A significant surge in short-term investments can have profound implications for the financial landscape. This phenomenon often reflects shifting market dynamics, investor sentiment, and economic conditions. Understanding the potential consequences is crucial for investors, businesses, and policymakers alike, as it can influence investment strategies, market stability, and overall economic growth. The following paragraphs will delve into the various aspects and implications of such a substantial increase in short-term investments.

What You'll Learn

- Market Volatility: Increased short-term investments can lead to higher market volatility, affecting asset prices

- Liquidity Concerns: A surge in short-term investments may strain liquidity, impacting trading and investment strategies

- Risk Management: Higher short-term investments can increase risk exposure, requiring careful portfolio management

- Economic Indicators: Short-term investment trends may reflect economic shifts, influencing market sentiment and policy decisions

- Investor Sentiment: Large short-term investments can impact investor confidence, affecting market behavior and investment decisions

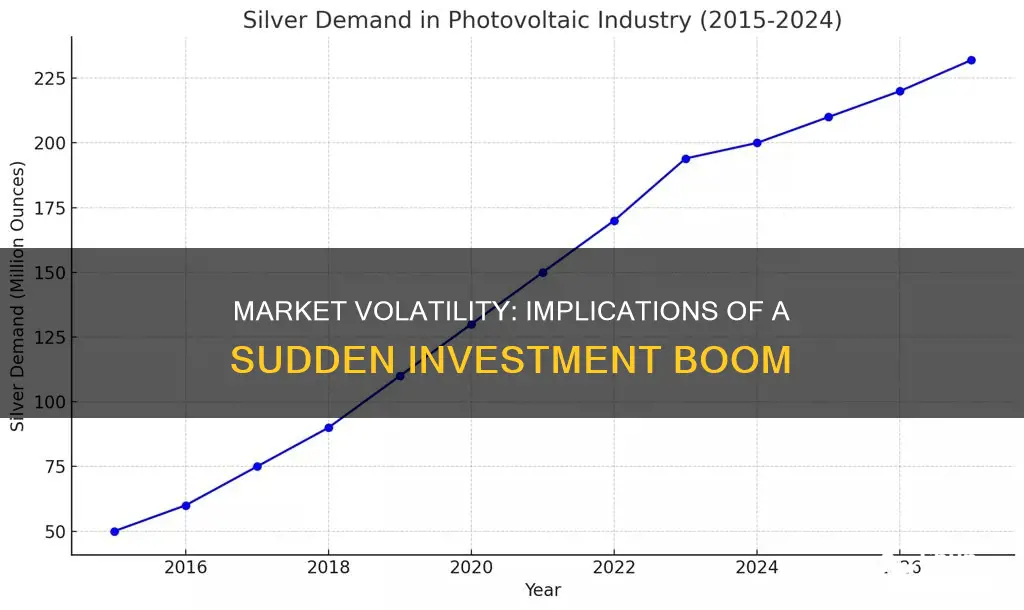

Market Volatility: Increased short-term investments can lead to higher market volatility, affecting asset prices

A significant surge in short-term investments can have a profound impact on market dynamics, particularly in terms of volatility. When investors opt for short-term gains, they often engage in rapid buying and selling activities, which can disrupt the stability of asset prices. This behavior is often driven by the desire to capitalize on quick profits, leading to a more frequent and intense exchange of assets. As a result, the market becomes more susceptible to price fluctuations, creating an environment of heightened volatility.

In the context of market volatility, increased short-term investments can have several consequences. Firstly, it may lead to a rapid and unpredictable movement of asset prices. Short-term traders often make decisions based on short-lived trends or news, which can cause prices to swing dramatically in a short period. This volatility can be particularly challenging for long-term investors who may find it difficult to navigate the market's frequent and sudden shifts.

Secondly, the influx of short-term investments can contribute to market inefficiencies. Short-term traders might not always consider the fundamental value of an asset, focusing instead on immediate price movements. This can result in mispricing, where assets are valued based on short-term sentiment rather than their long-term prospects. Such market inefficiencies can distort the true value of investments, making it harder for investors to make informed decisions.

Moreover, the impact of short-term investments on market volatility can have broader economic implications. Volatile markets may discourage long-term investment, as investors become hesitant to commit to assets with unpredictable short-term performance. This shift in investment behavior can hinder economic growth, as long-term investments are crucial for funding businesses, infrastructure, and other long-term projects.

In summary, a large increase in short-term investments can significantly contribute to market volatility. The rapid buying and selling activities of short-term traders can lead to frequent and dramatic price changes, affecting asset prices. This volatility may create challenges for investors and have broader economic consequences, emphasizing the importance of understanding and managing short-term investment trends in the financial markets.

Unraveling the Complexities: Understanding Seed Investment Terms

You may want to see also

Liquidity Concerns: A surge in short-term investments may strain liquidity, impacting trading and investment strategies

A significant surge in short-term investments can have several implications for the financial markets and investors, and one of the key concerns is the potential strain on liquidity. Liquidity refers to the ease with which an asset can be bought or sold without significantly impacting its price. When there is a large influx of short-term investments, it can create a unique set of challenges and considerations for market participants.

In the context of liquidity, a sudden increase in short-term investments might lead to a temporary surplus of funds in the market. This abundance of capital can result in heightened competition for investment opportunities, as investors seek attractive options to deploy their short-term capital. As a consequence, asset prices may become more volatile, and the ability to execute trades at desired prices could be compromised. Market makers and liquidity providers might face challenges in maintaining their usual trading activities, especially if the surge is sudden and not anticipated.

The impact on trading strategies is a critical aspect to consider. Short-term investors often focus on quick gains and frequent trading, which can lead to increased market activity and potential price fluctuations. This heightened trading activity may attract more market participants, but it can also create a more volatile environment. For long-term investors, this volatility might introduce additional risks and challenges in implementing their strategies, as short-term price movements can obscure the underlying value of investments.

Furthermore, the strain on liquidity can affect the speed at which investments are bought and sold. In a highly liquid market, transactions can be executed swiftly, ensuring that investors can enter or exit positions with minimal delay. However, with a surge in short-term investments, the market might become less liquid, leading to longer settlement times and potential delays in receiving funds. This can impact investment strategies that rely on quick capital turnover or those that require immediate access to funds.

To navigate these liquidity concerns, investors and market participants should closely monitor market conditions and adjust their strategies accordingly. Diversification, risk management, and a comprehensive understanding of the market dynamics will be crucial in managing the potential challenges associated with a large increase in short-term investments. Additionally, staying informed about regulatory changes and market trends can help investors make more informed decisions during such periods of market activity.

Quantitative Strategies: Unlocking Long-Term Investment Potential

You may want to see also

Risk Management: Higher short-term investments can increase risk exposure, requiring careful portfolio management

A significant surge in short-term investments can have profound implications for risk management, demanding a meticulous approach to portfolio management. This phenomenon often arises from various factors, such as market volatility, economic uncertainties, or the pursuit of quick returns. While short-term investments can offer liquidity and potential gains, they inherently carry higher risks that demand careful consideration and strategic planning.

One of the primary risks associated with increased short-term investments is the heightened exposure to market fluctuations. Short-term investments typically involve holding assets for a brief period, making them more susceptible to daily price volatility. This volatility can lead to rapid changes in the value of the portfolio, potentially resulting in substantial losses if not managed effectively. For instance, a sudden market downturn could significantly erode the value of short-term holdings, impacting the overall risk profile of the investment portfolio.

To mitigate these risks, investors must adopt a disciplined approach to portfolio management. This includes diversifying the investment mix to spread risk across various asset classes. By allocating a portion of the portfolio to long-term investments, investors can balance the need for short-term gains with the stability of long-term holdings. Regular portfolio reviews are essential to ensure that the investment strategy aligns with the investor's risk tolerance and financial goals.

Additionally, investors should consider implementing risk management techniques such as stop-loss orders and position sizing. Stop-loss orders allow investors to automatically sell assets if they reach a predetermined price, limiting potential losses. Position sizing involves managing the percentage of the portfolio allocated to short-term investments, ensuring that it remains within a defined risk threshold. These strategies enable investors to navigate market volatility and protect their capital.

In summary, a large increase in short-term investments can significantly impact risk management, requiring investors to be vigilant and proactive. By understanding the risks associated with short-term holdings, diversifying the portfolio, and employing risk management techniques, investors can navigate market fluctuations and make informed decisions. Careful portfolio management is essential to strike a balance between short-term gains and long-term financial stability.

Are NFTs a Long-Term Investment? Exploring the Future of Digital Art

You may want to see also

Economic Indicators: Short-term investment trends may reflect economic shifts, influencing market sentiment and policy decisions

A significant surge in short-term investments can be a powerful indicator of shifting economic dynamics and market sentiment. This phenomenon often arises during periods of economic uncertainty or when investors anticipate favorable short-term opportunities. Here's how it influences various aspects of the economic landscape:

Market Sentiment and Investor Confidence: A large influx of short-term investments typically signifies a positive outlook among investors. When market participants believe that the economy is about to experience growth or that specific sectors will perform well in the near future, they tend to invest in short-term assets. This increased confidence can lead to a rise in stock prices, as investors buy into the perceived value of companies or industries. As a result, market sentiment becomes more optimistic, creating a self-fulfilling prophecy where further investments are attracted.

Economic Shifts and Policy Responses: Short-term investment trends are closely watched by economists and policymakers. A substantial increase in these investments may indicate that investors are anticipating a short-term economic upswing. This could be a response to various factors, such as favorable interest rates, improved business conditions, or government policies that stimulate economic activity. Policymakers might interpret this as a sign to maintain or adjust monetary and fiscal policies to support the economy. For instance, central banks might consider keeping interest rates low to encourage further investment and sustain economic growth.

Impact on Financial Markets: The surge in short-term investments can have a direct impact on financial markets. As more capital flows into these investments, it can lead to increased volatility, especially in the stock market. Higher trading volumes and rapid price fluctuations may result, creating a dynamic and potentially risky environment. Investors and traders must carefully analyze these trends to make informed decisions, as short-term market movements can be influenced by various factors, including news, events, and investor behavior.

Business and Consumer Behavior: Short-term investment trends can also influence business and consumer behavior. Companies might interpret a rise in short-term investments as a sign of improving economic conditions, encouraging them to invest in expansion, research, and development. Consumers may feel more confident about spending, leading to increased consumption and potentially boosting the overall economy. However, if this trend is sudden and not well-sustained, it could also lead to market bubbles or speculative bubbles, which can have negative consequences when they burst.

In summary, a large increase in short-term investments is a critical economic indicator that can shape market dynamics and influence policy decisions. It reflects investor confidence, market sentiment, and the potential for economic growth or shifts. Understanding these trends is essential for investors, policymakers, and businesses to navigate the ever-changing economic landscape effectively.

Mastering Long-Term Currency Investing: Strategies for Financial Growth

You may want to see also

Investor Sentiment: Large short-term investments can impact investor confidence, affecting market behavior and investment decisions

A significant surge in short-term investments can have a profound impact on investor sentiment, which, in turn, influences market dynamics and individual investment choices. This phenomenon often reflects a shift in market psychology, where investors' confidence and behavior are driven by short-term opportunities and potential gains. When a large influx of short-term investments occurs, it typically indicates a positive sentiment among investors, who are eager to capitalize on the perceived potential for quick profits. This heightened enthusiasm can lead to a surge in market activity, with investors actively buying and selling assets to take advantage of the short-term trends.

One of the key effects of this sentiment is the increased volatility in the market. As short-term investors dominate the scene, the market becomes more responsive to news, events, and even rumors, which can cause rapid price fluctuations. This volatility may attract some investors who seek to profit from these short-term movements, but it also poses risks. The market's sensitivity to short-term changes can lead to irrational decision-making, where investors might overreact to temporary trends, potentially causing asset prices to deviate significantly from their long-term values.

Investor confidence plays a critical role in this context. A large increase in short-term investments often signifies a belief in the market's ability to generate quick returns. This confidence can be further bolstered by positive economic indicators, favorable market conditions, or even successful short-term trades by influential investors. As a result, investors may become more aggressive in their strategies, taking on higher risks to achieve short-term gains. This shift in sentiment can create a self-reinforcing cycle, where the initial surge in short-term investments attracts more investors, further fueling market activity and potentially leading to a bubble-like situation.

However, this investor sentiment also has the potential to impact long-term investment strategies. When short-term investments dominate the market, it may divert attention and resources from long-term value-oriented investments. This shift can lead to a neglect of fundamental analysis and a focus on technical indicators and market trends, which are more prevalent in short-term trading. As a consequence, long-term investors might feel pressured to adjust their strategies, potentially compromising their investment goals and risk management approaches.

In summary, a large increase in short-term investments can significantly influence investor sentiment, market behavior, and individual investment decisions. It often reflects a positive and confident market outlook, but it also carries risks associated with increased volatility and potential market bubbles. Understanding and managing this sentiment is crucial for investors to navigate the short-term market dynamics while maintaining a balanced and informed approach to long-term investment strategies.

Trading vs. Long-Term Investing: Understanding the Key Differences

You may want to see also

Frequently asked questions

A large increase in short-term investments often indicates a positive economic outlook or a shift in market sentiment. It could be a sign that investors are optimistic about near-term growth prospects, leading them to invest in assets with higher liquidity and potentially quicker returns.

Such a surge in short-term investments can have a substantial effect on the market. It may lead to a rise in asset prices, especially in sectors that are considered more volatile or speculative. This can create a ripple effect, influencing other investors' decisions and potentially attracting more short-term traders.

While a large influx of short-term investments can be beneficial, it also carries risks. It may contribute to market volatility, as these investments are often sensitive to changes in interest rates, economic news, or even sentiment shifts. Additionally, it could lead to a bubble-like situation, where asset prices become detached from their intrinsic values.

Investors might consider diversifying their portfolios to manage risk effectively. They could also look for long-term investment opportunities that offer stable returns, as short-term investments may not always provide sustainable gains. Staying informed about market trends and economic indicators can help investors make more informed decisions in this dynamic environment.