital Gains: Capital gains are profits made when redeeming debt mutual fund holdings. If the Net Asset Value (NAV) at redemption is higher than the NAV at purchase, the difference is taxed as a capital gain.

Taxation of Capital Gains from Debt Mutual Funds

Before April 1, 2023, capital gains from debt funds were classified as STCG or LTCG based on the holding period. However, after the Union Budget 2024, the holding period required to qualify for LTCG treatment was reduced from 36 months to 24 months. Additionally, the LTCG tax rate for all assets, excluding debt mutual funds, was set at 12.5% without indexation benefits. This change does not apply to debt mutual funds, which continue to be taxed according to the investor's income tax slab rate.

Maximizing Your Emergency Fund: Smart Investment Strategies

You may want to see also

Capital gains taxes on hybrid funds

Hybrid funds are a type of mutual fund that combines investments in stocks, bonds, and other assets, providing investors with a diverse portfolio. These funds typically have between 35% and 65% of their assets in equities, with the remainder in debt instruments.

When it comes to capital gains taxes, hybrid funds are taxed differently depending on their equity and debt components. Here's an overview of how capital gains taxes apply to hybrid funds:

Long-Term Capital Gains (LTCG)

For hybrid funds with an equity component, long-term capital gains are taxed at 12.5% on profits exceeding a certain threshold, which is currently Rs. 1.25 lakh per year in India. This tax applies if the fund is held for more than a year.

For hybrid funds with a debt component, long-term capital gains are taxed at 20% with indexation benefits. This tax applies if the fund is held for more than three years.

Short-Term Capital Gains (STCG)

For the equity component of hybrid funds, short-term capital gains are taxed at 20% if the fund is held for less than a year.

For the debt component, short-term capital gains are added to the investor's net income and taxed according to their applicable income tax slab rate.

Dividend Income

If you choose to receive dividends from a hybrid fund, this income will be added to your net income and taxed accordingly.

Strategies to Minimise Taxes on Hybrid Funds

- Hold for the Long Term: By holding your hybrid fund investments for longer periods, you can benefit from the LTCG exemption threshold and potentially avoid paying any capital gains tax.

- Tax-Efficient Investing: Focus on investing in consistent performers and avoid frequently buying and selling funds to minimise taxable gains.

- Systematic Withdrawal Plan (SWP): Set up regular withdrawals from your hybrid fund investments to keep them below the LTCG threshold.

- Sell at the Right Time: Monitor your portfolio and market conditions to time your sales and avoid incurring high capital gains taxes.

- Tax Harvesting: Use tax-loss harvesting to offset capital gains with capital losses by selling underperforming investments.

Unlocking Numerai Hedge Fund Investment: A Step-by-Step Guide

You may want to see also

Securities Transaction Tax (STT)

The STT is part of the taxes on dividends and capital gains that investors need to pay when investing in mutual funds. These taxes depend on factors such as the type of fund, dividend distribution, capital gains, and holding period. For example, if you sell a capital asset, such as mutual fund units, for a higher price than you bought it, you will realise a capital gain, which is subject to tax. The tax rate depends on whether it is a short-term or long-term capital gain, with long-term capital gains generally being taxed at a lower rate.

Additionally, dividends offered by mutual fund schemes are taxed as part of the investor's taxable income, following amendments made in the Union Budget 2020. Previously, dividends were tax-free as companies paid the Dividend Distribution Tax (DDT) before distribution.

Social Security Fund: Index Annuities and Government Investment

You may want to see also

Frequently asked questions

Mutual funds are not tax-free, but there are some tax incentives for investors. For example, in India, investors can claim a tax deduction of up to Rs.1.5 lakh in a financial year under Section 80C by investing in ELSS funds. In the US, investors can use tax-loss harvesting to offset taxes by selling underperforming mutual funds or securities at a loss.

Ordinary income is taxed at a higher rate than capital gains. Capital gains are only considered gains if the investment has been held for more than a year.

The type of distribution, the duration of the investment holding, and the type of investment all factor into how much tax you will pay on mutual fund distributions. The IRS's Publication 550 can be a helpful resource for investors.

The IRS allows taxpayers to determine the basis of their investment income using two methods: cost basis and average basis. Cost basis is the price you paid for the shares that were liquidated. Average basis is the aggregate cost of all your shares.

Investors can wait to sell their mutual fund shares, buy mutual fund shares through a tax-advantaged account like a 401(k) or IRA, or work with a tax professional to find other strategies.