Investing in mutual funds is a popular way to build a diversified portfolio without the extra cost and hassle of purchasing individual stocks and bonds. Mutual funds are a good option for both beginner and experienced investors as they offer instant diversification and allow investors to benefit from the stock market's historically high average annual returns.

The requirements to invest in mutual funds include:

- Deciding on your investment goals and risk tolerance.

- Choosing the right mutual fund strategy, such as active or passive funds, stock or bond funds, etc.

- Researching potential mutual funds and considering factors such as past performance, expense ratios, load fees, and management style.

- Opening an investment account through an online broker, fund manager, or employer-sponsored retirement plan.

- Purchasing shares of mutual funds, keeping in mind the minimum investment requirements, which can range from $0 to a few thousand dollars.

- Setting up a plan to invest regularly and monitoring your portfolio to ensure it aligns with your financial goals and risk tolerance.

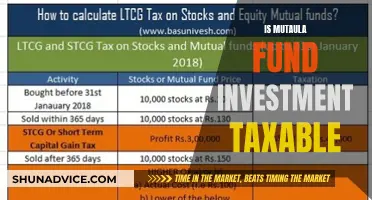

- Considering your exit strategy, including any fees or taxes that may be incurred when selling mutual fund shares.

| Characteristics | Values |

|---|---|

| Investment goals | Long-term goals like retirement or education |

| Mid-term goals like buying a home or a car | |

| Near-term goals like short-term savings | |

| Investment strategy | Active or passive |

| Investment type | Stock, bond, money market, index, target-date funds |

| Investment amount | Minimum investment of a few thousand dollars |

| Investment timing | Daily, weekly, monthly |

| Investment research | Mutual Fund Observer, Maxfunds, brokerages' websites |

| Investment fees | Expense ratios, load fees, management fees, 12b-1 fees, legal fees, accounting fees, administrative costs |

| Investment account | Individual retirement accounts (IRAs), taxable brokerage accounts, education savings accounts |

What You'll Learn

- Investment goals: Are you investing for the short or long term

- Active vs passive funds: Do you want to beat or mimic the market

- Budget: How much money do you have to invest

- Where to buy: Will you use a brokerage account, or buy directly from the fund company?

- Fees: What fees and commissions will you be charged

Investment goals: Are you investing for the short or long term?

When deciding how to invest in mutual funds, it is important to consider your investment goals and whether you are investing for the short or long term.

Short-term goals

Short-term goals are generally those that you are investing in for less than five years, but this can be as short as three to six months. Short-term goals might include saving for a vacation, a down payment on a car, home improvements, or buying a new appliance.

When saving for short-term goals, it is important to put money into less risky investments that will still earn money and preserve the principal amount. Short-term mutual funds are good for people who don't want to take big risks with their money. They typically encompass investments with durations ranging from a few months to a few years and often involve lower-risk profiles. Examples of short-term mutual funds include money market funds and short-duration bond funds.

Long-term goals

Long-term goals are usually in place for ten or more years. Long-term mutual funds are better for people who are okay with taking more risk and leaving their money invested for longer. They focus on wealth accumulation over time, offering higher growth potential but with greater market volatility. Examples of long-term mutual funds include equity funds and hybrid schemes.

Intermediate-term goals

It is also worth noting that some sources refer to intermediate-term goals, which can be achieved through a mix of cash and short-to-intermediate-term investments. Examples of intermediate-term investments include certificates of deposit and debt funds.

Pension Funds: Choosing the Right Investment for Your Future

You may want to see also

Active vs passive funds: Do you want to beat or mimic the market?

Active vs. Passive Funds: Do You Want to Beat or Mimic the Market?

When investing in mutual funds, one of the first choices you'll need to make is whether to opt for active or passive funds. This decision will determine your investment strategy and have an impact on your returns. So, what's the difference between the two, and which is the best option for you?

Active Funds

Active funds are managed by professionals who actively research and buy investments with the goal of outperforming the market. Active fund managers aim to beat a specific market index, such as the S&P 500, by identifying and selecting the best-performing stocks. This approach requires a hands-on, proactive strategy, and fund managers often work with a team of analysts to make investment decisions. Active funds offer more flexibility, as managers are not restricted to holding specific stocks or bonds and can use various hedging strategies to manage risk.

However, active funds typically come with higher fees to cover the cost of professional management. These fees can eat into returns, and active funds may struggle to consistently outperform the market over the long term.

Passive Funds

Passive funds, on the other hand, aim to mirror the performance of a market index. Instead of trying to beat the market, passive funds simply try to match it. This approach is more hands-off and involves less buying and selling, which results in lower fees for investors. Passive funds are often index funds or exchange-traded funds (ETFs) that are not professionally managed. While passive funds may sound less exciting, they have consistently outperformed active funds over long periods.

Both active and passive funds have their advantages and disadvantages, and the right choice depends on your investment goals, risk tolerance, and preferences. Active funds may be more suitable for those who want a more hands-on approach and are willing to pay higher fees for the potential of higher returns. On the other hand, passive funds are ideal for those who prefer a more passive, long-term investment strategy with lower fees.

Ultimately, there is no one-size-fits-all answer, and some investors choose to blend active and passive strategies to diversify their portfolio and manage risk.

Venture Capital Funds: A Guide to Getting Started

You may want to see also

Budget: How much money do you have to invest?

The amount of money you have to invest will determine the type of mutual fund you can invest in. Mutual funds have different minimum investment amounts, ranging from $0 to $5,000 or more. Some funds have a minimum investment of a few thousand dollars, while others have a minimum of $100 or less. There are even some funds with no minimum investment requirement, meaning you can get started with as little as $1.

It's important to consider not only the minimum investment amount but also your overall budget for investing. Mutual funds typically require a lump sum investment, so you'll need to have the funds readily available. Keep in mind that investing in mutual funds may also incur additional fees, such as management fees, transaction fees, and expense ratios. These fees can impact your overall returns, so it's crucial to factor them into your budget.

When deciding how much to invest, consider your financial goals and risk tolerance. If you're investing for the long term, such as retirement, you may want to allocate a larger portion of your budget to mutual funds. On the other hand, if you're saving for a shorter-term goal, such as a down payment on a car, you may want to invest a smaller amount.

Additionally, diversification is an important consideration. Mutual funds offer instant diversification by pooling your money with other investors to purchase a variety of stocks, bonds, or other securities. This diversification can help reduce risk, but it may also require a larger investment.

Once you've determined your budget and investment goals, you can start researching specific mutual funds that align with your budget and objectives. Compare the minimum investment requirements, fees, and historical performance of different funds to make an informed decision. Remember that past performance does not guarantee future results, but it can give you an idea of the fund's potential.

In summary, determining your budget for investing in mutual funds involves considering the minimum investment requirements, your overall financial goals, risk tolerance, and the fees associated with the funds. By carefully evaluating these factors, you can choose the right mutual funds that fit within your budget and help you achieve your investment objectives.

Mutual Fund Stocktrak: A Guide to Investing

You may want to see also

Where to buy: Will you use a brokerage account, or buy directly from the fund company?

When it comes to buying mutual funds, you have two main options: using a brokerage account or buying directly from the fund company. Here's a detailed look at each option:

Using a Brokerage Account

Using a brokerage account is a popular choice for investors looking to purchase mutual funds. This option offers several benefits and advantages. Firstly, brokerage accounts provide access to a diverse range of mutual funds from different fund companies. This allows investors to compare and choose from a wide array of funds that align with their investment goals and strategies.

Another advantage of brokerage accounts is the availability of research and educational tools. Reputable brokers provide investors with valuable resources, such as fund screeners, performance analyses, and market insights. These tools empower investors to make more informed decisions about their mutual fund selections.

Additionally, brokerage accounts offer convenience, especially for those who already have investment accounts. Investors can manage their various investments, including stocks, bonds, and ETFs, all through a single platform. This simplifies the investment process and provides a comprehensive view of their portfolio.

However, it's important to consider the fees associated with brokerage accounts. While some brokers offer no-transaction-fee mutual funds, others may charge fees for buying or selling funds. These fees can vary among brokers, so it's essential to review their fee structures before opening an account.

Buying Directly from the Fund Company

Another option for purchasing mutual funds is to buy them directly from the fund company. This approach can be advantageous in certain situations. For example, buying directly from the fund company may offer lower fees compared to using a brokerage account. By eliminating the middleman, investors can potentially save on transaction costs.

Additionally, buying directly from the fund company can provide access to specialised funds that may not be available through brokerage accounts. Some fund companies offer proprietary funds or exclusive investment opportunities that are only accessible by purchasing directly from them.

However, one of the limitations of buying directly from the fund company is the reduced variety of fund choices. Investors are restricted to the funds offered by that specific company, limiting their ability to explore other options in the market.

In conclusion, both options have their advantages and considerations. Using a brokerage account provides access to a broader range of funds, along with valuable research tools, while buying directly from the fund company may offer lower fees and access to exclusive investment opportunities. Investors should carefully weigh their priorities, fee structures, and investment goals when deciding between these two options.

Cooperative vs Investment Fund: Understanding the Key Differences

You may want to see also

Fees: What fees and commissions will you be charged?

Fees and commissions are an important aspect of investing in mutual funds, as they can significantly impact your overall returns. Here's a detailed overview of the fees and commissions typically associated with mutual funds:

Annual Fund Operating Expenses:

These are ongoing fees charged by the fund to cover various operational costs. They are typically expressed as a percentage of the fund's average net assets and can range from 0.25% to 1% or more. Here are some common types of annual fund operating expenses:

- Management Fees: Paid to the fund's investment adviser or manager for managing the fund's investment portfolio.

- 12b-1 Fees: Capped at 1%, these fees cover the costs of marketing, selling the fund, and sometimes shareholder services.

- Other Expenses: May include custodial, legal, accounting, transfer agent, and other administrative costs.

Shareholder Fees:

These are one-time costs incurred when buying or selling mutual fund shares. They include:

- Sales Loads: Commissions paid to brokers when purchasing or redeeming shares. There are front-end sales loads (paid when buying shares) and back-end or deferred sales loads (paid when selling shares).

- Redemption Fees: Charged when selling shares within a short period after purchasing them, typically to discourage short-term trading.

- Exchange Fees: Charged by some funds when shareholders transfer their investment to another fund within the same fund group.

- Account Fees: May be charged for maintaining your account, especially if your balance falls below a certain minimum.

- Purchase Fees: Charged by some funds when purchasing shares, distinct from front-end sales loads.

It's important to carefully review the fund's prospectus, which outlines all the fees and charges, to understand the full scope of fees associated with a particular mutual fund. Additionally, funds managed by professionals to outperform the market (active funds) tend to have higher fees than passively managed funds (passive funds) that aim to mirror market performance.

A Guide to Mutual Funds: Investing Basics

You may want to see also

Frequently asked questions

To invest in mutual funds, you will need to meet the minimum investment amount, which can range from $0 to over $3,000. You will also need to open an investment account with a brokerage or the fund manager themselves.

No, you can buy mutual funds directly from the fund manager. However, this will limit your choice of funds. Most investors opt to buy mutual funds through an online brokerage, which offers a broader selection of funds.

Mutual funds charge annual fees, expense ratios, or commissions, which will lower your overall returns. These include management fees, administrative costs, and marketing expenses. Some funds also charge sales fees, known as "loads", when you buy or sell shares.

There are many types of mutual funds, including stock, money market, bond, index, and target-date funds. Stock funds focus on companies that pay dividends, growth, or specific industries, sectors, or geographies. Bond funds invest in various forms of debt, while money market funds invest in short-term debt. Index funds track the performance of a market index, such as the S&P 500.

When choosing a mutual fund, consider whether the fund's investment objectives align with your financial goals and risk tolerance. Look at the fund's past performance, expense ratios, load fees, and management style (active or passive).