Major investments in long-term assets are significant financial outlays that businesses make to acquire tangible or intangible assets with a useful life extending beyond one year. These investments are crucial for a company's growth and expansion, as they provide a foundation for future operations and contribute to long-term success. Examples of such investments include the purchase of property, plant, and equipment (PP&E), such as land, buildings, machinery, and vehicles, as well as intangible assets like trademarks, patents, and goodwill. Understanding these major investments is essential for businesses to effectively manage their finances, plan for the future, and make informed decisions about their capital expenditures.

What You'll Learn

- Tangible Assets: Physical investments like property, machinery, and vehicles

- Intangible Assets: Non-physical investments like patents, trademarks, and goodwill

- Financial Investments: Stocks, bonds, and other securities for long-term growth

- Research & Development: Spending on innovation and product development

- Infrastructure: Large-scale projects like roads, bridges, and utilities

Tangible Assets: Physical investments like property, machinery, and vehicles

Tangible assets are physical investments that play a crucial role in long-term business growth and stability. These assets are considered major investments because they are substantial and often require significant financial outlay. Tangible assets are physical items that can be touched and have a physical presence, which sets them apart from intangible assets like patents or trademarks.

One of the most prominent examples of tangible assets is property. This includes real estate, such as office buildings, industrial sites, or residential properties. Property investments are significant because they provide a solid foundation for businesses, offering space for operations, storage, or even rental income. For instance, a company might purchase a warehouse to store inventory, ensuring a steady supply chain and reducing the costs associated with renting multiple smaller storage units. Over time, property values can appreciate, providing a valuable asset for the business and potential returns on investment.

Machinery and vehicles are another essential category of tangible assets. These are physical items that enable businesses to carry out their core operations efficiently. For example, manufacturing companies invest in machinery like robots, conveyor belts, and computer-controlled equipment to streamline production processes. These machines can increase productivity, reduce human error, and improve overall output quality. Similarly, vehicles such as delivery trucks, buses, or specialized equipment are purchased to facilitate transportation, logistics, and various business activities. The longevity and reliability of these assets make them a critical part of a company's long-term strategy.

When considering tangible assets, it is important to note that their acquisition and maintenance can be costly. However, these investments are often necessary to support a business's operations and growth. For instance, a company might need to invest in new machinery to keep up with market demands, improve product quality, or reduce production costs. Similarly, vehicles and transportation assets are vital for businesses that rely on efficient logistics and delivery systems.

In summary, tangible assets, including property, machinery, and vehicles, are significant investments in long-term assets. They provide the physical infrastructure and tools necessary for businesses to operate, grow, and maintain a competitive edge. While these investments may require substantial financial resources, they contribute to the overall success and sustainability of a business over an extended period. Proper planning and management of these tangible assets are essential to ensure their optimal utilization and long-term value.

Maximizing Savings: The Power of Term Life Insurance and Investing

You may want to see also

Intangible Assets: Non-physical investments like patents, trademarks, and goodwill

Intangible assets are a crucial aspect of long-term investments, representing a significant portion of a company's value. These assets are non-physical in nature, meaning they cannot be seen or touched, but they hold immense value and play a vital role in a company's operations and future prospects. Patents, trademarks, and goodwill are prime examples of intangible assets that can significantly impact a business's success and longevity.

Patents are legal protections granted to inventors, allowing them to exclude others from making, using, or selling their invention for a limited period. This investment in intellectual property is a major long-term asset as it provides a competitive edge in the market. For instance, a pharmaceutical company investing in research and development to create a new drug can secure a patent, ensuring they have exclusive rights to produce and sell it. This exclusivity period allows the company to recoup their investment and generate substantial profits before competitors can enter the market. Patents are a powerful tool for businesses to safeguard their innovations and maintain a strong market position.

Trademarks, on the other hand, are legal protections for brand names, logos, and other distinctive signs that identify a company's products or services. These intangible assets are essential for building brand recognition and customer loyalty. A well-known brand with a unique trademark can create a strong connection with its customers, leading to increased sales and market share. For example, a technology company might invest in a catchy brand name and logo, which becomes instantly recognizable, allowing them to stand out in a crowded market. Trademarks provide a competitive advantage by protecting a company's unique identity and ensuring customer trust.

Goodwill, an intangible asset, represents the portion of a business's value that cannot be attributed to tangible assets alone. It encompasses the positive reputation, customer loyalty, and relationships that the business has cultivated over time. When a company acquires another, the purchase price often includes goodwill, reflecting the value of these intangible factors. For instance, a successful restaurant chain with a loyal customer base and a positive reputation for quality food and service has significant goodwill. This goodwill can lead to future growth and expansion opportunities, as the acquired company's relationships and reputation enhance the acquiring company's overall value.

These intangible assets are considered major investments in long-term assets because they contribute to a company's sustainability and growth. While they may not be physically present, their impact on a business's operations and future prospects is immense. Patents, trademarks, and goodwill provide a competitive advantage, protect intellectual property, and foster brand recognition, all of which are essential for long-term success in today's business landscape. Understanding and effectively managing these intangible assets can significantly influence a company's ability to thrive and adapt in a rapidly changing market.

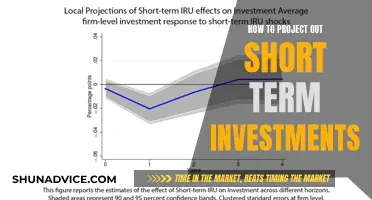

Maximizing Returns: A Guide to Short-Term Investment Measurement

You may want to see also

Financial Investments: Stocks, bonds, and other securities for long-term growth

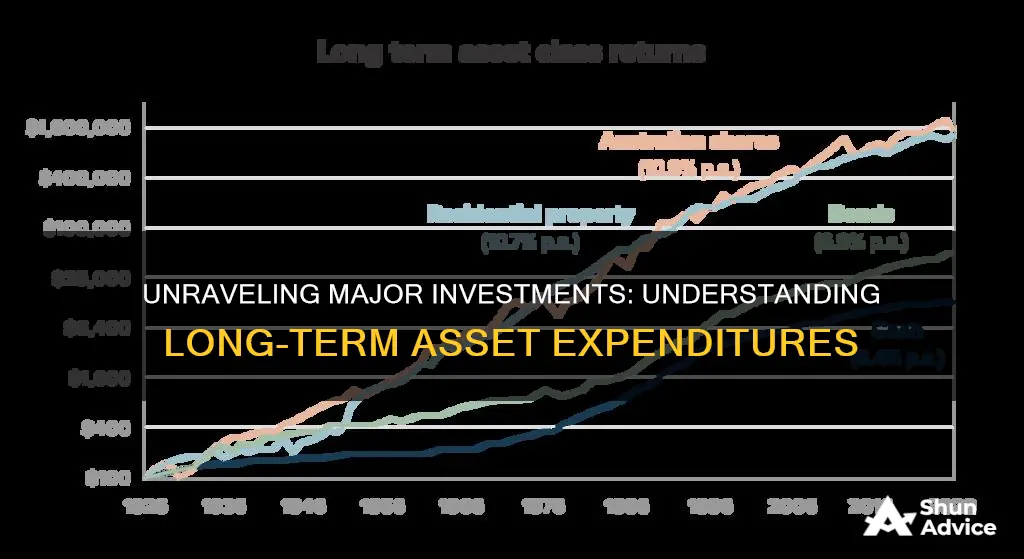

Financial investments are a crucial aspect of long-term asset management, offering individuals and institutions a means to grow their wealth over time. When considering major investments in long-term assets, it's essential to focus on financial instruments that provide stability, growth potential, and a diversified approach to wealth creation. Here's an overview of stocks, bonds, and other securities that can be considered for long-term financial investments:

Stocks (Equities): Investing in stocks is a fundamental way to participate in the growth of companies. When you buy stock, you essentially become a partial owner of the company. Stocks are considered long-term investments because they offer the potential for significant capital appreciation over time. This is achieved through the company's growth, increased profitability, and expansion. Investors can choose from various sectors and industries, allowing for diversification. Long-term stock investors aim to benefit from the compound effect of reinvesting dividends and the potential for substantial returns as the company's value increases.

Bonds: Bonds are a type of debt security issued by governments, municipalities, or corporations to raise capital. When you invest in bonds, you are essentially lending money to the issuer in exchange for a fixed return (interest) over a specified period. Bonds are often considered a more conservative investment compared to stocks, making them attractive for long-term portfolios. They provide a steady income stream through regular interest payments and the return of the principal amount at maturity. Government bonds are generally considered low-risk, while corporate bonds may offer higher yields but with increased risk.

Mutual Funds and Exchange-Traded Funds (ETFs): These are investment funds that pool money from many investors to invest in a diverse range of securities, such as stocks, bonds, or other assets. Mutual funds and ETFs offer instant diversification, which is a key strategy for long-term investment success. Investors can choose from various types, including index funds, which track a specific market index, and actively managed funds, where professional fund managers make investment decisions. ETFs, in particular, offer flexibility and can be traded on stock exchanges, providing investors with a liquid and cost-effective way to invest in a basket of assets.

Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-producing real estate. By investing in REITs, individuals can gain exposure to the real estate market without directly purchasing properties. REITs offer the potential for both dividend income and capital appreciation. They are considered long-term investments as they provide a stable and often growing source of cash flow, making them an attractive addition to a diversified portfolio.

When considering long-term investments, it's crucial to assess your risk tolerance, investment goals, and time horizon. Diversification across different asset classes is a key strategy to manage risk and maximize returns. Stocks and bonds provide different risk-return profiles, and combining them with other securities like mutual funds or REITs can create a well-rounded investment portfolio.

Doge's Long-Term Potential: A Crypto Investment Strategy

You may want to see also

Research & Development: Spending on innovation and product development

Research and Development (R&D) is a critical aspect of any business aiming to stay competitive and drive long-term growth. It involves a significant investment in human capital, technology, and resources to create new products, improve existing ones, and explore innovative solutions to complex problems. This expenditure is considered a major investment in long-term assets as it directly contributes to a company's ability to innovate, adapt to market changes, and maintain a competitive edge.

R&D spending is a strategic decision that can have a profound impact on a company's future success. It involves allocating resources towards exploring new ideas, technologies, and processes that can lead to the development of groundbreaking products or services. This process often requires a long-term commitment, as it may take years to see tangible results, but it is essential for businesses to stay ahead in dynamic markets. The focus is on creating intellectual property, such as patents, trademarks, or copyrights, which can provide a competitive advantage and generate future revenue streams.

In the context of long-term assets, R&D expenditures are unique in that they represent a commitment to future growth and development. Unlike other types of investments, R&D is not a tangible asset that can be easily sold or liquidated. Instead, it is an intangible asset that generates value over time through the creation of new products, improved processes, and technological advancements. This type of investment is crucial for businesses to stay relevant and adaptable, especially in rapidly changing industries.

The benefits of R&D spending are multifaceted. Firstly, it fosters innovation, leading to the development of new products or services that can capture market opportunities. This can result in increased market share, higher revenue, and improved customer satisfaction. Secondly, R&D enables businesses to stay ahead of the competition by continuously improving their offerings and processes. It allows companies to adapt to changing consumer needs and market trends, ensuring they remain competitive and relevant.

Moreover, R&D investments can lead to cost savings and operational efficiency. By developing new technologies or processes, companies can streamline their operations, reduce waste, and optimize resource utilization. This can result in lower production costs, improved product quality, and enhanced overall efficiency. Additionally, R&D can contribute to risk mitigation by identifying potential issues early in the product development cycle, allowing businesses to make informed decisions and avoid costly mistakes.

In summary, Research & Development spending is a significant investment in long-term assets, driving innovation, and fostering a competitive advantage. It is a strategic decision that requires careful planning and allocation of resources, but the potential benefits are substantial. By embracing R&D, businesses can stay agile, adapt to market dynamics, and position themselves for sustained success in an ever-evolving business landscape. This expenditure is a powerful tool for companies to create value, drive growth, and maintain their market leadership.

Navigating the Game of Life: Unlocking Long-Term Investment Strategies

You may want to see also

Infrastructure: Large-scale projects like roads, bridges, and utilities

Infrastructure development is a critical aspect of any economy's growth and stability, and large-scale projects in this sector are indeed considered major investments in long-term assets. These projects involve substantial financial outlays and have a significant impact on a country's economic development and overall well-being. When governments or organizations invest in infrastructure, they are essentially building the foundation for future growth and prosperity.

One of the most prominent examples of such investments is the construction and maintenance of transportation networks, including roads, highways, and bridges. These projects are essential for connecting people, facilitating trade, and promoting economic activities. For instance, building a new highway can reduce travel time between cities, improve logistics efficiency, and open up new opportunities for businesses and residents. Similarly, maintaining and upgrading existing bridges ensures safe and efficient transportation, preventing potential disasters and costly repairs in the future.

Utilities, such as water supply systems, power grids, and telecommunications infrastructure, are another crucial area of investment. These services are fundamental to modern life and support various economic activities. Upgrading power grids to accommodate renewable energy sources is a prime example of a major investment. It not only improves energy security but also contributes to a more sustainable and environmentally friendly future. Upgrading water treatment facilities and distribution networks can ensure a reliable and safe water supply, which is essential for both domestic and industrial use.

The impact of these large-scale infrastructure projects extends beyond immediate economic benefits. They create numerous job opportunities during the construction phase, stimulating local economies and providing employment for skilled and unskilled workers. Once completed, these projects attract businesses, encourage tourism, and foster the development of supporting industries. Moreover, well-developed infrastructure can increase a region's attractiveness for investment, leading to further economic growth and development.

In summary, infrastructure investments in large-scale projects like roads, bridges, and utilities are vital for long-term economic prosperity. These projects not only improve connectivity and efficiency but also create a foundation for sustainable development. By allocating resources to such initiatives, governments and organizations contribute to the overall growth and resilience of their economies, ensuring a brighter future for their citizens.

Navigating Long-Term CDS: A Strategic Investment Decision

You may want to see also

Frequently asked questions

Major investments in long-term assets typically refer to significant expenditures made by a business to acquire or enhance assets that will provide benefits over an extended period. These assets are usually tangible and have a physical presence, such as property, plant, and equipment (PPE). Examples include purchasing land, buildings, machinery, vehicles, or significant upgrades to existing infrastructure. The key factor is the long-term nature of the investment, where the asset's useful life extends beyond one accounting period.

When a business makes a major investment in long-term assets, it is generally capitalized and depreciated over its useful life. This means the cost is not expensed immediately but allocated as an expense over the asset's useful life. Depreciation methods, such as straight-line or declining balance, are used to systematically reduce the asset's value over time, reflecting its wear and tear or obsolescence. Proper accounting treatment ensures that the financial statements provide a realistic view of the company's financial position and performance.

Yes, there are certain criteria that can help identify major investments in long-term assets. Firstly, the expenditure should be significant in amount, often exceeding a certain threshold set by accounting standards or the company's policies. Secondly, the asset must have a definite useful life, meaning it will provide benefits for more than one accounting period. Lastly, the asset should have a physical form and be used in the business's operations. Examples include real estate purchases, major construction projects, or the acquisition of specialized equipment that is integral to the company's core operations.