Investments are a crucial aspect of personal finance, offering individuals a way to grow their wealth over time. They represent a commitment of funds with the expectation of generating a return, whether through interest, dividends, or capital appreciation. Understanding how investments work is essential for anyone looking to build a secure financial future. This involves grasping the concepts of risk and return, as well as the various types of investments available, such as stocks, bonds, real estate, and mutual funds. Each investment type carries its own set of risks and rewards, and the key to successful investing lies in making informed decisions based on one's financial goals, risk tolerance, and time horizon.

What You'll Learn

- Investment Vehicles: Stocks, bonds, real estate, and derivatives

- Risk and Return: Understanding risk tolerance and expected returns

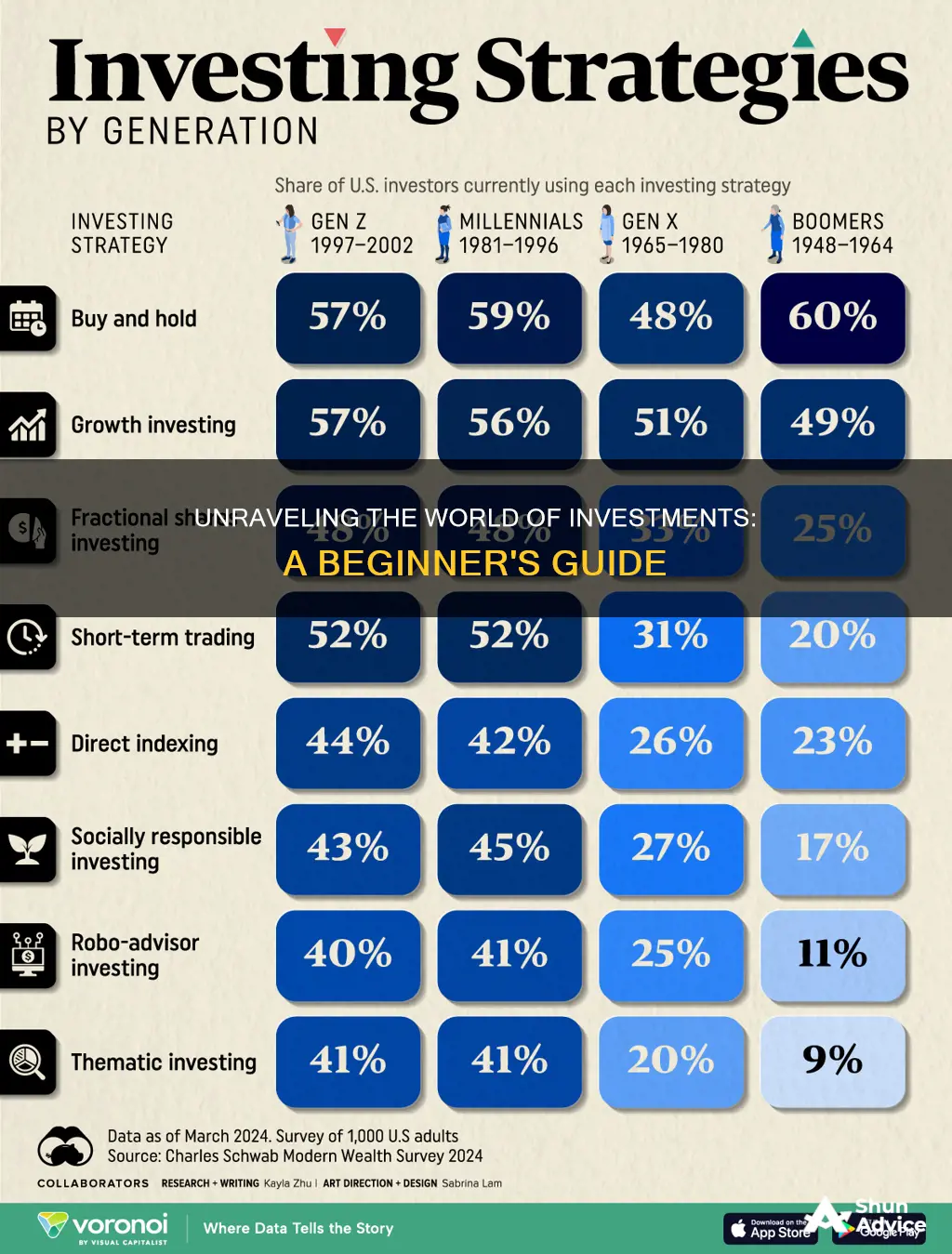

- Investment Strategies: Long-term vs. short-term, active vs. passive management

- Market Dynamics: Supply and demand, pricing, and market trends

- Investment Analysis: Fundamental and technical analysis, financial ratios, and metrics

Investment Vehicles: Stocks, bonds, real estate, and derivatives

Stocks

Stocks, also known as equities, represent ownership in a company. When you buy a stock, you become a shareholder and are entitled to a portion of the company's assets and profits. Stocks are typically traded on stock exchanges, such as the New York Stock Exchange (NYSE) or NASDAQ. When you purchase a stock, you are essentially buying a small piece of the company, and your investment grows as the company's value increases. This can be achieved through various factors, including the company's performance, industry trends, and market sentiment. Investors can buy and sell stocks through a brokerage account, which acts as an intermediary between the investor and the stock market.

Bonds

Bonds are a type of debt security issued by governments, municipalities, or corporations to raise capital. When you invest in a bond, you are essentially lending money to the issuer in exchange for a promise to repay the principal amount (the initial investment) plus interest over a specified period. Bonds are considered a more conservative investment compared to stocks, as they provide a steady stream of income in the form of interest payments. The interest rate on a bond is determined by factors such as the creditworthiness of the issuer, the maturity date, and market conditions. Bond prices and interest rates have an inverse relationship; when interest rates rise, bond prices typically fall, and vice versa.

Real Estate

Real estate investments involve purchasing property, such as residential or commercial buildings, land, or real estate investment trusts (REITs). Owning real estate provides an opportunity to generate income through rent or property appreciation. Real estate can be a tangible asset, offering a sense of security and control over a physical asset. Investors can choose to directly purchase and manage properties or invest in REITs, which are companies that own and operate income-generating real estate. REITs allow investors to diversify their portfolios by owning a share of a large portfolio of properties without the need for direct management.

Derivatives

Derivatives are financial instruments whose value is derived from an underlying asset, such as stocks, commodities, currencies, or interest rates. These instruments include options, futures, swaps, and forwards. Derivatives can be used for various purposes, including hedging, speculation, or leveraging an investment. For example, an investor might buy a call option on a stock, giving them the right to purchase the stock at a specific price before a certain date. Derivatives can provide flexibility and leverage, allowing investors to gain exposure to an asset or market without directly owning it. However, they can also be complex and carry significant risks, including market volatility and potential losses.

Ethereum: Invest or Avoid?

You may want to see also

Risk and Return: Understanding risk tolerance and expected returns

When it comes to investing, understanding the relationship between risk and return is crucial for making informed financial decisions. Risk tolerance refers to an individual's ability to withstand fluctuations in the value of their investments and their willingness to accept potential losses in exchange for higher returns. It is a personal assessment of how comfortable one is with the volatility and uncertainty associated with different investment options.

Risk tolerance is influenced by various factors, including age, financial goals, and time horizon. Younger investors often have a higher risk tolerance as they have more time to recover from potential losses and can afford to take on more aggressive investments. As individuals age and approach retirement, their risk tolerance typically decreases, favoring more conservative investment strategies to preserve capital. Additionally, an individual's financial goals play a significant role; those saving for short-term goals might opt for less risky investments, while those with long-term objectives, such as funding their child's education, may be more inclined to take on higher risks for potentially greater returns.

Expected returns, on the other hand, are the potential profits or losses an investor anticipates from an investment over a specific period. These returns are often associated with different levels of risk, and investors must carefully consider their risk tolerance when evaluating expected returns. Generally, higher-risk investments offer the potential for greater returns but also come with a higher probability of loss. For instance, stocks are known for their higher risk and potential for substantial gains but also carry the risk of significant losses if the market performs poorly. In contrast, more conservative investments like bonds or savings accounts provide lower potential returns but are generally considered safer.

Assessing one's risk tolerance is a critical step in investment planning. It involves evaluating your emotional comfort with market fluctuations and your ability to stay invested during periods of volatility. Some investors prefer a more hands-off approach, focusing on long-term growth, while others may actively manage their investments, seeking to capitalize on short-term market opportunities. Understanding your risk tolerance helps in constructing a well-balanced investment portfolio that aligns with your financial objectives and ensures that your investments are tailored to your personal comfort level with risk.

In summary, the concept of risk and return is fundamental to investing. Risk tolerance determines an individual's capacity to handle market volatility, while expected returns represent the potential outcomes of different investment choices. By recognizing your risk tolerance and aligning it with the expected returns of various investments, you can make strategic decisions that optimize your financial journey, ensuring a more secure and prosperous future.

Unveiling the Future of Investing: Next-Gen Strategies Explained

You may want to see also

Investment Strategies: Long-term vs. short-term, active vs. passive management

When it comes to investing, understanding the different strategies and approaches is crucial for making informed decisions. One of the fundamental choices investors face is between long-term and short-term investment strategies, each with its own set of advantages and considerations.

Long-term investment strategies are characterized by a patient and consistent approach. This strategy involves holding investments for an extended period, often years or even decades. The core idea is to ride out short-term market fluctuations and focus on the long-term growth potential of the investment. Long-term investors typically aim to benefit from compound interest, where earnings are reinvested to generate additional returns over time. This approach is particularly effective for retirement planning, as it allows investors to build substantial wealth by consistently investing and letting their money grow. For example, investing in index funds or carefully selected stocks and holding them for a prolonged period can lead to significant gains, especially when compared to short-term trading.

On the other hand, short-term investment strategies cater to those seeking quicker returns or those who prefer a more active approach. Short-term investors often engage in frequent buying and selling, aiming to capitalize on market trends and price movements within a relatively brief period. This strategy requires a keen understanding of market dynamics and the ability to make rapid decisions. Short-term traders may utilize various techniques, such as day trading, where positions are held for only a few hours or even minutes. While this approach can be lucrative, it also carries higher risks due to the increased volatility and potential for significant losses in a short time frame.

Another aspect of investment strategy is the distinction between active and passive management. Active management involves a hands-on approach where investors or fund managers actively select and manage individual securities to beat the market. This strategy requires extensive research, analysis, and decision-making, aiming to outperform the broader market index. Active investors often have higher fees due to the personalized service and expertise provided. However, this approach can be challenging, as outperforming the market consistently is difficult, and there is a risk of underperformance.

In contrast, passive management takes a more relaxed and market-following approach. Passive investors typically invest in index funds or exchange-traded funds (ETFs) that track a specific market index. This strategy aims to mirror the market's performance rather than trying to beat it. Passive management is generally associated with lower fees and less frequent trading, making it an attractive option for long-term investors seeking simplicity and diversification. While passive investors may not outperform the market in the short term, they often achieve similar returns over the long haul, providing a more consistent and less stressful investment experience.

In summary, the choice between long-term and short-term strategies, as well as active and passive management, depends on an investor's goals, risk tolerance, and time horizon. Long-term and passive approaches are often favored for their simplicity and potential for substantial wealth accumulation, while short-term and active strategies may be more suitable for those seeking quicker returns or willing to take on higher risks. Understanding these investment strategies is essential for making well-informed decisions and navigating the complex world of investing.

Financial Intermediaries: Linking Savers and Investors

You may want to see also

Market Dynamics: Supply and demand, pricing, and market trends

The concept of market dynamics is fundamental to understanding how investments function and how they can be analyzed. At its core, market dynamics refers to the interplay between supply and demand, which significantly influences pricing and market trends. This intricate relationship is the backbone of economic activity and investment strategies.

Supply and Demand:

Supply and demand are the two primary forces that shape market dynamics. When demand for a particular good or service exceeds its supply, it creates a situation of scarcity, driving up prices. Conversely, if supply surpasses demand, the market becomes oversaturated, potentially leading to price decreases. Investors closely monitor these dynamics to identify opportunities. For instance, in the technology sector, a sudden increase in demand for a specific gadget, coupled with a limited supply, can result in higher prices and potential investment gains for those who anticipate this shift.

Pricing:

Pricing is a critical aspect of market dynamics, as it reflects the interaction of supply and demand. Prices are not set in stone and can fluctuate based on market conditions. When demand is high and supply is stable, prices tend to rise. This is often observed in industries with inelastic demand, where consumers are willing to pay more regardless of price changes. On the other hand, if supply exceeds demand, prices may drop to attract customers. Investors analyze pricing trends to make informed decisions, such as buying stocks when prices are low, anticipating a future price increase.

Market Trends:

Market trends are long-term patterns that emerge from the dynamics of supply and demand. These trends can be influenced by various factors, including technological advancements, consumer behavior, and economic policies. For instance, the rise of renewable energy has led to a growing demand for sustainable products, impacting various industries. Investors who identify these trends can make strategic investments. For example, investing in companies that produce eco-friendly materials or renewable energy solutions can be lucrative, as these businesses are likely to benefit from the shifting market dynamics.

Understanding market dynamics is crucial for investors as it enables them to make informed choices. By analyzing supply and demand, pricing patterns, and market trends, investors can predict potential price movements and make strategic decisions. This knowledge is essential for building a successful investment portfolio, as it allows investors to navigate the ever-changing market landscape with confidence.

Wine Investment: Navigating the Fine Vintage Market

You may want to see also

Investment Analysis: Fundamental and technical analysis, financial ratios, and metrics

Investment analysis is a critical process that helps investors make informed decisions about their financial portfolios. It involves evaluating and assessing various aspects of an investment to determine its potential for growth, risk, and profitability. There are two primary approaches to investment analysis: fundamental analysis and technical analysis, each offering unique insights into the market and the investments themselves.

Fundamental Analysis:

Fundamental analysis is a method used to evaluate the intrinsic value of a security or investment by examining its underlying factors. This approach focuses on the 'fundamental' aspects of a business or asset, such as its financial health, management quality, industry position, and competitive advantage. Investors using this technique aim to identify undervalued assets or companies with strong growth potential. Key components of fundamental analysis include:

- Financial Statements: Investors scrutinize a company's financial reports, including income statements, balance sheets, and cash flow statements, to understand its financial performance, liquidity, and solvency.

- Economic and Industry Analysis: This involves studying economic indicators, market trends, and industry-specific factors that can impact the investment. It helps investors gauge the overall health of an industry and the specific company's position within it.

- Company-Specific Factors: These include management quality, corporate governance, and the company's strategic direction. Strong management and a clear vision can significantly influence investment success.

- Valuation Metrics: Fundamental analysts use various financial ratios and metrics to determine the fair value of an investment. These may include price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and return on equity (ROE).

Technical Analysis:

In contrast, technical analysis focuses on the historical performance and patterns of an investment's price and volume data. It assumes that market trends and price movements can be predicted by analyzing past data, making it a popular approach for short-term traders and investors. Here's an overview:

- Price and Volume Data: Technical analysts study historical price charts, volume trends, and various technical indicators derived from this data. They look for patterns, trends, and support/resistance levels to make trading decisions.

- Charting Tools: Technical analysis heavily relies on charting software and tools to visualize and analyze price movements. Common chart types include line charts, bar charts, and candlestick charts.

- Indicators: Numerous technical indicators, such as moving averages, relative strength index (RSI), and exponential moving averages (EMAs), are used to identify trends, overbought/oversold conditions, and potential entry/exit points.

- Trading Strategies: Technical analysts develop strategies based on these indicators and patterns, aiming to buy when prices are expected to rise and sell when prices are likely to decline.

Financial Ratios and Metrics:

Financial ratios and metrics are essential tools for investors to assess a company's financial performance, efficiency, and overall health. These ratios provide a comparative analysis and help investors make informed decisions. Here are some key financial ratios:

- Profitability Ratios: These include gross profit margin, net profit margin, and return on assets (ROA), which indicate a company's ability to generate profits from its operations.

- Liquidity Ratios: Current ratio, quick ratio, and cash ratio assess a company's ability to meet its short-term financial obligations.

- Solvency Ratios: Debt-to-equity ratio and times-interest-earned ratio evaluate a company's long-term financial stability and ability to manage debt.

- Efficiency Ratios: Inventory turnover ratio and days' sales outstanding (DSO) measure a company's efficiency in managing its assets and accounts receivable.

In investment analysis, a combination of fundamental and technical analysis, along with a thorough understanding of financial ratios, can provide a comprehensive view of an investment's potential. Investors often use these tools to identify undervalued assets, assess market trends, and make strategic decisions to optimize their portfolios.

Uncovering the Work Hours of Municipal Investment Bankers: A Deep Dive

You may want to see also

Frequently asked questions

An investment is a commitment of money or capital with the expectation of generating an income or profit. It involves allocating resources with the goal of increasing their value over time. This can be done through various financial instruments and strategies, such as stocks, bonds, real estate, or other assets.

Investments work by channeling funds into assets or projects that have the potential to generate returns. These returns can be in the form of capital gains (increase in the value of the investment) or income, such as dividends, interest, or rental payments. The value of an investment can fluctuate based on market conditions, economic factors, and the performance of the underlying asset.

There are numerous types of investments, each with its own characteristics and risk profiles. Common categories include:

- Stocks or Equities: Ownership shares in companies, offering potential for capital growth and dividends.

- Bonds: Debt instruments where investors lend money to governments or corporations, typically with fixed interest payments.

- Real Estate: Investing in properties, either directly or through real estate investment trusts (REITs).

- Mutual Funds and ETFs: Pools of money from multiple investors to invest in a diversified portfolio of assets.

- Cryptocurrencies: Digital currencies like Bitcoin, offering decentralized and often volatile investment opportunities.

Starting an investment journey involves several steps:

- Define your financial goals: Determine whether you're investing for short-term gains, long-term wealth accumulation, retirement, or other objectives.

- Assess your risk tolerance: Understand your ability to handle potential losses and choose investments accordingly.

- Research and educate yourself: Learn about different investment options, market trends, and risk management strategies.

- Create a diversified portfolio: Spread your investments across various asset classes to minimize risk.

- Consider consulting a financial advisor: They can provide personalized guidance based on your financial situation and goals.