A short-term investment that is considered highly liquid refers to assets that can be quickly converted into cash with minimal impact on their value. These investments are typically low-risk and easily accessible, making them attractive to investors seeking flexibility and quick access to their funds. Common examples include money market funds, certificates of deposit (CDs), and treasury bills, which are highly sought after for their ability to provide a safe and liquid store of value.

| Characteristics | Values |

|---|---|

| Definition | A short-term investment that is highly liquid refers to assets that can be quickly converted into cash with minimal impact on their market value. |

| Examples | Money market funds, high-yield savings accounts, certificates of deposit (CDs), treasury bills, and short-term government bonds. |

| Risk | Generally low risk, as these investments are typically backed by strong financial institutions or governments. |

| Liquidity | High liquidity, allowing investors to access their funds quickly without significant loss of value. |

| Return on Investment (ROI) | Moderate to high returns, often outpacing traditional savings accounts but with less volatility than stocks. |

| Accessibility | Widely accessible to the public, with various financial institutions offering these products. |

| Regulation | Often regulated by financial authorities to ensure stability and protect investors. |

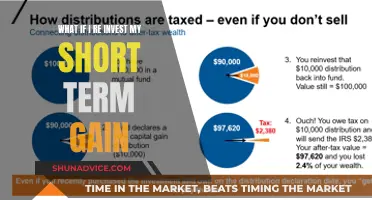

| Tax Implications | May have tax advantages, such as tax-free savings accounts or tax-efficient growth in certain cases. |

| Diversification | Can be part of a diversified investment portfolio, providing a balance between risk and liquidity. |

| Market Influence | Less influenced by market trends compared to long-term investments, making them less volatile. |

What You'll Learn

- Treasury Bills: Short-term, low-risk securities issued by governments with maturity dates of less than a year

- Money Market Funds: Pools of highly liquid assets, offering easy access to cash and low volatility

- Commercial Paper: Short-term, unsecured debt issued by corporations for working capital needs

- Repurchase Agreements (Repos): Secure, short-term loans using securities as collateral, typically settled within a day

- Stocks of Liquid Companies: Shares of well-known, publicly traded companies with high trading volumes

Treasury Bills: Short-term, low-risk securities issued by governments with maturity dates of less than a year

Treasury bills are a type of short-term investment that is highly liquid and considered one of the safest options for investors. These financial instruments are issued by governments, typically with maturity dates ranging from a few days to less than a year. They are a crucial component of the global financial market, offering a secure and low-risk way to invest.

The primary characteristic of Treasury bills is their short-term nature, which makes them an attractive option for investors seeking quick access to their capital. These bills are issued at a discount to their face value, meaning investors purchase them at a lower price than their stated value. For example, a $1,000 Treasury bill with a maturity of 90 days might be sold for $950, with the investor receiving $1,000 at maturity. This discount allows investors to earn a return on their investment without having to wait for the full maturity date.

One of the key advantages of Treasury bills is their low risk. Since they are backed by the full faith and credit of the government, investors can be confident that the principal amount will be repaid upon maturity. This makes them an ideal choice for risk-averse investors who prioritize capital preservation. Despite their low-risk nature, Treasury bills still offer a competitive return, making them a preferred option for those seeking a safe and liquid investment.

In the context of liquidity, Treasury bills excel. They can be easily converted into cash without significant loss of value. This is because they are highly sought after by investors and financial institutions, ensuring a constant demand. As a result, investors can quickly buy or sell Treasury bills in the secondary market, making them a highly liquid asset. This liquidity is particularly important for investors who may need to access their funds promptly without incurring substantial costs.

Treasury bills are a versatile investment tool, suitable for various investors. They are often used by individuals seeking a safe and stable investment, as well as by institutions that require a low-risk, highly liquid asset. Additionally, they play a crucial role in the financial markets, helping to maintain liquidity and provide a benchmark for short-term interest rates. Understanding the characteristics and benefits of Treasury bills is essential for investors looking to optimize their portfolios and manage risk effectively.

Mastering Long-Term Investing: Strategies for Building Wealth Over Time

You may want to see also

Money Market Funds: Pools of highly liquid assets, offering easy access to cash and low volatility

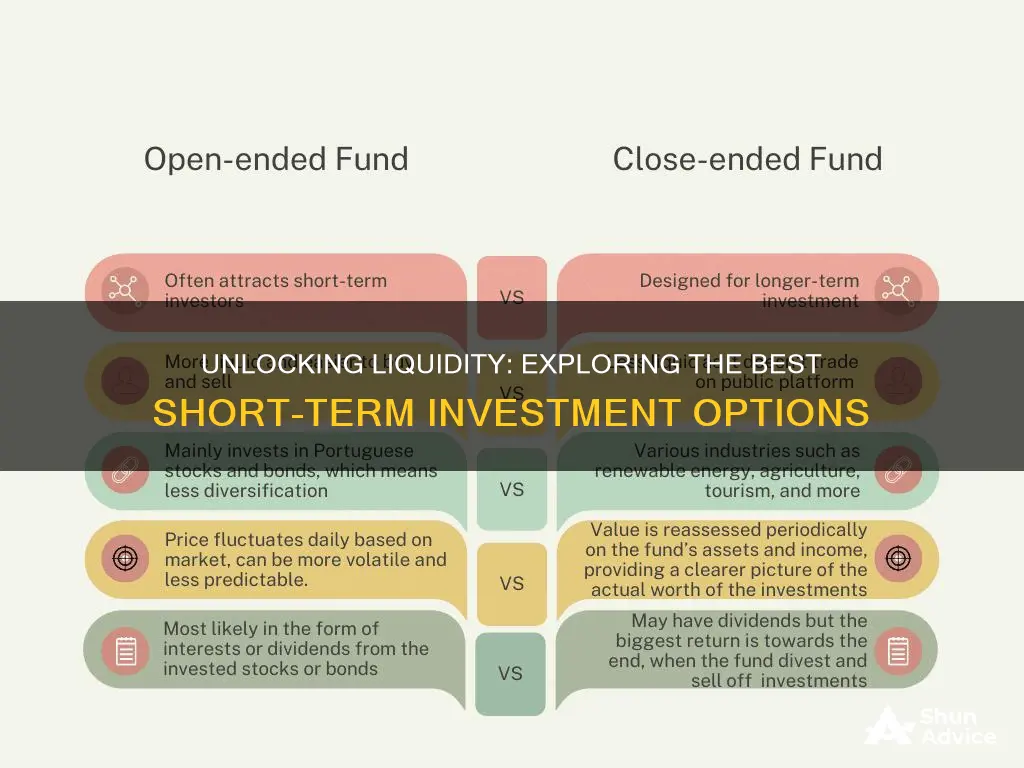

Money market funds are a type of investment vehicle that plays a crucial role in the financial markets, offering a unique blend of liquidity, safety, and stability. These funds are designed to provide investors with a secure and accessible way to invest their short-term capital while also offering a modest return. The primary characteristic that sets money market funds apart is their focus on highly liquid assets, ensuring that investors can access their funds quickly and with minimal risk.

At their core, money market funds are pools of money managed by professional fund managers. These funds primarily invest in short-term, highly liquid assets, such as government securities, commercial paper, and high-quality corporate bonds. The assets held by these funds are typically due to mature within a short period, often within a few days to a few months. This short-term nature of the investments is what makes money market funds an attractive option for investors seeking both liquidity and safety.

One of the key advantages of money market funds is the ease of access to cash. Investors can typically redeem their shares quickly and without significant penalties, making it an ideal choice for those who need a readily available source of funds. For example, if an investor needs to make an emergency purchase or cover unexpected expenses, they can quickly convert their money market fund investment into cash. This liquidity is further enhanced by the fact that money market funds are regulated, ensuring a high level of transparency and security.

In addition to liquidity, money market funds offer low volatility, making them a relatively stable investment option. The assets held by these funds are generally considered low-risk, and the fund managers employ conservative investment strategies. This approach minimizes the potential for significant price fluctuations, providing investors with a sense of security, especially during turbulent market conditions. As a result, money market funds are often used by conservative investors, institutions, and even governments as a safe haven for their short-term cash reserves.

For investors, money market funds offer a way to earn a modest return on their short-term investments while maintaining easy access to their capital. These funds typically provide a higher yield compared to traditional savings accounts, making them an attractive alternative for those seeking better returns without compromising liquidity. Moreover, the low volatility associated with money market funds ensures that investors can sleep soundly knowing their investments are relatively secure.

In summary, money market funds are an essential component of the financial landscape, providing investors with a highly liquid, low-risk, and accessible investment option. Their focus on short-term, highly liquid assets ensures that investors can quickly convert their investments into cash when needed, making them an ideal choice for short-term savings and emergency funds. With their conservative investment approach, money market funds offer a stable and secure environment for investors seeking both liquidity and a modest return.

Navigating Long-Term CDS: A Strategic Investment Decision

You may want to see also

Commercial Paper: Short-term, unsecured debt issued by corporations for working capital needs

Commercial paper is a short-term, unsecured debt instrument that plays a crucial role in the financial markets, particularly for corporations seeking quick access to working capital. It is a highly liquid investment, meaning it can be easily converted into cash within a short period, typically up to 270 days. This characteristic makes it an attractive option for businesses to manage their short-term financial obligations and maintain a healthy cash flow.

When a corporation issues commercial paper, it essentially borrows funds from investors, promising to repay the principal amount along with interest by the maturity date. The key feature here is that it is an unsecured debt, meaning the corporation does not pledge any specific assets as collateral. Instead, the creditworthiness and financial stability of the issuing corporation serve as the guarantee. This makes commercial paper a relatively low-risk investment, especially compared to other short-term instruments.

The process of issuing commercial paper involves a structured approach. Corporations typically approach a dealer or underwriter, who then sells the paper to investors. These dealers act as intermediaries, ensuring the efficient distribution of the paper and managing the entire process. The maturity of commercial paper can vary, but it is generally short-term, ranging from a few days to several months. This short-term nature aligns with the working capital needs of businesses, allowing them to finance their day-to-day operations and manage short-term cash flow requirements.

One of the advantages of commercial paper is its accessibility. It is available to a wide range of investors, including banks, insurance companies, and other financial institutions. This broad investor base ensures that corporations can easily find buyers for their commercial paper, facilitating quick funding. Moreover, the secondary market for commercial paper is highly active, allowing investors to buy and sell these instruments at any time before maturity, further enhancing liquidity.

In summary, commercial paper is a short-term, unsecured debt instrument that provides corporations with a highly liquid and accessible means of financing their working capital needs. Its short maturity, broad investor base, and active secondary market make it an efficient and reliable tool for managing short-term financial obligations. For investors, it offers a relatively low-risk investment opportunity, while for businesses, it provides a flexible and cost-effective way to maintain a healthy cash flow.

Unlocking Short-Term Profits: Diamond Business Investment Strategies

You may want to see also

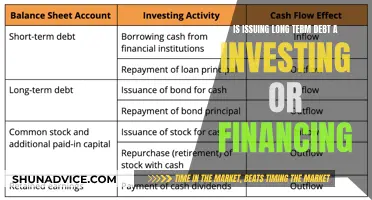

Repurchase Agreements (Repos): Secure, short-term loans using securities as collateral, typically settled within a day

A repurchase agreement, or repo, is a financial transaction that serves as a secure and highly liquid short-term investment strategy. It involves a process where an investor borrows securities (such as government bonds, treasury bills, or stocks) from another party, typically a financial institution, and agrees to buy them back at a predetermined price on a specific future date. This agreement is a form of short-term borrowing, often used by investors to access funds quickly while maintaining the underlying securities as collateral.

In a repo transaction, the borrower (often an investor or a financial institution) receives cash or a short-term loan from the seller (the counterparty) in exchange for the securities. The key aspect is that the securities act as collateral, ensuring the lender that the borrower will return the funds with interest by the agreed-upon date. This collateralization feature makes repos a secure and reliable form of financing.

The process is designed for speed and efficiency. Once the agreement is made, the securities are transferred to the lender, and the borrower receives the funds. Typically, repos are settled within a day, making them an extremely liquid investment option. This liquidity is crucial for investors who need to access their funds quickly without compromising security.

Repos are commonly used by various market participants, including hedge funds, commercial banks, and central banks. Hedge funds often use repos to finance their short positions, allowing them to leverage their portfolios. Commercial banks may employ repos to manage their liquidity needs and provide short-term funding to their customers. Central banks utilize repos as a tool for monetary policy, adjusting the money supply by buying or selling securities in the repo market.

The nature of repos makes them an attractive option for investors seeking short-term gains or those in need of immediate access to funds. The collateralization and short-term settlement process ensure that the investment is secure and highly liquid, providing a valuable tool for managing cash flow and investment strategies in the financial markets.

Ripple: A Long-Term Investment Strategy?

You may want to see also

Stocks of Liquid Companies: Shares of well-known, publicly traded companies with high trading volumes

When considering short-term investments that are highly liquid, stocks of well-known, publicly traded companies with high trading volumes can be an attractive option. These companies are typically large, established businesses with a strong market presence, which often results in a high level of liquidity. Here's why this investment strategy can be beneficial:

Firstly, these companies usually have a large and diverse shareholder base. This means that there are numerous buyers and sellers in the market, ensuring an active trading environment. High trading volumes indicate that shares are frequently exchanged, making it easier for investors to buy or sell their positions quickly. Liquidity is crucial for short-term investors as it allows them to enter and exit positions promptly without incurring significant costs or delays.

Secondly, well-known companies often have a history of financial stability and transparency. They are subject to strict regulations and reporting requirements, providing investors with a wealth of information to make informed decisions. This transparency can reduce the risk associated with short-term investments, as investors can assess the company's performance and make adjustments accordingly. Additionally, these companies typically have a strong track record, which can provide a sense of security for investors, especially those seeking short-term gains.

Furthermore, the shares of liquid companies are often more accessible to a wider range of investors. Since these companies are publicly traded, they are included in various stock market indices, making them easily accessible through index funds or exchange-traded funds (ETFs). This accessibility allows investors to gain exposure to these companies without having to purchase individual shares, which can be particularly useful for those with limited capital or time.

In summary, investing in the stocks of well-known, publicly traded companies with high trading volumes offers several advantages for short-term investors. The high liquidity of these stocks enables quick buying and selling, while the transparency and stability of these companies provide a sense of security. Additionally, the accessibility of these investments through various financial products makes them a convenient choice for investors seeking short-term gains.

Understanding Short-Term Investments: Are They Cash Equivalents?

You may want to see also

Frequently asked questions

A short-term investment that is highly liquid is typically a financial asset that can be quickly converted into cash with minimal impact on its market value. These investments are often sought after by investors who prioritize accessibility and the ability to access their funds on short notice without incurring significant losses. Some common examples include money market funds, treasury bills, and short-term government bonds.

Money market funds are a type of mutual fund that invests in a diversified portfolio of short-term, highly liquid assets. These assets are typically low-risk and include government securities, commercial paper, and high-quality corporate bonds. Money market funds provide investors with an easy way to access their funds, as they can be redeemed quickly and often offer a stable net asset value (NAV) per share. They are a popular choice for conservative investors seeking a safe and liquid investment option.

Yes, treasury bills (T-bills) are another excellent example of short-term, highly liquid investments. T-bills are short-term debt securities issued by the government and are considered one of the safest investments due to their low risk. They mature in a matter of days to a few months, making them highly liquid. Investors can buy and sell T-bills in the secondary market, providing flexibility and quick access to their investment value.