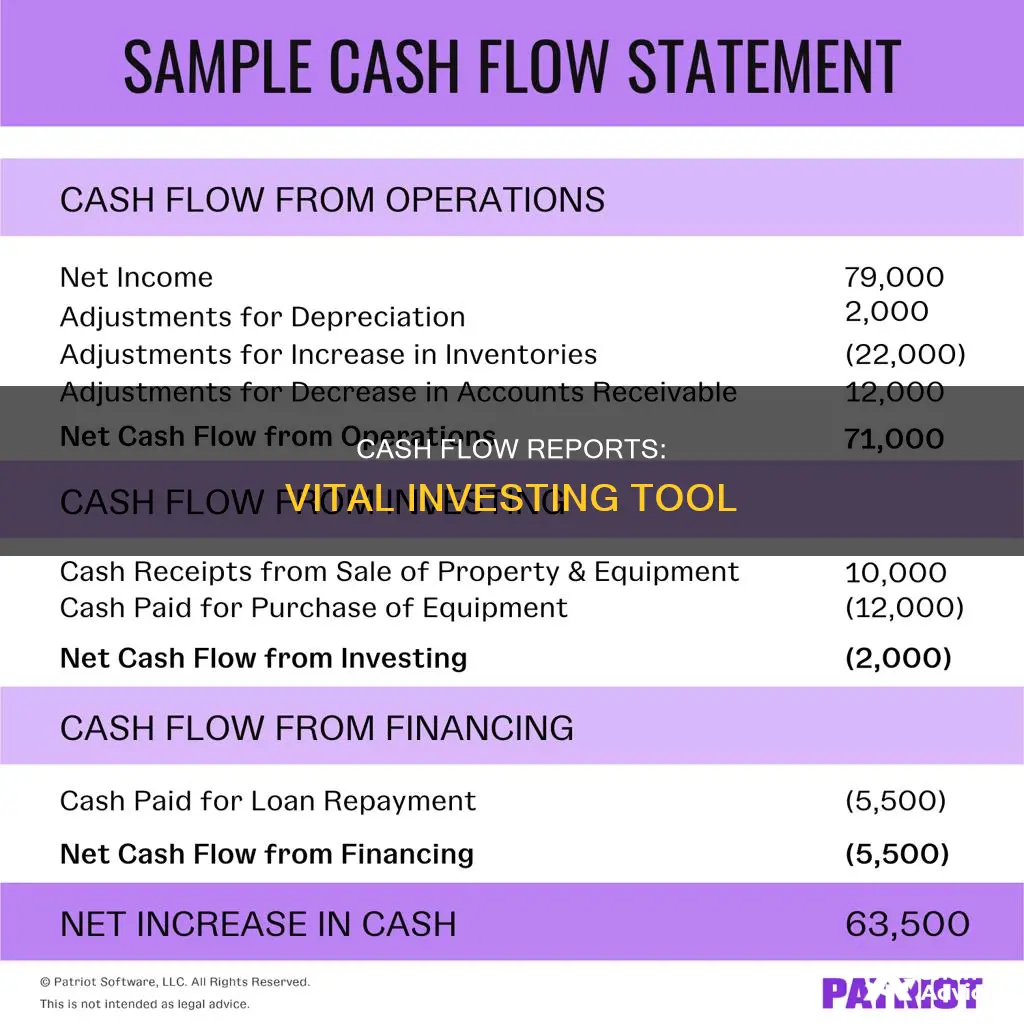

A cash flow report is a financial statement that provides an overview of a company's financial health and operational efficiency. It tracks the inflow and outflow of cash, offering insights into how well a company manages its cash position, including its ability to generate cash to pay debts and fund expenses. The report is divided into three sections: operating activities, investing activities, and financing activities. Operating activities refer to the cash flow generated from the sale of goods and services, while investing activities involve the purchase or sale of assets, and financing activities relate to debt and equity financing. These reports are essential for investors, creditors, and analysts to assess a company's performance and make informed decisions.

What You'll Learn

Operating Activities

This section of the cash flow statement includes cash received from the sale of goods and services, salary and wage payments, and payments to suppliers for inventory or goods needed for production. It also includes cash collected from customers, interest income, and dividends received.

There are two methods for depicting cash from operating activities: the indirect method and the direct method. The indirect method starts with net income and adjusts for changes in non-cash transactions, while the direct method tracks all transactions in a period on a cash basis, using actual cash inflows and outflows.

E*Trade Cash Balance Program: Investing Strategies for Beginners

You may want to see also

Investing Activities

Positive cash flow within the investing activities section is generally considered good, but investors prefer that companies generate their cash flow primarily from business operations. Negative cash flow from investing activities is not necessarily a bad sign, as it may indicate that management is investing in the long-term health of the company.

Capital expenditures (CapEx) are also included in this section. This item is a popular measure of capital investment used in the valuation of stocks. An increase in capital expenditures means the company is investing in future operations, but it is a reduction in cash flow. Typically, companies with significant capital expenditures are in a state of growth.

When analysing the cash flow statement, investors and analysts can look at the investing activities section to understand how much a company spends on property, plant, and equipment (PP&E).

The types of investing activities that can appear on the cash flow statement include:

- Purchase of fixed assets

- Purchase of investments such as stocks or securities

- Sale of fixed assets

- Sale of investment securities

- Collection of loans and insurance proceeds

When calculating investing cash flows, only transactions completed with free cash or money the company has on hand to spend are included. Investing cash flows do not include transactions that use financing or debt.

Cash Payments for Trading Securities: An Investment Activity?

You may want to see also

Financing Activities

- Bond offerings that generate cash

- Issuance or repayment of debt

- Issuance or repayment of equity

- Payment of dividends

- Capital lease obligations

- Repurchase of stock

The cash flow from financing activities provides investors with insight into a company's financial strength and how well its capital structure is managed. A positive cash flow from financing activities means more money is flowing into the company, increasing its assets. However, it is important to note that a company that frequently turns to new debt or equity for cash may not be generating enough earnings.

The cash flow statement is typically prepared using the indirect method, which starts with net income and adjusts for changes in non-cash transactions. The direct method, which is less common, involves listing all cash receipts and payments during the reporting period.

Cash Dividends: Investing Activity or Not?

You may want to see also

Cash Flow Calculation Methods

Cash flow statements are a crucial aspect of financial reporting, providing insights into a company's financial health and operational efficiency. These statements can be prepared using two primary methods: the direct method and the indirect method.

Direct Method

The direct method for calculating cash flow involves directly listing all the cash receipts and payments during a specific reporting period. This approach is straightforward and commonly used by small businesses that employ the cash basis accounting method. It is less complex than the indirect method and provides a clear picture of the company's cash position.

Indirect Method

The indirect method, on the other hand, starts with the net income and makes adjustments for changes in non-cash transactions. This method is more commonly used by larger companies that utilise the accrual basis accounting method. It focuses on the changes in the balance sheet and income statement to determine the cash flow.

Operating Cash Flow

Operating cash flow is one of the key sections of a cash flow statement. It reflects the cash inflows and outflows from the company's principal revenue-generating activities. This includes cash flows associated with sales, purchases, and other expenses. The formula for calculating operating cash flow is:

> Operating Cash Flow = Net Income + Depreciation and Amortisation + Accounts Receivables + Inventory – Accounts Payables

Investing Cash Flow

Investing cash flow is another critical component of the cash flow statement. It captures the cash inflows and outflows from the acquisition and disposal of non-current assets, investments, and other long-term assets. This includes purchases or sales of physical assets, investments in securities, and other similar activities. The formula for calculating investing cash flow is:

> Investing Cash Flow = Incoming Investment Cash Flows – Outgoing Investment Cash Flows

Financing Cash Flow

Financing cash flow reflects the cash inflows and outflows related to a company's capital structure and debt obligations. This includes activities such as issuing or repaying loans, issuing or repurchasing shares, and paying dividends. The formula for calculating financing cash flow is:

> Financing Cash Flow = Incoming Financing Cash Flows – Outgoing Financing Cash Flows

Net Cash Flow

Net cash flow is the sum of operating cash flow, investing cash flow, and financing cash flow. It represents the overall change in cash and cash equivalents during the reporting period. The formula for net cash flow is:

> Net Cash Flow = Operating Cash Flow + Investing Cash Flow + Financing Cash Flow

Free Cash Flow

Free cash flow is a crucial metric that indicates the amount of cash a company has available after covering all operational costs. It is calculated by subtracting capital expenditures from the operating cash flow and is essential for assessing a company's ability to invest in future growth opportunities. The formula for free cash flow is:

> Free Cash Flow = Operating Cash Flow – Capital Expenditures

In conclusion, understanding the different calculation methods for cash flow statements is vital for investors, creditors, and business owners. These methods provide valuable insights into a company's financial health, liquidity, and solvency, enabling better decision-making and strategic planning.

Is Your Cash App Investing Insured? Know the Facts

You may want to see also

Cash Flow Statement Users

A cash flow statement is a financial statement that provides data on a company's cash inflows and outflows from its operations, investments, and financing activities. It is one of the three main financial statements, alongside the balance sheet and the income statement. The cash flow statement is important for creditors and investors as it helps them understand a company's financial health and make informed decisions.

Who Uses Cash Flow Statements and Why?

Cash flow statements are used by a company's management, analysts, and investors. They provide valuable insights into the company's financial health and operational efficiency, helping users understand how the company's operations are running, where its money is coming from, and how it is being spent.

For creditors, the cash flow statement helps determine a company's liquidity and its ability to fund its operating expenses and pay down debts. Investors use the statement to assess whether a company is on solid financial ground and make informed investment decisions. A positive cash flow, where cash inflows exceed outflows, is generally seen as a good sign, indicating the company's ability to reinvest in itself, settle debt payments, and find new growth avenues.

Analysts use the cash flow statement to evaluate a company's cash flow between the company and its owners and creditors, as well as its ability to raise cash for operational growth. They also use it to determine how much a company has paid out in dividends or share buybacks.

Business owners and entrepreneurs can use the statement to understand business performance and adjust strategies accordingly. It can also help managers effectively manage budgets, oversee teams, and develop stronger relationships with leadership.

Overall, the cash flow statement is a valuable tool for understanding a company's financial health and making informed decisions about investments, business strategies, and operational growth.

Investing in Cash Balance Plans: Understanding Your Options

You may want to see also

Frequently asked questions

A cash flow report, or cash flow statement, is a financial statement that tracks the inflow and outflow of cash in a company. It provides insights into a company's financial health and operational efficiency. The cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities.

Cash flow reports are important for investors because they provide a clear picture of a company's liquidity and financial health. Investors can use these reports to make informed decisions about their investments, as they show how well a company generates cash to pay its debts and fund its operations.

The three types of cash flow in a cash flow report are operating cash flow, investing cash flow, and financing cash flow. Operating cash flow refers to the cash generated by a company's core business activities, such as sales and payments for goods and services. Investing cash flow refers to the cash used in or generated from the purchase and sale of long-term assets. Financing cash flow refers to the cash received from or paid to investors and lenders, such as issuing stock, paying dividends, or repaying loans.