Net Present Value (NPV) is a financial analysis tool used to determine the feasibility of investing in a project or business. It is the present value of future cash flows compared with the initial investment. NPV is calculated by taking the difference between the present value of cash inflows and outflows over a period of time. A positive NPV indicates that the projected earnings generated by an investment exceed the anticipated costs, suggesting it will be profitable. Conversely, a negative NPV suggests that the expected costs outweigh the earnings, indicating potential financial losses. NPV is a crucial metric for businesses and investors when evaluating investment opportunities and deciding between different projects.

| Characteristics | Values |

|---|---|

| Definition | Net Present Value (NPV) |

| Used by | Corporate finance professionals, investment bankers, accountants, business owners |

| Used for | Determining the feasibility of an investment in a project or business |

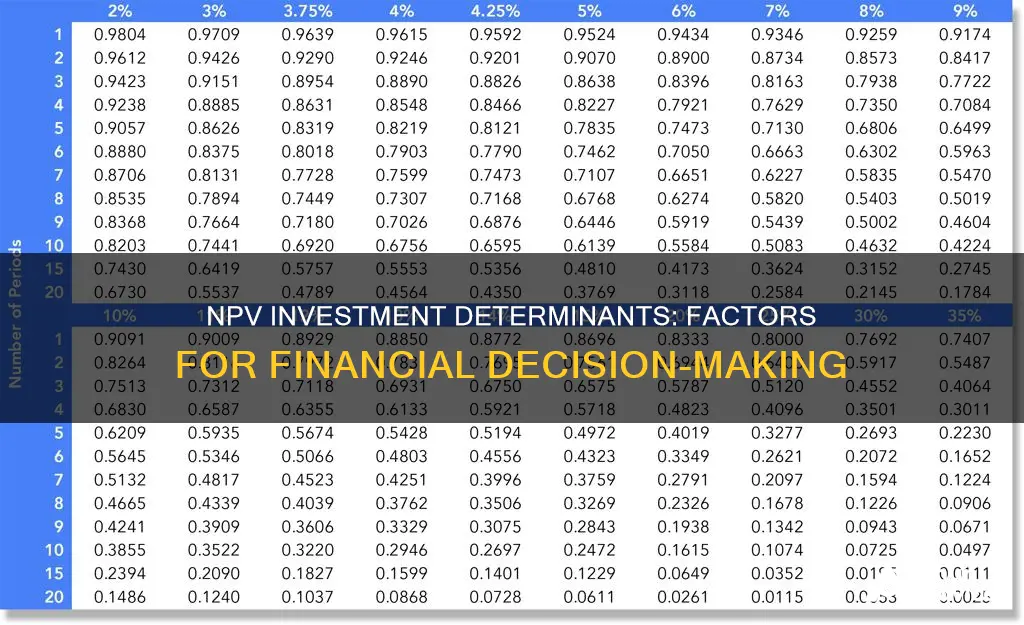

| Formula | NPV = Sum of [Total cash flow for the year / (1+Discount Rate)n] |

| Discount rate | The rate used to adjust future cash flow for current economic conditions; may also be called the interest rate |

| Time period | Applicable if there is a set time limit to receive returns |

| Initial investment | The amount paid upfront for an opportunity or the total upfront expenses of a new project |

| Future cash flow | Ongoing expenses (e.g. broker fees for an investment) and returns of the project |

| Positive NPV | The project or investment will provide a return on the initial investment |

| Negative NPV | Cash inflows will be lower than the outflows over the course of the project |

| Zero NPV | The financial income and output required for a project will balance one another |

| Limitations | NPV relies on assumptions that may not reflect a true projection of risk; assumes a constant discount rate over time |

What You'll Learn

The time value of money

Net Present Value (NPV) is a widely used tool in financial analysis that accounts for the time value of money. NPV calculates the difference between the present value of cash inflows and the present value of cash outflows over an investment's entire life, discounted to a specific rate. A positive NPV indicates that the investment is likely to be profitable, while a negative NPV suggests that it may result in a loss. NPV analysis is valuable for businesses and investors when deciding between different projects or investment opportunities.

In summary, the time value of money is a critical concept in financial decision-making, and it plays a significant role in NPV analysis. By accounting for the impact of time on the value of money, NPV provides a valuable tool for assessing the profitability of investments and projects, helping businesses and investors make more informed choices.

Extra Cash: Smart Investment Strategies for Beginners

You may want to see also

Discounted cash flow

DCF analysis helps investors who are considering whether to acquire a company or buy securities. It can also assist business owners and managers in making capital budgeting or operating expenditure decisions.

The DCF formula is:

> CF1 / (1 + r)1 + CF2 / (1 + r)2 + CFn / (1 + r)n

Where:

- CF1 = The cash flow for year one

- CF2 = The cash flow for year two

- CFn = The cash flow for additional years

- R = The discount rate

The discount rate in DCF analysis is the interest rate used when calculating the net present value (NPV) of the investment. It represents the time value of money from the present to the future.

DCF analysis finds the present value of expected future cash flows using a discount rate. Investors can use the present value of money to determine whether the future cash flows of an investment or project are greater than the value of the initial investment.

DCF analysis is used to estimate the money an investor might receive from an investment, adjusted for the time value of money. The time value of money assumes that a dollar today is worth more than a dollar tomorrow because it can be invested.

To conduct a DCF analysis, an investor must make estimates about future cash flows and the end value of the investment, equipment, or other assets. The investor must also determine an appropriate discount rate for the DCF model, which will vary depending on the project or investment under consideration.

DCF analysis can provide investors and companies with a reasonable projection of whether a proposed investment is worthwhile. It can be applied to a variety of investments and capital projects where future cash flows can be reasonably estimated.

A disadvantage of DCF analysis is its reliance on estimates of future cash flows, which could prove inaccurate. DCF analysis also involves estimates, not actual figures, so the result is also an estimate.

DCF analysis shouldn't be relied on exclusively, even if solid estimates can be made. Companies and investors should consider other known factors when sizing up an investment opportunity.

Understanding Investment Cash Flows: A Timeline Perspective

You may want to see also

Initial investment

The initial investment is a crucial component of Net Present Value (NPV) analysis, which is a capital budgeting tool used to assess the profitability of a project or investment. NPV compares the present value of future cash inflows and outflows over a period of time, and the initial investment is a critical factor in this calculation.

The initial investment, also known as the cash outflow at time zero (X0), represents the purchase price or upfront cost of an investment. It is included in the NPV formula as a negative value since it is an outflow of cash. The formula for NPV is:

> NPV = Cash inflows – Cash outflows + Initial investment

The impact of the initial investment on NPV can be significant. A higher initial investment will reduce the overall NPV, while a lower initial investment will have the opposite effect. This is because the NPV calculation involves discounting future cash flows to their present value, and then comparing them to the initial investment. Therefore, a larger initial investment will require higher future cash inflows to achieve a positive NPV, indicating profitability.

Additionally, the timing of the initial investment also plays a role in NPV analysis. In most cases, the initial investment is assumed to occur at the beginning of a project or investment. However, if there are multiple cash outflows or investments over time, each outflow will be discounted based on its timing. This is important because the time value of money dictates that money received today is worth more than the same amount received in the future. Therefore, an initial investment made today will have a different impact on NPV compared to an investment made in the future.

Furthermore, the NPV analysis also considers the risk associated with the initial investment. The discount rate used in NPV calculations is adjusted based on the level of risk involved in the investment. Riskier investments will have a higher discount rate, which will reduce the present value of future cash inflows, making it more challenging to achieve a positive NPV. Therefore, the initial investment's risk profile can significantly impact the overall NPV assessment.

In conclusion, the initial investment is a critical factor in NPV analysis, and its impact on NPV depends on its amount, timing, and associated risk. A careful consideration of these factors is essential when evaluating the potential profitability of a project or investment using NPV.

HSA Investment or Cash: Which Option is Better?

You may want to see also

Positive vs negative NPV

Net present value (NPV) is a method used to determine the feasibility of investing in a project or business. It is calculated by taking the difference between the present value of cash inflows and the present value of cash outflows over a period of time. A positive NPV indicates that the projected earnings generated by an investment exceed the anticipated costs, and it is assumed that such an investment will be profitable. On the other hand, a negative NPV indicates that the expected costs outweigh the expected earnings, signalling potential financial losses.

A positive NPV suggests that an investment will be profitable, while a negative NPV suggests it will result in a net loss. The net present value rule states that company managers and investors should only invest in projects or transactions that have a positive NPV and should avoid those with a negative NPV. This is because a positive NPV indicates that the present value of cash flows generated from a project or investment exceeds the costs required for that project. Therefore, a positive NPV project is said to "create value". Conversely, a negative NPV project shows that the costs exceed the cash flows generated, and it is said to "destroy value".

The NPV calculation is widely used in capital budgeting and investment planning to analyse a project's projected profitability. It is also used to determine how much an investment, project, or series of cash flows is worth. It is a comprehensive tool that takes into account all inflows, outflows, the period of time, and the risk involved.

While a positive NPV indicates a profitable investment opportunity, it is important to consider other factors as well. For example, the NPV calculation makes assumptions about future events that may not always come true. Additionally, it does not consider the size of the project or the return on investment (ROI). Therefore, it is crucial to evaluate all relevant factors and perform a thorough analysis before making investment decisions.

Should I Withdraw My Vanguard Investments?

You may want to see also

NPV limitations

Net Present Value (NPV) is a popular method for evaluating the profitability of different projects or investments. However, it has some limitations that should be carefully considered. Here are some key limitations of the NPV method:

- Determining the discount rate: One of the challenges of using NPV is determining an accurate discount rate that represents the investment's true risk premium. The discount rate is crucial in the NPV formula as it discounts future cash flows to their present-day value. Selecting the wrong discount rate can lead to unreliable results.

- Estimating future cash flows: NPV calculations rely on estimates of future cash inflows and outflows. These estimates may not always be accurate, especially for projects with long time horizons or those with uncertain outcomes.

- Inability to compare projects: NPV is not suitable for comparing projects with different investment amounts or time spans. A larger project will naturally have a higher NPV, but that does not necessarily make it a better investment. Additionally, NPV cannot be used to compare projects with different risk levels or those with non-financial objectives.

- Sensitivity to assumptions: NPV analysis is sensitive to the assumptions and inputs used in the model. Small changes in assumptions can significantly impact the NPV result. This sensitivity also makes it easier to manipulate NPV models to produce desired outcomes.

- Assumptions about risk and discount rates: NPV models assume a constant discount rate over time, which may not reflect the changing risk profile of a project. Accurate risk adjustment is challenging, especially when dealing with projects that have varying levels of risk throughout their lifespan.

- Limited scope: NPV focuses solely on the financial aspects of a project and may not capture the full range of benefits and impacts, especially those that are non-financial or occur outside the project's scope.

While NPV is a useful tool for evaluating investment opportunities, it is important to be aware of its limitations and consider other factors when making investment decisions.

Blockchain Tech for Secure and Smart Investments

You may want to see also

Frequently asked questions

Net Present Value (NPV) is a financial analysis method used to determine the feasibility of investing in a project or business. It calculates the value of all future cash flows over an investment's entire life, discounted to its present value.

The NPV formula takes into account the present value of cash inflows and outflows over a period of time, discounted at a specified rate. The cash inflows and outflows are determined for each period of the investment, and the present value is calculated by discounting the future value at a periodic rate of return (the discount rate).

A positive NPV indicates that the investment is likely to be profitable and worth pursuing, while a negative NPV suggests that the investment is unlikely to be profitable and should be avoided. A zero NPV means the investment is neither profitable nor costly.