Hedge funds are a type of investment used by wealthy, accredited investors. They are actively managed and are usually less regulated and riskier than traditional investments such as mutual funds. They often charge higher fees than other investments and have higher minimum investment requirements, typically starting at $100,000 and going up to $2 million or more. Hedge funds use complex trading and risk management techniques, including short-selling, leverage, and derivatives, to improve investment performance and insulate returns from market risk. They aim to deliver absolute positive returns over time, regardless of market conditions. While hedge funds can provide diversification and reduce overall portfolio risk, they are considered risky investments due to their aggressive trading strategies and potential for significant losses.

| Characteristics | Values |

|---|---|

| Risk | Riskier than other investments |

| Returns | Higher potential returns |

| Investor Type | Wealthy, high-net-worth, accredited investors |

| Investment Type | Complex, aggressive, illiquid |

| Investment Options | Real estate, art, currency, derivatives, distressed debt, commodities, private companies |

| Minimum Investment | $25,000 to upwards of $2 million |

| Fees | High fees, e.g. "two and 20" structure |

| Lock-up Period | Yes, typically at least a year |

What You'll Learn

High fees and high minimum investment amounts

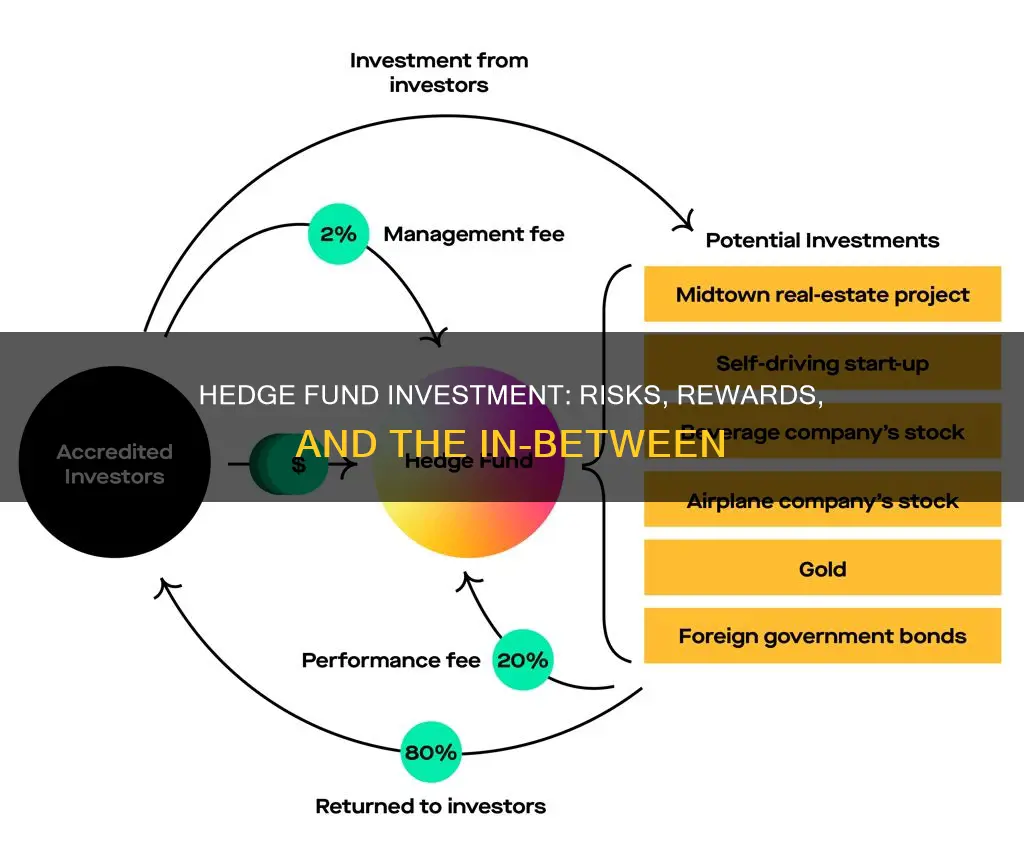

Hedge funds are generally associated with high fees and high minimum investment amounts. These fees can include a management fee, which is typically 2% per year of the assets being managed, and a performance fee, which is typically 20% of the fund's profits. Some funds also charge a redemption fee for early withdrawals. All of these fees can eat into your overall return.

Minimum initial investment amounts for hedge funds can range from $25,000 to upwards of $2 million. These high minimums are designed to allow access only to more sophisticated investors who can handle a large financial loss.

The high fees and minimum investment amounts associated with hedge funds can make them inaccessible to many investors. As a result, hedge funds tend to cater to high-net-worth individuals.

Additionally, hedge funds are often less liquid than other investments such as stocks or bonds. They may only allow investors to withdraw their money after a certain amount of time or during specific periods of the year. This lack of liquidity is another factor that potential investors should consider when evaluating hedge funds.

Overall, the high fees, high minimum investment amounts, and illiquidity of hedge funds are important factors to consider when deciding whether to invest in these types of funds.

Diversifying Your Investment: Multiple Fund Families, Pros and Cons

You may want to see also

Hedge funds are riskier than other investments

Hedge funds are loosely regulated by the SEC and can invest in options and derivatives as well as esoteric investments that mutual funds cannot. They are also not limited in the same ways mutual funds are. They often employ aggressive investment strategies, like leveraged, debt-based investing and short-selling, and they can purchase types of assets other funds can’t invest in, like real estate, art, and currency.

Hedge funds are also known for taking a more aggressive strategy by using leverage or investing in alternative asset classes. They take outsized risks in order to achieve outsized gains. Many use leverage to multiply their potential gains. They also are unconstrained in their investment picks, with the freedom to take big positions in alternative investments.

Hedge funds are only accessible to sophisticated investors, so-called accredited investors who are high-net-worth individuals or organizations and are presumed to understand the unique risks associated with hedge funds. They require large sums to invest, leaving the ordinary investor out of luck. Minimum initial investment amounts for hedge funds range from $100,000 to upwards of $2 million.

Hedge funds are also less liquid than stocks or bonds and may only allow investors to withdraw their money after a certain amount of time or during set times of the year. They also have lock-up periods, which prevent the investor from accessing their funds for a certain time, typically at least a year.

Hedge funds also carry hefty fees. Typically, they charge an asset management fee of 1% to 2% of the amount invested, plus a performance fee that is equal to 20% of the fund's profit. All of these fees can eat into the overall return.

High-Yield Funds: Risky Business or Smart Investment Strategy?

You may want to see also

They are less regulated than other funds

Hedge funds are less regulated than other funds, such as mutual funds, and are therefore considered alternative investments. They are not subject to the many restrictions that apply to regulated funds, and they are not required to register with the Securities and Exchange Commission (SEC). This is because hedge funds don't advertise publicly, and they are only marketed to institutional investors and high-net-worth individuals.

However, this doesn't mean that hedge funds are completely unregulated. In the US, hedge funds are subject to regulatory, reporting, and record-keeping requirements. They also fall under the jurisdiction of the Commodity Futures Trading Commission and are subject to the rules and provisions of the 1922 Commodity Exchange Act, which prohibits fraud and manipulation.

Hedge funds are also required to abide by national, federal, and state regulatory laws in their respective locations. For example, US hedge funds aimed at US-based taxable investors are generally structured as limited partnerships or limited liability companies.

While hedge funds may be less regulated than other funds, they are still required to follow certain rules and restrictions. The lack of regulation is due in part to the fact that hedge funds are private entities and have fewer public disclosure requirements. This can create the perception of a lack of transparency, and it means that investors may have to do their own research to fully understand the fund's activities and risks.

Obtaining Your Mutual Fund Investment Statement: A Guide

You may want to see also

Hedge funds are only open to accredited investors

The reason for this restriction is that hedge funds are riskier than other types of investments. They employ complex trading and risk management techniques, including short-selling, leverage, and the use of derivatives. They also use aggressive trading strategies, such as leveraged, debt-based investing and short-selling, and can invest in alternative asset classes such as real estate, art, and currency.

Hedge funds are also less regulated than other types of investments, such as mutual funds. They are not required to register with the Securities and Exchange Commission (SEC) and are therefore not subject to the same protections and disclosure requirements as mutual funds. This lack of transparency makes it more difficult for investors to verify a hedge fund's claims and see exactly how their money is being invested.

The high barrier to entry for hedge funds means that they are out of reach for most retail investors. However, there are alternative ways to gain exposure to hedge funds, such as investing in the stock of a financial company that operates hedge funds or investing in publicly traded fund companies.

Retirement Fund: Investing for a Secure Future

You may want to see also

They use aggressive trading strategies

Hedge funds are known for their aggressive trading strategies, which can include short-selling, leverage, and investing in alternative asset classes such as private companies, real estate, distressed assets, currencies, and commodities. These strategies are designed to produce returns regardless of market conditions, making them appealing to investors seeking returns even in bear markets.

One common strategy employed by hedge funds is short-selling, where they borrow shares from a financial institution and sell them immediately, expecting to buy them back at a lower price later and keep the difference as profit. Hedge funds may also use leverage, which involves borrowing money to make trades, amplifying potential returns and losses. Additionally, they invest in alternative asset classes, such as private companies, real estate, distressed assets, currencies, and commodities. These investments are often less regulated and more complex than traditional investments, allowing hedge funds to employ sophisticated techniques to generate returns.

Hedge funds' aggressive strategies come with significant risks. The use of leverage, for example, can lead to larger gains but also larger losses. Short-selling is another risky strategy, as funds bet on declining stock prices and can face unlimited losses if the stock price rises instead. These strategies, therefore, require careful management and a sophisticated understanding of personal finance, investing, and trading.

The aggressive nature of hedge fund strategies also contributes to their higher fees. In addition to the typical management fee, hedge funds often charge a performance fee, which can be substantial. This fee structure rewards fund managers for taking on higher-risk strategies and can result in significant profits for them.

Overall, the aggressive trading strategies employed by hedge funds can lead to higher returns but also come with significant risks and fees. These strategies are a key factor in attracting investors to hedge funds, especially those seeking returns in various market conditions. However, the complexity and risks associated with these strategies require careful consideration and a thorough understanding of the potential downsides.

Growth Mutual Funds: Invest or Avoid?

You may want to see also

Frequently asked questions

In the US, hedge funds are marketed only to institutional investors and high-net-worth individuals. To be considered an accredited investor, you must have a net worth of at least $1 million, not including the value of your primary residence, or an annual individual income of over $200,000 ($300,000 if you're married).

Hedge funds charge a management fee (typically 2% per year) and a performance fee (typically 20% of profits). Minimum investment requirements vary but can range from $25,000 to upwards of $2 million.

Hedge funds are considered riskier than most other investments because they employ aggressive investment strategies, such as leveraged, debt-based investing and short-selling. They also have less regulatory oversight than mutual funds and are less liquid, meaning you may not be able to withdraw your money for a certain period of time.

Hedge funds can provide access to return drivers that are not present elsewhere in an investor's portfolio. They can also offer diversification and are designed to produce returns regardless of market conditions.