Ally Invest is a good choice for investors looking for low fees and a focus on the US market. It offers commission-free trading on eligible US stocks and ETFs, and its options trading costs are lower than those of its competitors. The company provides online banking, securities brokerage, investment advisory, mortgage and auto financing, and insurance offerings to its approximately 11 million customers. Ally Invest has easy and fully digital account opening, and there are a lot of high-quality educational tools, making it a good choice for beginner investors.

| Characteristics | Values |

|---|---|

| Account minimum | $0 |

| Trading commissions on eligible U.S. securities | $0 |

| Options-contract fee | $0.50 |

| Fractional shares | No |

| Third-party research providers | Limited |

| Trading platform | Basic |

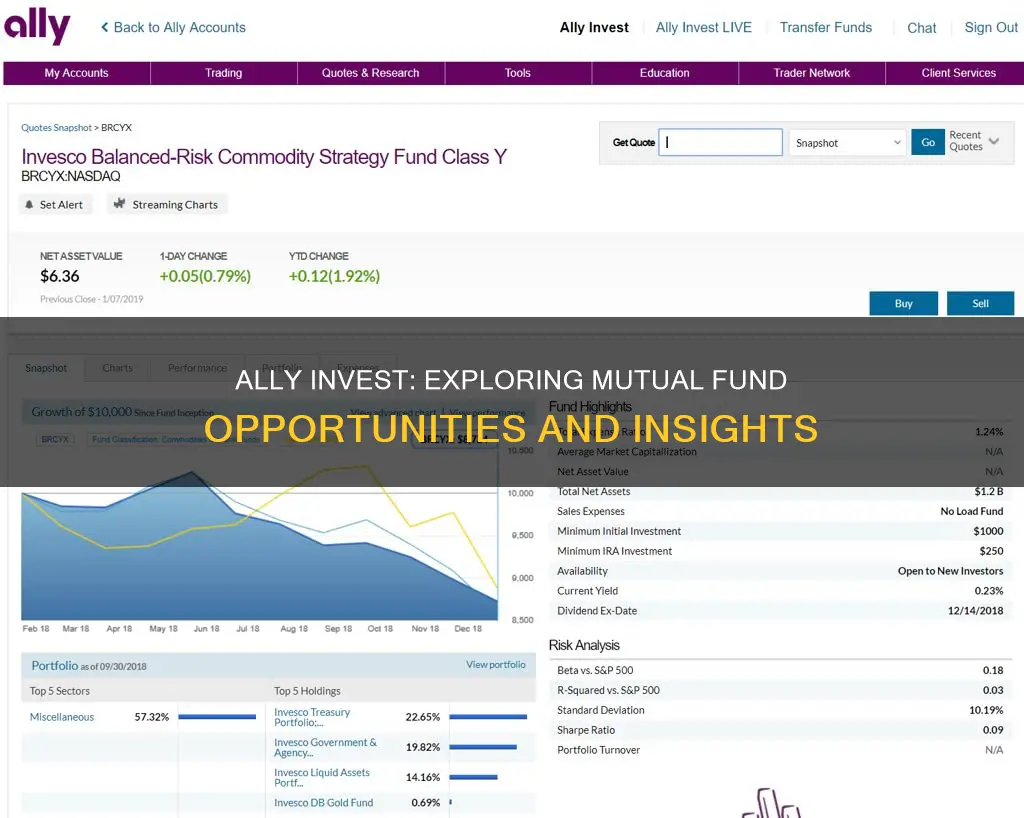

| Mutual funds | No-load funds available |

| Mutual fund commission | Commission-free |

What You'll Learn

Mutual funds are commission-free

Ally Invest is a good choice for beginner investors as it offers low trading and non-trading fees, an easy and fully digital account opening process, and high-quality educational tools. The account opening is also user-friendly and requires no minimum deposit in most cases.

Ally Invest offers a wide range of investment selections, including stocks, bonds, ETFs, options, and mutual funds. The platform is well-designed and intuitive, making it easy to navigate and find the information you need.

In addition to commission-free mutual funds, Ally Invest also offers commission-free trading on eligible U.S. stocks and ETFs. This means that you can trade a variety of securities without paying any fees, making it an affordable option for investors.

Ally Invest also provides a high level of investor protection. It is regulated by top-tier financial authorities in the US, including the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). This means that your investments are protected up to a certain amount if something goes wrong.

Overall, Ally Invest is a good choice for investors looking for low fees and a user-friendly platform, with a wide range of investment options, including commission-free mutual funds.

Mutual Funds: Electric Vehicle Investments for the Future

You may want to see also

There's no minimum deposit required to open a self-directed brokerage cash account

When it comes to investing in mutual funds at Ally Invest, there are a few things to note. Firstly, Ally Invest offers self-directed brokerage cash accounts with no minimum deposit required to open one. This means that anyone can start investing with Ally, regardless of their financial situation. This is in line with their overall low-cost structure, which makes it an attractive option for beginner and intermediate investors.

With a self-directed account, you have the freedom to choose from various investment options, including stocks, bonds, ETFs, margin accounts, and more. You also benefit from commission-free trades on most U.S.-listed securities and access to a wide range of tools and resources to guide your investment decisions.

Ally Invest also stands out for its integration with Ally Bank, allowing for easy transfers between savings and brokerage accounts. This feature enables investors to take advantage of higher interest rates compared to typical default sweep interest rates offered by most brokerages. However, it's important to note that uninvested cash in an Ally Invest brokerage account does not earn interest, so transferring funds to an Ally savings account is essential to maximize returns.

In addition to the self-directed brokerage cash account, Ally Invest offers other types of accounts, such as self-directed brokerage margin accounts and robo-portfolios. The former requires a $2,000 minimum deposit, while the latter has a $100 initial minimum deposit.

Overall, Ally Invest provides an intuitive and user-friendly platform for investors, offering educational support, screeners, and analysis tools. Their competitive rates, low minimums, and solid trading platform make them a popular choice for those looking for a straightforward and accessible investment experience.

Investing in Index Funds: A Beginner's Guide to Getting Started

You may want to see also

There's a $0.50 per contract fee for options

Ally Invest is a good low-cost broker for beginner and intermediate investors. Its options trading costs are lower than those of its competitors, and it offers a solid, if basic, trading platform and app.

Ally Invest's per-contract fee for options is $0.50, which is lower than some other brokers. This fee applies to both buying and selling options. There is no base commission for options trades.

Ally Invest's browser-based platform is basic but effective. It offers quick trading capabilities, real-time streaming quotes and data, a customizable dashboard, and access to all of the broker's tools. It doesn't require any downloads, which is convenient for customers who frequently trade from different computers.

Ally Invest also allows customers to trade via mobile devices with the Ally Mobile app. The app is part of the larger Ally Bank app and lets users access holdings, the trading platform, research, screeners, and a stocks watchlist, among other features.

Ally Invest's trading costs are competitive and include zero-commission trading for stocks and ETFs. Its options trades are a flat $0.50 per contract.

VTIs: Auto-Reinvesting for Hands-Off Investors

You may want to see also

Ally Invest offers a robo-advisory service called Managed Portfolios

It only takes a $100 minimum amount to start your portfolio and the annual advisory fee is low, at 0.3% of the account balance.

Ally Invest also provides access to a platform called Maxit Tax Manager. It's a third-party service that helps you easily manage the factors that determine the taxes you pay on your investments each year. Maxit has a number of tax strategies that are easy to set up, for example, which lots get sold when.

Mutual Funds: Financial Aid Investment Strategy

You may want to see also

You can only trade on US markets

Ally Invest is a US-based stockbroker that offers low trading and non-trading fees, with no commission on most US-listed stocks, ETFs, and options. The company provides online banking, securities brokerage, investment advisory, mortgage and auto financing, and insurance offerings to its approximately 11 million customers.

Ally Invest is a good choice for investors who want to focus on the US market. The platform offers commission-free trading on eligible US stocks and ETFs, and a $0.50 per contract fee for options trading.

Ally Invest provides several options for investors of all experience levels, including self-directed and managed accounts. The platform is particularly attractive to beginners due to its low fees, $0 account minimum, and easy account opening process.

The company's primary website provides the most access to screeners, trading products, and educational resources. However, the mobile app only offers trading in eligible stocks, ETFs, and options, and does not support all available trading products.

While Ally Invest covers the US market extensively, it does not support trading on international securities listed outside US-based exchanges. Forex trading is also not available for basic brokerage accounts and must be done through a separate forex account.

Cash Reserves Fund: A Safe and Smart Investment Choice

You may want to see also

Frequently asked questions

Mutual fund trades are commission-free.

There is no minimum investment for mutual funds.

Yes, Ally Invest offers a dividend reinvestment program (DRIP) for all marginable US equities and selected ADRs priced at $4 or more.

You can trade mutual funds on Ally Invest's web trading platform or mobile trading app.

Yes, Ally Invest offers margin trading for mutual funds.